Philippine Bank CEO Warns Of Economic Downturn Amid Tariff War

Table of Contents

Impact of Tariff Wars on Philippine Exports

The ongoing tariff disputes significantly impact Philippine exports, particularly in sectors heavily reliant on global trade. Industries like electronics manufacturing and agriculture are particularly vulnerable to increased tariffs imposed by trading partners. These increased tariffs reduce the competitiveness of Philippine goods in international markets, leading to several detrimental consequences.

- Decreased demand for Philippine goods: Higher prices due to tariffs make Philippine products less attractive to international buyers, directly reducing demand.

- Loss of market share to competitors: Competitors from countries not facing similar tariffs gain a significant price advantage, leading to the Philippines losing market share.

- Potential job losses in export-oriented industries: Reduced demand and competitiveness inevitably lead to production cuts and potential job losses within export-focused industries, exacerbating the Philippine economic downturn.

Data from [insert source if available – e.g., the Philippine Statistics Authority] could show a quantifiable decrease in exports in specific sectors since the escalation of tariff disputes. This decline further underscores the severity of the threat to the Philippine economy.

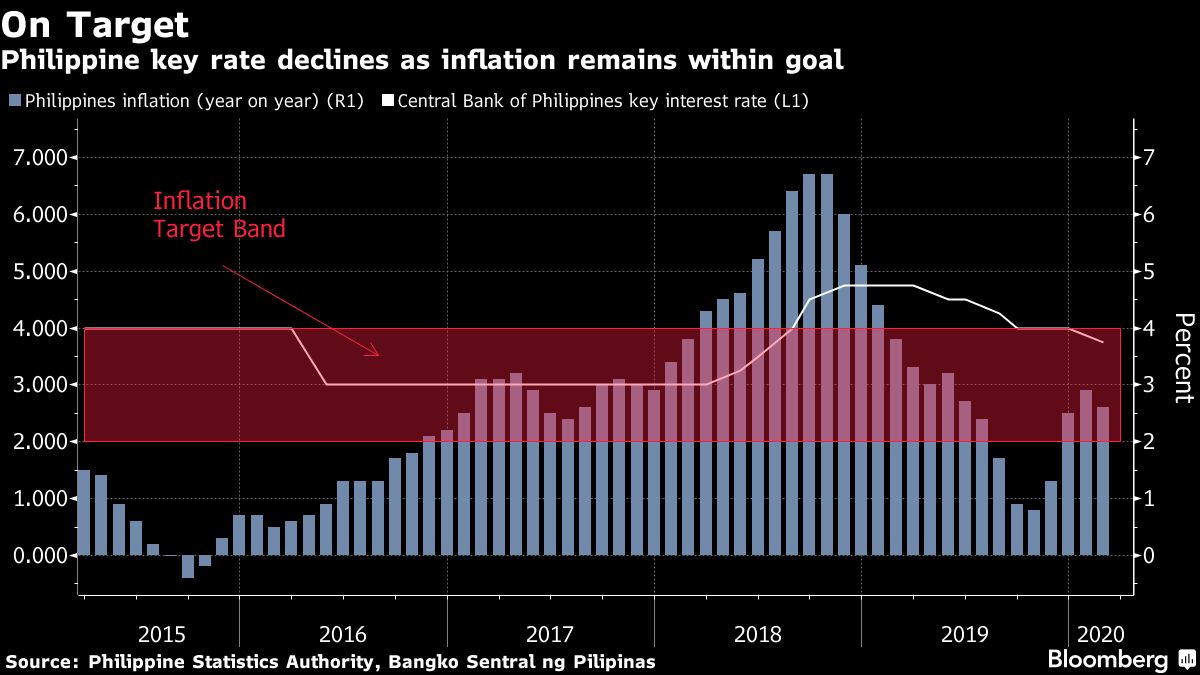

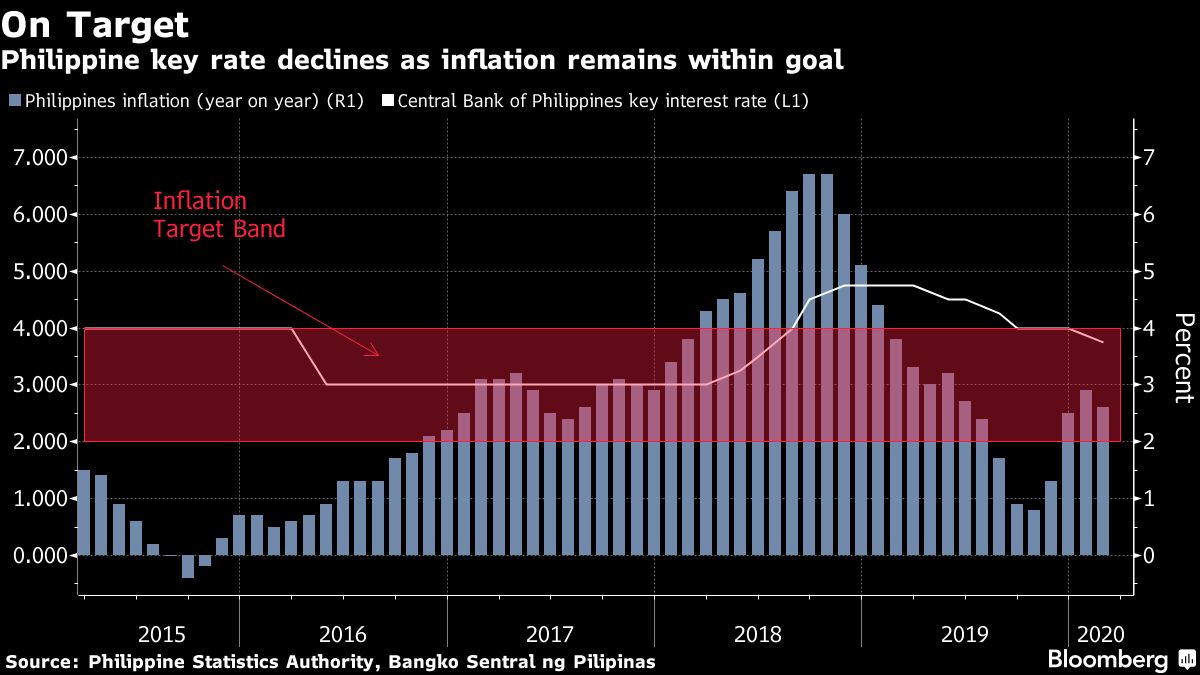

Rising Inflation and its Impact on Philippine Consumers

Tariffs don't just affect businesses; they directly impact consumers. Increased tariffs on imported goods lead to higher prices for consumers, contributing to rising inflation. This inflationary pressure has a ripple effect, increasing the cost of various goods and services within the Philippine economy.

- Increased cost of living for Filipinos: Higher prices for essential goods and services directly reduce the purchasing power of Filipino consumers.

- Reduced consumer spending: As the cost of living rises, consumers are forced to reduce spending, impacting overall economic activity and potentially slowing economic growth, further contributing to the Philippine economic downturn.

- Potential for social unrest: Persistently high inflation rates can lead to widespread discontent and potentially trigger social unrest.

The impact of inflation on the most vulnerable segments of the population requires urgent attention. Government measures to cushion this blow are crucial in mitigating the effects of a potential Philippine economic downturn.

Erosion of Investor Confidence in the Philippine Economy

The uncertainty surrounding the ongoing tariff disputes significantly erodes investor confidence in the Philippine economy. This uncertainty discourages both foreign direct investment (FDI) and domestic investment.

- Withdrawal of foreign investments: Investors may choose to move their capital to more stable economies, reducing crucial foreign investment needed for growth.

- Slowdown in economic growth: Reduced investment leads to slower economic growth, potentially deepening the Philippine economic downturn.

- Negative impact on the Philippine Stock Exchange: Investor uncertainty often manifests in a decline in stock market performance, impacting investor wealth and further dampening confidence.

The Philippine peso's value can also be negatively affected by this loss of confidence, potentially leading to further economic instability.

Government Response and Mitigation Strategies

The Philippine government has implemented various measures to address these economic challenges, focusing on providing support to affected industries and exploring strategies to mitigate the impact of the tariff war.

- Government support for affected industries: Financial aid, tax breaks, and other forms of support are vital for helping struggling businesses stay afloat.

- Investment in infrastructure and human capital: Investing in infrastructure projects and upgrading the skills of the workforce can improve long-term competitiveness.

- Negotiations for trade agreements: Seeking alternative trade partnerships and negotiating favorable trade agreements are crucial for diversifying export markets and reducing reliance on vulnerable trade relationships.

The effectiveness of these strategies will be crucial in determining the severity and duration of any potential Philippine economic downturn.

Conclusion: Preparing for a Potential Philippine Economic Downturn

The warning from the Philippine bank CEO highlights significant concerns about a potential Philippine economic downturn driven by the escalating tariff war. The impacts on exports, inflation, and investor confidence are substantial and require a proactive and comprehensive response. The government's role in mitigating these challenges through targeted support and strategic policy decisions is paramount. To avoid or lessen the impact of the Philippine economic downturn, staying informed about the evolving economic situation and government initiatives is crucial. Learn more about mitigating the impact of the Philippine economic downturn and stay updated on the latest news about the Philippine economic downturn by following reputable news sources and government publications.

Featured Posts

-

Benson Boones Coachella Surprise Brian May Guest Appearance

Apr 26, 2025

Benson Boones Coachella Surprise Brian May Guest Appearance

Apr 26, 2025 -

Numbers Never Lie Is Deion Sanders Hurting Shedeur Sanders Nfl Draft Stock

Apr 26, 2025

Numbers Never Lie Is Deion Sanders Hurting Shedeur Sanders Nfl Draft Stock

Apr 26, 2025 -

Saab Reports Improved Defense Order Delivery Times

Apr 26, 2025

Saab Reports Improved Defense Order Delivery Times

Apr 26, 2025 -

127 Years Of Brewing History Anchor Brewing Company Shuttering Its Doors

Apr 26, 2025

127 Years Of Brewing History Anchor Brewing Company Shuttering Its Doors

Apr 26, 2025 -

Track Failures Cripple Randstad Rail Services Amsterdam Area Heavily Affected

Apr 26, 2025

Track Failures Cripple Randstad Rail Services Amsterdam Area Heavily Affected

Apr 26, 2025