Powell's Fed: Why Delaying Interest Rate Cuts Risks Being Too Late

Table of Contents

The Current Economic Landscape and the Fed's Dilemma

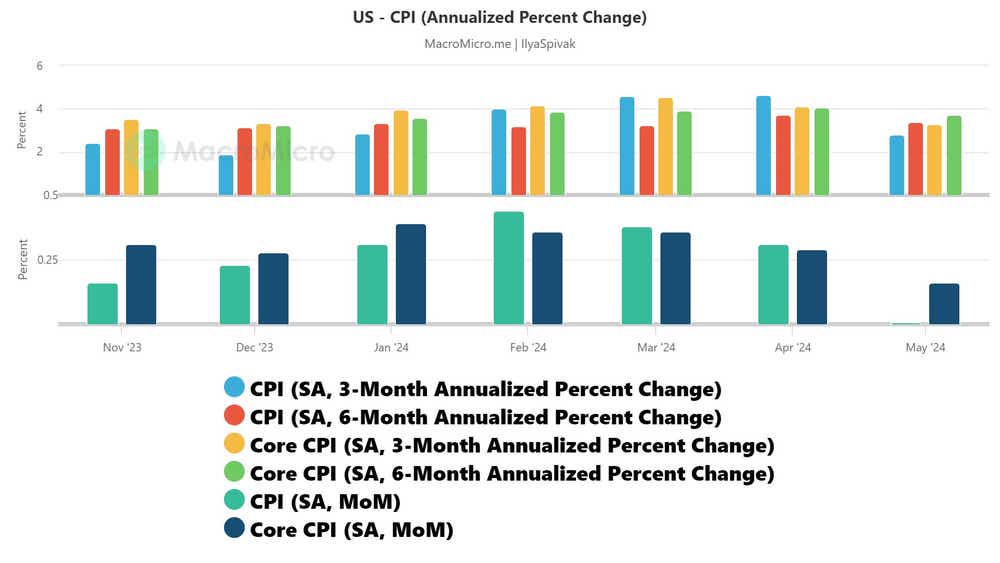

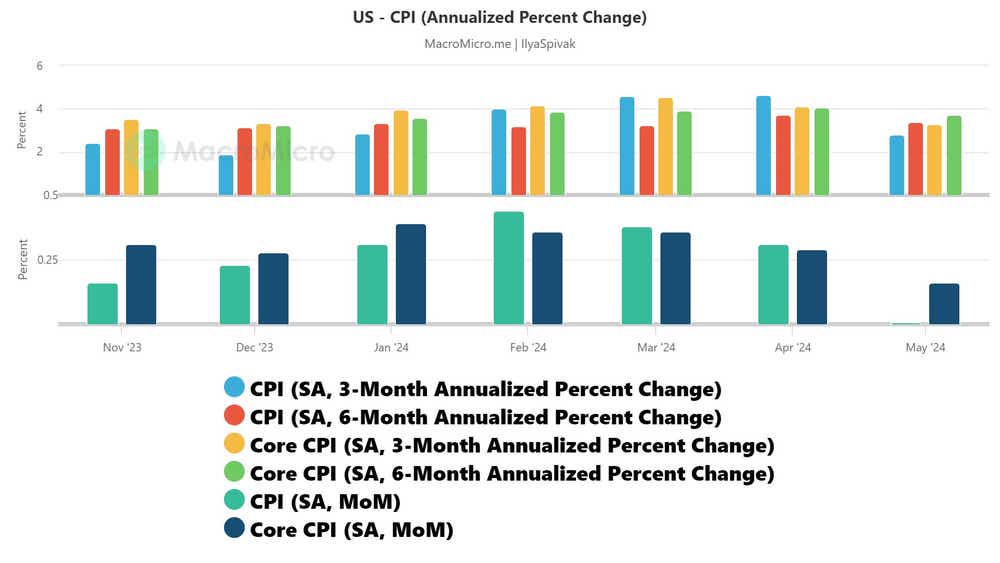

The economic landscape is complex and fraught with challenges. Inflation, currently hovering around [insert current inflation rate and source], continues to erode purchasing power, impacting consumer spending and business investment. Simultaneously, the unemployment rate stands at [insert current unemployment rate and source], leaving the Fed walking a tightrope between controlling inflation and maintaining maximum employment – its dual mandate. The risk of a recession is palpable, with GDP growth forecasts [insert GDP growth forecast and source] suggesting potential contraction. Consumer confidence indicators also paint a picture of uncertainty and apprehension.

- Inflation: [Insert details on inflation trends, specific inflation metrics (CPI, PPI), and contributing factors.]

- Unemployment: [Insert details on unemployment trends, sector-specific unemployment, and projections.]

- GDP Growth: [Insert details on GDP growth forecasts, potential contraction scenarios, and contributing factors.]

- Consumer Confidence: [Insert details on consumer confidence indexes, survey results, and interpretation.]

The Risks of Delayed Interest Rate Cuts

The longer the Fed waits to lower interest rates, the more severe the potential consequences. Delaying action risks deepening and prolonging a recession, leading to a cascade of negative effects. Businesses, already burdened by high borrowing costs, may face increased financial strain, resulting in job losses and potential failures. Consumer spending, already dampened by inflation, could further decline as higher interest rates make borrowing more expensive.

- Increased Borrowing Costs: Higher interest rates significantly increase the cost of borrowing for businesses, hindering investment and expansion.

- Reduced Consumer Spending: Higher interest rates translate to higher payments on loans, mortgages, and credit cards, leaving consumers with less disposable income.

- Potential Credit Crunch: A delayed response could lead to a credit crunch, limiting access to credit for businesses and individuals, further stifling economic activity.

- Impact on Interest-Rate Sensitive Sectors: Sectors like housing and automobiles, highly sensitive to interest rate changes, would suffer disproportionately.

The Argument for Proactive Rate Cuts

A proactive approach to interest rate cuts presents a compelling counter-argument. Stimulating economic activity sooner rather than later could help prevent a severe recession and mitigate its impact. Lowering interest rates can encourage borrowing and investment, boosting business activity and creating jobs. Importantly, proactive cuts can help maintain consumer and business confidence, preventing a self-fulfilling prophecy of economic decline.

- Stimulating Economic Growth: Lower interest rates incentivize borrowing and investment, fueling economic expansion.

- Preventing a Deeper Recession: Early action can prevent a minor downturn from escalating into a major recession.

- Maintaining Financial Market Stability: Proactive rate cuts can help stabilize financial markets and prevent a panic.

- Supporting Businesses and Consumers: Lower rates provide relief to businesses and consumers struggling with high debt burdens.

Analyzing Powell's Strategy and Potential Outcomes

Jerome Powell's past decisions and his likely approach to the current situation are crucial to understanding potential outcomes. His past responses to economic downturns [cite examples] provide insights into his current strategy. The timing and magnitude of interest rate adjustments will significantly impact the trajectory of the economy. Different scenarios, ranging from early, aggressive cuts to delayed, incremental reductions, lead to vastly different economic forecasts. Furthermore, political pressures inevitably influence the Fed's decisions, adding another layer of complexity to the analysis.

- Past Fed Rate Decisions: [Analyze past decisions and their consequences.]

- Potential Scenarios: [Compare and contrast the economic implications of different rate cut scenarios.]

- Economic Forecasts: [Present economic forecasts under different interest rate scenarios.]

- Political Implications: [Discuss the influence of political factors on the Fed's decisions.]

Conclusion: Powell's Fed and the Urgency of Timely Action

The arguments for and against delaying interest rate cuts highlight a critical juncture. Delaying action risks a deeper and more prolonged recession, while proactive cuts offer the potential to mitigate the downturn and facilitate a quicker recovery. The Fed's decisions regarding interest rate cuts are paramount in shaping the future economic outlook. Understanding the complexities of Powell's Fed and the potential consequences of delaying interest rate cuts is crucial. Stay informed and continue to research this critical issue to navigate these challenging economic times.

Featured Posts

-

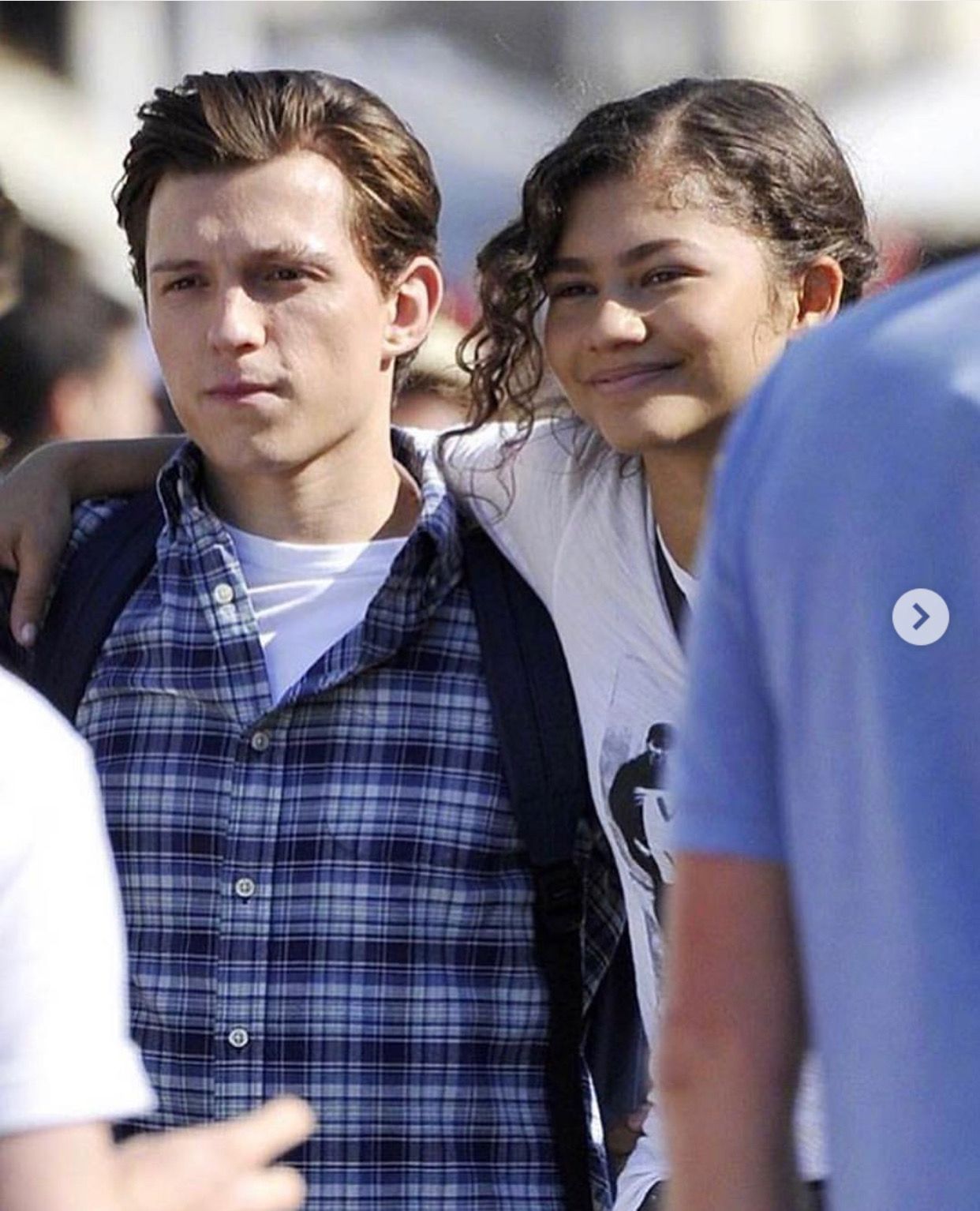

Is Zendayas Sister Skipping Her Wedding To Tom Holland The Story Behind The Rumor

May 07, 2025

Is Zendayas Sister Skipping Her Wedding To Tom Holland The Story Behind The Rumor

May 07, 2025 -

The Ed Sheeran Rihanna Connection What We Know

May 07, 2025

The Ed Sheeran Rihanna Connection What We Know

May 07, 2025 -

Yankees 2000 Season A Diary Entry Comeback Attempt Fails

May 07, 2025

Yankees 2000 Season A Diary Entry Comeback Attempt Fails

May 07, 2025 -

Knicks Vs Cavaliers Prediction New Yorks Home Court Advantage

May 07, 2025

Knicks Vs Cavaliers Prediction New Yorks Home Court Advantage

May 07, 2025 -

Where Will Simone Biles Go After Gymnastics

May 07, 2025

Where Will Simone Biles Go After Gymnastics

May 07, 2025

Latest Posts

-

Is Anthony Edwards Baby Mama Drama Real Or Manufactured

May 07, 2025

Is Anthony Edwards Baby Mama Drama Real Or Manufactured

May 07, 2025 -

Rsmssb Exam Schedule 2025 26 Key Dates And Notifications

May 07, 2025

Rsmssb Exam Schedule 2025 26 Key Dates And Notifications

May 07, 2025 -

Anthony Edwards Shoving Incident What Happened During The Lakers Game

May 07, 2025

Anthony Edwards Shoving Incident What Happened During The Lakers Game

May 07, 2025 -

Cleveland Cavs Rookie Car Prank Mitchells Foresight

May 07, 2025

Cleveland Cavs Rookie Car Prank Mitchells Foresight

May 07, 2025 -

Nba Game Anthony Edwards Shoving Match With Lakers Center Sparks Controversy

May 07, 2025

Nba Game Anthony Edwards Shoving Match With Lakers Center Sparks Controversy

May 07, 2025