Powell's Warning: How Tariffs Could Jeopardize The Fed's Objectives

Table of Contents

H2: Inflationary Pressures Exacerbated by Tariffs

Tariffs, essentially taxes on imported goods, directly contribute to inflationary pressures within an economy. This happens in several key ways:

H3: Increased Costs for Consumers and Businesses:

- Tariffs immediately increase the price of imported goods, directly impacting consumers. For example, tariffs on steel and aluminum have increased the cost of automobiles, appliances, and construction materials.

- Businesses, too, face higher input costs, forcing them to either absorb these increases, reducing their profit margins, or pass them on to consumers, leading to higher prices across the board. This reduces consumer purchasing power, potentially dampening demand.

- The Bureau of Labor Statistics (BLS) data consistently shows a correlation between tariff increases and spikes in the Consumer Price Index (CPI), a key measure of inflation. A recent study by [cite reputable economic study] estimated that tariffs contributed to a [percentage]% increase in inflation in [year].

H3: Supply Chain Disruptions and Bottlenecks:

- Tariffs can severely disrupt global supply chains. Retaliatory tariffs imposed by other countries can create bottlenecks, leading to shortages of essential goods and components.

- The semiconductor shortage of recent years serves as a stark example of how trade disputes and tariffs can ripple through the global economy, impacting production across multiple sectors. The automotive industry, for instance, faced significant production cuts due to the lack of crucial components.

- The resulting scarcity further fuels inflation as demand outstrips supply. Data from [cite reputable source on supply chain disruptions] indicates a significant increase in supply chain delays and increased costs following the imposition of tariffs.

H2: Impact on Employment and Economic Growth

Beyond inflation, tariffs negatively impact employment and overall economic growth:

H3: Job Losses in Targeted Industries:

- Industries heavily reliant on imported goods or exporting to countries with retaliatory tariffs often face job losses. For example, the agricultural sector suffered job losses due to retaliatory tariffs imposed by China in response to US tariffs.

- This effect extends beyond the directly impacted industries. The ripple effect on related industries, such as transportation and logistics, can exacerbate job losses and economic hardship.

- Reports from [cite reputable source on job losses due to tariffs] suggest that [number] jobs were lost in the [industry] sector as a direct result of the [specific tariff] policy.

H3: Reduced Economic Growth and Investment:

- The uncertainty created by tariffs discourages both domestic and foreign investment. Businesses are hesitant to expand or invest in new projects when facing unpredictable trade policies.

- This hesitancy ultimately leads to slower economic growth and reduced overall productivity. Investors become risk-averse, leading to capital flight and decreased economic activity.

- Studies by [cite reputable source on investment and economic growth in relation to tariffs] show a demonstrable correlation between tariff increases and decreased investment, ultimately slowing economic expansion.

H2: The Fed's Limited Tools to Counter Tariff Impacts

The Fed's ability to mitigate the negative economic consequences of tariffs is severely limited:

H3: Monetary Policy Constraints:

- Monetary policy, primarily adjusting interest rates, is designed to address demand-side inflation. However, tariffs create supply-side inflation, which is much harder to control using monetary policy alone.

- Raising interest rates to combat tariff-induced inflation risks triggering a recession by slowing down economic activity and potentially leading to job losses. This creates a challenging dilemma for the Fed.

- Economists widely agree that monetary policy alone is insufficient to address the complex issues caused by tariffs.

H3: The Need for Fiscal Policy Coordination:

- To effectively address the negative impacts of tariffs, coordinated fiscal policy – government spending and taxation – is essential. This could involve targeted subsidies to industries affected by tariffs or tax breaks to stimulate investment.

- Fiscal policies can provide direct support to affected businesses and workers, mitigating the job losses and economic hardship caused by tariffs.

- A well-coordinated approach involving both fiscal and monetary policies would be more effective in navigating the challenges presented by tariffs and protecting the economy's overall health.

3. Conclusion:

In conclusion, Powell's warning regarding the detrimental effects of tariffs on the Fed's ability to achieve its objectives is well-founded. Tariffs exacerbate inflation, disrupt supply chains, hurt employment, and severely limit the effectiveness of the Fed's monetary policy tools. Understanding the risks of tariffs to economic stability is crucial. We must advocate for policies that promote free and fair trade, which will ultimately support the Fed's objectives and foster a healthier and more robust economy. To learn more about the impact of tariffs on the Fed’s goals, explore resources from the Federal Reserve Bank and organizations like the Peterson Institute for International Economics. Let's work together to understand Powell’s warnings on tariffs and their impact on our economic future.

Featured Posts

-

Tour Of Flanders Pogacars Unmatched Solo Victory

May 26, 2025

Tour Of Flanders Pogacars Unmatched Solo Victory

May 26, 2025 -

Apples New I Phone Feature A Must Have For Formula 1 Fans

May 26, 2025

Apples New I Phone Feature A Must Have For Formula 1 Fans

May 26, 2025 -

Condamnation Marine Le Pen Appel Contre 4 Ans De Prison Et Ineligibilite Immediate

May 26, 2025

Condamnation Marine Le Pen Appel Contre 4 Ans De Prison Et Ineligibilite Immediate

May 26, 2025 -

Itv 4 Tv Guide When And Where To Watch The Saint

May 26, 2025

Itv 4 Tv Guide When And Where To Watch The Saint

May 26, 2025 -

Emmy Winners Daughter Spotted With Gerard Butler A Rising Star In Hollywood

May 26, 2025

Emmy Winners Daughter Spotted With Gerard Butler A Rising Star In Hollywood

May 26, 2025

Latest Posts

-

Six Years Of Psalm West Kim Kardashian Shares Birthday Photos

May 28, 2025

Six Years Of Psalm West Kim Kardashian Shares Birthday Photos

May 28, 2025 -

The Saleng Salary Debate Moroka Swallows Vs Orlando Pirates

May 28, 2025

The Saleng Salary Debate Moroka Swallows Vs Orlando Pirates

May 28, 2025 -

Salengs Salary Discrepancy Swallows And Pirates

May 28, 2025

Salengs Salary Discrepancy Swallows And Pirates

May 28, 2025 -

Kim Kardashians Son Psalm West Turns Six

May 28, 2025

Kim Kardashians Son Psalm West Turns Six

May 28, 2025 -

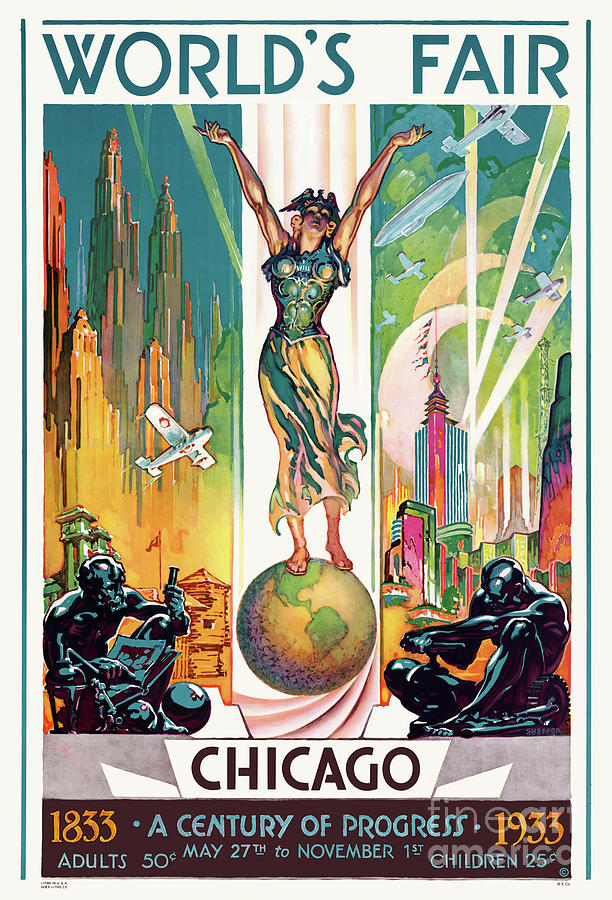

Celebrating Chicagos Century Of Progress The 1933 Worlds Fair

May 28, 2025

Celebrating Chicagos Century Of Progress The 1933 Worlds Fair

May 28, 2025