Potential IPO: Sabic Explores Options For Its Gas Business In Saudi Arabia

Table of Contents

The Potential Benefits of a Sabic Gas Business IPO

A successful Sabic IPO for its gas business could unlock significant opportunities for growth and development within the Saudi Arabian energy sector. The potential benefits are multifaceted:

Increased Investment and Growth

An IPO would provide access to a massive influx of capital. This injection of funds could be used to significantly enhance and expand Sabic's operations.

- Funding for new technologies: Investing in cutting-edge technologies for gas exploration, extraction, and processing.

- Development of renewable energy sources alongside gas: Diversifying the energy portfolio and aligning with global sustainability goals.

- Enhanced operational efficiency: Improving infrastructure, streamlining processes, and reducing operational costs.

The influx of capital could facilitate innovation and advancements, attracting foreign expertise and technology to enhance Saudi Arabia's gas sector competitiveness on a global scale. This would not only modernize existing infrastructure but also potentially unlock new reserves and reserves and exploration opportunities.

Enhanced Transparency and Corporate Governance

A public listing compels a higher level of transparency and accountability. This benefits all stakeholders.

- Improved financial reporting: Meeting stringent public listing requirements for transparent financial disclosures.

- Stronger accountability: Increased scrutiny from investors and regulatory bodies, fostering better corporate governance.

- Increased regulatory oversight: Compliance with stricter regulations, ensuring ethical and responsible operations.

Increased transparency builds trust, attracting long-term investors and strengthening the credibility of the Saudi Arabian market, leading to greater foreign direct investment (FDI).

Valuation and Market Potential

An IPO provides a clear market valuation of Sabic's gas assets, opening doors to a wider range of investment opportunities.

- Attracting global investors: Access to a larger pool of capital from international investors.

- Access to wider capital markets: Listing on major global stock exchanges expands funding options.

- Potential for increased market share: Enhanced financial strength to compete more effectively in the global gas market.

The global demand for natural gas is robust, and a successful Sabic IPO could position the company to capitalize on this demand, potentially leading to significant market share gains and expansion into new markets.

Challenges and Considerations for a Sabic Gas IPO

While the potential benefits are substantial, a Sabic IPO also presents several key challenges and considerations.

Geopolitical Risks and Market Volatility

The energy sector is inherently volatile, susceptible to geopolitical events and fluctuating global demand.

- Oil price fluctuations: Oil price volatility directly impacts the gas market, creating price uncertainty.

- Global political instability: Geopolitical tensions in the Middle East could affect investor confidence and market stability.

- Potential regulatory changes: Changes in government regulations could impact the profitability and operations of the gas business.

These inherent risks must be carefully assessed and mitigated to maintain investor confidence and ensure the long-term success of the IPO.

Competitive Landscape and Market Saturation

The global gas market is fiercely competitive, with many established players vying for market share.

- Competition from other energy providers: Facing competition from both established and emerging energy companies.

- Potential challenges in market penetration: Difficulties in securing new customers and expanding market share.

- Need for a strong competitive strategy: Developing a robust strategy to differentiate itself and maintain a competitive edge.

A comprehensive market analysis and a well-defined competitive strategy are crucial for success in this demanding market.

Regulatory Approvals and Legal Frameworks

Navigating the regulatory landscape in Saudi Arabia will be crucial for a smooth and successful IPO process.

- Regulatory compliance: Meeting all the necessary regulatory requirements for a public listing.

- Legal and financial due diligence: Thorough due diligence to ensure compliance with all legal and financial regulations.

- Complex approval processes: Navigating the complex approval processes within the Saudi Arabian regulatory framework.

Securing the necessary approvals may prove time-consuming and challenging, potentially impacting the timeline and overall success of the IPO.

Conclusion

The potential Sabic IPO of its gas business presents both significant opportunities and considerable challenges. While the substantial capital influx and enhanced transparency could drive considerable growth and innovation, effectively navigating geopolitical risks and market volatility will be critical for success. The successful execution of a Sabic IPO hinges on a well-defined strategy that addresses these challenges while leveraging the immense potential of the Saudi Arabian gas sector. Keep a close watch on developments regarding this potentially transformative Sabic IPO and its impact on the future of the Saudi energy market. Stay informed about this important development in the global energy landscape.

Featured Posts

-

A Comprehensive Review Of Trumps Aerospace Transactions Promises And Performance

May 19, 2025

A Comprehensive Review Of Trumps Aerospace Transactions Promises And Performance

May 19, 2025 -

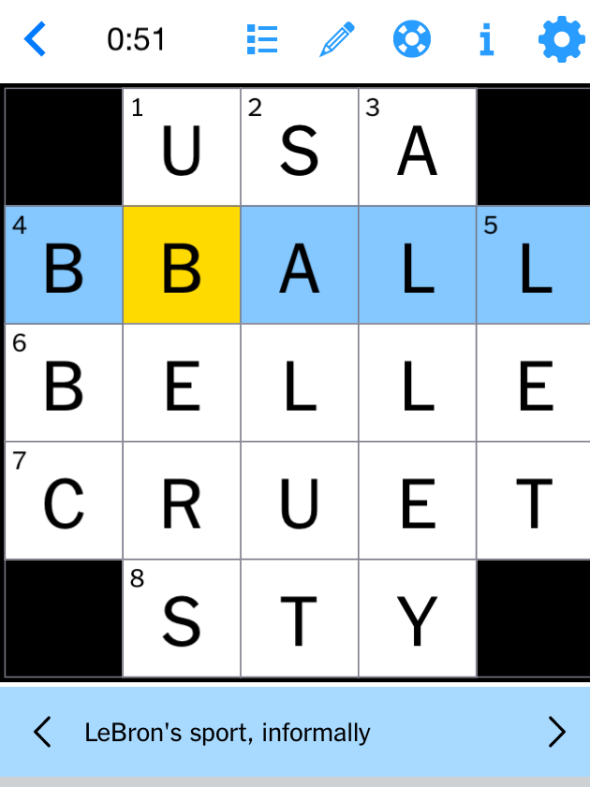

Nyt Mini Crossword March 12 2025 Hints And Solutions

May 19, 2025

Nyt Mini Crossword March 12 2025 Hints And Solutions

May 19, 2025 -

Post Ufc 313 Santos Gives Credit To Marshalls Victory

May 19, 2025

Post Ufc 313 Santos Gives Credit To Marshalls Victory

May 19, 2025 -

Analyzing The Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 19, 2025

Analyzing The Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 19, 2025 -

Credit Mutuel Am Evaluation Des Resultats Du 4eme Trimestre 2024

May 19, 2025

Credit Mutuel Am Evaluation Des Resultats Du 4eme Trimestre 2024

May 19, 2025

Latest Posts

-

Azzi Fudd And Paige Bueckers Comparing Their Wnba Draft And U Conn Looks

May 19, 2025

Azzi Fudd And Paige Bueckers Comparing Their Wnba Draft And U Conn Looks

May 19, 2025 -

Azzi Fudd And Paige Bueckers U Conn Casuals Vs Wnba Draft Glamour

May 19, 2025

Azzi Fudd And Paige Bueckers U Conn Casuals Vs Wnba Draft Glamour

May 19, 2025 -

Final Destination 5 Where To Stream And Find Showtimes

May 19, 2025

Final Destination 5 Where To Stream And Find Showtimes

May 19, 2025 -

Hopkins To Become Paige Bueckers For A Day May 16th Announcement

May 19, 2025

Hopkins To Become Paige Bueckers For A Day May 16th Announcement

May 19, 2025 -

Paige Bueckers Wnba Arrival Marked By Citys Unique Tribute

May 19, 2025

Paige Bueckers Wnba Arrival Marked By Citys Unique Tribute

May 19, 2025