Posthaste Recession Fears: Canadian Economists Issue Warning

Table of Contents

Rising Interest Rates and Their Impact

The Bank of Canada's recent aggressive interest rate hikes, aimed at curbing inflation, are significantly impacting consumer spending and investment. This aggressive approach, while intended to cool the economy, is creating a ripple effect throughout various sectors.

The Bank of Canada's Aggressive Approach

- Increased borrowing costs: Higher interest rates translate to increased borrowing costs for mortgages, loans, and credit cards. This directly impacts household budgets and reduces disposable income.

- Reduced consumer spending: As borrowing becomes more expensive, consumers are less likely to make large purchases, such as new cars or homes, leading to a slowdown in consumer spending. This decreased consumer demand is a major contributor to economic slowdown.

- Dampened business investment: Businesses are also affected by higher borrowing costs. This discourages investment in expansion projects and hiring, further slowing economic growth. Businesses may postpone capital expenditures until interest rates fall.

- Variable-rate mortgage impact: Homeowners with variable-rate mortgages are particularly vulnerable, facing significantly higher monthly payments as interest rates rise. This can lead to financial distress for some households.

The Ripple Effect on the Housing Market

The Canadian housing market, a significant driver of economic activity, is already showing signs of a slowdown due to higher interest rates. This slowdown has implications beyond just real estate.

- Falling house prices: Decreased demand due to higher borrowing costs is leading to falling house prices in some regions across Canada, impacting homeowner equity.

- Decreased consumer confidence: Falling house prices can negatively affect consumer confidence, as homeowners feel less wealthy and less secure. This can lead to further reductions in spending.

- Reduced construction activity: The slowdown in the housing market leads to reduced demand for construction materials and labour, impacting the construction sector and related industries. This translates to job losses and reduced economic activity within the sector.

Inflationary Pressures and Their Persistence

Persistent high inflation continues to erode purchasing power and fuels uncertainty about the future. The impact of inflation goes beyond simple price increases.

Stubbornly High Inflation Rates

- Rising food and energy prices: The most significant impact of inflation is felt through rising prices for essential goods like food and energy. This disproportionately affects low-income households.

- Supply chain disruptions: Ongoing supply chain disruptions, exacerbated by global events, contribute significantly to persistent inflationary pressure. These disruptions continue to impact the availability and cost of various goods.

- Wage increases lagging inflation: In many sectors, wage increases are failing to keep pace with inflation. This means that real wages are declining, reducing consumer purchasing power and impacting living standards.

The Impact on Consumer Confidence

High inflation erodes consumer confidence, resulting in reduced spending and investment. This is a self-reinforcing cycle.

- Postponed major purchases: Consumers postpone major purchases, such as appliances, vehicles, and home renovations, waiting for prices to stabilize or for their financial situation to improve.

- Delayed business expansion: Businesses delay expansion plans and hiring due to uncertainty about future demand and profitability. This leads to reduced economic growth.

- Uncertainty about future inflation: Uncertainty about future inflation further dampens economic activity as businesses and consumers become hesitant to commit to long-term plans.

Global Economic Headwinds and Their Influence

A slowdown in global economic growth poses a significant threat to the Canadian economy, which is heavily reliant on exports. External factors also play a critical role in the potential for a Canadian recession.

Weakening Global Growth

- Reduced demand for Canadian goods: A slowdown in global growth reduces demand for Canadian goods and services, particularly exports to major trading partners. This can lead to job losses in export-oriented industries.

- Uncertainty about export revenues: Reduced demand for Canadian exports creates uncertainty about future export revenues, further dampening business investment and economic growth.

- Further supply chain disruptions: A global economic slowdown can lead to further supply chain disruptions, exacerbating inflationary pressures.

Geopolitical Instability

Global geopolitical instability, such as the war in Ukraine, adds further uncertainty to the economic outlook. This uncertainty can impact multiple sectors within the Canadian economy.

- Rising energy prices and shortages: Geopolitical events, particularly those impacting energy supplies, can lead to higher energy prices and shortages, increasing inflation and dampening economic growth.

- Disruptions to international trade: Geopolitical instability disrupts international trade and supply chains, further impacting the Canadian economy's reliance on global trade.

- Increased risk aversion among investors: Increased risk aversion among investors can lead to reduced investment in Canada, further slowing economic growth.

Conclusion

The mounting concerns regarding a posthaste recession in Canada are driven by a confluence of factors: aggressive interest rate hikes, persistent inflation, and weakening global economic growth. The potential impact on the Canadian economy, including the housing market and consumer spending, is substantial. Staying informed about the evolving economic situation and adapting financial strategies accordingly is crucial for individuals and businesses alike. Understanding the risks associated with a potential posthaste recession and proactively managing finances is paramount to navigating these uncertain times. It is important to monitor economic indicators and seek professional financial advice to mitigate the potential negative impacts of a Canadian economic slowdown. Don't wait until a Canadian recession hits – prepare now!

Featured Posts

-

Investor Flight To Safety Gold And Cash Etfs See Record Inflows

Apr 23, 2025

Investor Flight To Safety Gold And Cash Etfs See Record Inflows

Apr 23, 2025 -

Otvorene Trgovine Tijekom Uskrsa I Uskrsnog Ponedjeljka

Apr 23, 2025

Otvorene Trgovine Tijekom Uskrsa I Uskrsnog Ponedjeljka

Apr 23, 2025 -

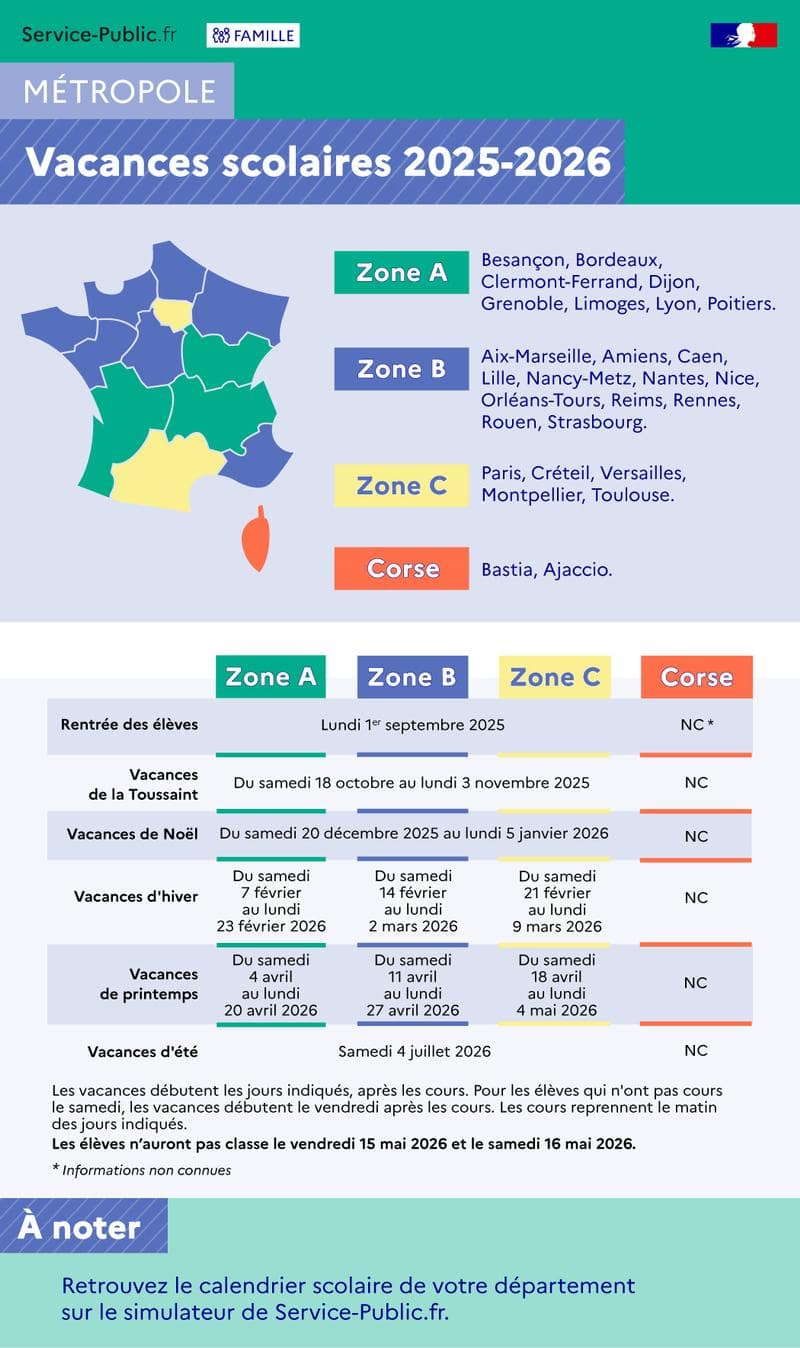

Calendrier Des Vacances Scolaires 2025 Federation Wallonie Bruxelles

Apr 23, 2025

Calendrier Des Vacances Scolaires 2025 Federation Wallonie Bruxelles

Apr 23, 2025 -

Mulai Pekan Dengan Semangat 350 Kata Inspirasi Hari Senin

Apr 23, 2025

Mulai Pekan Dengan Semangat 350 Kata Inspirasi Hari Senin

Apr 23, 2025 -

New York Yankee Broadcaster Faces Backlash For Seattle Mariners Remark

Apr 23, 2025

New York Yankee Broadcaster Faces Backlash For Seattle Mariners Remark

Apr 23, 2025