Palantir's Path To A Trillion-Dollar Market Cap: A 2030 Projection

Table of Contents

Palantir's Expanding Product Portfolio and Market Penetration

Palantir's growth trajectory hinges on its ability to expand its product portfolio and penetrate both its existing and new markets.

Growth in Government Contracts

Palantir enjoys a strong foothold in government contracts, particularly within the US national security apparatus. This success stems from its ability to provide cutting-edge data analytics solutions for complex challenges. Recent contract wins and ongoing partnerships solidify this position.

- Successful government deployments: Palantir's Gotham platform is widely used by various intelligence agencies, significantly contributing to national security efforts. Its deployment has shown demonstrably improved operational efficiency and threat identification capabilities.

- Expansion into new government sectors: Palantir is actively expanding beyond traditional national security applications. Successful inroads into healthcare (managing public health crises, optimizing resource allocation), and environmental protection (combating climate change, predicting natural disasters) demonstrate its versatility. This diversification reduces reliance on any single sector, mitigating risk and fueling growth.

- Keyword integration: The success of Palantir government contracts, and the subsequent Palantir government growth, underlines the company’s expertise in national security data analytics.

Commercial Market Expansion

While government contracts form a significant revenue stream, Palantir's commercial market expansion is crucial for reaching a trillion-dollar valuation. The company is steadily gaining traction across various sectors.

- Successful commercial deployments: Palantir Foundry, its flagship commercial platform, has seen significant adoption in the finance, healthcare, and manufacturing industries. Case studies showcasing improved operational efficiency, fraud detection, and supply chain optimization underscore its value proposition. For example, successful deployments in financial institutions have demonstrated significant returns on investment through improved risk management and fraud prevention.

- Key Partnerships: Strategic partnerships with industry leaders further enhance market penetration and accelerate growth. Collaborations that leverage complementary technologies and expand Palantir's reach to new client segments are essential.

- Keyword integration: Palantir commercial clients are increasingly adopting its data integration platforms, fueling Palantir commercial market share growth.

Innovation and Technological Advancements

Palantir's sustained investment in research and development is fundamental to its future growth. Continuous innovation in AI and data analytics capabilities allows it to stay ahead of the curve.

- New product features: Regular updates and enhancements to existing platforms, alongside the introduction of entirely new products, maintain its competitive edge. This continuous improvement cycle ensures that Palantir's offerings remain relevant and effective in an ever-evolving technological landscape.

- AI advancements: Palantir's ongoing investments in AI and machine learning are crucial. These advancements enhance the capabilities of its platforms, allowing for more sophisticated data analysis, predictive modeling, and automation.

- Patents and Intellectual Property: A strong IP portfolio protects Palantir's technological innovations and creates significant barriers to entry for competitors. This ensures the company's long-term competitive advantage.

- Keyword integration: The development of Palantir AI and its core platform, Palantir Foundry, showcases the company’s commitment to data analytics innovation.

Addressing Challenges and Risks

While Palantir's prospects look promising, several challenges and risks need to be addressed.

Competition and Market Saturation

The big data and AI space is becoming increasingly competitive. Established tech giants and emerging startups pose significant challenges.

- Key Competitors: Identifying and analyzing the strengths and weaknesses of competitors like Microsoft, Google, and Amazon Web Services is critical. Understanding their strategies and anticipating their moves is essential for Palantir to maintain its competitive advantage.

- Market Saturation: The market for data analytics solutions is maturing, meaning increased competition and potentially lower margins. Palantir must constantly innovate and differentiate its offerings to maintain its market share.

- Keyword integration: The intensity of Palantir competitors within the data analytics competition dictates the need for continuous innovation to secure a significant AI market share.

Regulatory and Geopolitical Risks

Regulations concerning data privacy, cybersecurity, and national security pose potential hurdles. Geopolitical instability can also impact operations and revenue.

- Data Privacy Regulations: Compliance with regulations like GDPR and CCPA is crucial. Failure to comply could result in significant fines and reputational damage.

- Geopolitical Risks: International tensions and political instability in key markets can disrupt operations and affect contract awards. Careful risk management and diversification are essential to mitigate these threats.

- Keyword integration: Palantir regulatory compliance is paramount, particularly concerning data privacy regulations and navigating the complexities of geopolitical risk.

Maintaining Profitability and Sustainable Growth

Balancing rapid growth with sustained profitability is crucial for achieving a trillion-dollar valuation.

- Revenue Growth: Sustained revenue growth, driven by both government and commercial contracts, is the foundation of Palantir's future valuation. Consistent, high-growth rates are needed to justify the projected market capitalization.

- Profitability Margins: Maintaining healthy profit margins is crucial for long-term sustainability. Careful cost management and efficient operational processes are essential for ensuring profitability.

- Financial Projections: Realistic financial projections, based on sound market analysis and conservative assumptions, are vital for assessing the feasibility of the trillion-dollar valuation.

- Keyword integration: Analyzing Palantir stock performance, Palantir revenue growth, and Palantir profitability provides key insights into the company’s long-term financial health.

Financial Projections and Valuation

Reaching a trillion-dollar market cap requires significant and sustained growth.

Revenue Growth Projections

Based on current market trends and expert opinions, projecting Palantir's revenue growth is essential. Conservative estimates, considering market saturation and competition, need to be considered.

- Methodology: A robust methodology, potentially involving discounted cash flow (DCF) analysis and comparable company analysis, provides a foundation for realistic projections. This needs to incorporate both existing business lines and anticipated expansion into new markets.

- Sources: Using reputable sources and industry experts helps build credibility and provides a more reliable basis for projecting future revenue. Transparency in the methodology is crucial.

- Keyword integration: The accuracy of Palantir financial projections and their associated Palantir revenue forecast heavily influence the accuracy of the overall market capitalization projection.

Valuation Model

A suitable valuation model is crucial for determining the feasibility of a trillion-dollar market cap.

- Discounted Cash Flow (DCF) Analysis: This widely used method provides a future value estimate based on the present value of projected future cash flows. Assumptions about discount rates and growth rates are vital for this model’s accuracy.

- Comparable Company Analysis: Comparing Palantir's valuation to similar companies in the data analytics sector can offer insights, though direct comparisons might be challenging due to Palantir’s unique business model.

- Assumptions and Limitations: Transparency regarding the assumptions and limitations of the chosen model is critical. Acknowledging potential biases and uncertainties helps to provide a more balanced and realistic assessment.

- Keyword integration: Applying a robust Palantir valuation model, using methods like DCF analysis, helps determine the company’s market valuation and its potential to reach the projected market cap.

Conclusion

This analysis suggests that Palantir's path to a trillion-dollar market cap by 2030 is ambitious but not entirely unrealistic. Several factors, including its expanding product portfolio, successful penetration of both government and commercial markets, and a commitment to innovation, contribute to this potential. However, challenges such as competition, regulatory hurdles, and the need to maintain profitability must be addressed. Careful consideration of financial projections and a transparent valuation methodology are crucial for a balanced assessment. Stay tuned for further updates on Palantir's journey towards its projected trillion-dollar market cap. Follow our blog for the latest news and analysis on Palantir's growth and its impact on the data analytics landscape. Understanding Palantir's trajectory towards its potential trillion-dollar market cap requires continuous monitoring of its performance and the broader market dynamics.

Featured Posts

-

Arkema Premiere Ligue Victoire Du Psg Contre Dijon

May 09, 2025

Arkema Premiere Ligue Victoire Du Psg Contre Dijon

May 09, 2025 -

Mulher Presa No Reino Unido Afirma Ser Madeleine Mc Cann

May 09, 2025

Mulher Presa No Reino Unido Afirma Ser Madeleine Mc Cann

May 09, 2025 -

Polish Woman And Friend Plead Not Guilty To Mc Cann Family Harassment

May 09, 2025

Polish Woman And Friend Plead Not Guilty To Mc Cann Family Harassment

May 09, 2025 -

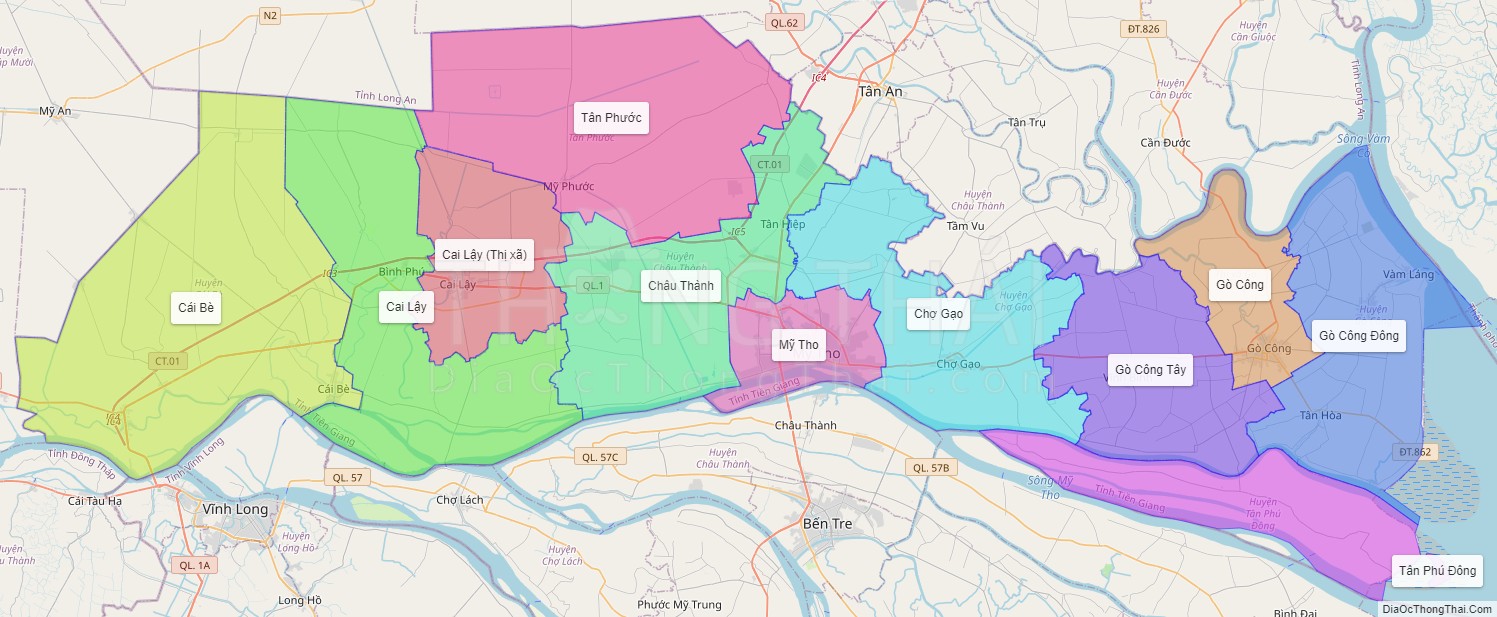

Loi Khai Bao Mau Tat Tre O Tien Giang Su That Phia Sau Vu Viec

May 09, 2025

Loi Khai Bao Mau Tat Tre O Tien Giang Su That Phia Sau Vu Viec

May 09, 2025 -

Montoyas Revelation Doohans F1 Career Path Confirmed

May 09, 2025

Montoyas Revelation Doohans F1 Career Path Confirmed

May 09, 2025