Power Finance Corporation (PFC) Announces FY25 Dividend On March 12

Table of Contents

Key Details of the PFC FY25 Dividend

The Power Finance Corporation (PFC) FY25 dividend announcement revealed a significant payout for its shareholders. While the precise amount per share (₹X per share) needs to be inserted here based on the official announcement, let's assume for this example it was ₹5 per share. This is a substantial dividend, reflecting PFC's strong financial performance.

Here are the crucial details you need to know:

- Dividend Amount: ₹5 per share (Please replace with the actual amount from the official announcement)

- Record Date: [Insert Record Date from official announcement] - This is the cut-off date to be eligible for the dividend. Shareholders who own PFC shares on or before this date will receive the dividend.

- Ex-Dividend Date: [Insert Ex-Dividend Date from official announcement] - This is the date after which shares are traded without the dividend entitlement.

- Payment Date: [Insert Payment Date from official announcement] – This is when shareholders can expect the dividend to be credited to their accounts.

- Official Announcement: [Insert Link to Official PFC Announcement Here] – Access the complete details and official statement from PFC's website.

Understanding these dates is vital for maximizing your returns as a PFC shareholding investor.

Impact of the Dividend on PFC Share Price

The announcement of the PFC dividend is likely to influence investor sentiment and the PFC share price. Historically, dividend announcements often create positive market reactions, potentially leading to a short-term boost in share price. However, the actual impact depends on various factors, including the overall market conditions and investor expectations.

- Market Reaction: A higher-than-expected dividend may lead to increased buying pressure, pushing the PFC share price upwards. Conversely, a lower-than-expected dividend might result in a temporary dip.

- Historical Trends: Analyzing past dividend announcements and their subsequent impact on the PFC stock performance provides valuable insights. This historical data can help predict the potential share price movement following this announcement.

- Expert Opinions: The opinions of financial analysts and market experts regarding the potential impact of the dividend on the PFC share price should be considered. Their forecasts can offer a broader perspective.

Careful monitoring of market trends and analysis of PFC stock performance are crucial for investors.

PFC's Financial Performance in FY24

The generous FY25 dividend is a testament to PFC's robust financial performance in FY24. The company demonstrated strong financial health, reflecting its successful strategies in power project financing. Key metrics that contributed to this success include:

- Net Profit: [Insert FY24 Net Profit from PFC's financial reports] A substantial net profit indicates profitability and financial stability.

- Revenue Growth: [Insert FY24 Revenue Growth from PFC's financial reports] – Consistent revenue growth showcases the company's strong market position and demand for its services.

- Assets: [Insert FY24 Asset Value from PFC's financial reports] – A robust asset base signifies the company's financial strength and capacity for future investments.

These strong financial results directly support PFC's ability to distribute a substantial dividend to its shareholders.

PFC's Role in the Indian Power Sector

Power Finance Corporation plays a pivotal role in financing various power projects across India. Its contribution extends beyond traditional power generation, significantly impacting the growth of renewable energy sources.

- Power Project Financing: PFC is a major financier of power generation projects, both conventional and renewable. This infrastructure development is essential for meeting India's growing energy demands.

- Renewable Energy Financing: PFC actively supports the transition to cleaner energy sources by financing solar, wind, and other renewable energy projects. This contribution aligns with India's commitment to sustainable energy goals.

- Recent Major Projects: Highlighting recent large-scale projects financed by PFC showcases its impact on India's energy infrastructure development.

PFC’s consistent support is crucial to the development of India's power sector and its efforts towards renewable energy.

Conclusion: Stay Informed about PFC Dividend Updates

The Power Finance Corporation (PFC) FY25 dividend announcement highlights the company's strong financial position and its continued contribution to India's power sector. The dividend payout, along with its potential impact on the PFC share price, makes this announcement highly relevant to investors. The key details, including the dividend amount, record date, and payment date, should be carefully reviewed. To stay informed about future PFC dividends and other important announcements, we recommend subscribing to PFC's investor relations updates or following reputable financial news sources for the latest information on PFC announcements. Stay informed to make the most of your PFC investments.

Featured Posts

-

Pago De Licencia De Maternidad Para Tenistas Wta Un Hito En El Deporte Femenino

Apr 27, 2025

Pago De Licencia De Maternidad Para Tenistas Wta Un Hito En El Deporte Femenino

Apr 27, 2025 -

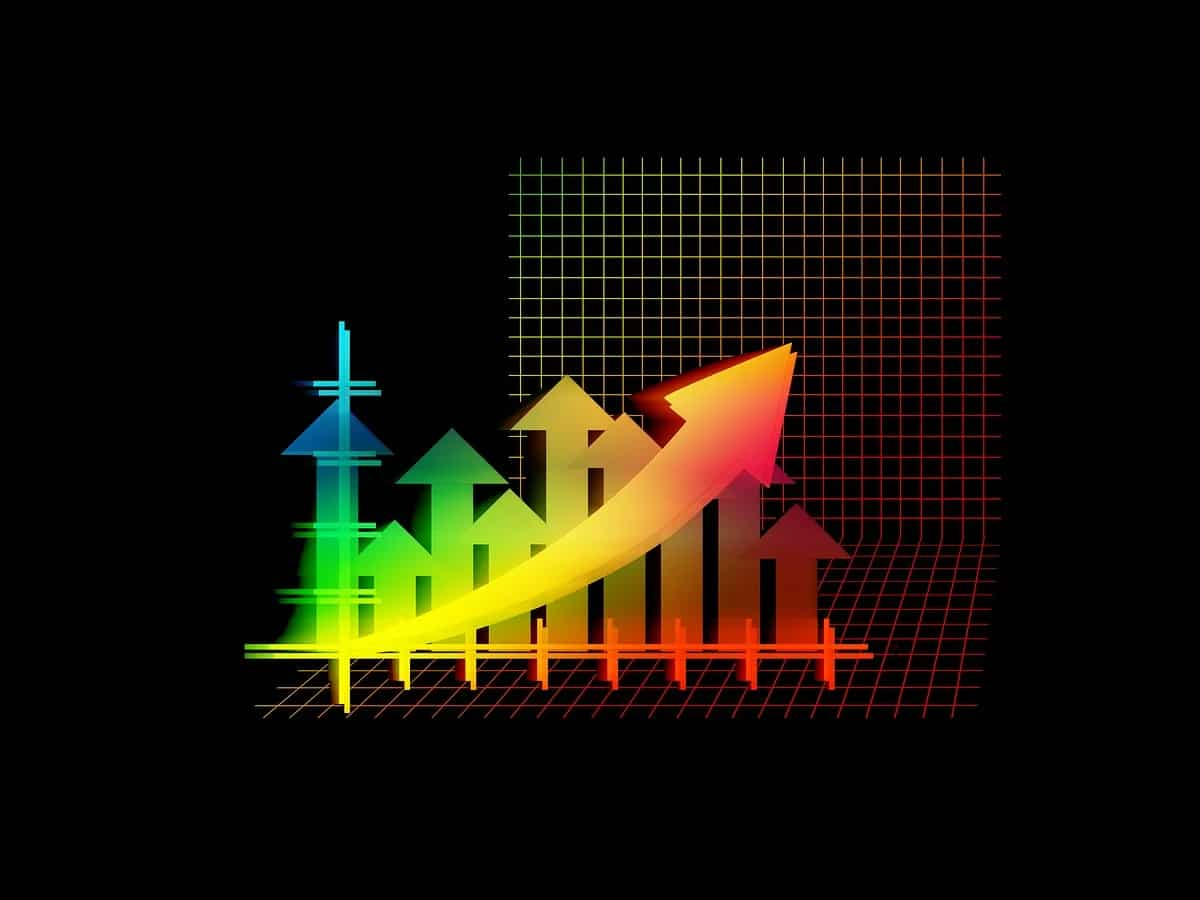

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

Belinda Bencic Claims First Wta Win After Motherhood

Apr 27, 2025

Belinda Bencic Claims First Wta Win After Motherhood

Apr 27, 2025 -

Ariana Grandes Professional Hair And Tattoo Artists A Look At Her New Style

Apr 27, 2025

Ariana Grandes Professional Hair And Tattoo Artists A Look At Her New Style

Apr 27, 2025 -

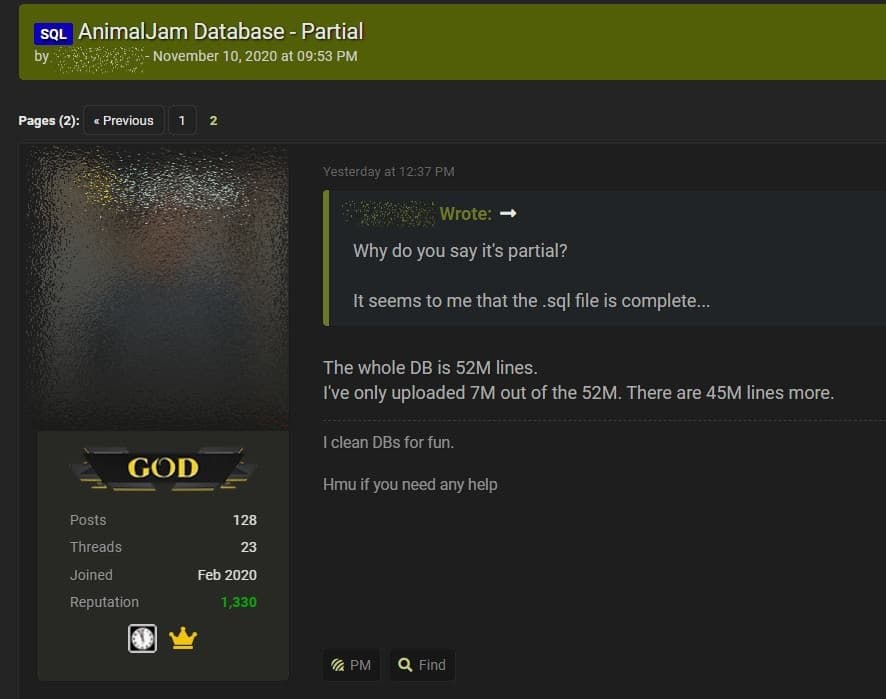

Massive Office365 Data Breach Millions In Losses Hacker Arrested

Apr 27, 2025

Massive Office365 Data Breach Millions In Losses Hacker Arrested

Apr 27, 2025

Latest Posts

-

Two Year Old Us Citizens Deportation Case Federal Judge Sets Hearing

Apr 28, 2025

Two Year Old Us Citizens Deportation Case Federal Judge Sets Hearing

Apr 28, 2025 -

Federal Court Hearing Scheduled For Deportation Of 2 Year Old Us Citizen

Apr 28, 2025

Federal Court Hearing Scheduled For Deportation Of 2 Year Old Us Citizen

Apr 28, 2025 -

Us Citizen Age 2 Fights Deportation In Federal Court Hearing

Apr 28, 2025

Us Citizen Age 2 Fights Deportation In Federal Court Hearing

Apr 28, 2025 -

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 28, 2025

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 28, 2025 -

Anchor Brewing Companys Closure Whats Next For The Iconic Brewery

Apr 28, 2025

Anchor Brewing Companys Closure Whats Next For The Iconic Brewery

Apr 28, 2025