Private Credit Investments Now Available To Retail Investors Through Invesco And Barings

Table of Contents

Invesco's Approach to Retail Private Credit Investment

Invesco, a global investment management firm, is making inroads into the retail private credit market with several compelling offerings. Their strategy focuses on providing diversified access to this asset class, mitigating risk through careful portfolio construction.

-

Invesco's Specific Offerings: Invesco offers various private credit funds designed specifically for retail investors, allowing participation with relatively lower minimum investment thresholds compared to traditional private equity vehicles. These funds often invest across a range of sectors and credit ratings, aiming for a balance between risk and return.

-

Investment Strategy: Invesco's private credit investment strategy typically employs a diversified approach, focusing on various sectors and debt instruments, including senior secured loans, mezzanine debt, and unitranche financing. This diversification aims to reduce the overall portfolio risk.

-

Risk and Return Profile: While private credit investments offer the potential for higher returns than traditional fixed-income investments, they also carry higher risk. Illiquidity is a key factor; investors may not be able to readily sell their investments. Invesco's funds aim to mitigate this risk through active portfolio management and diversified holdings. Potential return profiles should be carefully reviewed in the fund prospectuses.

-

Minimum Investment and Access: Invesco’s minimum investment requirements for retail access to private credit funds vary depending on the specific fund. Access is generally achieved through brokerage accounts or directly through Invesco's platform. Detailed information on specific minimums and access procedures is available on Invesco’s website.

-

Diversification Benefits: By including Invesco’s private credit funds in a broader portfolio, retail investors can gain exposure to an asset class that historically has shown low correlation with traditional equities and bonds, potentially enhancing overall portfolio stability and returns.

Barings' Private Credit Solutions for Retail Investors

Barings, another prominent global investment firm, also offers retail investors access to private credit markets through specialized funds and vehicles. Their approach may differ slightly from Invesco's, offering investors alternative avenues to participate in private debt.

-

Barings' Private Credit Vehicles: Barings provides access to private credit through a range of investment products, potentially including separately managed accounts and commingled funds catering to different investor risk profiles and capital requirements.

-

Comparison with Invesco: While both Invesco and Barings offer diversified approaches, their specific investment strategies and fund structures may differ. For instance, Barings might have a greater emphasis on certain sectors or types of debt compared to Invesco. A direct comparison requires careful review of individual fund prospectuses from each firm.

-

Risk-Return Profile: Similar to Invesco, Barings' private credit offerings present both higher potential returns and increased risk compared to traditional investments. The risk-return profile of each fund will be detailed in the offering documents.

-

Minimum Investment and Accessibility: Similar to Invesco, Barings' minimum investment amounts will vary depending on the specific product and may be subject to change. Accessibility typically involves account opening procedures through approved brokerage channels or directly via Barings’ platforms.

-

Portfolio Diversification: Including Barings' private credit investments in a well-diversified portfolio can contribute to overall portfolio risk reduction and enhance potential returns, given the typically low correlation with other asset classes.

Understanding the Risks and Rewards of Private Credit Investments

Private credit investments offer the potential for attractive returns but carry inherent risks that retail investors must understand.

-

Risks of Private Credit: Illiquidity is a major risk; investors may find it difficult to sell their investments quickly. Lack of transparency in comparison to publicly traded securities is another concern. Credit risk, the possibility of borrowers defaulting on their loans, is also significant.

-

Potential for Higher Returns: Private credit investments often provide the potential for higher yields than traditional fixed-income instruments. This stems from the higher risk and illiquidity premium embedded in these investments.

-

Due Diligence: Thorough due diligence is critical before investing in private credit. Understanding the fund’s investment strategy, the underlying borrowers' creditworthiness, and the fund manager's track record are all crucial.

-

Risk Tolerance: Investors should carefully assess their risk tolerance before allocating any significant portion of their portfolio to private credit. These investments are not suitable for all investors.

Accessing Private Credit Investments: A Step-by-Step Guide

Gaining access to private credit investments through Invesco or Barings (or similar firms) typically involves several steps.

-

Account Opening: Open an account with a brokerage firm or directly with Invesco or Barings, if available, that offers access to their private credit funds. This usually requires completing application forms and providing necessary documentation.

-

Investment Process: Once your account is opened, you can begin the investment process. This typically involves reviewing fund prospectuses and other relevant documents, followed by placing an order to purchase shares in the chosen fund.

-

Fees and Expenses: Be aware that investing in private credit involves various fees and expenses, including management fees, performance fees, and administrative expenses. These are usually outlined in the fund's offering documents.

-

Financial Advisor: Consider consulting a qualified financial advisor specializing in alternative investments, including private credit, to assess whether these investments are suitable for your financial goals and risk tolerance.

Conclusion

Invesco and Barings are leading the way in making private credit investments accessible to retail investors, opening a new avenue for portfolio diversification and potentially higher returns. Understanding the risks and rewards is crucial, and careful due diligence is paramount. Private credit investments, while offering potentially higher returns, require a higher risk tolerance and a long-term investment horizon. Before investing, consult with a financial advisor to ensure alignment with your investment goals and risk profile. Learn more about accessing lucrative private credit investment opportunities through Invesco and Barings. Start diversifying your portfolio today and explore the world of private debt!

Featured Posts

-

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 23, 2025

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 23, 2025 -

The Science Behind Shota Imanagas Unhittable Splitter

Apr 23, 2025

The Science Behind Shota Imanagas Unhittable Splitter

Apr 23, 2025 -

Brewers Fall To Diamondbacks In Dramatic Ninth Inning

Apr 23, 2025

Brewers Fall To Diamondbacks In Dramatic Ninth Inning

Apr 23, 2025 -

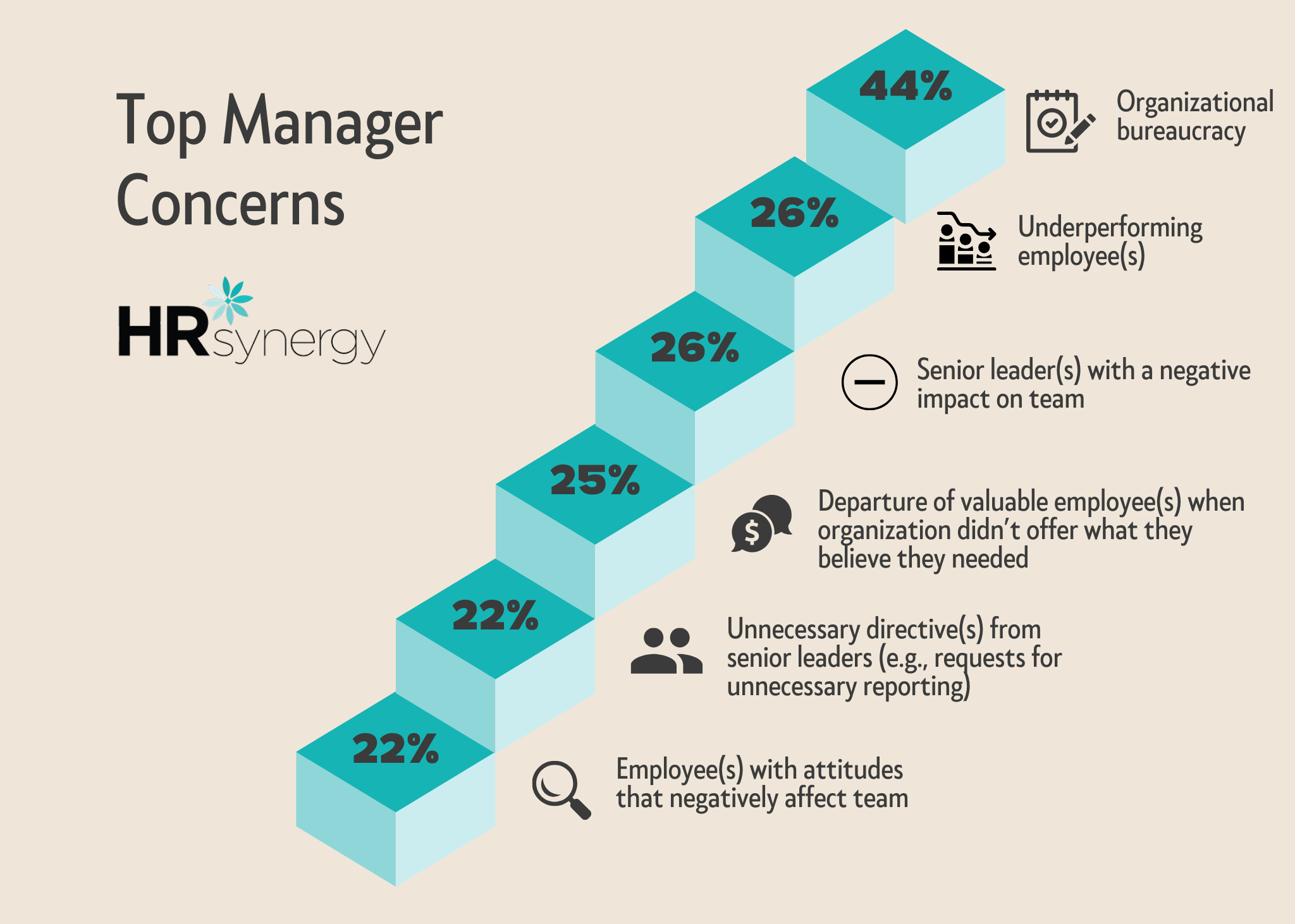

Why Middle Managers Are Essential For Company And Employee Success

Apr 23, 2025

Why Middle Managers Are Essential For Company And Employee Success

Apr 23, 2025 -

The Hegseth Accusation Leaks And The Trump Administration

Apr 23, 2025

The Hegseth Accusation Leaks And The Trump Administration

Apr 23, 2025