Pounce Now: S&P 500 Downside Protection For Volatility-Wary Investors

Table of Contents

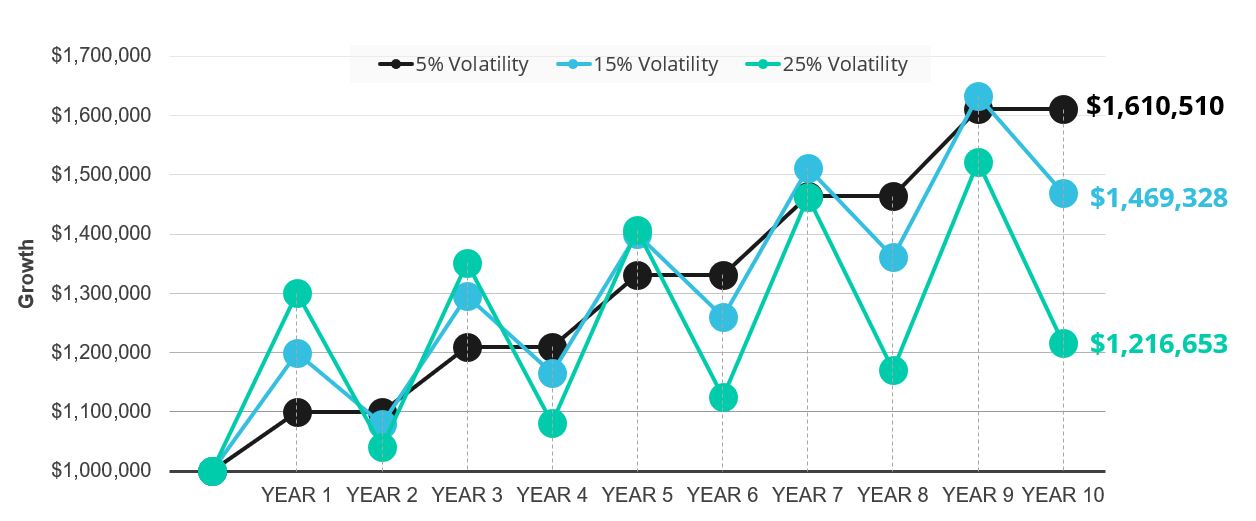

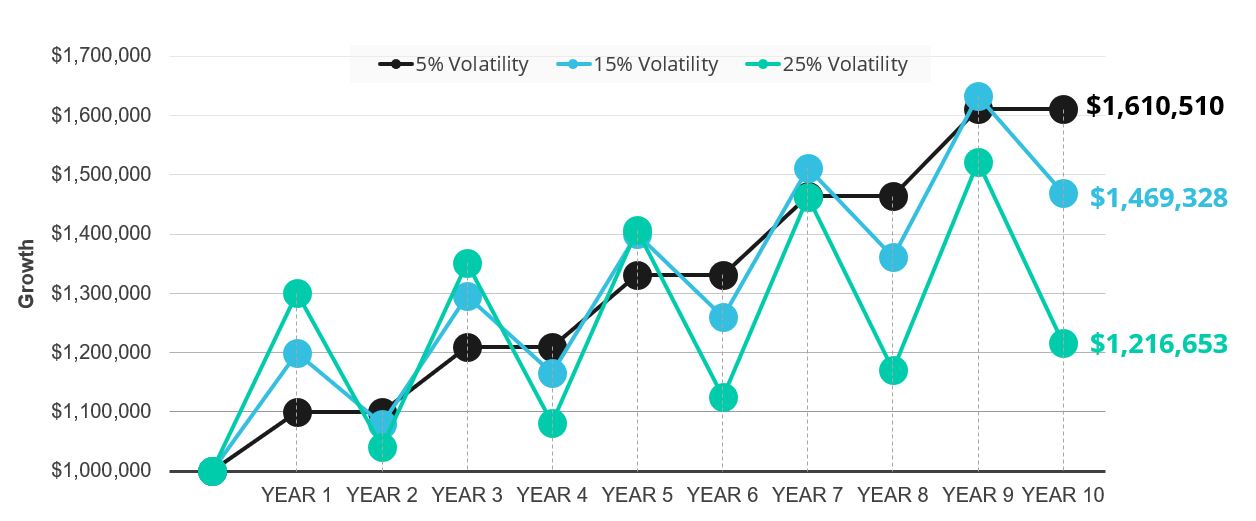

Understanding S&P 500 Volatility and its Impact

Market volatility refers to the rate and extent of price fluctuations in financial markets. For investors in the S&P 500, this translates to significant potential gains and losses within short periods. The S&P 500, a broad market index representing 500 large-cap US companies, is inherently subject to these fluctuations. Historical events like the 2008 financial crisis and the COVID-19 market crash vividly illustrate the devastating impact of high volatility on the S&P 500 and investor portfolios.

Understanding key terms is crucial:

- Beta: Measures a stock's volatility relative to the overall market. A beta of 1 means the stock moves in line with the market; a beta greater than 1 indicates higher volatility.

- Standard Deviation: A statistical measure of the dispersion of returns around the average return. A higher standard deviation implies greater volatility.

- Sharpe Ratio: Measures risk-adjusted return, helping investors compare the performance of different investments with varying levels of risk.

Factors contributing to S&P 500 volatility include:

- Economic Indicators: Inflation rates, unemployment figures, and GDP growth directly influence investor sentiment and market performance.

- Geopolitical Events: International conflicts, political instability, and unexpected global events can trigger significant market swings.

- Interest Rate Changes: Federal Reserve decisions on interest rates significantly impact borrowing costs and investor behavior, affecting the S&P 500.

The emotional impact of volatility on investors can be substantial, often leading to impulsive decisions. Having a robust risk management plan is paramount to mitigating these emotional responses and making rational investment choices.

Strategies for S&P 500 Downside Protection

Several strategies can be employed to mitigate losses and protect your S&P 500 investments.

Hedging Strategies

Hedging involves using financial instruments to offset potential losses. Several options exist:

- Options Strategies: Buying put options provides the right, but not the obligation, to sell the underlying asset (e.g., S&P 500 index funds) at a specific price before a certain date. Covered call writing involves selling call options on assets you already own, generating income but limiting potential upside.

- Example: Buying put options on an S&P 500 ETF provides a buffer against potential price declines.

- Costs: Option premiums.

- Considerations: Requires understanding of options trading and careful consideration of expiry dates and strike prices.

- Inverse ETFs: These exchange-traded funds (ETFs) aim to deliver returns that are the inverse of a specific index. Investing in an inverse S&P 500 ETF can partially offset losses during a market downturn.

- Example: Shorting the market via an inverse S&P 500 ETF.

- Costs: Expense ratios and potential tracking errors.

- Considerations: These are generally considered high-risk investments, suitable only for sophisticated investors.

Diversification Tactics

Diversification is a cornerstone of risk management. Don't put all your eggs in one basket!

-

Asset Allocation: Diversify across different asset classes, including stocks, bonds, real estate, and commodities, to reduce overall portfolio volatility.

-

Sector Diversification: Within the S&P 500, diversify across different sectors (technology, healthcare, energy, etc.) to mitigate sector-specific risks.

-

International Diversification: Expanding your portfolio to include international stocks reduces dependence on the US market and its fluctuations.

-

Examples of Diversified Portfolios: A 60/40 portfolio (60% stocks, 40% bonds) or a globally diversified portfolio with exposure to emerging markets. Their risk profiles vary significantly.

Defensive Asset Allocation

During volatile periods, shifting towards defensive assets can provide a buffer.

-

Low-Volatility Stocks and Bonds: These assets typically exhibit lower price fluctuations than the broader market.

-

Gold: Often considered a safe-haven asset, gold tends to hold its value or even appreciate during times of economic uncertainty.

-

Cash: Holding a portion of your portfolio in cash provides liquidity and allows you to take advantage of potential buying opportunities during market dips.

-

Examples of Defensive Assets: High-quality corporate bonds, government bonds, and precious metals.

Practical Steps to Implement S&P 500 Downside Protection

Implementing effective S&P 500 downside protection requires a structured approach.

Assessing Your Risk Tolerance

Honestly evaluate your comfort level with market fluctuations. Are you a conservative, moderate, or aggressive investor? Your risk tolerance dictates the strategies most suitable for you.

Defining Your Investment Goals

Clearly define your financial objectives – retirement planning, buying a house, etc. Your investment strategy should align with your goals and timeline.

Choosing the Right Investment Vehicles

Based on your risk tolerance and goals, select appropriate investment vehicles that align with your chosen strategies (hedging, diversification, defensive asset allocation).

Monitoring Your Portfolio

Regularly review and rebalance your portfolio to maintain your desired asset allocation and risk profile. Adjust your strategies as needed based on market conditions and your evolving goals.

- Checklist for Implementing Downside Protection Strategies:

- Assess your risk tolerance.

- Define your investment goals.

- Diversify your portfolio across asset classes and sectors.

- Consider hedging strategies (options, inverse ETFs).

- Allocate a portion to defensive assets (gold, cash, low-volatility bonds).

- Monitor and rebalance your portfolio regularly.

- Resources for Financial Planning: Consider consulting with a qualified financial advisor for personalized guidance.

Act Now for S&P 500 Downside Protection

Protecting your S&P 500 investments from downside risk isn't about avoiding potential gains; it's about mitigating losses and preserving capital during volatile periods. We've explored several key strategies, including hedging, diversification, and defensive asset allocation. Proactive risk management is essential in navigating market uncertainty. Don't wait for the next market downturn. Pounce now and implement S&P 500 downside protection strategies to safeguard your investments. Start by assessing your portfolio today and taking the necessary steps to secure your financial future. Consider exploring resources like [link to financial planning tool] and [link to investment platform] to help you get started.

Featured Posts

-

1 Million Debt Relief Michael Sheens Generosity Impacts 900 Lives

May 01, 2025

1 Million Debt Relief Michael Sheens Generosity Impacts 900 Lives

May 01, 2025 -

Xrp Up 400 In Three Months Investment Analysis And Future Outlook

May 01, 2025

Xrp Up 400 In Three Months Investment Analysis And Future Outlook

May 01, 2025 -

Xrps Future Uncertain As Sec Ripple Settlement Talks Progress

May 01, 2025

Xrps Future Uncertain As Sec Ripple Settlement Talks Progress

May 01, 2025 -

Xrp Cryptocurrency A Detailed Overview

May 01, 2025

Xrp Cryptocurrency A Detailed Overview

May 01, 2025 -

Star Wars Shadow Of The Empire Hasbro Releases Dash Rendar Figure

May 01, 2025

Star Wars Shadow Of The Empire Hasbro Releases Dash Rendar Figure

May 01, 2025

Latest Posts

-

Cach Nhan Biet Va Tranh Rui Ro Khi Dau Tu Vao Cong Ty Nghi Van Lua Dao

May 01, 2025

Cach Nhan Biet Va Tranh Rui Ro Khi Dau Tu Vao Cong Ty Nghi Van Lua Dao

May 01, 2025 -

Popular American Cruise Lines Reviews And Comparisons

May 01, 2025

Popular American Cruise Lines Reviews And Comparisons

May 01, 2025 -

Kiem Tra Ky Cang Truoc Khi Gop Von Tranh Rui Ro Voi Cong Ty Co Lich Su Gian Lan

May 01, 2025

Kiem Tra Ky Cang Truoc Khi Gop Von Tranh Rui Ro Voi Cong Ty Co Lich Su Gian Lan

May 01, 2025 -

Best Cruise Lines In The Usa For 2024

May 01, 2025

Best Cruise Lines In The Usa For 2024

May 01, 2025 -

Rui Ro Tiem An Khi Dau Tu Vao Cong Ty Tung Bi Nghi Van Lua Dao

May 01, 2025

Rui Ro Tiem An Khi Dau Tu Vao Cong Ty Tung Bi Nghi Van Lua Dao

May 01, 2025