Principal Financial Group (NASDAQ: PFG): What 13 Analysts Predict

Table of Contents

Average Analyst Price Target for PFG

Based on the analysis of 13 analyst predictions, the average price target for Principal Financial Group (PFG) stock is $85. The predictions ranged from a low of $70 to a high of $100, showcasing a considerable spread in individual analyst opinions. Compared to the current PFG stock price (please insert current stock price here), this average target suggests a (insert: buy, sell, or hold signal based on comparison. e.g., "buy" signal, implying potential upside for investors). It's crucial to remember this is an average; individual analyst opinions vary significantly.

- Analyst Price Targets and Ratings: (Insert Table Here - Example below)

| Analyst | Price Target | Rating |

|---|---|---|

| Analyst 1 | $95 | Buy |

| Analyst 2 | $80 | Hold |

| Analyst 3 | $100 | Buy |

| ... | ... | ... |

| Analyst 13 | $70 | Hold |

- Significant Discrepancies: Noteworthy discrepancies exist between individual analyst predictions, highlighting the diverse perspectives and methodologies employed in evaluating PFG's prospects. For example, Analyst 3's significantly higher price target compared to Analyst 13 reflects differing assessments of PFG's future growth potential.

Key Factors Influencing Analyst Predictions for PFG

Several macroeconomic factors and company-specific events influence analyst predictions for PFG. Rising interest rates, persistent inflation, and the overall economic growth outlook are all major considerations impacting the financial services industry, and PFG is not immune.

-

Macroeconomic Factors: The current inflationary environment and fluctuating interest rates significantly impact PFG's profitability and investment strategies. A slowdown in economic growth could reduce demand for PFG's financial products.

-

Recent Financial Performance: PFG's recent earnings reports, showcasing revenue growth (or decline), and profitability will heavily influence analyst sentiment. Positive results typically lead to higher price targets, while disappointing figures may lead to downward revisions.

-

Significant Events: Recent news such as new product launches, acquisitions, regulatory changes, or significant executive changes within Principal Financial Group can drastically shift analyst expectations.

-

Key Analyst Factors:

- Interest rate sensitivity of PFG's investment portfolio.

- Competitive landscape within the retirement and insurance sectors.

- Success of new product initiatives.

- Overall economic growth projections.

Analyst Ratings and Recommendations for PFG

Among the 13 analysts, the overall sentiment towards Principal Financial Group appears to be (insert: bullish, bearish, or neutral, based on data). Specifically, (insert percentage)% recommended a "buy," (insert percentage)% suggested a "hold," and (insert percentage)% issued a "sell" rating. This breakdown reveals a (insert: consensus view, e.g., predominantly bullish) outlook.

-

Rating Breakdown: The significant proportion of "buy" ratings signifies considerable optimism regarding PFG's future performance.

-

Deviation from Consensus: It's crucial to note any analysts whose recommendations significantly deviate from the majority view, as their rationale may offer valuable counterpoints and additional perspectives.

Potential Risks and Opportunities for PFG

Like any investment, PFG faces potential risks and opportunities.

-

Potential Risks: Increased competition within the financial services sector, stringent regulatory hurdles, and a potential economic downturn pose significant threats to PFG's future performance. Changes in consumer behavior and technological disruptions could also impact the company.

-

Potential Opportunities: Expansion into new markets, the adoption of innovative technologies to improve operational efficiency and customer experience, and strategic partnerships could significantly enhance PFG's future growth trajectory.

-

Key Risks and Opportunities:

- Risk: Increased competition from fintech companies.

- Opportunity: Expansion into the rapidly growing Asian markets.

- Risk: Negative impact from rising interest rates on the investment portfolio.

- Opportunity: Successful integration of new technologies to enhance customer engagement.

Conclusion: Making Informed Decisions on Principal Financial Group (PFG)

In summary, the 13 analysts' predictions for Principal Financial Group (PFG) reveal an average price target of $85, with a range from $70 to $100. The overall sentiment is (insert: bullish, bearish, or neutral), driven by factors such as macroeconomic conditions, PFG's financial performance, and significant company events. Remember to consider both the potential risks and opportunities before making any investment decisions. To stay informed about PFG, continue researching PFG's stock, monitor analyst predictions for PFG, consult reliable financial news sources, and, most importantly, consult with a qualified financial advisor. Thorough due diligence is paramount before investing in Principal Financial Group (PFG) or any other stock.

Featured Posts

-

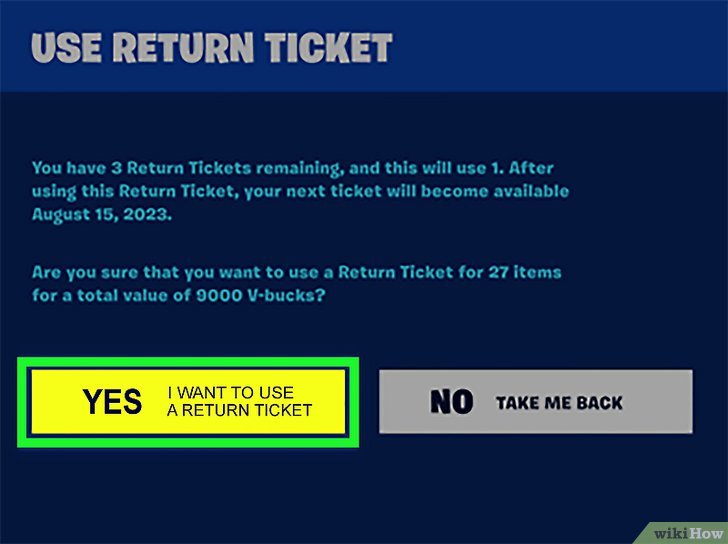

Fortnite Refund Signals Potential Cosmetic Changes

May 17, 2025

Fortnite Refund Signals Potential Cosmetic Changes

May 17, 2025 -

Doctor Who Christmas Special Cancellation Confirmed

May 17, 2025

Doctor Who Christmas Special Cancellation Confirmed

May 17, 2025 -

Gncc Racing News And More Mx Sx Flat Track And Enduro Updates

May 17, 2025

Gncc Racing News And More Mx Sx Flat Track And Enduro Updates

May 17, 2025 -

These Fortnite Skins Are Probably Gone Forever

May 17, 2025

These Fortnite Skins Are Probably Gone Forever

May 17, 2025 -

Office365 Data Breach Millions Stolen Suspect Arrested

May 17, 2025

Office365 Data Breach Millions Stolen Suspect Arrested

May 17, 2025

Latest Posts

-

Watch Celtics Vs Magic Game 1 Nba Playoffs Live Stream And Tv Broadcast Details

May 17, 2025

Watch Celtics Vs Magic Game 1 Nba Playoffs Live Stream And Tv Broadcast Details

May 17, 2025 -

Nba Playoffs Celtics Vs Magic Game 1 Where To Watch The Live Game

May 17, 2025

Nba Playoffs Celtics Vs Magic Game 1 Where To Watch The Live Game

May 17, 2025 -

How To Watch Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Live Stream

May 17, 2025

How To Watch Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Live Stream

May 17, 2025 -

Jalen Brunson Expresses Frustration Over Missing Next Weeks Raw

May 17, 2025

Jalen Brunson Expresses Frustration Over Missing Next Weeks Raw

May 17, 2025 -

Report Jalen Brunson Unhappy About Missing Cm Punk Seth Rollins Raw Match

May 17, 2025

Report Jalen Brunson Unhappy About Missing Cm Punk Seth Rollins Raw Match

May 17, 2025