Posthaste: Are Canadian Home Prices Entering A Correction?

Table of Contents

Rising Interest Rates and Their Impact

The Bank of Canada's aggressive interest rate hikes have significantly impacted mortgage affordability. There's a direct correlation between interest rates and the cost of borrowing, directly affecting the Canadian housing market.

-

Increased borrowing costs deter potential buyers: Higher interest rates translate to higher monthly mortgage payments, making homeownership less accessible for many Canadians. This reduced affordability directly impacts buyer demand.

-

Reduced purchasing power leads to decreased demand: With higher borrowing costs, potential buyers can afford less expensive homes, leading to a reduction in overall demand. This decreased demand puts downward pressure on prices.

-

Impact on variable-rate mortgages vs. fixed-rate mortgages: Borrowers with variable-rate mortgages are immediately exposed to interest rate fluctuations, leading to potentially significant increases in their monthly payments. Those with fixed-rate mortgages have some protection, but refinancing options become more challenging and potentially expensive.

-

Effect on investor activity in the housing market: Rising interest rates increase the cost of borrowing for investors, making investment properties less attractive and potentially decreasing investor activity in the Canadian housing market. This impacts the overall demand and price levels.

The Bank of Canada's recent rate increases have undeniably impacted housing affordability. Data from the Canadian Real Estate Association (CREA) shows a clear slowdown in sales activity following each rate hike, illustrating the immediate impact on market dynamics.

Inflation's Squeeze on Household Budgets

Rampant inflation significantly erodes disposable income, directly affecting housing affordability. The increased cost of essential goods and services leaves less money available for housing expenses.

-

Increased cost of living reduces the funds available for housing: As inflation pushes up the prices of groceries, gas, and other necessities, households have less discretionary income for large purchases like homes. This limits their purchasing power.

-

Impact on consumer confidence and willingness to buy: High inflation creates uncertainty and negatively impacts consumer confidence. This uncertainty translates into a hesitancy to commit to large financial obligations like mortgages, dampening demand.

-

Relationship between inflation and housing prices: While inflation can initially drive up housing prices due to increased construction costs, sustained high inflation typically leads to reduced demand and potentially a price correction as consumers struggle to afford homes.

-

How inflation might contribute to a slowing or correction of the Canadian housing market: The combination of reduced purchasing power and diminished consumer confidence directly contributes to a slowdown in the housing market and increases the likelihood of a price correction.

Statistics Canada reports inflation rates consistently above the Bank of Canada's target range, putting further pressure on household budgets and contributing to the slowdown in the housing market.

Economic Uncertainty and Its Influence

Concerns about a potential recession and economic slowdown significantly impact the housing market. Uncertainty surrounding job security and future income influences buyer behavior.

-

Job losses and potential for recession impact buyer confidence: The threat of job losses or reduced income makes potential homebuyers hesitant to commit to a large mortgage, reducing demand.

-

Impact on consumer spending and overall demand for housing: Economic uncertainty leads to reduced consumer spending across the board, including on non-essential items like houses. This decreased demand puts further pressure on prices.

-

Effect on government policies related to housing: Government policies aimed at cooling the housing market or supporting struggling homeowners may also influence the trajectory of prices.

-

Predictions from economic forecasters: Many economic forecasters predict a period of slower economic growth or even a mild recession, which would negatively impact the housing market.

Economic indicators like GDP growth and unemployment rates are closely monitored for signs of an economic slowdown, which could exacerbate the pressure on Canadian home prices.

Signs of a Correction in the Canadian Housing Market

While the Canadian housing market hasn't experienced a dramatic crash, several indicators suggest a correction might be underway or imminent.

-

Slowdown in sales activity: CREA data shows a noticeable decrease in the number of homes sold in many regions across Canada, indicating reduced demand.

-

Price reductions in certain regions or property types: Reports indicate price reductions, particularly in certain overheated markets or for specific property types, signifying a shift in market dynamics.

-

Increased inventory levels in some areas: The number of homes for sale is increasing in some regions, suggesting that supply is outpacing demand.

-

Changes in the average time properties are on the market: Homes are staying on the market for longer periods in various regions, indicating a less competitive seller's market.

Data from reputable sources like CREA and local real estate boards show a gradual slowing of the market, supporting the notion of a correction.

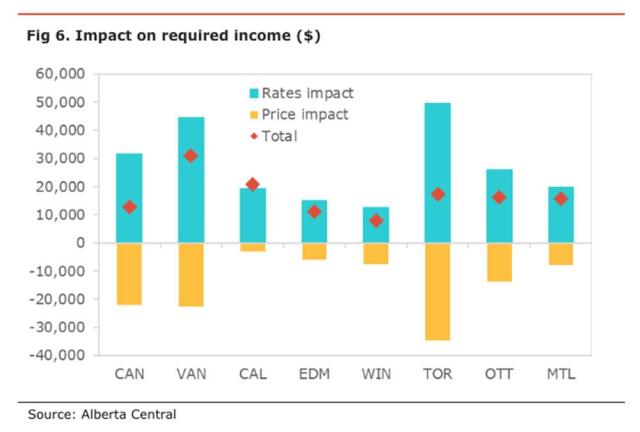

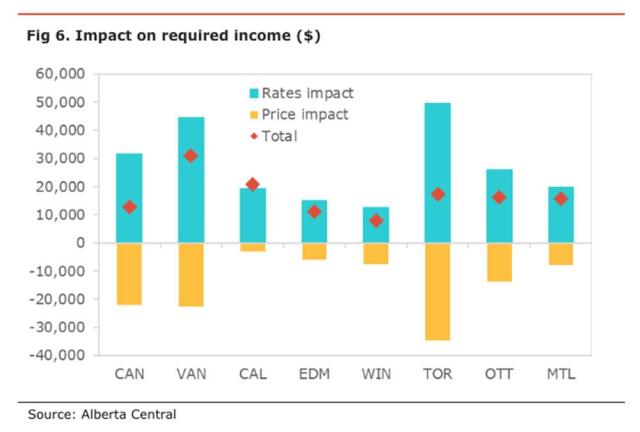

Regional Variations in the Canadian Housing Market

The Canadian housing market is not homogenous. Different regions experience varying levels of price change due to local economic factors and other regional influences.

-

Comparison of housing market trends in major Canadian cities: While some major cities might experience sharper price declines, others might see more moderate adjustments, or even relative stability.

-

Factors influencing regional variations: Local economic conditions, population growth rates, and the availability of inventory heavily influence regional market performance.

-

Specific examples of regions experiencing different levels of price changes: For instance, some smaller markets may have seen less dramatic price increases during the boom and, therefore, may be less susceptible to sharp corrections.

Analyzing the different regional trends within the Canadian housing market is crucial for understanding the complexities of a potential correction.

Conclusion

Several key factors—rising interest rates, persistent inflation, economic uncertainty, and regional variations—are converging to influence the Canadian housing market. While not a complete collapse, the evidence suggests a correction is underway, though the severity and duration remain uncertain. The slowdown in sales activity, price reductions in some areas, and increasing inventory levels all point to a market rebalancing.

Call to Action: Stay informed about the ever-evolving Canadian housing market. Continue to monitor key indicators like interest rates and inflation to make informed decisions regarding Canadian home prices and potential corrections. Follow [Your Website/Source] for the latest updates and analysis on Canadian real estate. Understanding the intricacies of a potential Canadian home price correction is crucial for navigating this dynamic market.

Featured Posts

-

Juergen Klopp Mu Carlo Ancelotti Mi Ideal Teknik Direktoer Tartismasi

May 22, 2025

Juergen Klopp Mu Carlo Ancelotti Mi Ideal Teknik Direktoer Tartismasi

May 22, 2025 -

Blake Livelys Recent Allegations A Closer Look

May 22, 2025

Blake Livelys Recent Allegations A Closer Look

May 22, 2025 -

Problemen Met Online Betalingen Voor Abn Amro Opslag

May 22, 2025

Problemen Met Online Betalingen Voor Abn Amro Opslag

May 22, 2025 -

The Blake Lively Taylor Swift Gigi Hadid Drama What We Know So Far

May 22, 2025

The Blake Lively Taylor Swift Gigi Hadid Drama What We Know So Far

May 22, 2025 -

Ket Noi Hai Tinh Qua Chan Hon 200 Nguoi Chay Bo Tu Dak Lak Den Phu Yen

May 22, 2025

Ket Noi Hai Tinh Qua Chan Hon 200 Nguoi Chay Bo Tu Dak Lak Den Phu Yen

May 22, 2025

Latest Posts

-

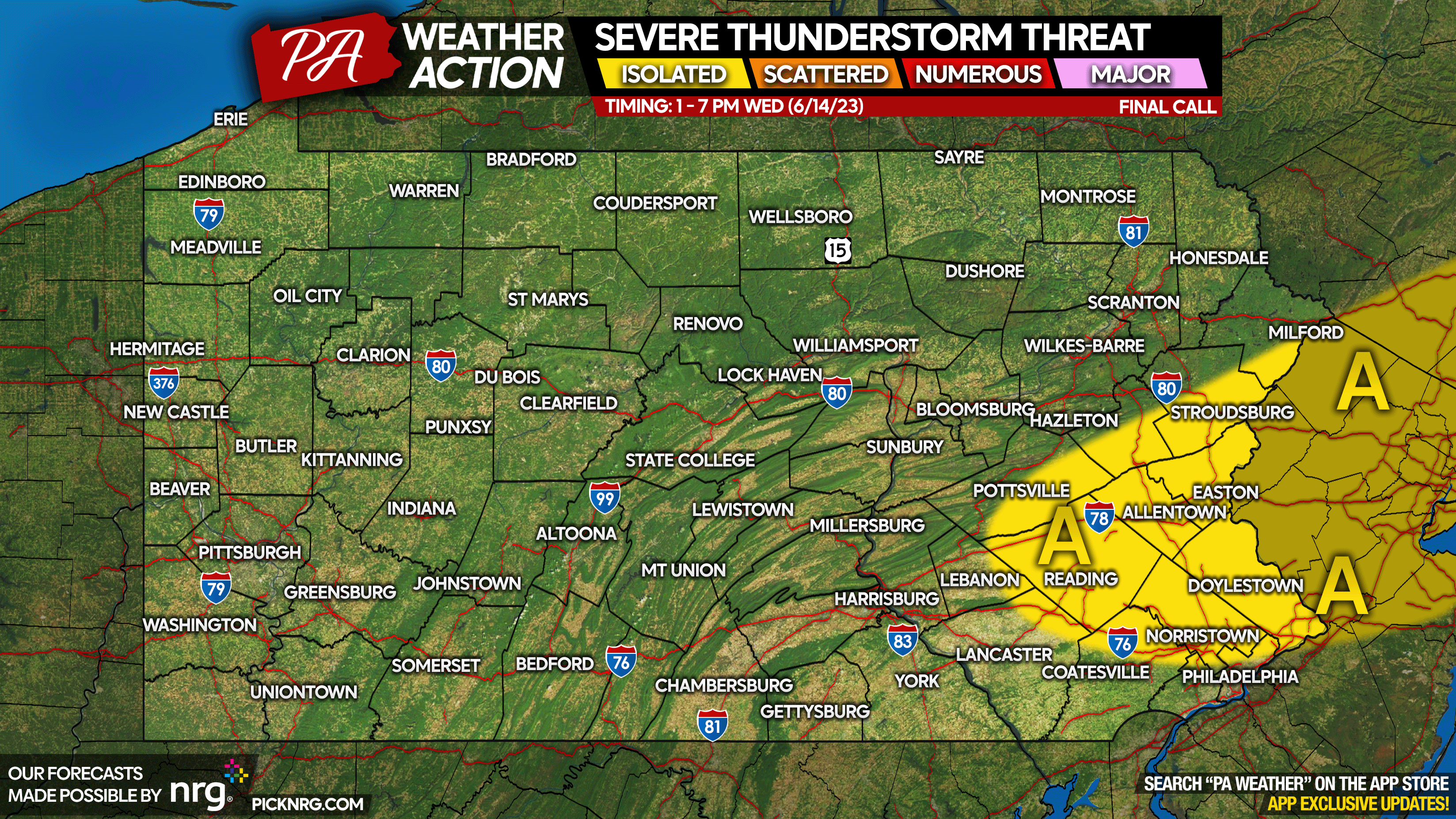

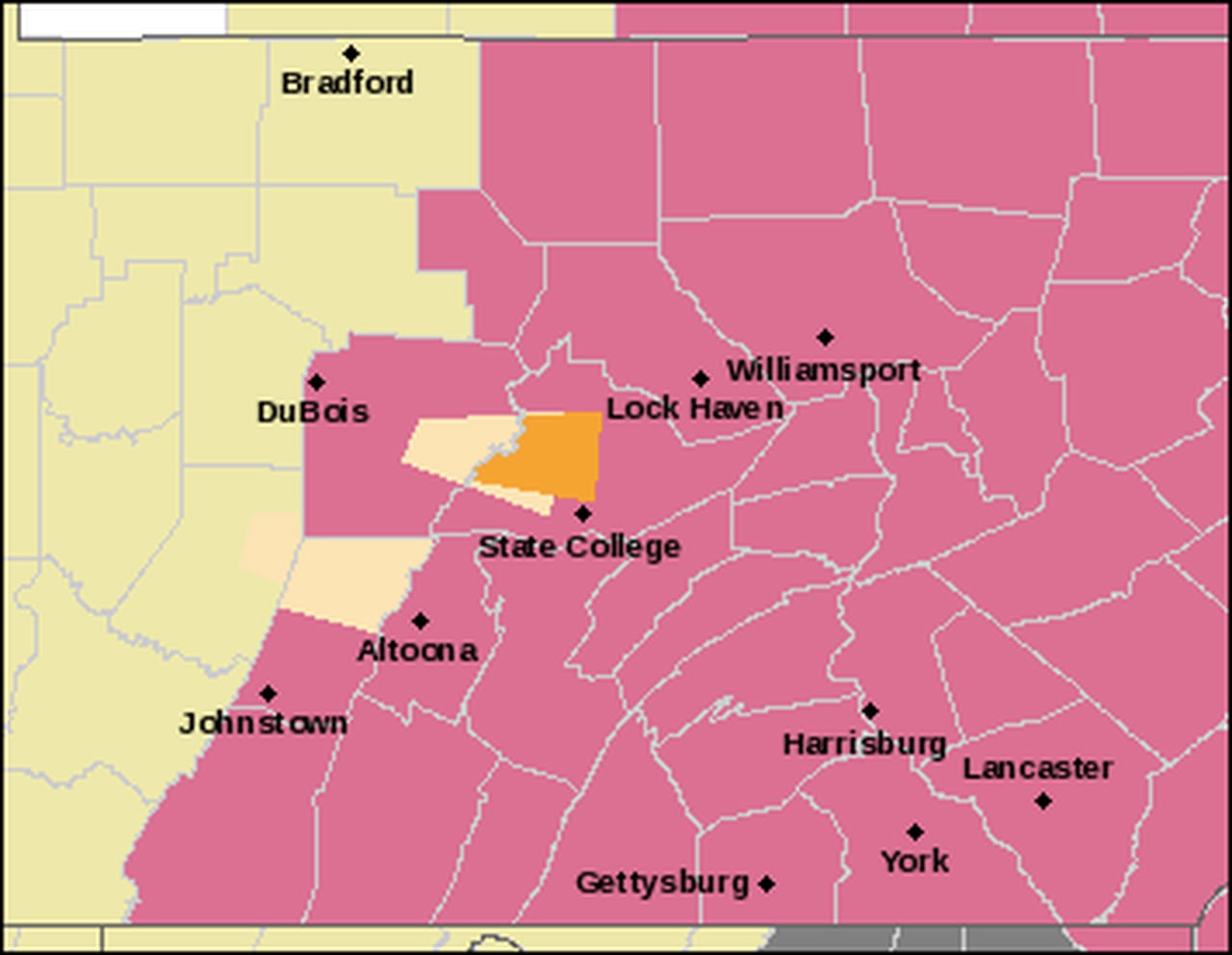

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025 -

Major Fire Damages Dauphin County Apartment Complex Overnight

May 22, 2025

Major Fire Damages Dauphin County Apartment Complex Overnight

May 22, 2025 -

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025 -

Overnight Fire Engulfs Dauphin County Apartment Building

May 22, 2025

Overnight Fire Engulfs Dauphin County Apartment Building

May 22, 2025 -

Shooting Investigation In Lancaster County Pa Details Emerge

May 22, 2025

Shooting Investigation In Lancaster County Pa Details Emerge

May 22, 2025