Post-Brexit Challenges For UK Luxury Exports To The EU

Table of Contents

Increased Customs Procedures and Delays

The post-Brexit era has introduced a mountain of new bureaucratic hurdles for UK luxury exporters. The seemingly simple act of shipping goods to the EU now involves significantly more complex customs declarations and procedures. This "Brexit red tape" has led to substantial delays and increased costs. The sheer volume of paperwork required, coupled with the need for precise and accurate completion, is a significant burden. Businesses now need a deep understanding of the new import/export documentation requirements, something that was previously largely unnecessary.

- Longer processing times at borders: Goods are often held up at customs for extended periods, resulting in delayed deliveries and impacting customer satisfaction. This is especially problematic for time-sensitive shipments and perishable goods.

- Increased costs associated with customs brokers and documentation: Many businesses are now forced to rely on specialized customs brokers to navigate the complexities of the new regulations. This adds a significant cost burden to the exporting process.

- Risk of goods being held up due to incorrect paperwork or compliance issues: Even minor errors in customs documentation can lead to delays and penalties, highlighting the importance of accuracy and attention to detail.

- The need for specialized knowledge of new customs regulations: Businesses need to invest in training or hire specialized staff to ensure compliance with the ever-evolving regulations.

Tariffs and Increased Costs

One of the most significant post-Brexit challenges for UK luxury exporters is the imposition of tariffs on goods entering the EU. These import duties substantially increase the cost of goods, directly impacting pricing strategies and profitability. For luxury goods, where pricing is a crucial element of brand positioning, these increased costs can severely erode competitive advantage. Businesses now face the difficult task of balancing maintaining profit margins with remaining price-competitive against EU-based rivals.

- Higher import tariffs significantly increasing the cost of goods: Tariffs add a considerable percentage to the final price, making UK luxury goods less attractive in the EU market.

- Reduced profit margins for exporters: The increased costs are often absorbed by the exporter, leading to a squeeze on profit margins.

- Potential loss of market share due to higher prices: Consumers may choose to buy similar, but cheaper, products from EU-based manufacturers.

- Need for businesses to adjust pricing strategies to remain competitive: Businesses must carefully reassess their pricing models to remain competitive while still ensuring profitability.

VAT and Tax Complications

Navigating VAT regulations post-Brexit has added a significant layer of complexity for UK businesses exporting to the EU. The changes mean dealing with varying VAT rules in different EU member states, demanding meticulous compliance across multiple jurisdictions. This necessitates accurate record-keeping, timely VAT declarations, and a clear understanding of the specific requirements of each country. Non-compliance can lead to costly penalties and legal issues.

- Increased complexity in managing VAT registration and compliance across different EU countries: Each country has its own specific rules and procedures, making it difficult for businesses to manage.

- Potential for penalties and fines for non-compliance: Errors in VAT declarations can lead to significant financial penalties and legal repercussions.

- Need for specialized tax advice and software: Businesses often need to invest in expert tax advice and specialized software to ensure compliance.

- Difficulties in recovering VAT on imported goods: The process of claiming back VAT on imported goods can be challenging and time-consuming.

Supply Chain Disruptions

Brexit has caused considerable disruption to supply chains, impacting the timely delivery of luxury goods to EU customers. Increased border checks, coupled with the general complexities of navigating new trade rules, have led to longer transportation times and increased costs. This is particularly problematic for businesses reliant on just-in-time inventory management systems. The fragility of global supply chains has been exposed, highlighting the need for businesses to adapt their logistical strategies.

- Longer transportation times due to increased border checks: Delays at borders increase lead times and complicate logistics planning.

- Increased transportation costs due to higher fuel prices and logistical complexities: The additional time and complexity involved in transportation add significantly to the overall costs.

- Higher risk of delays and stock-outs: Unforeseen delays can disrupt schedules and lead to shortages in the EU market.

- Need for businesses to diversify their supply chains and improve logistics planning: Businesses need to create more resilient supply chains by diversifying suppliers and improving their logistics planning to mitigate future disruptions.

Conclusion

Post-Brexit challenges for UK luxury exports to the EU are substantial and multifaceted. Increased customs procedures, tariffs adding to the cost of goods, VAT complexities, and supply chain disruptions all present significant hurdles for businesses. Understanding and proactively addressing these issues is paramount. Businesses must invest in expert advice, streamlined customs procedures, and robust supply chain management to navigate these new complexities and maintain competitiveness in the EU market. Seeking professional guidance to optimize your strategies for UK luxury exports to the EU is crucial to mitigate the risks and ensure continued success in this evolving landscape.

Featured Posts

-

From Underdogs To Champions Charting Liverpools Rise Under Juergen Klopp

May 21, 2025

From Underdogs To Champions Charting Liverpools Rise Under Juergen Klopp

May 21, 2025 -

5 Podcasts Esenciales Para Fans Del Misterio Suspenso Y El Horror

May 21, 2025

5 Podcasts Esenciales Para Fans Del Misterio Suspenso Y El Horror

May 21, 2025 -

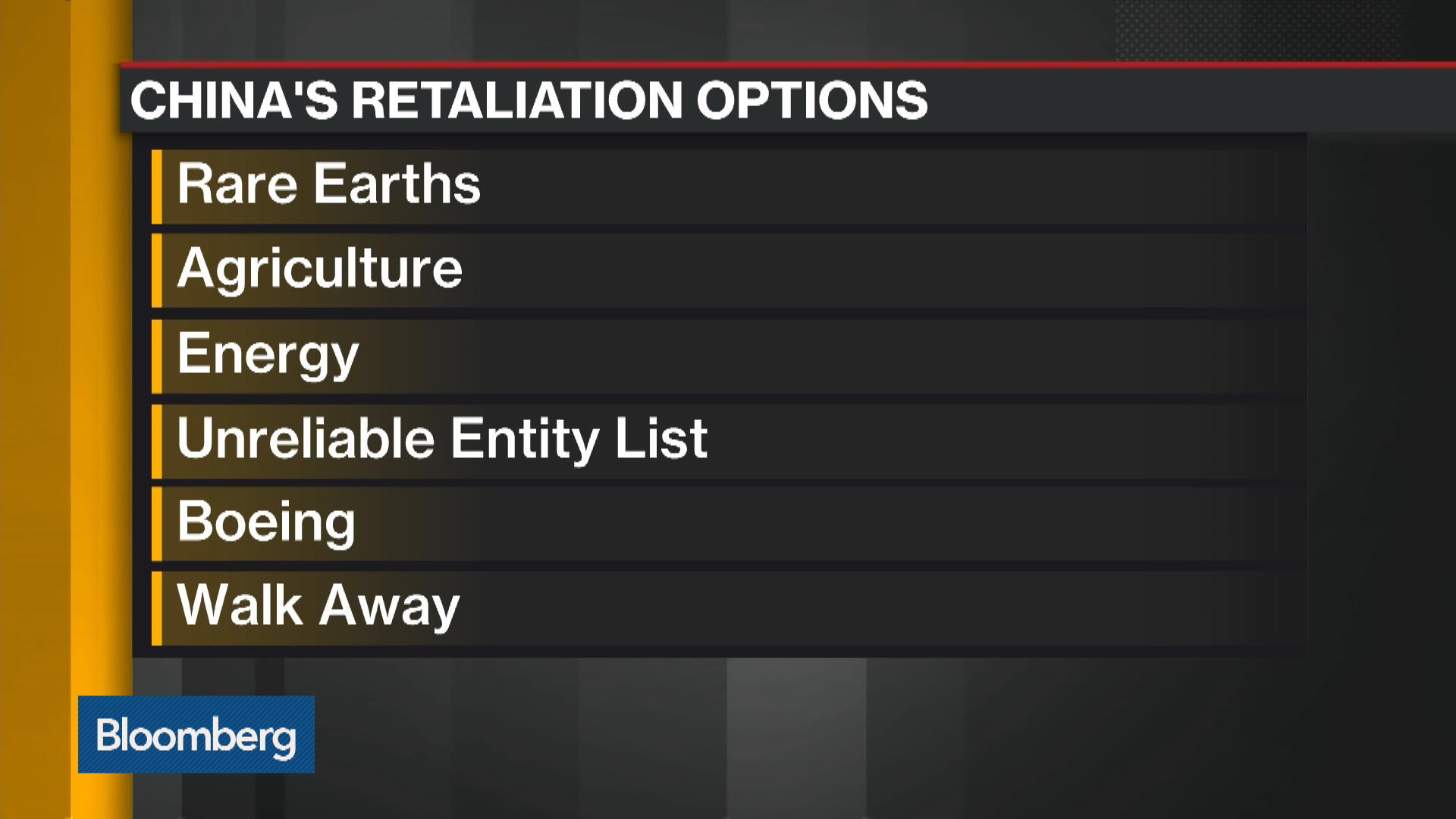

Swiss Chinese Call For De Escalation Through Tariff Talks

May 21, 2025

Swiss Chinese Call For De Escalation Through Tariff Talks

May 21, 2025 -

Tikkie Uw Gids Voor Probleemloos Bankieren In Nederland

May 21, 2025

Tikkie Uw Gids Voor Probleemloos Bankieren In Nederland

May 21, 2025 -

Kahnawake Casino Lawsuit Owners Sue Mohawk Council And Grand Chief

May 21, 2025

Kahnawake Casino Lawsuit Owners Sue Mohawk Council And Grand Chief

May 21, 2025

Latest Posts

-

Your First Alert Strong Wind And Severe Storms Expected

May 21, 2025

Your First Alert Strong Wind And Severe Storms Expected

May 21, 2025 -

D Wave Quantum Qbts Explaining The Recent Stock Market Rally

May 21, 2025

D Wave Quantum Qbts Explaining The Recent Stock Market Rally

May 21, 2025 -

Collins Aerospace Cedar Rapids Layoffs Confirmed

May 21, 2025

Collins Aerospace Cedar Rapids Layoffs Confirmed

May 21, 2025 -

Understanding D Wave Quantum Inc S Qbts Significant Stock Jump

May 21, 2025

Understanding D Wave Quantum Inc S Qbts Significant Stock Jump

May 21, 2025 -

Big Bear Ai Holdings Bbai Stock Plunge In 2025 Reasons And Analysis

May 21, 2025

Big Bear Ai Holdings Bbai Stock Plunge In 2025 Reasons And Analysis

May 21, 2025