Personal Loan Interest Rates Today: Financing Starting Under 6%

Table of Contents

Understanding Current Personal Loan Interest Rates

The current market for personal loan interest rates is dynamic, with rates varying significantly depending on several factors. You can generally expect to see a range of 6% to 36%, although the specific rate you qualify for will depend on your individual financial profile. Understanding this range and the factors influencing it is the first step to securing a loan with favorable terms.

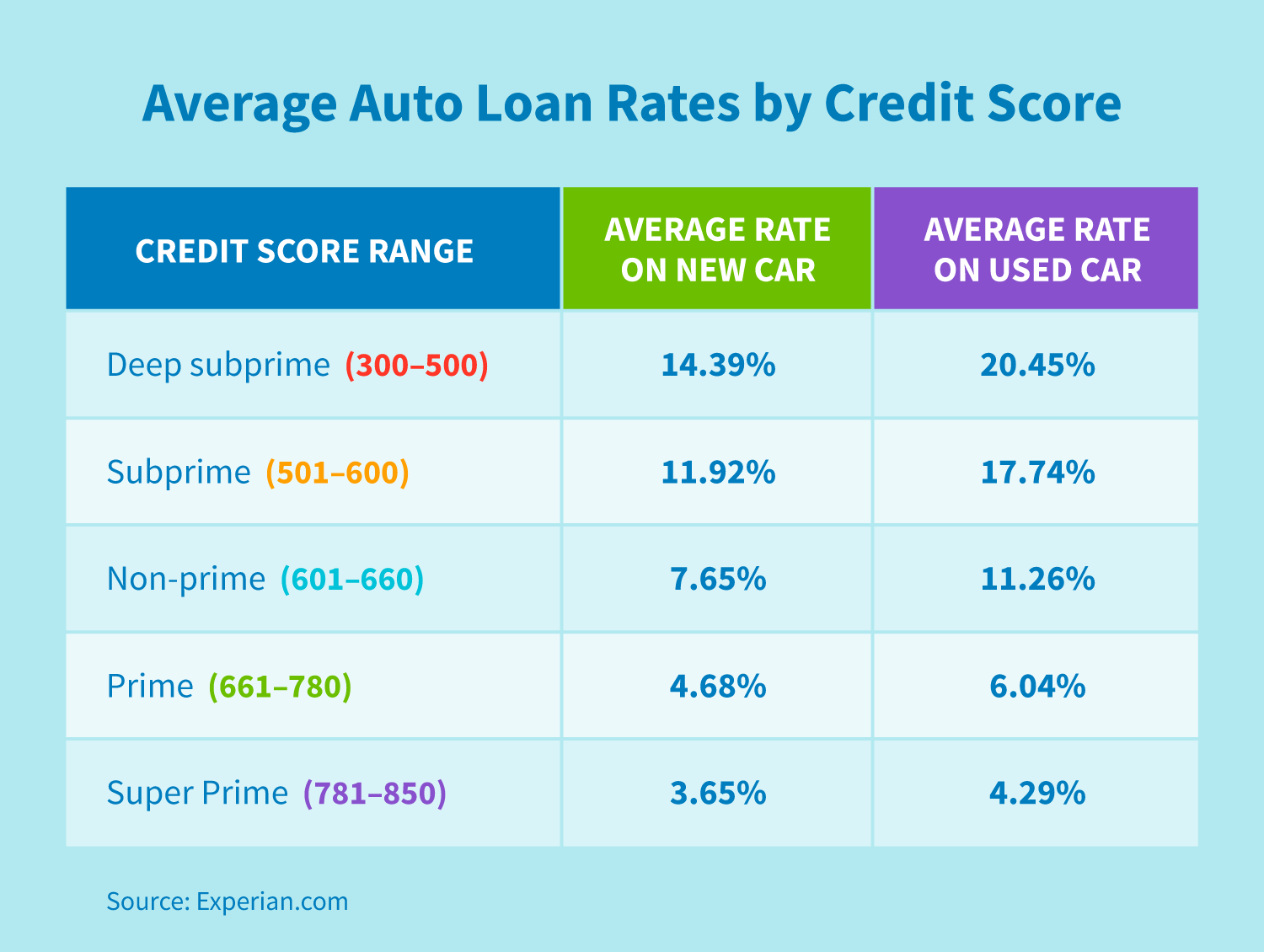

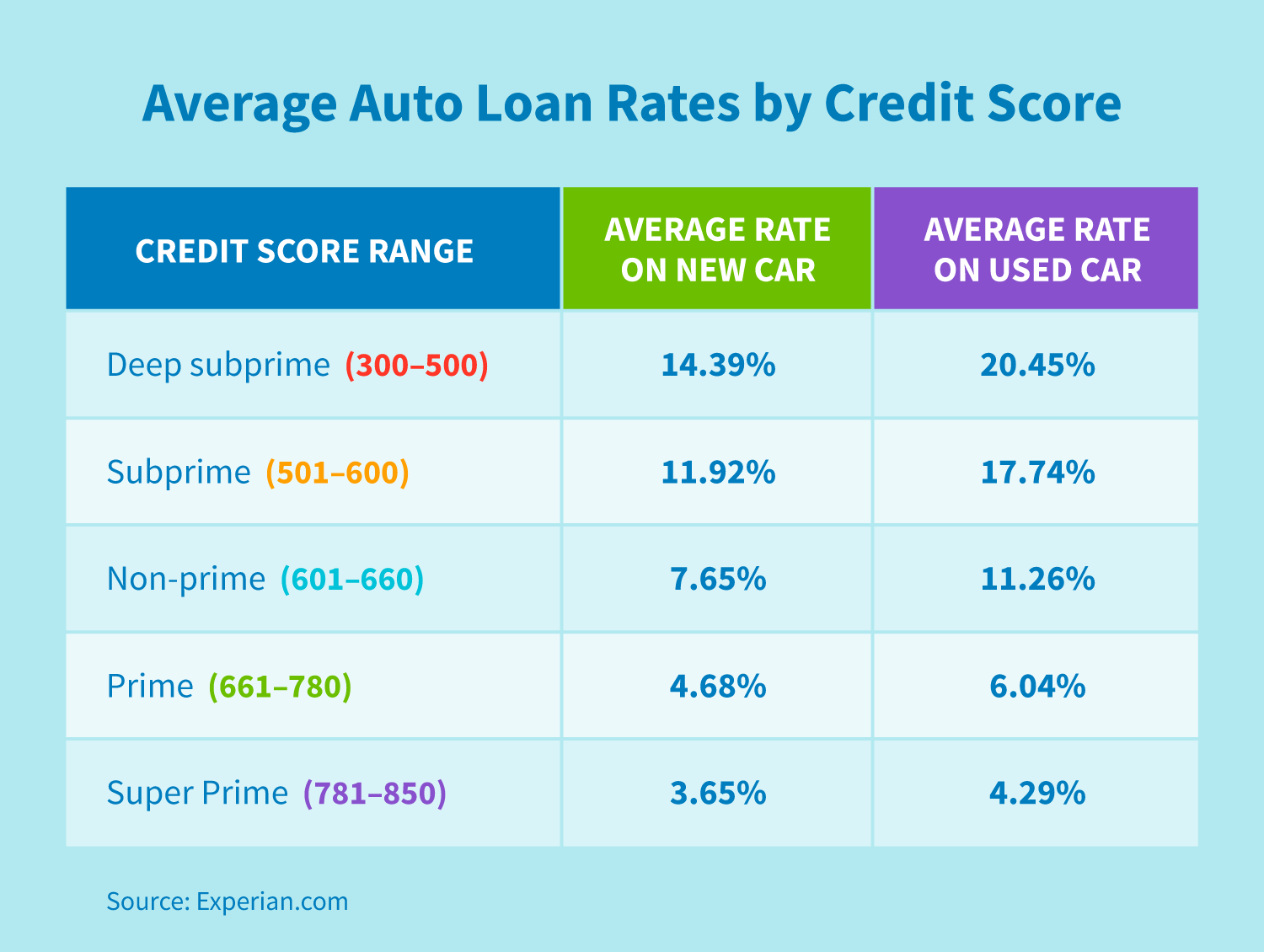

- Average personal loan interest rates for various credit scores:

- Excellent Credit (750+): Potentially as low as 6% - 10%

- Good Credit (700-749): Typically 10% - 15%

- Fair Credit (650-699): Often 15% - 20%

- Poor Credit (Below 650): May range from 20% to 36% or higher. Securing a loan at all may be challenging.

- Impact of loan terms (shorter vs. longer repayment periods) on interest rates: Shorter loan terms generally result in lower overall interest paid but higher monthly payments. Longer terms mean lower monthly payments but result in significantly higher total interest paid over the life of the loan.

- Examples of current offers from different lenders: While we cannot endorse specific lenders, it's crucial to shop around and compare offers from banks like Bank of America or Chase, credit unions, and online lenders like LendingClub or Upstart. Rates vary significantly between these types of institutions.

- Difference between fixed and variable interest rates: Fixed-rate personal loans offer consistent monthly payments throughout the loan term, providing predictability. Variable-rate loans have fluctuating interest rates, making monthly payments uncertain. Fixed rates are generally preferred for budgeting purposes.

Factors Affecting Your Personal Loan Interest Rate

Lenders use a variety of factors to assess your creditworthiness and determine your personal loan interest rate. Understanding these factors will help you improve your chances of getting a lower rate.

- Credit score: Your credit score is the most significant factor. A higher credit score (750 or above) significantly improves your chances of securing a lower interest rate. Consider using free credit score resources like Credit Karma or AnnualCreditReport.com to monitor your credit and identify areas for improvement.

- Debt-to-income ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, indicates your ability to manage additional debt. A lower DTI generally leads to better interest rates.

- Loan amount: Larger loan amounts often come with higher interest rates due to the increased risk for the lender.

- Loan term: As mentioned before, longer loan terms result in higher overall interest paid, even if monthly payments are lower. Choose a loan term that balances affordability with minimizing total interest.

- Type of lender: Banks, credit unions, and online lenders may offer different interest rates. Credit unions often offer more competitive rates to their members, while online lenders may have more flexible criteria.

How to Find the Best Personal Loan Interest Rate

Finding the best personal loan interest rate requires proactive steps and careful planning. Don't rush into a decision; take your time to compare options thoroughly.

- Shop around and compare offers from multiple lenders: This is crucial for finding the most competitive rates. Utilize online comparison tools or visit multiple lenders directly.

- Check your credit report for accuracy and address any errors: Inaccurate information on your credit report can negatively impact your interest rate. Dispute any errors promptly.

- Improve your credit score before applying: Even a small improvement in your credit score can lead to substantial savings on interest.

- Consider pre-qualification: Pre-qualification allows you to check your eligibility and see estimated rates without impacting your credit score.

- Negotiate with lenders for a better interest rate: Don't hesitate to negotiate, especially if you have multiple offers from different lenders.

- Understand all fees associated with the loan: Be aware of origination fees, prepayment penalties, and other charges that can add to the overall cost of the loan.

Alternatives to Personal Loans with Lower Interest Rates

Before committing to a personal loan, consider alternative financing options that may offer lower interest rates or better terms.

- 0% APR credit cards: For smaller, short-term purchases, a 0% APR credit card can be a great option, allowing you to pay off the balance interest-free within the promotional period.

- Balance transfer credit cards: If you have existing high-interest debt, a balance transfer credit card with a 0% or low introductory APR can help consolidate your debt and save on interest.

- Loans from family or friends: Borrowing from family or friends can sometimes result in lower interest rates or even interest-free loans, but it's crucial to have a formal written agreement.

Conclusion

Securing a personal loan with a favorable interest rate depends on several key factors, including your credit score, debt-to-income ratio, and the loan amount and term. By understanding these factors and taking proactive steps like shopping around and improving your credit, you can significantly increase your chances of finding financing starting under 6%. Remember, careful planning and research are key to securing the best personal loan interest rates for your specific financial situation. Start your search for the best personal loan interest rates today! Compare offers from various lenders to secure the most affordable financing for your needs. Don't hesitate to leverage the information presented here to find a personal loan that fits your budget and financial goals. Remember to check your credit score and shop around to get the lowest personal loan interest rates possible.

Featured Posts

-

Investigation Underway After Truck Explosion Propane Leak Suspected

May 28, 2025

Investigation Underway After Truck Explosion Propane Leak Suspected

May 28, 2025 -

Padres Position Shifts In Recent Mlb Power Rankings

May 28, 2025

Padres Position Shifts In Recent Mlb Power Rankings

May 28, 2025 -

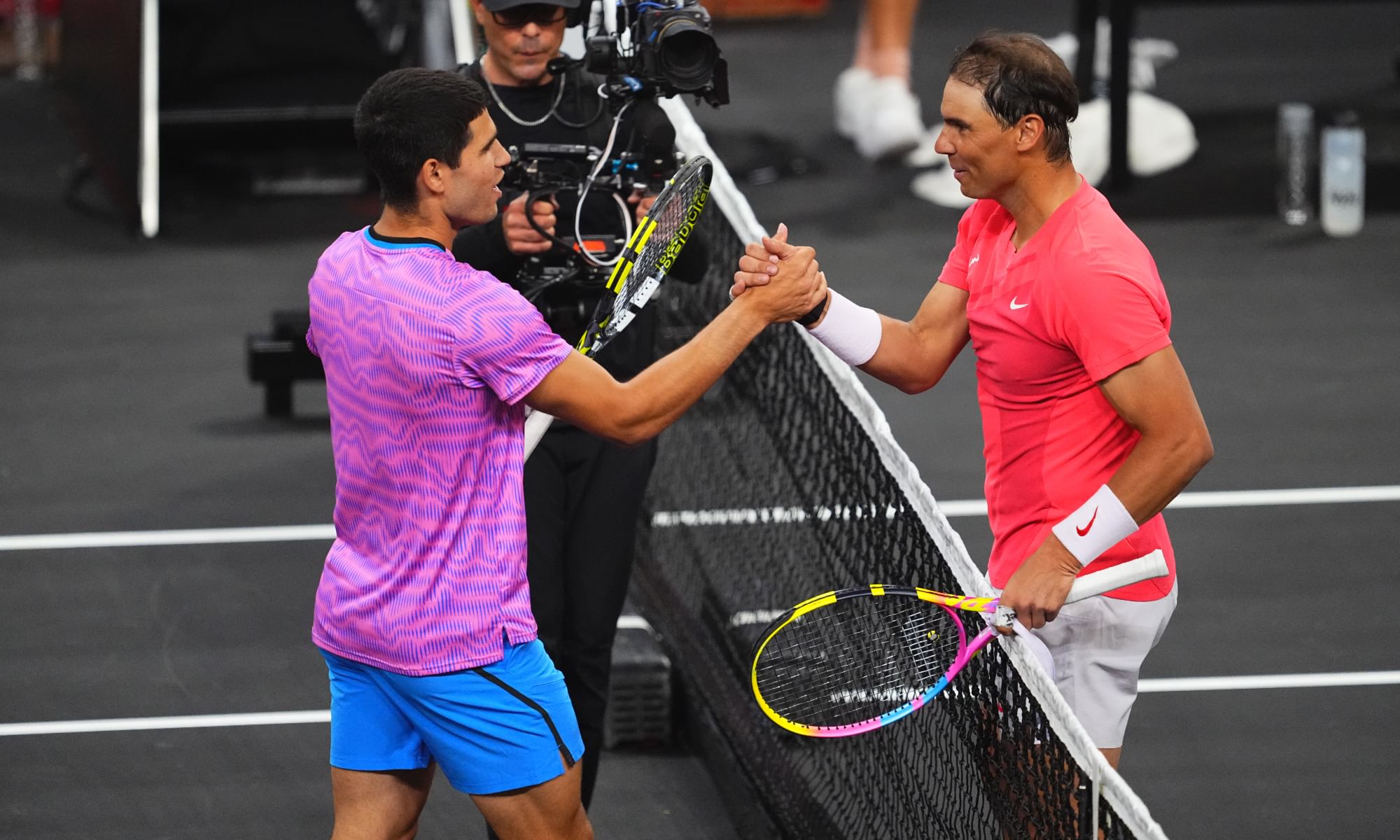

Alcaraz Sinner Launch French Open Challenges Swiatek Seeks Improvement

May 28, 2025

Alcaraz Sinner Launch French Open Challenges Swiatek Seeks Improvement

May 28, 2025 -

Opening Day Preview Phillies Vs Mets Arraez And Carpenters Impact

May 28, 2025

Opening Day Preview Phillies Vs Mets Arraez And Carpenters Impact

May 28, 2025 -

Strategic Shift How A New U S Missile System Challenges Chinas Naval Ambitions

May 28, 2025

Strategic Shift How A New U S Missile System Challenges Chinas Naval Ambitions

May 28, 2025

Latest Posts

-

Attaques Contre Des Prisons En Isere La Visite Ministerielle Critiquee

May 30, 2025

Attaques Contre Des Prisons En Isere La Visite Ministerielle Critiquee

May 30, 2025 -

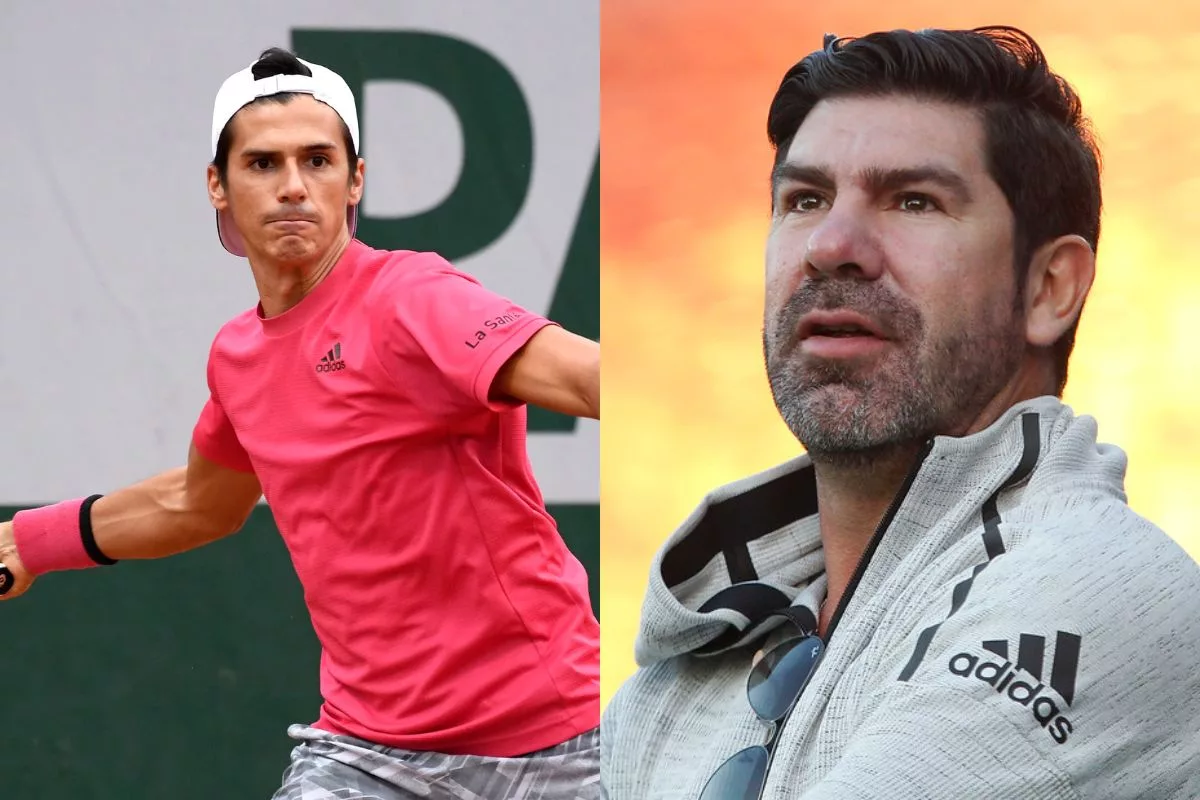

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025 -

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025 -

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025 -

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025