ProShares' XRP ETFs Launch: No Spot Market, But Price Jumps

Table of Contents

Understanding ProShares' XRP ETFs

What are ETFs and how do they work?

Exchange-traded funds (ETFs) are investment funds traded on stock exchanges, just like stocks. They offer diversified exposure to a specific asset class, in this case, XRP. Investors can buy and sell ETF shares throughout the trading day, making them a convenient way to access the cryptocurrency market. Unlike directly buying and holding XRP, ETFs offer several advantages, including:

- Regulatory Compliance: ETFs are subject to stricter regulatory oversight than direct cryptocurrency holdings, potentially offering greater investor protection.

- Ease of Trading: Buying and selling ETF shares is generally simpler and more familiar to investors compared to navigating cryptocurrency exchanges.

- Diversification: While focusing on XRP, ETFs might offer indirect diversification through the underlying assets used to create the fund.

The Significance of a Futures-Based XRP ETF

ProShares opted for a futures-based XRP ETF, rather than a spot-based one. This is a crucial distinction. A spot market involves the direct exchange of an asset for immediate delivery, while a futures market involves agreeing on a price for future delivery.

- Regulatory Hurdles: Launching a spot Bitcoin ETF has faced significant regulatory hurdles, primarily due to concerns about market manipulation and investor protection. The futures-based approach sidesteps some of these immediate challenges for XRP ETFs.

- Price Discovery: Futures contracts help to establish price discovery mechanisms, potentially reducing the volatility often associated with spot cryptocurrency trading.

- Risk Management: Futures contracts allow investors to manage their risk exposure more effectively.

ProShares' Track Record and Market Influence

ProShares is a well-established player in the ETF market, known for its diverse range of products and strong reputation. The launch of the XRP ETF significantly expands their portfolio into the cryptocurrency space. This move by a major financial institution signals a growing acceptance of cryptocurrencies within the traditional financial world. The potential impact is substantial:

- Increased Institutional Interest: ProShares' entry could attract more institutional investors to the XRP market, leading to increased liquidity and price stability.

- Market Validation: The launch legitimizes XRP in the eyes of many investors, increasing confidence and potentially driving further price appreciation.

- Competitive Landscape: Other firms are likely to follow suit, further shaping the future of crypto ETFs and boosting competition.

Market Reaction: XRP Price Surge and Volatility

Immediate Price Impact of the ETF Launch

Following the announcement of the ProShares XRP ETF, XRP's price experienced a noticeable surge. The exact percentage increase varied depending on the timeframe and exchange, but it was a clear indicator of market excitement. Factors contributing to this price jump include:

- Anticipation: Investors had been eagerly anticipating the launch, leading to a buildup of buying pressure before and after the official announcement.

- Investor Sentiment: Positive news surrounding the ETF launch improved overall sentiment towards XRP.

- Short Squeezes: Short sellers (those betting against XRP's price) may have been forced to cover their positions, further driving up the price.

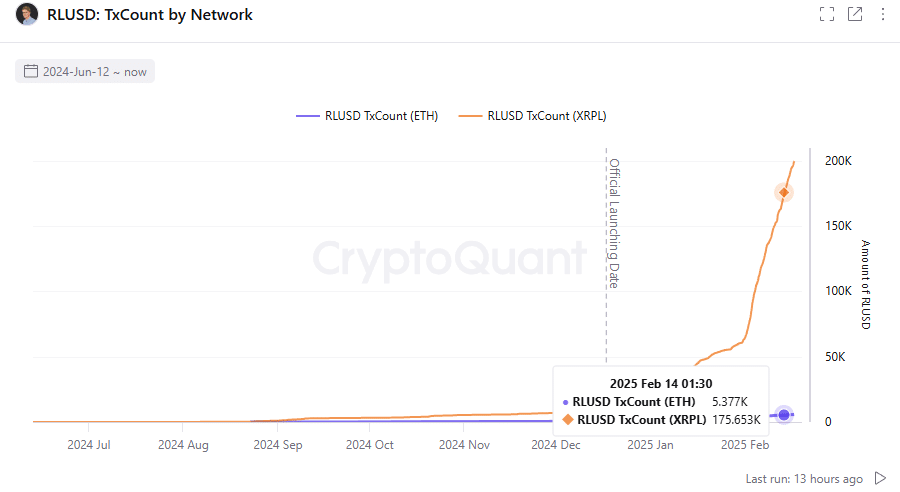

[Insert chart/graph illustrating XRP price movement around the ETF launch here]

Short-Term and Long-Term Price Predictions

Predicting cryptocurrency prices is notoriously difficult. However, experts offer varied opinions on XRP's short-term and long-term trajectory. Short-term price fluctuations are largely influenced by market sentiment and trading activity. Long-term forecasts depend on factors like:

- Outcome of the SEC Lawsuit: A positive resolution could significantly boost XRP's price.

- Adoption Rate: Increased adoption by businesses and institutions would support price growth.

- Technological Advancements: Developments within the XRP Ledger could positively influence investor sentiment.

It's crucial to remember that investing in cryptocurrencies carries inherent risk and volatility.

Trading Volume and Investor Interest

The launch of the XRP ETF resulted in a substantial increase in XRP trading volume. This higher volume is generally seen as positive, indicating increased liquidity and potentially contributing to price stability in the long run. Moreover:

- Institutional Participation: The increased trading volume is partially attributed to increased participation from institutional investors, who often trade larger quantities of assets.

- Retail Investor Interest: Retail investors are also increasingly showing interest in accessing XRP through a more regulated and accessible avenue like ETFs.

- Market Depth: Higher trading volume contributes to greater market depth, making it easier for investors to buy and sell XRP without significantly affecting the price.

The Ongoing Ripple vs. SEC Lawsuit and Its Influence

The Impact of the Lawsuit on XRP's Price and Adoption

The ongoing legal battle between Ripple and the SEC casts a long shadow over XRP. The lawsuit alleges that XRP is an unregistered security, which could have significant repercussions for the cryptocurrency's future.

- Investor Sentiment: Uncertainty surrounding the lawsuit has caused periods of both price decline and unexpected rallies.

- Regulatory Uncertainty: The outcome of the lawsuit will significantly influence the regulatory landscape for XRP and potentially other cryptocurrencies.

- Adoption Challenges: The lawsuit makes it more challenging for businesses to adopt XRP due to the ongoing uncertainty.

Regulatory Uncertainty and Future Outlook

Regulatory clarity is crucial for the growth and stability of the cryptocurrency market. The current landscape is characterized by significant uncertainty, particularly regarding ETFs.

- Global Regulatory Differences: Different countries have varying regulatory approaches to cryptocurrencies, adding complexity to the market.

- Evolution of Regulations: Regulatory frameworks are constantly evolving, and businesses must adapt to these changes.

- Future of XRP ETFs: The long-term success of XRP ETFs will depend heavily on increased regulatory clarity and a positive resolution to the Ripple vs. SEC lawsuit.

Conclusion

The launch of ProShares' XRP ETFs is a significant step forward for the cryptocurrency market, even without a spot market counterpart. The initial price surge in XRP demonstrates the growing interest and investment potential in this asset class. While the future of XRP remains contingent on factors such as the Ripple vs. SEC lawsuit outcome, the availability of XRP ETFs through reputable financial institutions like ProShares offers investors a more accessible and potentially less risky pathway to gain exposure to XRP. Stay informed on the latest developments in the XRP market and carefully consider the potential risks and rewards before investing in XRP ETFs or other cryptocurrencies. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Angels Farm System Where Do The Scouts See It Now A Ranking Analysis

May 08, 2025

Angels Farm System Where Do The Scouts See It Now A Ranking Analysis

May 08, 2025 -

U S China Trade Talks Officials To Meet Amid Ongoing Tensions

May 08, 2025

U S China Trade Talks Officials To Meet Amid Ongoing Tensions

May 08, 2025 -

Xrp Price Outlook Whales 20 Million Token Acquisition Sparks Speculation

May 08, 2025

Xrp Price Outlook Whales 20 Million Token Acquisition Sparks Speculation

May 08, 2025 -

The Great Decoupling In Action Case Studies And Real World Examples

May 08, 2025

The Great Decoupling In Action Case Studies And Real World Examples

May 08, 2025 -

Counting Crows The Snl Effect And Its Lasting Influence

May 08, 2025

Counting Crows The Snl Effect And Its Lasting Influence

May 08, 2025