Potential Liquidation Looms For Lion Electric

Table of Contents

Lion Electric's Financial Difficulties

Lion Electric's recent financial performance paints a concerning picture. The company has been grappling with declining revenue, accumulating substantial debt, and experiencing persistent negative cash flow. This precarious financial position significantly increases the risk of Lion Electric liquidation.

-

Recent Financial Reports: Analysis of Lion Electric's quarterly and annual reports reveals a consistent trend of increasing losses and dwindling revenue. Key metrics such as gross margin and operating income show significant deterioration, raising serious concerns about the company's long-term viability.

-

Credit Rating Downgrades: Several credit rating agencies have issued warnings and downgraded Lion Electric's credit rating, reflecting the growing risk of default and potential bankruptcy. These downgrades further limit the company's access to capital and increase the likelihood of Lion Electric liquidation.

-

Cash Burn Rate and Reserves: Lion Electric's substantial cash burn rate, exceeding its ability to generate positive cash flow, is rapidly depleting its cash reserves. This unsustainable situation necessitates immediate action to secure additional funding or face the consequences of a potential Lion Electric liquidation.

-

Failed Funding Attempts: The company's attempts to secure additional funding through equity offerings or debt financing have reportedly met with limited success, further exacerbating its financial woes and increasing the pressure for Lion Electric liquidation.

Operational Challenges Facing Lion Electric

Beyond its financial struggles, Lion Electric faces significant operational hurdles that hinder its progress and contribute to its precarious position. These challenges hamper the company's ability to deliver on its promises and meet market demands, ultimately fueling speculation about Lion Electric liquidation.

-

Production Delays and Bottlenecks: Reports indicate consistent production delays and bottlenecks at Lion Electric's manufacturing facilities. These delays lead to missed delivery deadlines, impacting customer relationships and revenue streams.

-

Quality Control Issues and Warranty Claims: Concerns have been raised regarding quality control issues and a rising number of warranty claims. Addressing these issues requires significant investment and resources, diverting funds away from other critical areas and adding to the financial strain leading to potential Lion Electric liquidation.

-

Supply Chain Disruptions: Like many companies in the manufacturing sector, Lion Electric has been significantly impacted by global supply chain disruptions. The unavailability of key components and materials has further hampered production and contributed to the company's operational challenges, increasing the threat of Lion Electric liquidation.

-

Scaling Production Difficulties: Lion Electric has struggled to scale its production to meet the growing demand for its electric vehicles. This inability to efficiently ramp up production capacity puts immense pressure on the company's resources and financial position, making Lion Electric liquidation a real possibility.

Potential Scenarios and Implications of Lion Electric Liquidation

Several scenarios could unfold for Lion Electric, each with significant implications for its stakeholders and the broader EV market. The most extreme outcome is complete Lion Electric liquidation, but other possibilities exist.

-

Complete Liquidation: In a complete liquidation, Lion Electric's assets would be sold to recover value for creditors. Shareholders would likely experience significant losses, potentially losing their entire investment. This scenario would significantly impact employee job security.

-

Strategic Sale: An alternative to complete liquidation is a strategic sale of Lion Electric or parts of its business to a larger competitor or investor. This could potentially save some jobs and preserve certain aspects of the company's operations.

-

Restructuring: Lion Electric may attempt to restructure its debt and operations to improve its financial position. This would involve difficult negotiations with creditors and potentially require significant cost-cutting measures. The success of such a plan is uncertain.

-

Impact on the EV Market: A Lion Electric liquidation would undoubtedly have a ripple effect on the broader EV market. Competitors might benefit from increased market share, but the overall impact on industry confidence could be negative.

Alternatives to Liquidation for Lion Electric

While Lion Electric liquidation appears a significant threat, several avenues remain to avoid this outcome. The company needs to aggressively pursue these options to ensure its survival.

-

Debt Restructuring and Refinancing: Negotiating with creditors to restructure its existing debt or secure refinancing could provide Lion Electric with some breathing room.

-

Strategic Partnerships and Acquisitions: Forming strategic partnerships with larger automakers or suppliers could provide much-needed capital and technological expertise. Being acquired by a larger player could provide a lifeline.

-

Government Subsidies and Grants: Seeking government subsidies or grants specifically designed to support the EV industry could provide vital financial support.

-

Improving Operational Efficiency and Cost Reduction: Implementing rigorous cost-cutting measures and streamlining its operations are crucial for improving profitability and ensuring long-term viability.

Conclusion

The potential for Lion Electric liquidation is a serious concern stemming from a combination of significant financial difficulties and persistent operational challenges. Several scenarios are possible, each with far-reaching implications for shareholders, employees, and the broader EV market. While complete Lion Electric liquidation is a real possibility, the company still has options to explore, including restructuring, securing further investment, and forming strategic partnerships. The future remains uncertain, but understanding these factors is critical.

The future of Lion Electric remains uncertain, with the threat of Lion Electric liquidation casting a long shadow. Stay informed about developments surrounding Lion Electric liquidation and the broader EV industry by following reputable financial news sources. Understanding the intricacies of this situation is crucial for investors and anyone interested in the future of the electric vehicle market. Keep an eye out for updates on Lion Electric's financial performance and any potential restructuring or sale announcements.

Featured Posts

-

Zavershenie Karery Rekordsmen N Kh L Po Silovym Priemam Proschaetsya S Khokkeem

May 07, 2025

Zavershenie Karery Rekordsmen N Kh L Po Silovym Priemam Proschaetsya S Khokkeem

May 07, 2025 -

Daily Lotto Draw Results For Thursday April 17th 2025

May 07, 2025

Daily Lotto Draw Results For Thursday April 17th 2025

May 07, 2025 -

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center

May 07, 2025

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center

May 07, 2025 -

Plany Ovechkina Vozvraschenie V Rodnoy Klub Dinamo

May 07, 2025

Plany Ovechkina Vozvraschenie V Rodnoy Klub Dinamo

May 07, 2025 -

Simone Biles To Deliver Commencement Address At Washington University

May 07, 2025

Simone Biles To Deliver Commencement Address At Washington University

May 07, 2025

Latest Posts

-

Rogue One Actor Reflects On Popular Character

May 08, 2025

Rogue One Actor Reflects On Popular Character

May 08, 2025 -

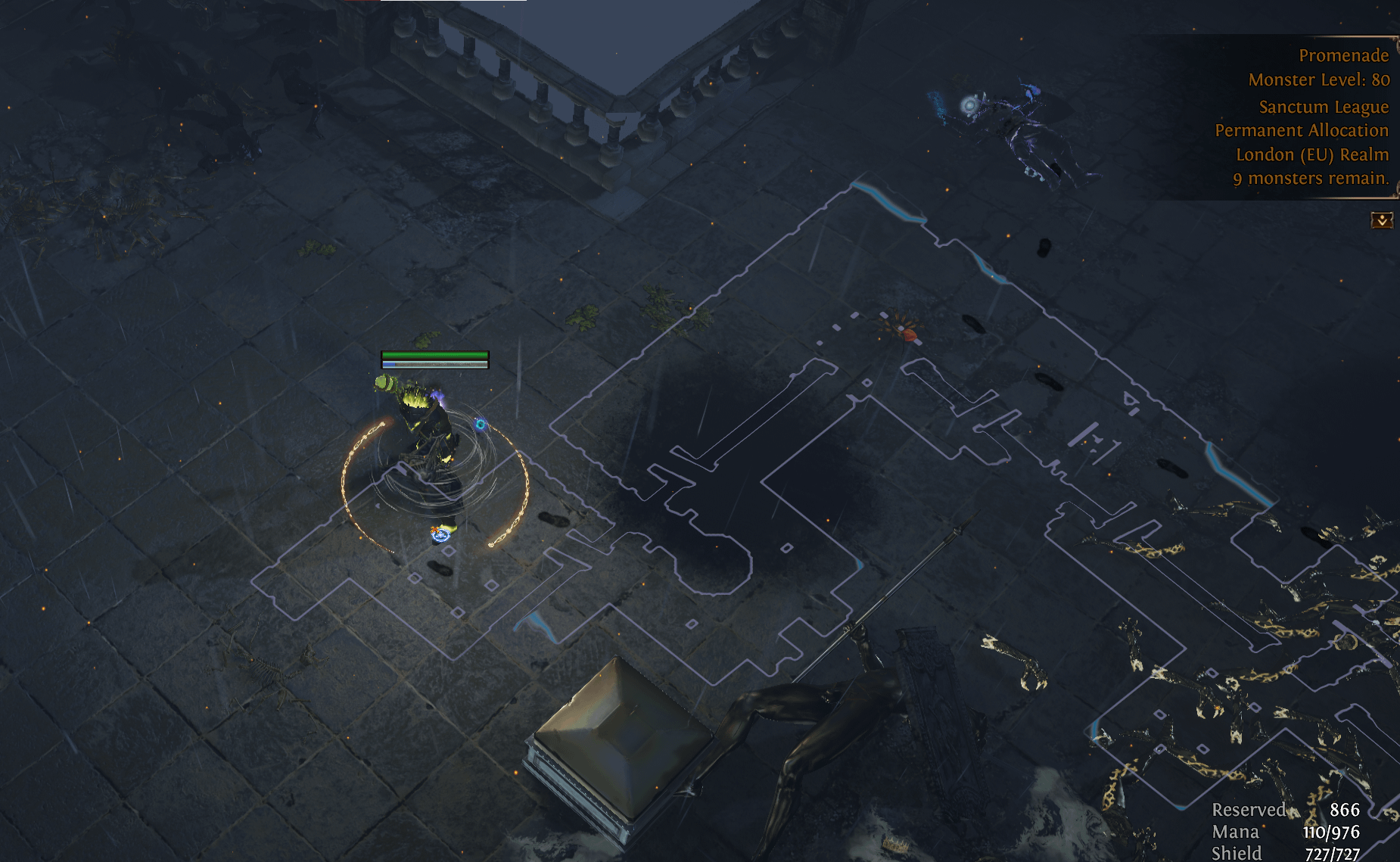

Path Of Exile 2 The Mystery Of The Rogue Exiles

May 08, 2025

Path Of Exile 2 The Mystery Of The Rogue Exiles

May 08, 2025 -

Rogue One Stars Unexpected Opinion On A Fan Favorite Character

May 08, 2025

Rogue One Stars Unexpected Opinion On A Fan Favorite Character

May 08, 2025 -

The Role Of Rogue Exiles In Path Of Exile 2

May 08, 2025

The Role Of Rogue Exiles In Path Of Exile 2

May 08, 2025 -

Rogue Exiles A Deep Dive Into Path Of Exile 2

May 08, 2025

Rogue Exiles A Deep Dive Into Path Of Exile 2

May 08, 2025