Palantir Technologies Stock: Investment Analysis And Buying Guide

Table of Contents

Understanding Palantir Technologies' Business Model and Revenue Streams

Palantir Technologies is a data analytics company offering two primary platforms: Gotham and Foundry. Understanding these platforms is crucial to assessing Palantir's overall business model and revenue streams.

-

Palantir Gotham: This platform is primarily geared towards government clients, including intelligence agencies and defense departments. Gotham helps these organizations integrate and analyze massive datasets to improve operational efficiency, enhance national security, and combat crime. It's known for its ability to handle highly sensitive and classified information.

-

Palantir Foundry: Designed for commercial clients across various sectors, Foundry offers a more scalable and adaptable platform. It enables organizations to integrate data from disparate sources, uncover hidden insights, and make data-driven decisions. Foundry is used for applications ranging from fraud detection in finance to optimizing supply chains in manufacturing.

-

Big Data Analytics and AI: Both Gotham and Foundry leverage cutting-edge big data analytics and artificial intelligence techniques. Palantir's unique approach focuses on intuitive interfaces, enabling users without extensive technical expertise to harness the power of complex data analysis.

-

Data Integration and Analysis: Palantir excels at integrating data from various sources, regardless of format or structure. This capability is a key differentiator, allowing clients to gain a holistic view of their data and unlock valuable insights that would otherwise remain hidden. This capability is a key driver of Palantir's revenue growth. Related keywords: Palantir Gotham, Palantir Foundry, Big Data Analytics, AI, Data Integration, Government Contracts, Commercial Clients.

Analyzing Palantir Technologies' Financial Performance and Growth Potential

Analyzing Palantir's financial performance is crucial for any potential investor. While profitability has been a focus, revenue growth has been significant.

-

Revenue Trends: Palantir has demonstrated consistent revenue growth over the past few years, driven by increasing adoption of its platforms by both government and commercial clients. Examining the year-over-year growth rates offers valuable insights into the company's trajectory.

-

Profitability and Margins: Investors should carefully assess Palantir's profitability, paying close attention to its operating margins and net income. Understanding the factors driving profitability (or losses) is crucial for projecting future financial performance.

-

Cash Flow and Debt: A strong cash flow is essential for a company's long-term sustainability. Analyzing Palantir's cash flow statements and debt levels can provide insights into its financial health and ability to fund future growth initiatives.

-

Growth Prospects: Palantir's growth potential is significant, given the increasing demand for big data analytics and AI solutions across various industries. Evaluating its market position, competitive landscape, and expansion plans is critical to assessing its future prospects. Related keywords: Palantir Revenue, Palantir Profitability, Palantir Financial Statements, Palantir Stock Price, Market Growth, Financial Metrics.

Assessing the Risks and Challenges Facing Palantir Technologies

Investing in Palantir Technologies stock involves certain risks. A thorough understanding of these challenges is crucial for informed decision-making.

-

Competition: The data analytics market is highly competitive, with established players and numerous emerging startups vying for market share. Analyzing Palantir's competitive advantages and its ability to maintain its market position is crucial.

-

Government Contract Dependence (Gotham): A significant portion of Palantir's revenue historically came from government contracts. Over-reliance on this sector could expose the company to fluctuations in government spending and geopolitical risks.

-

Valuation Concerns and Market Volatility: Palantir's stock price can be volatile, influenced by market sentiment, financial performance, and broader economic conditions. Potential investors need to assess the company's valuation relative to its peers and understand the potential for price swings.

-

Regulatory Risks and Ethical Considerations: The use of big data analytics and AI raises ethical concerns regarding privacy, data security, and potential bias. Changes in regulations or public perception could significantly impact Palantir's operations. Related keywords: Palantir Competition, Market Risk, Regulatory Risk, Palantir Valuation, Ethical Concerns, Stock Volatility.

A Practical Buying Guide for Palantir Technologies Stock

This section provides actionable steps for investors considering purchasing Palantir stock.

-

Define Investment Goals and Risk Tolerance: Before investing, clarify your investment objectives and your comfort level with risk. Palantir, being a growth stock, carries inherent volatility.

-

Conduct Thorough Due Diligence: Thorough research is essential. Review Palantir's financial statements, analyze industry trends, and assess the company's competitive landscape.

-

Diversification: Diversifying your investment portfolio is crucial to mitigate risk. Don't put all your eggs in one basket.

-

Investment Strategies: Consider dollar-cost averaging to reduce the impact of market volatility. This involves investing a fixed amount at regular intervals.

-

Monitor Your Investment: Regularly monitor your investment in Palantir stock and adjust your strategy as needed based on changes in the company's performance and market conditions. Related keywords: Investment Strategy, Risk Tolerance, Due Diligence, Diversification, Dollar-Cost Averaging, Portfolio Management.

Conclusion

This investment analysis of Palantir Technologies stock provides a comprehensive overview of the company's business model, financial performance, growth potential, and inherent risks. While Palantir offers exciting prospects in the rapidly expanding big data analytics market, potential investors should carefully assess their risk tolerance and investment goals before making any decisions. Remember to conduct thorough due diligence and consider diversifying your portfolio. Making informed choices regarding your investment in Palantir Technologies stock is crucial for achieving your financial objectives. Start your research today and make a smart investment decision!

Featured Posts

-

Did Young Thug Just Vow To End Infidelity New Music Suggests So

May 09, 2025

Did Young Thug Just Vow To End Infidelity New Music Suggests So

May 09, 2025 -

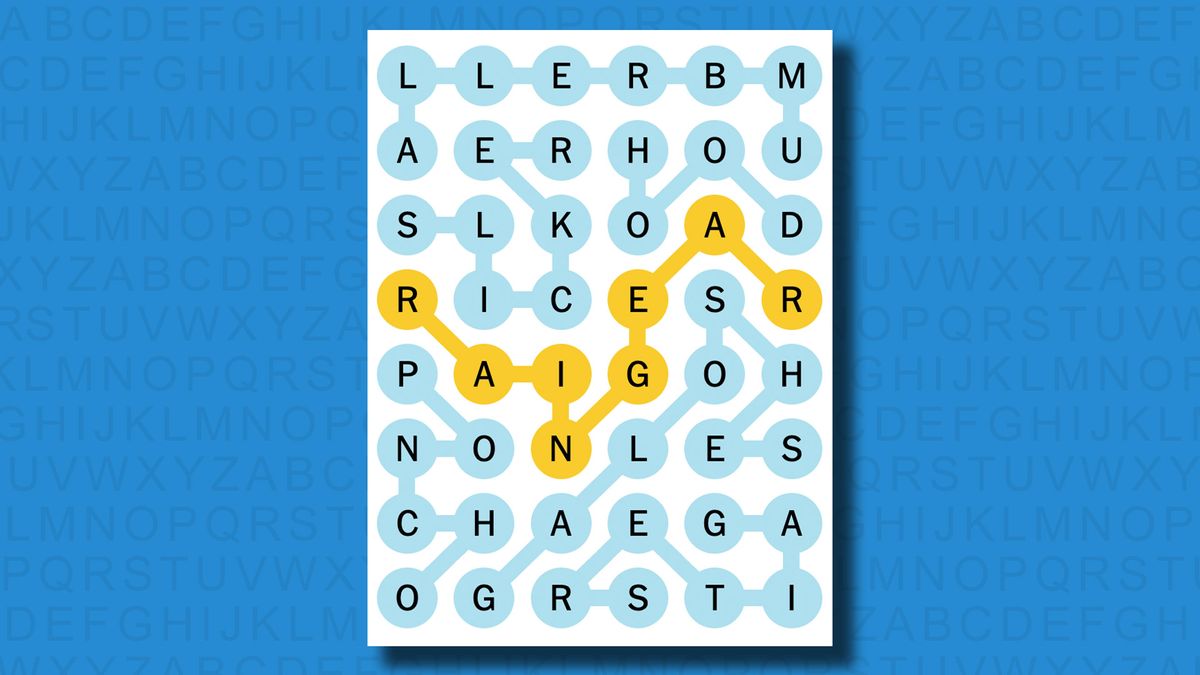

Nyt Strands Answers For Game 377 Saturday March 15

May 09, 2025

Nyt Strands Answers For Game 377 Saturday March 15

May 09, 2025 -

The High Cost Of Childcare A 3 000 Babysitter And A 3 600 Daycare Bill

May 09, 2025

The High Cost Of Childcare A 3 000 Babysitter And A 3 600 Daycare Bill

May 09, 2025 -

Trump Appoints Jeanine Pirro As Dc Top Prosecutor Fox News Role And Implications

May 09, 2025

Trump Appoints Jeanine Pirro As Dc Top Prosecutor Fox News Role And Implications

May 09, 2025 -

Under 5 Hours To A Stephen King Masterpiece Top Streaming Pick

May 09, 2025

Under 5 Hours To A Stephen King Masterpiece Top Streaming Pick

May 09, 2025