Profit-Taking In Gold Market After Positive US-China Trade News

Table of Contents

Understanding the Inverse Relationship Between Trade Optimism and Gold Prices

Gold, often considered a safe-haven asset, sees its appeal diminish when economic prospects brighten. Positive trade news generally signals improved global economic health, reducing the perceived need for a safe haven. This is due to several factors:

- Increased risk appetite due to improved trade relations: When trade tensions ease, investors are more willing to take on risk, shifting their investments towards assets with higher growth potential, such as stocks and equities.

- Shift in investor sentiment away from safe-haven assets like gold: The decreased uncertainty leads to a change in investor sentiment, causing a reduction in demand for gold's perceived safety net.

- Strengthening US dollar impacting gold prices (inverse correlation): Positive trade news often strengthens the US dollar, which typically has an inverse relationship with gold prices. A stronger dollar makes gold more expensive for holders of other currencies, thus reducing demand.

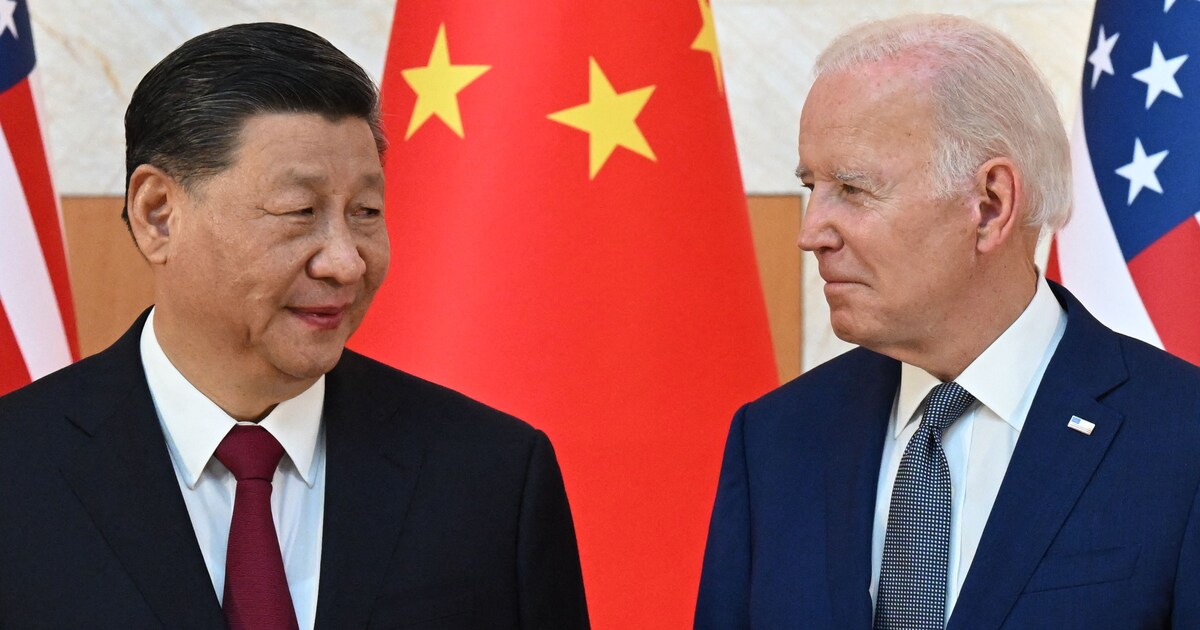

The Recent US-China Trade Deal and its Impact

The recent (insert specific date and details of the trade agreement here, e.g., "Phase One trade deal signed in January 2020") brought a significant degree of optimism to the market. This deal included (insert specific examples of agreements, e.g., "increased purchases of American agricultural goods by China").

- Specific agreements reached: Detail the key points of the agreement and its implications for the global economy.

- Market reaction immediately following the announcement: Describe the immediate price drop in gold following the news, referencing specific price points and percentage changes.

- Analysis of volume and price changes in gold futures and spot markets: Analyze the trading volume and price fluctuations in gold futures and spot markets after the announcement, providing evidence of profit-taking.

Identifying Profit-Taking Strategies in the Gold Market

Investors employ various strategies to capitalize on the anticipated price drops during periods of trade optimism. These include:

- Short-selling gold: Investors borrow gold and sell it, hoping to buy it back later at a lower price and profit from the difference.

- Selling existing gold holdings: Investors liquidate their gold holdings to free up capital and reinvest in assets they deem more profitable in the current market climate.

- Adjusting portfolio allocation away from gold: Investors reduce their gold exposure by decreasing the proportion of gold in their portfolios to reallocate funds elsewhere.

- Hedging strategies to mitigate risk: Some investors might use hedging strategies to protect themselves against potential losses if gold prices unexpectedly rise.

Analyzing Investor Behavior During Periods of Trade Optimism

Positive trade news triggers a shift from risk aversion to risk appetite. Investors react by:

- Risk aversion vs. risk appetite in investment decisions: The reduction in perceived risk changes investment strategies, leading to a movement away from safer assets.

- Impact of reduced uncertainty on investor sentiment: Lower uncertainty boosts investor confidence, encouraging them to invest in riskier but potentially higher-return assets.

- Role of technical analysis in identifying profit-taking opportunities: Many investors use technical analysis to time their profit-taking, identifying potential support and resistance levels.

Technical Indicators and Chart Patterns

Technical analysis tools aid in recognizing profit-taking signals:

- Support and resistance levels: Identifying key price levels where previous price movements have stalled can signal potential profit-taking points.

- Moving averages: Analyzing moving average trends can indicate price momentum and potential reversals.

- Relative Strength Index (RSI): RSI helps to determine whether gold is overbought or oversold, which can suggest potential profit-taking opportunities.

- Other relevant technical indicators: Other indicators, such as MACD and Bollinger Bands, can provide additional signals for profit-taking in gold.

Long-Term Outlook for Gold and Potential Reversal Factors

While trade optimism often leads to profit-taking, the trend isn't necessarily irreversible. Several factors could cause a reversal:

- Geopolitical risks and uncertainties: Unforeseen geopolitical events, such as escalating tensions between nations, can trigger a return to risk aversion and increase gold demand.

- Inflationary pressures: If inflation rises, gold, as a hedge against inflation, may become more attractive.

- Unexpected economic downturns: A sudden economic downturn can increase investor demand for safe-haven assets like gold.

- Changes in monetary policy: Changes in interest rates or other monetary policies by central banks can influence the value of gold.

Conclusion

Positive US-China trade news often leads to profit-taking in the gold market due to increased risk appetite and a strengthening US dollar. Understanding investor behavior and utilizing technical analysis are crucial for navigating this dynamic market. While profit-taking is a common response to improved trade relations, it’s vital to remember that geopolitical factors and economic shifts can reverse this trend.

Call to Action: Stay informed about the latest developments in US-China trade relations and their impact on the gold market. Learn to effectively manage your investments with a deep understanding of profit-taking strategies within the gold market to optimize your returns. Continuously monitor for signals of profit-taking and adapt your approach for successful gold market investment. Mastering the nuances of profit-taking in the gold market will allow you to navigate its volatility and maximize your investment success.

Featured Posts

-

Snl Audiences Profanity Filled Reaction To Ego Nwodim Sketch

May 18, 2025

Snl Audiences Profanity Filled Reaction To Ego Nwodim Sketch

May 18, 2025 -

Steun Voor Uitbreiding Nederlandse Defensie Industrie Neemt Toe Te Midden Van Groeiende Wereldwijde Spanningen

May 18, 2025

Steun Voor Uitbreiding Nederlandse Defensie Industrie Neemt Toe Te Midden Van Groeiende Wereldwijde Spanningen

May 18, 2025 -

Reddit Down A Worldwide Service Interruption Affecting Thousands

May 18, 2025

Reddit Down A Worldwide Service Interruption Affecting Thousands

May 18, 2025 -

King Day 2024 Celebration Plans Vs Abolition Debate

May 18, 2025

King Day 2024 Celebration Plans Vs Abolition Debate

May 18, 2025 -

The Dark Side Of Gambling Betting On The Devastation Of The Los Angeles Wildfires

May 18, 2025

The Dark Side Of Gambling Betting On The Devastation Of The Los Angeles Wildfires

May 18, 2025

Latest Posts

-

Exploring Queer Identity And Family Conflict In The Wedding Banquet

May 18, 2025

Exploring Queer Identity And Family Conflict In The Wedding Banquet

May 18, 2025 -

Snls White Lotus Parody Bowen Yang And Aimee Lou Woods Reactions

May 18, 2025

Snls White Lotus Parody Bowen Yang And Aimee Lou Woods Reactions

May 18, 2025 -

Bowen Yang On Snls White Lotus Parody Featuring Aimee Lou Wood

May 18, 2025

Bowen Yang On Snls White Lotus Parody Featuring Aimee Lou Wood

May 18, 2025 -

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025 -

Snl Bowen Yangs Plea To Lorne Michaels For Jd Vance Role Change

May 18, 2025

Snl Bowen Yangs Plea To Lorne Michaels For Jd Vance Role Change

May 18, 2025