Podcast: Financial Independence Through Practical Advice

Table of Contents

Building a Solid Foundation: Budgeting and Debt Management

Financial independence starts with a solid foundation built upon effective budgeting and debt management. These two crucial aspects are interconnected; responsible budgeting allows you to allocate funds towards debt reduction, accelerating your journey to financial freedom. Mastering these skills is vital for achieving your financial goals.

Creating a Realistic Budget

Tracking your expenses is the first step towards creating a realistic budget. Understanding where your money goes is critical for identifying areas where you can cut back and save. Several budgeting tools and apps, such as Mint, YNAB (You Need A Budget), and Personal Capital, can simplify this process. These apps offer features like automatic expense categorization, goal setting, and insightful reporting, streamlining your financial management.

- Use budgeting apps: Leverage technology to automate expense tracking and gain valuable insights into your spending habits.

- Categorize expenses: Organize your expenses into meaningful categories (housing, transportation, food, etc.) to identify spending patterns.

- Set financial goals: Define your short-term and long-term financial goals (e.g., paying off debt, saving for a down payment, building an emergency fund). This will guide your budget allocation.

- Review budget regularly: Regularly review your budget to ensure it aligns with your goals and adjust it as needed based on changing circumstances.

Popular budgeting methods like the 50/30/20 rule (allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment) and zero-based budgeting (allocating every dollar to a specific purpose) can provide a structured approach to financial planning.

Tackling Debt Strategically

High-interest debt can significantly hinder your progress towards financial independence. Therefore, developing a strategic debt reduction plan is crucial. Two popular methods are the debt snowball method (paying off the smallest debt first for motivation) and the debt avalanche method (paying off the highest-interest debt first to minimize total interest paid).

- Prioritize high-interest debt: Focus on paying down debts with the highest interest rates first to minimize the overall cost of borrowing.

- Consider debt consolidation loans: Explore debt consolidation options to simplify payments and potentially lower your interest rate.

- Negotiate lower interest rates: Contact your creditors to negotiate lower interest rates or more favorable repayment terms.

- Explore balance transfer options: Transfer high-interest balances to credit cards with introductory 0% APR periods to save on interest.

Investing for Growth and Passive Income

Once you've established a solid foundation with budgeting and debt management, investing becomes a crucial step in building wealth and achieving financial independence. Strategic investing can generate significant growth and even passive income streams.

Diversifying Your Investment Portfolio

Diversification is key to mitigating risk in your investment portfolio. Don't put all your eggs in one basket! Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce the impact of losses in any single asset.

- Invest in index funds: Low-cost index funds offer broad market exposure, providing diversification without requiring extensive research.

- Explore ETFs: Exchange-traded funds (ETFs) offer diversification across various sectors and asset classes in a single investment.

- Consider real estate investment trusts (REITs): REITs provide exposure to the real estate market without the complexities of direct property ownership.

- Diversify across sectors and asset classes: Don't concentrate your investments in a single sector or asset class.

Generating Passive Income Streams

Passive income, income earned with minimal ongoing effort, can significantly accelerate your journey towards financial independence. Several avenues can provide passive income streams:

- Research rental property investment: Rental properties can generate consistent cash flow, but require careful research and management.

- Explore dividend-paying stocks: Dividend stocks offer regular income payments, supplementing your investment growth.

- Consider affiliate marketing or creating online courses: These online businesses require upfront effort but can generate passive income over time.

Long-Term Financial Planning and Goal Setting

Achieving financial independence is a marathon, not a sprint. Long-term financial planning and the establishment of clear goals are vital for staying focused and motivated throughout this process.

Setting SMART Financial Goals

Setting SMART goals – Specific, Measurable, Achievable, Relevant, and Time-bound – is essential for effective financial planning.

- Define clear financial objectives: Clearly define what you want to achieve financially (e.g., retire at age 60, buy a house in five years).

- Set realistic timelines: Set achievable timelines for your financial goals, considering your current financial situation and potential growth.

- Track progress regularly: Monitor your progress towards your goals and make adjustments as needed.

- Adjust goals as needed: Life circumstances change. Be prepared to adjust your goals to reflect these changes.

The Importance of Professional Advice

While many aspects of financial planning can be self-managed, seeking professional advice can be invaluable, especially in complex situations.

- Consider seeking professional advice for complex financial situations: A financial advisor can provide expert guidance on investment strategies, retirement planning, and tax optimization.

- Estate planning: A financial advisor or estate planning attorney can help you create a comprehensive estate plan to protect your assets and your family’s future.

- Tax optimization: A tax professional can help you minimize your tax liability and maximize your financial returns.

Conclusion

This article, inspired by our podcast on financial independence, has outlined key strategies for achieving financial freedom. By mastering budgeting, strategically managing debt, diversifying your investments, and setting clear financial goals, you can build a path towards a financially secure future. Remember, the journey to financial independence is a personal one. Adapt these strategies to your individual circumstances and celebrate each milestone along the way.

Call to Action: Listen to our full podcast series on "Financial Independence Through Practical Advice" for detailed explanations, expert interviews, and actionable steps to reach your financial goals. Start building your path to financial independence today!

Featured Posts

-

Duncan Bannatynes Charitable Contribution To Children In Morocco

May 31, 2025

Duncan Bannatynes Charitable Contribution To Children In Morocco

May 31, 2025 -

Middle Managers Investing In Their Development For Optimal Business Results

May 31, 2025

Middle Managers Investing In Their Development For Optimal Business Results

May 31, 2025 -

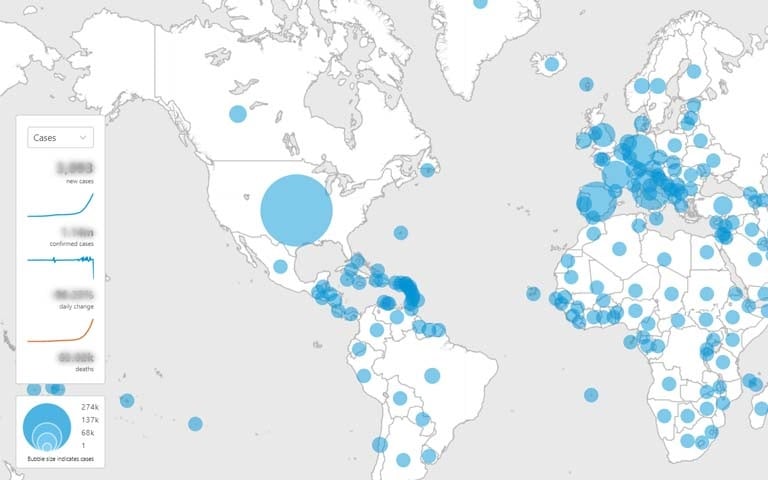

A New Covid 19 Variant And The Rise In Global Cases A Who Update

May 31, 2025

A New Covid 19 Variant And The Rise In Global Cases A Who Update

May 31, 2025 -

Anchor Brewing Companys Closure A Legacy In Beer Ends

May 31, 2025

Anchor Brewing Companys Closure A Legacy In Beer Ends

May 31, 2025 -

Nyt Mini Crossword Puzzle Solutions April 10th

May 31, 2025

Nyt Mini Crossword Puzzle Solutions April 10th

May 31, 2025