Posthaste Warning: Major Challenges Facing The World's Largest Bond Market

Table of Contents

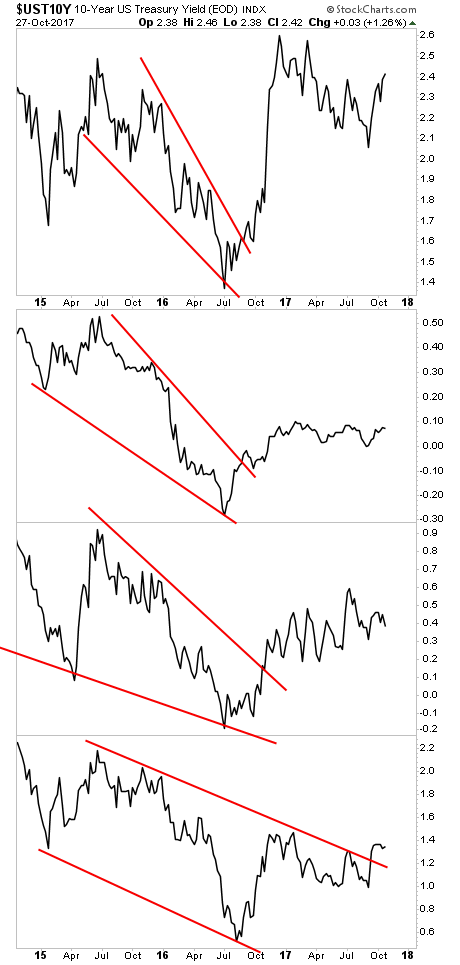

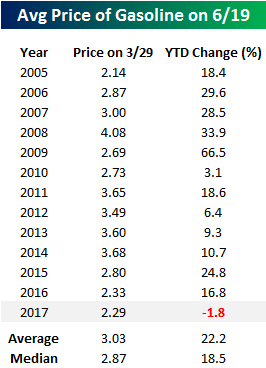

Rising Interest Rates and Their Impact on Bond Yields

The Mechanics of Rising Rates

Rising interest rates pose a significant challenge to the global bond market. The inverse relationship between interest rates and bond prices is well-established: as interest rates rise, bond prices fall, and vice-versa. This is because newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This interest rate risk affects all fixed-income investments, but particularly those with longer maturities.

- Impact on existing bond portfolios: Investors holding existing bonds face potential capital losses as their bond values decline in response to rising interest rates. Portfolio rebalancing becomes crucial.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for governments and corporations, potentially slowing economic growth and impacting their ability to service their debt.

- Potential for increased defaults: Higher borrowing costs can strain the finances of highly indebted entities, increasing the risk of defaults on corporate and sovereign bonds.

- Attractiveness of alternative investments: Rising interest rates can make alternative investments, such as high-yield savings accounts or short-term certificates of deposit, more attractive compared to fixed-income investments. The bond yield curve becomes a critical indicator to watch.

Inflationary Pressures and Their Effect on Bond Values

Inflation's Erosive Power

High inflation significantly erodes the purchasing power of bond returns. Even if a bond generates a positive nominal yield, high inflation can result in a negative real yield – meaning the investor's actual purchasing power diminishes over time. This inflation risk is a major concern for bond investors.

- Impact of inflation on real yields: Real yield, which accounts for inflation, is a crucial metric. High inflation reduces real yields, making bonds less attractive.

- Central bank responses to inflation and their effect on bond markets: Central banks often raise interest rates to combat inflation, which directly impacts bond prices and yields, as discussed above.

- The search for inflation-hedged investments: Investors are increasingly seeking inflation-protected securities (TIPS) and other assets that offer protection against inflation's eroding effects.

- The role of inflation expectations in bond pricing: Inflation expectations play a crucial role in determining bond prices. Anticipation of future inflation leads to higher bond yields to compensate investors for the anticipated loss of purchasing power.

Geopolitical Instability and its Influence on Bond Market Volatility

Global Uncertainty and Bond Markets

Geopolitical events, including wars, trade disputes, and political instability, create uncertainty in the global bond market. These events significantly impact investor sentiment, leading to increased volatility and shifts in demand for different types of bonds.

- Flight to safety and demand for government bonds: During periods of geopolitical uncertainty, investors often seek the perceived safety of government bonds, driving up their prices and lowering yields.

- Increased risk premiums for corporate bonds: Geopolitical risk increases the perceived risk associated with corporate bonds, leading to higher risk premiums (higher yields) demanded by investors to compensate for the added uncertainty.

- Impact of sanctions and geopolitical tensions on specific bond markets: Sanctions and geopolitical tensions can significantly impact specific bond markets, creating localized volatility and potentially triggering crises.

- Increased market volatility and uncertainty: Geopolitical instability translates into increased market volatility and uncertainty, making it more challenging for investors to predict bond prices and yields.

The Growing Debt Burden and Sustainability Concerns

Mounting Debt Levels

Globally, government and corporate debt levels are at historically high levels. This mounting debt burden raises serious concerns about debt sustainability and the potential for future debt crises. The global bond market is directly impacted by the ability of borrowers to service their debts.

- Debt sustainability concerns for various countries: Many countries face significant debt sustainability challenges, raising concerns about potential sovereign debt defaults.

- Increased risk of sovereign debt defaults: High levels of government debt increase the risk of sovereign debt defaults, which can have significant repercussions for the global financial system.

- Potential for a debt crisis: A confluence of high debt levels, rising interest rates, and economic slowdowns could trigger a debt crisis with severe consequences for the global bond market.

- Credit rating downgrades and their effects: Credit rating downgrades for countries or corporations increase borrowing costs and reduce investor confidence, negatively impacting bond prices.

Conclusion

The global bond market faces a confluence of significant challenges: rising interest rates impacting bond yields and prices, inflationary pressures eroding purchasing power, geopolitical instability increasing market volatility, and a growing global debt burden threatening debt sustainability. These challenges necessitate a cautious approach for investors and policymakers alike. Understanding these risks is crucial for navigating this complex financial landscape. Stay informed about developments in the global bond market and consider diversifying your investment portfolio to mitigate risks associated with the global bond market and its various segments. Careful analysis of the bond yield curve, inflation-protected securities, and geopolitical risk assessments are essential for making informed investment decisions within the world's largest bond market.

Featured Posts

-

Apples Future A 254 Price Target And What It Means For Investors

May 24, 2025

Apples Future A 254 Price Target And What It Means For Investors

May 24, 2025 -

Nanari Upplysingar Um Nyju Rafmagnsutgafu Porsche Macan

May 24, 2025

Nanari Upplysingar Um Nyju Rafmagnsutgafu Porsche Macan

May 24, 2025 -

Rising Living Costs Force Canadians To Compromise On Vehicle Security

May 24, 2025

Rising Living Costs Force Canadians To Compromise On Vehicle Security

May 24, 2025 -

600 Svadeb Na Kharkovschine Tendentsii Brachnykh Tseremoniy

May 24, 2025

600 Svadeb Na Kharkovschine Tendentsii Brachnykh Tseremoniy

May 24, 2025 -

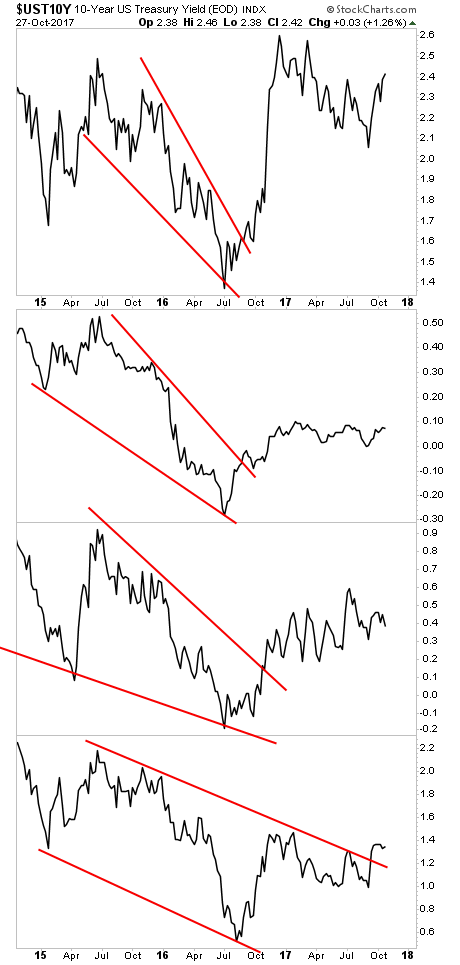

Memorial Day Travel Gas Prices Could Be Historically Low

May 24, 2025

Memorial Day Travel Gas Prices Could Be Historically Low

May 24, 2025

Latest Posts

-

Neal Mc Donough And The Last Rodeo A Western Showdown

May 24, 2025

Neal Mc Donough And The Last Rodeo A Western Showdown

May 24, 2025 -

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025 -

Memorial Day 2025 Sales And Deals Dont Miss These Top Offers

May 24, 2025

Memorial Day 2025 Sales And Deals Dont Miss These Top Offers

May 24, 2025 -

Neal Mc Donough A Commanding Presence In The Last Rodeo

May 24, 2025

Neal Mc Donough A Commanding Presence In The Last Rodeo

May 24, 2025 -

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 24, 2025

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 24, 2025