Parkland's US$9 Billion Acquisition: A June Shareholder Decision

Table of Contents

The Target Company and Acquisition Details

This US$9 billion fuel acquisition targets [Insert Target Company Name Here], a major player in the [Insert Target Company Industry Here] sector. [Insert Target Company Name Here] boasts a strong market position, significant assets including [List key assets, e.g., a network of retail fuel stations, crude oil pipelines, storage facilities], and a proven track record in [Mention key strengths or achievements]. The acquisition's financial details are substantial. The purchase price of US$9 billion will be funded through a combination of [Specify payment methods: e.g., cash, debt financing, equity issuance]. The transaction is subject to several conditions precedent, including [List key conditions: e.g., regulatory approvals, shareholder approval, financing conditions]. Extensive due diligence was conducted to assess the target company's financial health, operational efficiency, and compliance with relevant regulations. Potential challenges during this process might have included [Mention potential challenges: e.g., valuation discrepancies, integration complexities, unforeseen liabilities].

- Company name and industry: [Insert Target Company Name Here], [Insert Target Company Industry Here]

- Key assets and operations of the target company: [List key assets and operations]

- Purchase price breakdown (cash, stock, debt): [Detailed breakdown of the funding sources]

- Key milestones and timelines of the acquisition process: [List key dates and events]

- Synergies and potential benefits for Parkland: [Outline potential synergies, e.g., expanded geographic reach, economies of scale]

Potential Benefits and Synergies for Parkland

Parkland's strategic rationale for this significant fuel acquisition centers on accelerating its growth strategy and enhancing shareholder value. The acquisition promises several key synergies. The combined entity will benefit from expanded geographic reach, potentially leading to increased market share within [Mention specific regions or markets]. The acquisition also brings increased product diversification, offering Parkland access to new product lines and customer segments. This leads to significant cost savings through economies of scale, particularly in areas like procurement, logistics, and marketing. Furthermore, Parkland gains access to [Insert Target Company Name Here]'s established technologies and expertise, fostering innovation and operational efficiency. The financial projections suggest a substantial increase in revenue, improved profitability margins, and a boost in earnings per share, ultimately enhancing shareholder returns.

- Expanded geographic reach and market share: [Quantify the potential increase in market share]

- Increased product diversification and offerings: [List new product lines or services]

- Cost savings through economies of scale: [Estimate potential cost savings]

- Access to new technologies and expertise: [Describe new technologies or expertise]

- Potential for increased profitability and shareholder returns: [Provide projected financial figures, if available]

Potential Risks and Challenges of the Acquisition

While the acquisition offers substantial potential, several risks and challenges must be considered. The regulatory approval process may encounter delays or even rejection due to antitrust concerns or other regulatory hurdles. Integrating two large organizations presents significant operational challenges, with the potential for disruptions in supply chains, customer service, and employee morale. The acquisition will considerably increase Parkland's debt levels, exposing it to interest rate risk and impacting its financial flexibility. Unforeseen costs and liabilities associated with the target company's operations could also materialize. Finally, market volatility in the energy sector could negatively affect the deal's success and the projected financial benefits.

- Regulatory approval process and potential delays: [Discuss potential regulatory hurdles]

- Integration challenges and potential disruption to operations: [Outline potential integration challenges]

- Increased debt levels and interest rate risk: [Analyze the impact of increased debt]

- Potential for unforeseen costs and liabilities: [Discuss potential hidden liabilities]

- Impact of market conditions on the success of the acquisition: [Analyze the impact of market volatility]

Shareholder Perspective and the June Vote

The June shareholder vote will be pivotal in determining the fate of this US$9 billion acquisition. Investor sentiment will heavily influence the vote outcome. Positive investor sentiment, driven by a belief in the deal's long-term benefits, should lead to shareholder approval. However, negative sentiment, fueled by concerns about the risks outlined above, could result in rejection. The impact on Parkland's stock price leading up to and following the vote will reflect market confidence in the acquisition strategy. Parkland's management will undoubtedly engage in robust investor relations efforts to ensure transparency and address shareholder concerns.

- Expected shareholder reaction and voting patterns: [Analyze anticipated voting outcomes]

- Potential impact on Parkland's stock price before and after the vote: [Predict the stock market's reaction]

- Analysis of shareholder communications and investor relations efforts: [Evaluate Parkland's communication strategy]

Conclusion

Parkland's US$9 billion acquisition is a high-stakes endeavor with significant potential rewards and substantial risks. The June shareholder vote represents a critical juncture, shaping the company's future trajectory. The successful integration of [Insert Target Company Name Here] and the realization of projected synergies will be crucial to the acquisition's ultimate success. The impact of this large-scale fuel acquisition will be felt throughout the energy sector.

Call to Action: Stay informed about the outcome of the June shareholder decision regarding Parkland's US$9 billion acquisition. Follow our updates for continued analysis and insights into this transformative deal for the energy sector. Learn more about the impact of this significant Parkland acquisition by subscribing to our newsletter or following us on social media.

Featured Posts

-

Zendaya And Her Sisters Public Feud A Family Rift Exposed

May 07, 2025

Zendaya And Her Sisters Public Feud A Family Rift Exposed

May 07, 2025 -

Selling Sunset Star Calls Out La Landlords For Price Gouging Amid Fires

May 07, 2025

Selling Sunset Star Calls Out La Landlords For Price Gouging Amid Fires

May 07, 2025 -

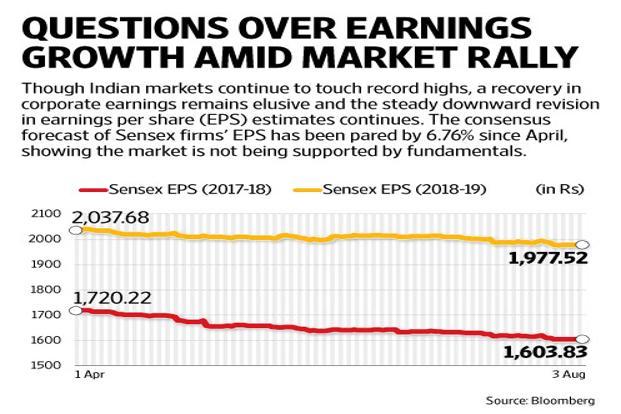

Rally In Bse Shares Positive Earnings Outlook For Indian Bourse

May 07, 2025

Rally In Bse Shares Positive Earnings Outlook For Indian Bourse

May 07, 2025 -

How To Watch The Warriors Vs Hornets Game On March 3rd Tv And Live Stream

May 07, 2025

How To Watch The Warriors Vs Hornets Game On March 3rd Tv And Live Stream

May 07, 2025 -

Sleduyuschiy Papa Rimskiy Zdorove Frantsiska I Predstoyaschie Vybory

May 07, 2025

Sleduyuschiy Papa Rimskiy Zdorove Frantsiska I Predstoyaschie Vybory

May 07, 2025

Latest Posts

-

A24s New Horror Movie Signals The End Of Jenna Ortegas Five Year Domination

May 07, 2025

A24s New Horror Movie Signals The End Of Jenna Ortegas Five Year Domination

May 07, 2025 -

Jenna Ortegas Reign A24 Horror Ends 5 Year Trend

May 07, 2025

Jenna Ortegas Reign A24 Horror Ends 5 Year Trend

May 07, 2025 -

Jenna Ortega Past Marvel Role No Future Plans

May 07, 2025

Jenna Ortega Past Marvel Role No Future Plans

May 07, 2025 -

Ortega Remains Unsure About Future Marvel Projects

May 07, 2025

Ortega Remains Unsure About Future Marvel Projects

May 07, 2025 -

Jenna Ortega And Glen Powells Fantasy Film A London Summer Production

May 07, 2025

Jenna Ortega And Glen Powells Fantasy Film A London Summer Production

May 07, 2025