PBOC Daily Yuan Support Below Estimates: First Time In 2024

Table of Contents

The Scale of Reduced PBOC Daily Yuan Support

The reduction in PBOC daily Yuan support is a significant development. While precise figures are subject to ongoing market analysis and official announcements from the PBOC, preliminary data suggests a notable decrease compared to previous interventions in 2024 and the latter half of 2023.

Specific Figures and Comparisons

Quantifying the exact reduction requires access to real-time market data and official PBOC statements, which can fluctuate daily. However, comparing the daily intervention figures from Q4 2023 with those from the early weeks of 2024 reveals a discernible trend of decreased support. Analysts are currently comparing percentage changes in daily interventions to assess the full extent of this shift. The deviation from market expectations, which had anticipated a continuation of the previous levels of support, is also a key aspect under scrutiny. Official statements released by the PBOC regarding these changes, or the lack thereof, are crucial in interpreting this new approach to Yuan management.

- Comparison with daily intervention figures from Q4 2023 and Q1 2024: Detailed analysis is ongoing, but initial reports suggest a substantial difference.

- Analysis of the deviation from market expectations: The market was clearly surprised by the lower level of support.

- Mention any official statements released by the PBOC regarding the reduced support: As of the writing of this article, no official statements clarifying the reasons for the reduced support have been publicly released. Any future statements will be vital to understanding the PBOC's intentions.

Potential Reasons Behind Reduced PBOC Intervention

The reduction in PBOC intervention could stem from several factors, suggesting a potential shift in China's economic policy.

Shifting Economic Priorities

The PBOC might be prioritizing less direct market manipulation and focusing on other economic levers. This could reflect a growing confidence in the resilience of the Chinese economy or a shift towards longer-term goals.

- Analysis of recent economic data indicating strength or weakness in the Chinese economy: Recent economic indicators are being closely examined to understand the context of this decision.

- Discussion on the PBOC's long-term goals for the Yuan's exchange rate: The PBOC's long-term objectives for the Yuan’s value against other global currencies will be pivotal to understanding its current strategy.

- Exploration of the role of market forces in determining the Yuan's value: The PBOC might be aiming to increase the influence of market forces in setting the Yuan's value.

Increased Confidence in Market Mechanisms

The reduced intervention may indicate increasing confidence in the effectiveness of market mechanisms in managing the Yuan's exchange rate.

- Examine the increasing depth and liquidity of the Chinese currency markets: The development of more sophisticated and liquid currency markets could contribute to this shift.

- Discuss the impact of internationalization efforts on the Yuan's stability: The ongoing internationalization of the Yuan could provide greater stability and reduce the need for extensive intervention.

- Analyze any signals suggesting a move towards a more flexible exchange rate regime: This shift could be a step towards a more flexible exchange rate system, allowing the market to play a larger role.

Impact on the Yuan and Global Markets

The decreased PBOC daily Yuan support has implications for both the Yuan itself and global financial markets.

Yuan Volatility and Trading Activity

The reduced intervention has already led to increased volatility in the Yuan's exchange rate.

- Analyze the Yuan's performance against major currencies (USD, EUR, JPY) following the reduced intervention: Fluctuations against major currencies need to be monitored to fully assess the impact.

- Discuss the impact on Chinese exports and imports: The change in the Yuan's value will affect the price competitiveness of Chinese exports and imports.

- Mention any significant changes in investor sentiment towards the Chinese economy: Investor confidence in the Chinese economy is also likely to be impacted.

Global Market Reactions and Implications

The PBOC's actions have broader global implications.

- Discuss the potential spillover effects on other emerging market currencies: The decision could impact other emerging market currencies.

- Mention any changes in global risk appetite or investor confidence: Global investor confidence and risk appetite could be affected by the change in China's monetary policy.

- Assess the impact on global trade flows involving China: Changes in the Yuan's value will significantly affect international trade flows involving China.

Conclusion

The reduction in PBOC daily Yuan support marks a significant development, potentially signaling a shift in Chinese economic policy toward greater reliance on market mechanisms. The impact on the Yuan's value and global financial markets warrants close monitoring. While the immediate consequences are still unfolding, this move suggests a possible long-term strategic shift in China's approach to currency management.

Call to Action: Stay informed about the ongoing developments concerning PBOC daily Yuan support. Monitor official announcements, economic data releases, and market analysis for a clearer understanding of China's monetary policy and its implications for the global economy. Closely following the PBOC's actions and conducting thorough market analysis is crucial for understanding the future trajectory of the Yuan and its impact on global financial markets.

Featured Posts

-

Top 20 Vratarey Pley Off N Kh L Bobrovskiy V Spiske

May 15, 2025

Top 20 Vratarey Pley Off N Kh L Bobrovskiy V Spiske

May 15, 2025 -

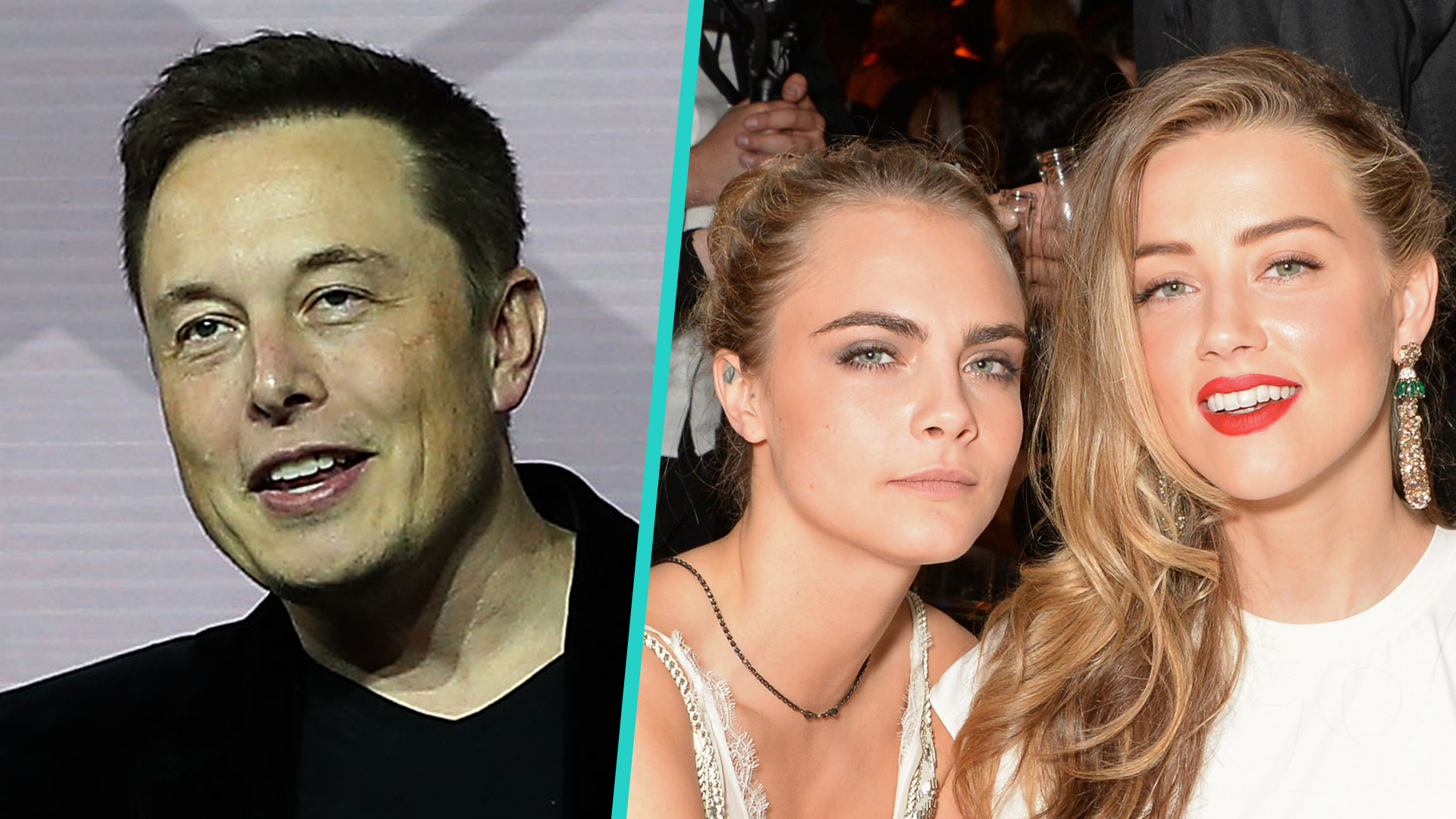

Elon Musk Denies Paternity Of Amber Heards Twins A Timeline Of Events

May 15, 2025

Elon Musk Denies Paternity Of Amber Heards Twins A Timeline Of Events

May 15, 2025 -

Elon Musk Denies Fathering Amber Heards Twins Embryo Dispute Aftermath

May 15, 2025

Elon Musk Denies Fathering Amber Heards Twins Embryo Dispute Aftermath

May 15, 2025 -

San Diego Padres Vs Chicago Cubs Who Will Win Prediction And Analysis

May 15, 2025

San Diego Padres Vs Chicago Cubs Who Will Win Prediction And Analysis

May 15, 2025 -

Foot Lockers Sneaker Sale Get Nike Air Dunks Jordans At 40 Off

May 15, 2025

Foot Lockers Sneaker Sale Get Nike Air Dunks Jordans At 40 Off

May 15, 2025