Powell Warns: Tariffs Threaten Federal Reserve Goals

Table of Contents

Inflationary Pressures Exacerbated by Tariffs

Tariffs, essentially taxes on imported goods, directly increase the cost of those goods for consumers and businesses. This leads to higher prices across the board, fueling inflationary pressures that directly challenge the Federal Reserve's mandate of maintaining price stability, typically targeting around 2% inflation. The impact isn't limited to the specific goods targeted by tariffs.

-

Ripple Effect: Increased costs for imported raw materials ripple through the supply chain, impacting the prices of finished goods and services. A tariff on steel, for instance, increases the cost of producing automobiles, construction materials, and countless other products.

-

Consumer Price Increases: Higher prices for imported goods and domestically produced goods utilizing imported materials directly reduce consumer purchasing power. This decrease in disposable income can lead to reduced consumer spending and a slowdown in economic growth.

-

Examples: Tariffs on imported steel and aluminum have already increased the prices of various products, from cars and appliances to construction projects. Similarly, tariffs on goods from China have impacted a wide range of consumer products, increasing their cost to consumers.

-

Bullet Points:

- Increased cost of imported raw materials.

- Reduced consumer purchasing power.

- Higher inflation impacting Federal Reserve's 2% target.

- Supply chain disruptions leading to shortages and higher prices.

Impact on Economic Growth and Uncertainty

Powell's warnings extend beyond inflation; tariffs create significant uncertainty for businesses. This uncertainty directly impacts investment decisions, potentially slowing economic growth and jeopardizing the goal of maximum employment.

-

Business Investment: Businesses hesitate to invest in expansion or new projects when faced with unpredictable trade policies and the potential for further tariff increases. This lack of investment can stifle job creation and overall economic growth.

-

Reduced Consumer Spending: Higher prices coupled with economic uncertainty lead consumers to reduce spending, further slowing economic activity. This creates a negative feedback loop, where reduced spending leads to lower production and potentially job losses.

-

Global Impact: Trade wars are rarely confined to two countries. Retaliatory tariffs and disruptions to global supply chains can have a significant negative impact on the U.S. economy, potentially reducing exports and hindering overall economic growth.

-

Bullet Points:

- Decreased business confidence.

- Reduced exports and decreased global trade.

- Negative impact on global supply chains.

- Uncertainty dampening consumer and business sentiment.

Federal Reserve's Response and Monetary Policy Challenges

The Federal Reserve faces significant challenges in responding to the economic consequences of tariffs. Its traditional tools, such as adjusting interest rates, are not always effective in addressing issues stemming from trade disputes.

-

Balancing Act: The Fed must carefully balance the need to combat inflation caused by tariffs with the risk of slowing economic growth by raising interest rates too aggressively. This delicate balancing act is made more difficult by the uncertainty surrounding the future course of trade policy.

-

Monetary Policy Limitations: Monetary policy is primarily designed to address domestic economic factors. It has limited ability to directly offset the effects of external shocks like trade wars. The Fed can adjust interest rates to manage inflation or stimulate growth, but it cannot directly influence trade policy.

-

Policy Response: While the Fed can use tools like quantitative easing to inject liquidity into the markets, this doesn't address the underlying issue of tariff-induced inflation and economic uncertainty.

-

Bullet Points:

- Difficulty in balancing inflation and economic growth.

- Potential for interest rate hikes to combat inflation, potentially slowing economic growth.

- Limitations of monetary policy in the face of trade-related shocks.

- The need for coordinated fiscal and trade policy responses.

Potential Long-Term Consequences of Tariff Policies

The long-term effects of prolonged tariff policies could be severely detrimental to the US economy and global trade relations.

-

Damaged Relationships: Escalating trade tensions can damage international cooperation and lead to retaliatory tariffs, creating a cycle of economic harm. This can severely hamper global economic growth.

-

Reduced Competitiveness: Tariffs can reduce the competitiveness of U.S. businesses by increasing their costs and making their products less attractive in global markets.

-

Sustained Inflation: Prolonged tariff policies can lead to persistent inflationary pressures, eroding consumer purchasing power and potentially leading to economic instability.

-

Bullet Points:

- Damage to international trade relationships.

- Reduced competitiveness of US businesses in global markets.

- Long-term inflationary pressures impacting sustainable growth.

- Uncertainty affecting long-term investment and economic planning.

Conclusion

Powell's warnings about the threats tariffs pose to the Federal Reserve's goals are clear and serious. The inflationary pressures, economic uncertainty, and challenges to monetary policy resulting from trade disputes represent a significant risk to the U.S. economy. The potential long-term consequences, including damaged trade relationships and reduced competitiveness, are equally concerning. Understanding the full implications of Powell's concerns regarding tariffs and the Federal Reserve's objectives is crucial for navigating the current economic landscape. Stay updated on how Powell's warnings about tariffs affecting Federal Reserve goals are impacting the economy by following the Federal Reserve's website and reputable financial news sources. [Link to Federal Reserve Website]

Featured Posts

-

News Corp Undervalued And Underappreciated Analyzing Its Potential

May 25, 2025

News Corp Undervalued And Underappreciated Analyzing Its Potential

May 25, 2025 -

Stocks Trading 8 Higher On Euronext Amsterdam Analysis Of Trumps Tariff Impact

May 25, 2025

Stocks Trading 8 Higher On Euronext Amsterdam Analysis Of Trumps Tariff Impact

May 25, 2025 -

Monaco Vs Nice Le Groupe Convoque

May 25, 2025

Monaco Vs Nice Le Groupe Convoque

May 25, 2025 -

Thierry Ardisson Accusations De Sexisme Et Reponses

May 25, 2025

Thierry Ardisson Accusations De Sexisme Et Reponses

May 25, 2025 -

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 25, 2025

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 25, 2025

Latest Posts

-

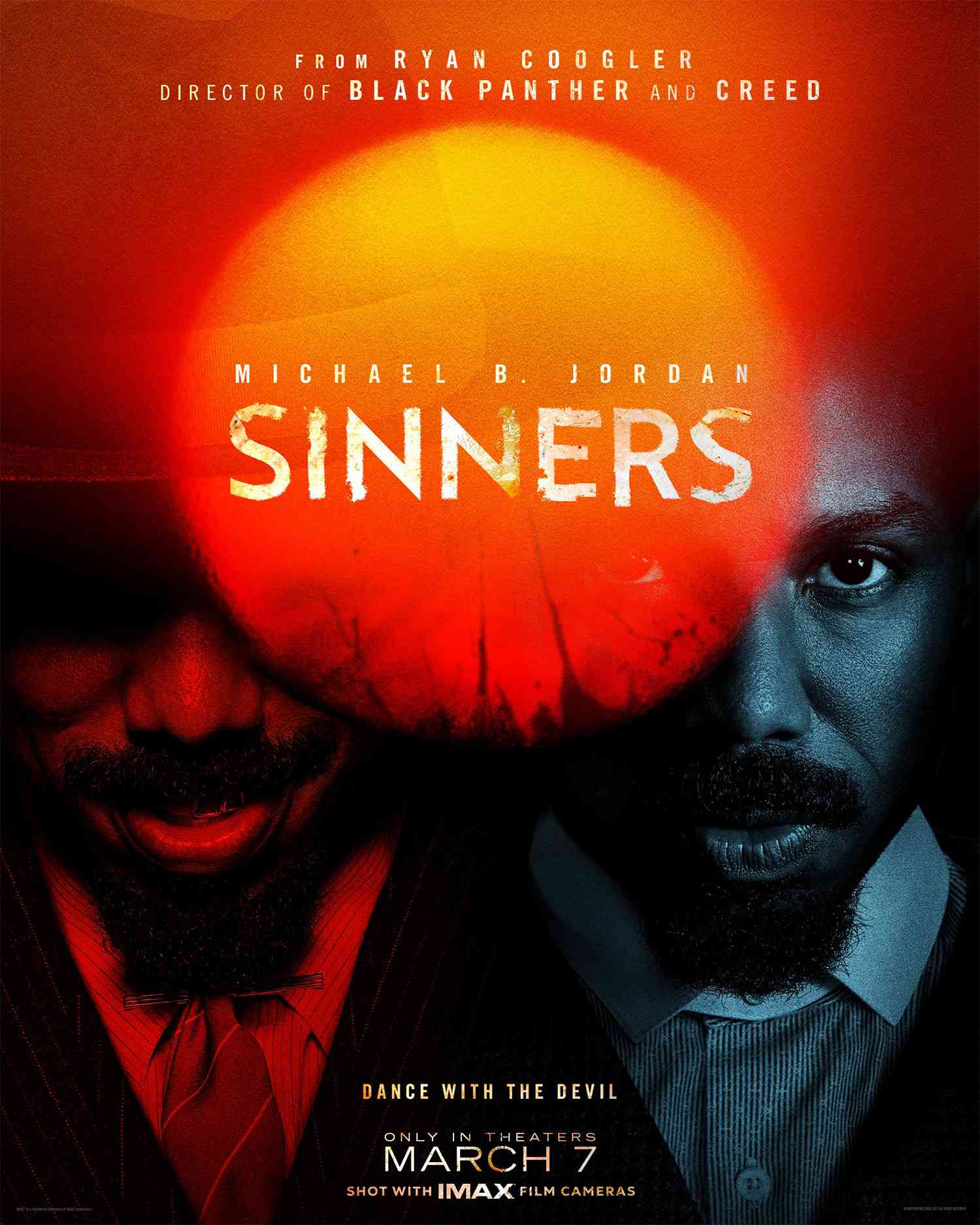

Louisiana Horror Film Sinners Set For Theatrical Release

May 26, 2025

Louisiana Horror Film Sinners Set For Theatrical Release

May 26, 2025 -

Experience Sinners The Louisiana Based Horror Movie

May 26, 2025

Experience Sinners The Louisiana Based Horror Movie

May 26, 2025 -

Learning From Sarah Vines Whats App Error Crisis Communication Strategies

May 26, 2025

Learning From Sarah Vines Whats App Error Crisis Communication Strategies

May 26, 2025 -

The Best Office Chairs For 2025 User Reviews And Comparisons

May 26, 2025

The Best Office Chairs For 2025 User Reviews And Comparisons

May 26, 2025 -

Sarah Vine How A Whats App Mistake Became A Pr Crisis

May 26, 2025

Sarah Vine How A Whats App Mistake Became A Pr Crisis

May 26, 2025