PCC Community Markets Posts Surprise Profit For 2024: Analysis And Outlook

Table of Contents

Analyzing PCC Community Markets' Unexpected Profitability in 2024

PCC Community Markets' 2024 success wasn't accidental; it resulted from a strategic combination of factors. Let's break down the key elements that fueled this impressive financial performance.

Strategic Pricing and Inventory Management

Effective pricing and inventory control are fundamental to maximizing profit margins. PCC Community Markets demonstrated expertise in both areas.

- Dynamic Pricing: PCC likely employed a data-driven approach to pricing, adjusting prices based on demand, seasonality, and competitor analysis. This allows for maximizing revenue on high-demand items while strategically discounting others to drive sales.

- Loyalty Programs: Rewarding loyal customers with exclusive discounts and promotions fosters repeat business and increases overall profitability. PCC's loyalty program likely played a significant role in driving sales and building customer relationships.

- Just-in-Time Inventory: Minimizing waste through efficient inventory management is crucial. PCC's commitment to a just-in-time inventory system likely reduced storage costs and minimized losses due to spoilage or obsolescence. This improved their supply chain efficiency significantly.

- Cost Control: Implementing rigorous cost control measures across all aspects of the business, from sourcing to logistics, contributed to higher profit margins. This includes negotiating favorable deals with suppliers and optimizing internal processes.

Increased Customer Loyalty and Engagement

PCC's commitment to community engagement and sustainability has fostered strong customer loyalty.

- Community Involvement: PCC's active participation in local events and its support of community initiatives build positive brand perception and attract customers who align with their values.

- Local Sourcing: Prioritizing local and organic products resonates with environmentally conscious consumers, creating a unique selling proposition and reinforcing brand identity.

- Customer Retention: High customer retention rates suggest a successful strategy in building lasting relationships with shoppers. This likely stems from their dedication to quality, service, and community.

- Sustainability Initiatives: PCC's commitment to sustainable practices appeals to environmentally aware customers, further enhancing brand loyalty and attracting new customers.

Successful Adaptability to Market Changes

Navigating challenges like inflation and supply chain disruptions requires adaptability and innovation.

- Inflation Mitigation: PCC likely implemented strategies to offset the impact of rising inflation, such as adjusting pricing strategically and sourcing products more efficiently.

- Supply Chain Resilience: Developing strong relationships with suppliers and diversifying sourcing helped PCC navigate supply chain disruptions. This ensured product availability despite external challenges.

- Consumer Behavior Shifts: PCC's ability to adapt to changing consumer behaviors, such as increased demand for online ordering or delivery services, contributed to their success. They likely leveraged this to increase revenue streams.

- Innovative Solutions: Implementing innovative solutions to address market challenges, such as adopting new technologies or streamlining processes, allowed PCC to maintain efficiency and profitability.

Factors Contributing to the Positive Financial Performance of PCC Community Markets

Beyond the operational aspects, other factors played a vital role in PCC's financial success.

Expansion of Product Offerings and Services

- Product Diversification: The introduction of new product lines, perhaps catering to specific dietary needs or preferences, likely broadened their customer base and boosted revenue.

- Service Enhancements: Improvements to existing services, like online ordering or delivery options, may have contributed to increased sales and customer satisfaction.

- Revenue Growth Analysis: A detailed analysis of revenue growth across different product categories would provide valuable insights into the success of PCC’s expansion strategies.

Effective Marketing and Brand Building

- Targeted Marketing: PCC's marketing strategies likely focus on reaching specific target audiences through effective channels. This ensures marketing dollars are spent efficiently.

- Brand Storytelling: Communicating PCC's commitment to community and sustainability through compelling storytelling builds a strong brand identity and fosters customer loyalty.

- Brand Awareness: Effective marketing campaigns have likely contributed to increased brand awareness and recognition among consumers.

Operational Efficiency and Cost Optimization

- Process Improvement: Streamlining operations, such as optimizing warehouse management or improving delivery routes, contributes to significant cost savings.

- Technology Adoption: Utilizing technology to automate tasks and improve efficiency further reduces costs and improves operational efficiency.

- Cost Reduction Initiatives: Implementing various cost-reduction initiatives across all departments helps maximize profitability.

Outlook and Future Projections for PCC Community Markets

While PCC Community Markets' 2024 performance is impressive, maintaining this success requires ongoing adaptation and strategic planning.

- Competitive Landscape: Continued competition from larger grocery chains presents a significant challenge. Maintaining a competitive edge requires innovative strategies.

- Economic Uncertainty: Economic fluctuations and potential downturns could impact consumer spending, necessitating flexible pricing and marketing strategies.

- Sustainability Goals: Maintaining commitment to sustainability while managing costs will require careful resource allocation and innovative solutions.

- Growth Opportunities: Identifying new growth opportunities, such as expanding to new locations or developing new product lines, will be crucial for long-term success.

Conclusion: PCC Community Markets' Profit Success: A Path Forward

PCC Community Markets' surprise profit in 2024 is a result of a multi-faceted approach encompassing strategic pricing, strong customer engagement, effective market adaptation, and operational efficiency. This success is a significant achievement within the competitive grocery market and showcases the power of combining community focus with sound business practices. Their commitment to sustainability, local sourcing, and customer loyalty has created a winning formula. However, navigating future challenges requires ongoing adaptation and innovation. Learn more about PCC Community Markets' financial performance and future strategies to understand their remarkable success story and discover their secrets to profitability. Analyze PCC Community Markets' innovative approach to the grocery market and observe how they continue to thrive.

Featured Posts

-

Sorteo Escolar Aragon 2024 58 Colegios Afectados

May 29, 2025

Sorteo Escolar Aragon 2024 58 Colegios Afectados

May 29, 2025 -

Saldanha Bay Disappearance Sisters Claim On Joshlin Smiths Location

May 29, 2025

Saldanha Bay Disappearance Sisters Claim On Joshlin Smiths Location

May 29, 2025 -

Aragon 58 Colegios Con Listas De Espera Soluciones Y Consejos

May 29, 2025

Aragon 58 Colegios Con Listas De Espera Soluciones Y Consejos

May 29, 2025 -

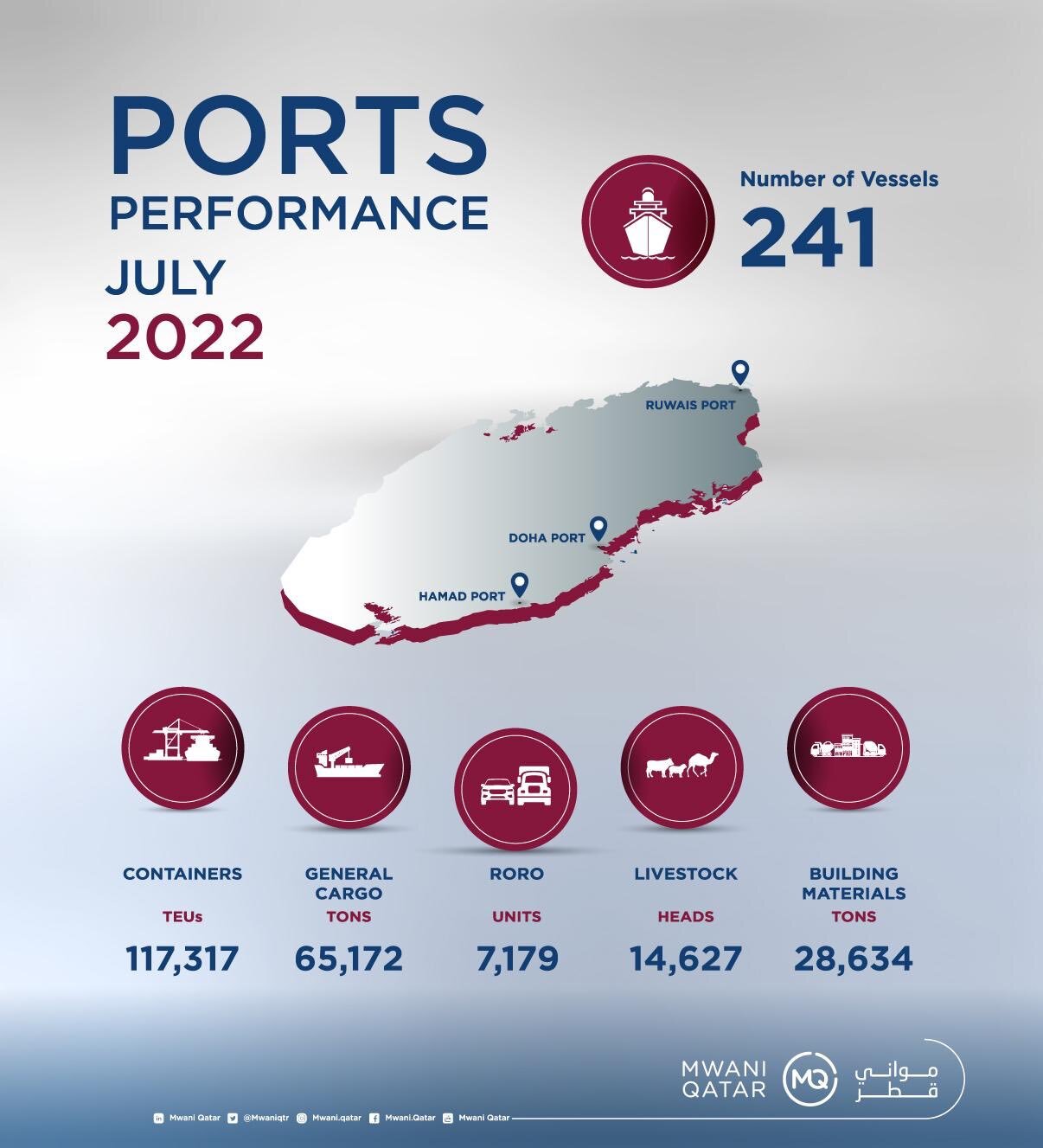

2024 A Year Of Growth For Doha Port Under Mwani Qatars Management

May 29, 2025

2024 A Year Of Growth For Doha Port Under Mwani Qatars Management

May 29, 2025 -

Chiquis On Her Latin Women In Music Impact Award An Exclusive Interview

May 29, 2025

Chiquis On Her Latin Women In Music Impact Award An Exclusive Interview

May 29, 2025

Latest Posts

-

Double Trouble Harmful Algal Blooms Strike Kodiak Waters Again

May 30, 2025

Double Trouble Harmful Algal Blooms Strike Kodiak Waters Again

May 30, 2025 -

An Insiders Guide To Paris Best Neighborhoods

May 30, 2025

An Insiders Guide To Paris Best Neighborhoods

May 30, 2025 -

Kodiak Waters Two Consecutive Harmful Algal Blooms Warn Shellfish Harvesters

May 30, 2025

Kodiak Waters Two Consecutive Harmful Algal Blooms Warn Shellfish Harvesters

May 30, 2025 -

Aeroport De Bordeaux La Piste Secondaire Au C Ur D Une Mobilisation

May 30, 2025

Aeroport De Bordeaux La Piste Secondaire Au C Ur D Une Mobilisation

May 30, 2025 -

Autoroute A69 La Justice Contournee Le Projet Rouvert Par Les Ministres Et Parlementaires

May 30, 2025

Autoroute A69 La Justice Contournee Le Projet Rouvert Par Les Ministres Et Parlementaires

May 30, 2025