Palantir Technologies Stock: A Detailed Investment Analysis For 2024 And Beyond

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's business model revolves around providing cutting-edge data integration and analysis platforms to both government and commercial clients. Its success hinges on two key pillars: its strong presence in the government sector and its growing penetration into the commercial market.

Government Contracts: Palantir has built a reputation for providing sophisticated data analytics solutions to government agencies worldwide, playing a critical role in national security and intelligence operations. This sector provides a significant portion of its revenue, however, it comes with inherent risks.

- Examples of key government contracts: Contracts with various US intelligence agencies, defense departments of allied nations.

- Percentage of revenue from government contracts: Historically a significant portion (exact percentage fluctuates and should be checked with up-to-date financial reports).

- Projected growth in this sector: While significant, future growth depends on continued government spending and successful contract renewals. Geopolitical instability can also impact this sector.

Commercial Partnerships: Recognizing the immense potential of the commercial market, Palantir has actively pursued partnerships across diverse industries. Its Foundry platform serves as a cornerstone for these endeavors.

- Examples of significant commercial partnerships: Partnerships with financial institutions, healthcare providers, and manufacturing companies (specific examples should be researched and updated regularly).

- Target markets: Finance, healthcare, manufacturing, energy, and other data-intensive industries.

- Challenges in this sector: Intense competition from established players, the need to prove ROI to potential clients, and navigating complex data privacy regulations.

Foundry Platform: Palantir's Foundry platform is a crucial driver of revenue growth. This integrated data platform allows organizations to consolidate, analyze, and act on vast datasets, creating actionable insights.

- Key features of Foundry: Data integration capabilities, advanced analytics tools, customizable workflows, and robust security measures.

- Competitive advantages: Its ability to handle complex data sets, its user-friendly interface, and its strong security features distinguish it from competitors.

- Growth projections based on platform adoption: Market penetration and adoption rates are key indicators of future revenue growth; these projections are highly speculative and should be reviewed from multiple sources.

Financial Performance and Valuation

Understanding Palantir's financial performance and valuation is critical for any investment decision.

Revenue Growth and Profitability: Palantir has demonstrated significant revenue growth over recent years, but its path to profitability has been a key area of focus for investors.

- Revenue figures for the past few years: (Insert updated figures from financial reports).

- Profit margins: (Insert updated figures from financial reports; note the distinction between gross, operating, and net profit margins).

- Key financial ratios (e.g., P/E ratio, debt-to-equity ratio): (Insert updated figures from financial reports and reputable financial analysis websites).

Stock Valuation and Future Projections: Palantir's valuation varies depending on the chosen metric. Various valuation models, such as discounted cash flow (DCF) analysis, provide different perspectives on its future price.

- Current market capitalization: (Insert current market cap; this is highly dynamic).

- Price-to-earnings ratio (P/E): (Insert current P/E ratio).

- Price-to-sales ratio (P/S): (Insert current P/S ratio).

- Discounted cash flow (DCF) analysis: (Note that DCF analysis is highly dependent on assumptions, making projections uncertain).

- Projected stock price targets: (Include a disclaimer noting that these are just projections and subject to significant variability based on market conditions and company performance).

Risks and Challenges Facing Palantir

Despite its potential, Palantir faces several challenges that investors must carefully consider.

Competition and Market Saturation: The data analytics market is becoming increasingly crowded, with both established tech giants and nimble startups vying for market share.

- Key competitors: (List key competitors, including their strengths and weaknesses).

- Market share analysis: (Provide a general overview of market share; precise data may require subscription to market research services).

- Potential for disruptive technologies: The rapid pace of technological innovation poses a constant threat.

Dependence on a Few Large Customers: Palantir's revenue is concentrated among a relatively small number of large clients, primarily in the government sector. This dependence creates significant risk.

- Customer concentration analysis: (Analyze the concentration risk based on available financial data).

- Potential impact of losing a major client: Losing a large client could have a substantial negative impact on revenue and profitability.

Regulatory and Legal Concerns: Palantir operates in a heavily regulated industry, facing potential challenges related to data privacy, antitrust concerns, and potential legal liabilities.

- Data privacy regulations: (Mention relevant regulations like GDPR, CCPA, etc.).

- Antitrust concerns: (Discuss potential antitrust issues related to market dominance).

- Potential legal liabilities: (Mention any potential legal risks, acknowledging the inherent uncertainties).

Conclusion:

Palantir Technologies stock presents a compelling investment opportunity for those with a high-risk tolerance and a long-term perspective. While its innovative technology and strong government partnerships provide a solid foundation for growth, its reliance on a few key clients, intense competition, and regulatory challenges pose significant risks. The company’s transition to the commercial market remains a critical factor determining its future success.

Based on the analysis presented, we recommend a cautious "hold" strategy for Palantir Technologies stock. Further in-depth research, including examining quarterly earnings reports and industry analyst opinions, is strongly recommended before making any investment decision. Consult with a financial advisor to assess your risk tolerance and investment goals.

Investing in Palantir Technologies stock requires a thorough understanding of its business model, financial performance, and the inherent risks involved. By carefully considering the information provided, you can make a more informed decision about whether Palantir fits into your investment strategy. Remember that this analysis provides a snapshot in time and regular updates on the company's performance and the broader market conditions are essential for effective investment management.

Featured Posts

-

Golden Knights Clinch Playoff Spot Despite Oilers 3 2 Victory

May 10, 2025

Golden Knights Clinch Playoff Spot Despite Oilers 3 2 Victory

May 10, 2025 -

Politiko Ne Vse Soyuzniki Ukrainy Posetyat Kiev 9 Maya

May 10, 2025

Politiko Ne Vse Soyuzniki Ukrainy Posetyat Kiev 9 Maya

May 10, 2025 -

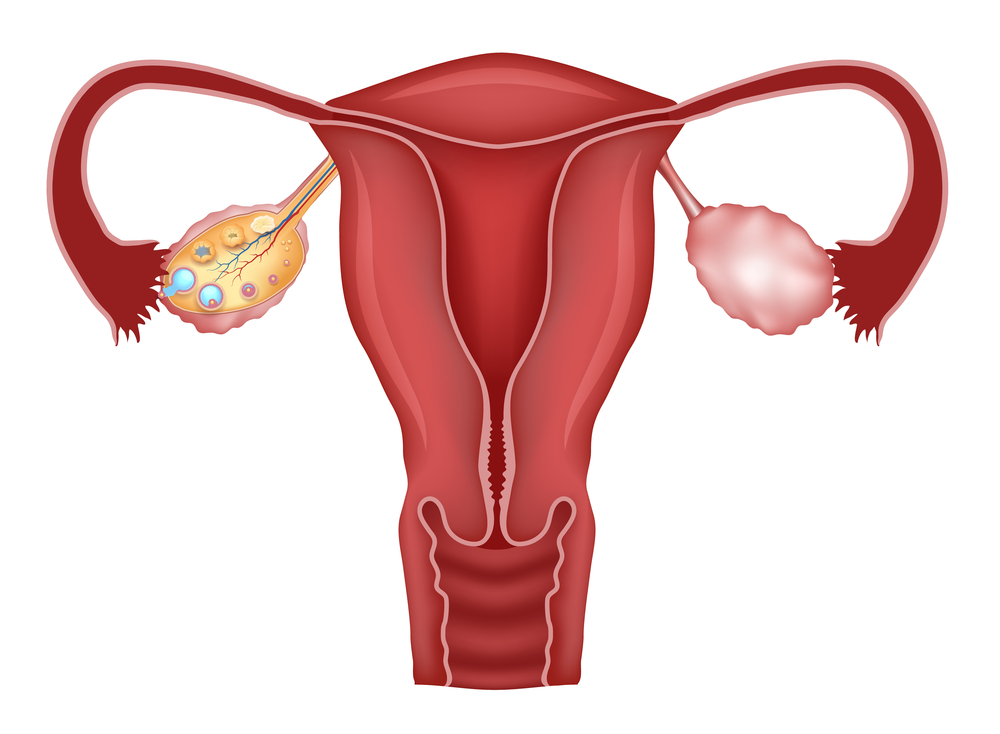

Transgender Women And Pregnancy A Community Activists Proposal On Uterine Transplants

May 10, 2025

Transgender Women And Pregnancy A Community Activists Proposal On Uterine Transplants

May 10, 2025 -

Dakota Dzhonson I Zolotaya Malina Samiy Khudshiy Film Goda

May 10, 2025

Dakota Dzhonson I Zolotaya Malina Samiy Khudshiy Film Goda

May 10, 2025 -

National 2 28e Journee Victoire De Concarneau A Dijon 0 1

May 10, 2025

National 2 28e Journee Victoire De Concarneau A Dijon 0 1

May 10, 2025