Private Credit Jobs: 5 Do's And Don'ts For A Successful Application

Table of Contents

5 Do's for a Successful Private Credit Job Application

Do 1: Tailor Your Resume and Cover Letter to Each Private Credit Role

Generic applications rarely succeed in the competitive private credit market. Each private credit role demands a unique skillset and experience. Therefore, it's crucial to customize your application materials for every opportunity.

- Highlight relevant skills and experiences: Carefully review the job description and identify the key skills and experiences the employer is seeking. Then, emphasize those aspects of your background in your resume and cover letter.

- Quantify your accomplishments: Instead of simply listing your responsibilities, quantify your achievements whenever possible. For example, instead of "managed a portfolio," write "managed a $100 million portfolio of middle-market private credit investments, consistently exceeding return targets."

- Incorporate keywords: Use keywords from the job description throughout your resume and cover letter. This helps applicant tracking systems (ATS) identify your application as a relevant match.

- Showcase your understanding of private credit markets: Demonstrate your familiarity with different private credit strategies, such as direct lending, mezzanine financing, distressed debt, and leveraged buyouts.

- Example: Instead of saying "analyzed financial statements," say "analyzed financial statements of 20+ companies to assess creditworthiness and identify potential investment opportunities, contributing to a 12% increase in deal flow."

Do 2: Network Strategically Within the Private Credit Industry

Networking is paramount in securing a private credit job. Building relationships with professionals in the field can open doors to unadvertised positions and provide invaluable insights.

- Attend industry conferences and events: These events provide excellent opportunities to meet potential employers and learn about the latest trends in the private credit industry. Look for events focused on private equity, alternative investments, and credit funds.

- Connect with professionals on LinkedIn: Actively engage with professionals on LinkedIn, join relevant groups, and participate in discussions.

- Conduct informational interviews: Reach out to professionals in private credit for informational interviews to gain insights into their careers and learn about their companies.

- Leverage alumni networks: If you're an alumnus of a reputable university, leverage your alumni network to connect with professionals in the private credit industry.

- Build relationships with recruiters: Cultivate relationships with recruiters specializing in private credit placements. They often have access to unadvertised positions and can provide valuable guidance throughout the job search process.

Do 3: Showcase Your Financial Modeling and Analytical Skills

Proficiency in financial modeling and analysis is crucial for private credit roles. Employers seek candidates who can critically assess investments, manage risk, and produce insightful reports.

- Demonstrate Excel proficiency: Master advanced Excel functions, including financial modeling techniques like discounted cash flow (DCF) analysis and leveraged buyout (LBO) modeling.

- Proficiency in financial modeling software: Familiarity with Bloomberg Terminal, Argus, or other financial modeling software is highly beneficial.

- Highlight your credit risk assessment skills: Demonstrate your ability to analyze financial statements, assess credit risk, and identify potential red flags.

- Showcase valuation methodologies: Be prepared to discuss your experience with various valuation methodologies, such as DCF analysis, precedent transactions, and market multiples.

- Communicate effectively: Practice explaining complex financial concepts clearly and concisely, both verbally and in written reports.

Do 4: Prepare Thoroughly for Behavioral and Technical Interviews

Interview preparation is critical for success. Private credit firms assess not only your technical skills but also your personality and cultural fit.

- Practice common interview questions: Prepare answers to common behavioral interview questions, such as "Tell me about a time you failed," "Why private credit?" and "Describe your experience with credit risk assessment."

- Research the firm and interviewer: Thoroughly research the firm's investment strategy, recent deals, and the interviewer's background.

- Prepare relevant examples: Prepare specific examples from your past experiences that showcase your skills and accomplishments. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Prepare insightful questions: Develop thoughtful questions to ask the interviewer to demonstrate your genuine interest and engagement.

- Practice your delivery: Practice your answers out loud to improve your delivery and project confidence.

Do 5: Follow Up After Each Stage of the Application Process

Following up demonstrates your professionalism, enthusiasm, and continued interest in the position.

- Send thank-you notes: Send a personalized thank-you note after each interview, reiterating your interest and highlighting key points from the conversation.

- Follow up on application status: After a reasonable timeframe, follow up on the status of your application to show your persistence and interest.

- Maintain professional communication: Maintain professional communication throughout the entire application process.

- Express continued interest: Reiterate your enthusiasm for the role and the firm.

- Showcase your proactive nature: Demonstrate your initiative and proactiveness throughout the process.

5 Don'ts for a Successful Private Credit Job Application

Don't 1: Submit a Generic Resume and Cover Letter

Avoid using a template without tailoring it to the specific requirements of each private credit job. A generic application shows a lack of effort and interest.

Don't 2: Neglect Networking Opportunities

Don't underestimate the power of networking. Networking can lead to unadvertised opportunities and valuable connections.

Don't 3: Overstate Your Skills or Experience

Be truthful and accurate in your representation of your qualifications. Exaggerating your skills can damage your credibility.

Don't 4: Underprepare for Interviews

Thorough preparation is crucial for a successful interview. Insufficient preparation can significantly reduce your chances of success.

Don't 5: Fail to Follow Up

A timely and professional follow-up demonstrates your interest and professionalism. Ignoring follow-up can signal disinterest.

Conclusion

Securing a coveted position in the field of private credit jobs requires diligent preparation and a strategic approach. By following these five dos and don'ts, you significantly increase your chances of success. Remember to tailor your application materials, network effectively, showcase your analytical skills, prepare thoroughly for interviews, and follow up diligently. Start your job search today and leverage these tips to land your dream private credit job! Don't delay – begin your search for rewarding private credit jobs now!

Featured Posts

-

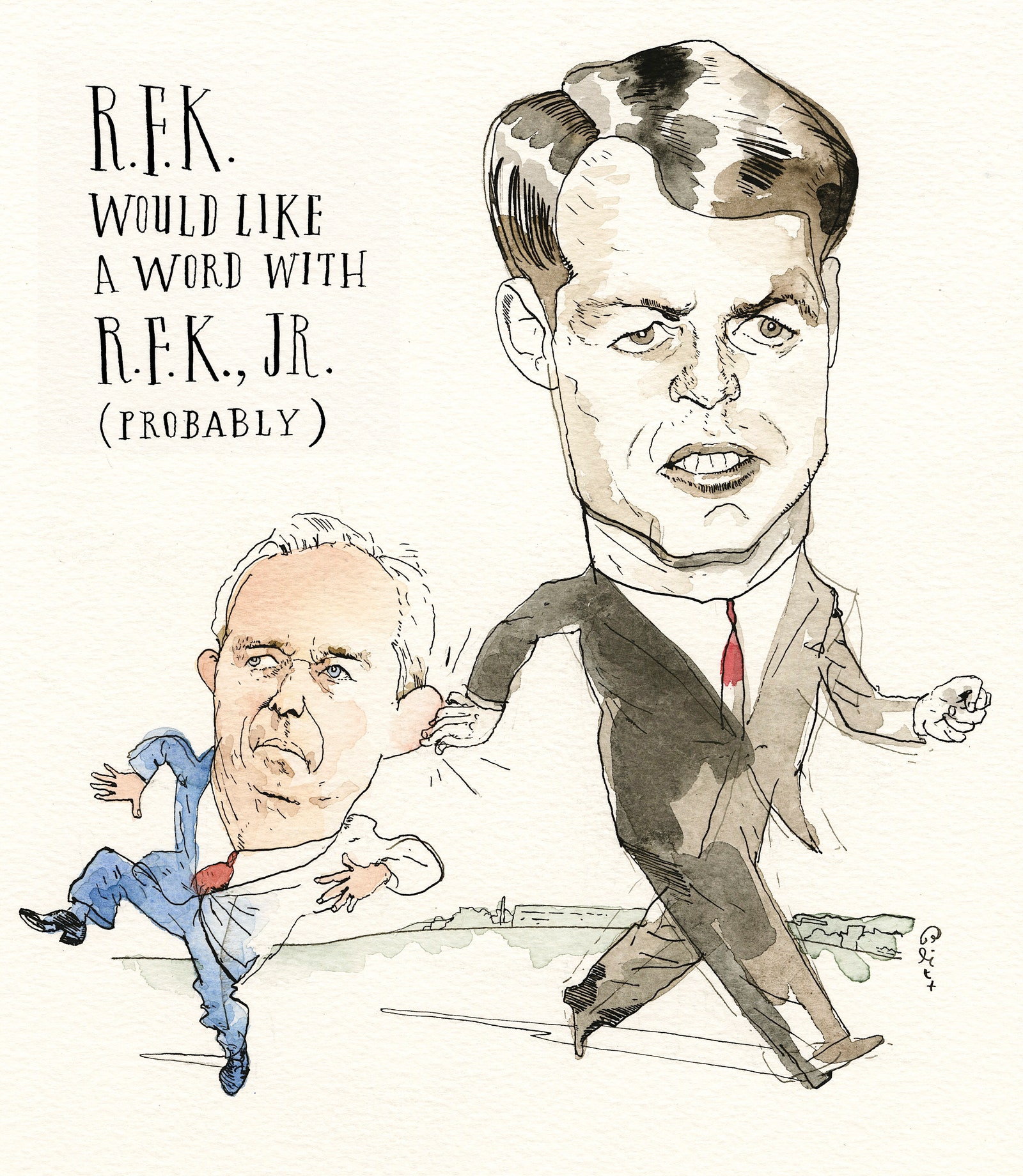

High Bacteria Levels In Rock Creek Rfk Jr And Family Take A Dip Despite Warnings

May 16, 2025

High Bacteria Levels In Rock Creek Rfk Jr And Family Take A Dip Despite Warnings

May 16, 2025 -

Australias Election A Deep Dive Into The Albanese And Dutton Platforms

May 16, 2025

Australias Election A Deep Dive Into The Albanese And Dutton Platforms

May 16, 2025 -

Exclusive Trump Administration Officials Reject Rfk Jr S Pesticide Attacks

May 16, 2025

Exclusive Trump Administration Officials Reject Rfk Jr S Pesticide Attacks

May 16, 2025 -

The Peculiar Action Tom Cruise Took After Suri Cruise Was Born

May 16, 2025

The Peculiar Action Tom Cruise Took After Suri Cruise Was Born

May 16, 2025 -

Bolee 200 Raket I Dronov Masshtabnaya Ataka Rossii Na Ukrainu

May 16, 2025

Bolee 200 Raket I Dronov Masshtabnaya Ataka Rossii Na Ukrainu

May 16, 2025