PwC Exits Multiple Countries: A Bangkok Post Report On Accounting Scandals

Table of Contents

The Bangkok Post Report and its Revelations

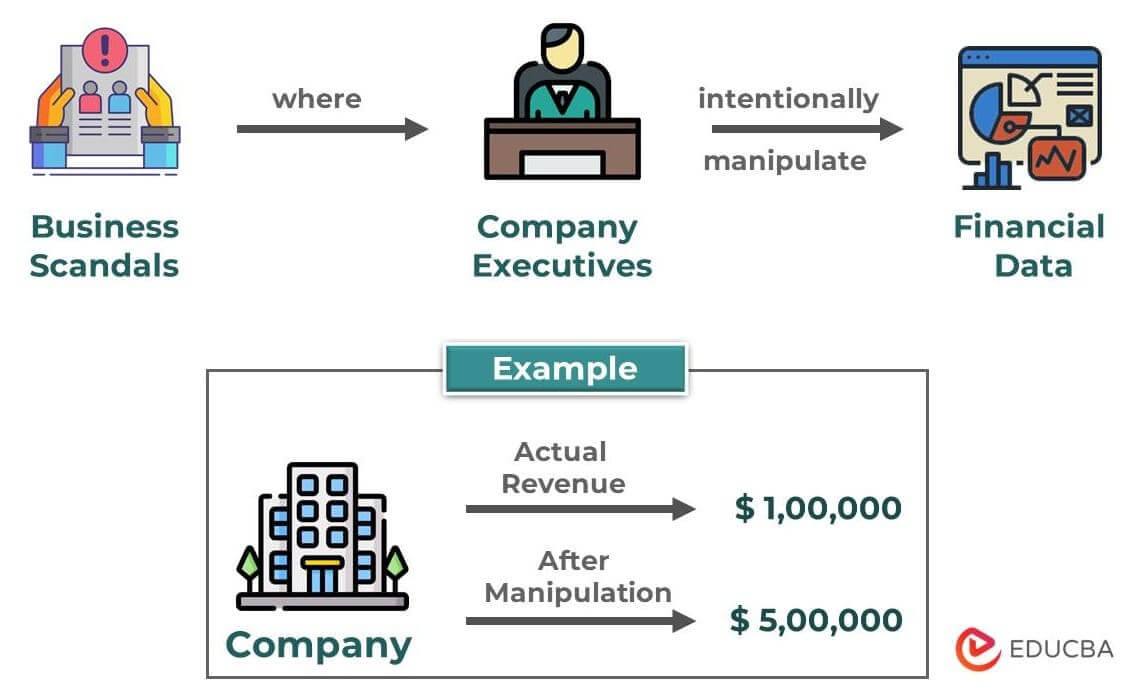

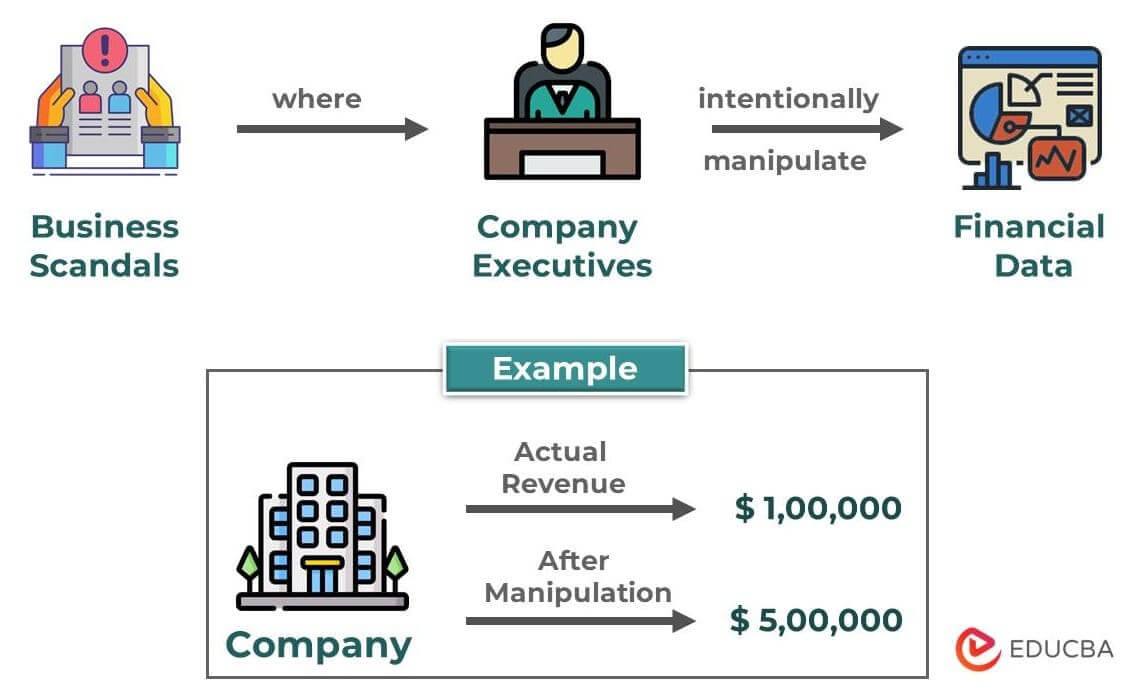

The Bangkok Post report revealed a series of significant accounting scandals that led to PwC's decision to either completely withdraw from or significantly scale back operations in multiple countries. The report highlighted a pattern of irregularities, raising serious questions about the firm's auditing practices and its commitment to upholding professional standards.

-

Specific countries affected: While the exact number of countries affected varies depending on the interpretation of "withdrawal," the report named several key locations where PwC's presence has been significantly reduced or eliminated, impacting its global footprint. Specific countries mentioned (though this would need verification from the original Bangkok Post article and requires referencing the original source) should be listed here.

-

Key accounting scandals cited: The report detailed several instances of alleged accounting fraud and irregularities, ranging from misrepresentation of financial statements to deliberate concealment of crucial information. These cases involved companies across various sectors, underscoring the widespread nature of the problem. Details about the nature and scale of these scandals, including the companies involved (again, requiring verification and referencing), should be included here.

-

Scale of financial irregularities: The financial implications of these scandals are substantial, involving potentially billions of dollars in misstated assets and liabilities. The sheer scale of the irregularities highlights the systemic nature of the problem and the potential for widespread damage to investor confidence.

-

Initial reactions: Regulatory bodies and the public reacted swiftly to the report, expressing serious concerns about the integrity of financial reporting and the role of auditing firms in preventing such scandals. Initial responses from regulatory bodies and the public (requiring verification and referencing) should be summarized.

Impact on PwC's Global Reputation and Brand Trust

The revelations in the Bangkok Post report have severely damaged PwC's global reputation and eroded public trust in the firm's auditing capabilities. The consequences extend far beyond the immediate financial losses.

-

Loss of clients and future business: Major corporations are likely to reconsider their relationships with PwC, leading to significant loss of clients and impacting future business prospects. The reputational damage could translate into a prolonged period of reduced revenue and market share.

-

Decreased investor confidence: The scandals have shaken investor confidence in the reliability of audited financial statements, potentially affecting investment decisions and overall market stability. Concerns about the adequacy of auditing practices will cast a shadow over the financial markets for some time.

-

Potential legal ramifications and investigations: PwC faces the prospect of extensive legal investigations and potential lawsuits from investors and affected companies. The scale of these potential liabilities could be substantial, further impacting the firm's financial stability.

-

Impact on employee morale and recruitment: The negative publicity surrounding the scandals is likely to impact employee morale and recruitment efforts. Top talent may be hesitant to join a firm facing such scrutiny, exacerbating the challenges faced by PwC.

Wider Implications for the Accounting Industry

The PwC exits multiple countries situation has far-reaching implications for the accounting industry globally, prompting a critical reassessment of auditing practices and regulatory frameworks.

-

Increased scrutiny of auditing practices and regulations: The scandals have highlighted critical weaknesses in existing auditing practices and regulatory oversight. Expect stricter scrutiny and more robust regulatory frameworks to be implemented in the coming years.

-

Calls for stricter oversight and accountability: There will be increased pressure on regulatory bodies to implement more stringent oversight mechanisms and enhance the accountability of auditing firms. This may involve increased penalties for negligence and stricter enforcement of existing regulations.

-

Potential for reform and changes in industry standards: The accounting industry may undergo significant reform to enhance transparency, improve auditing standards, and restore public trust. Changes to auditing standards and practices are likely to follow in response to these events.

-

Impact on smaller accounting firms and competition: Smaller accounting firms may benefit from the increased scrutiny of larger firms like PwC, potentially gaining market share and attracting new clients seeking more trustworthy audit services. The competitive landscape of the industry is expected to shift.

Responses from PwC and Regulatory Bodies

Both PwC and relevant regulatory bodies have issued statements regarding the allegations and the ongoing investigations.

-

PwC's response: PwC has issued official statements acknowledging the seriousness of the allegations and expressing its commitment to cooperate fully with regulatory investigations. The firm's response should be summarized here, citing official sources.

-

Statements from regulatory bodies: Regulatory bodies involved in the investigations have issued statements outlining their commitment to a thorough and impartial inquiry. The actions and statements of these bodies should be detailed here, again citing official sources.

-

Actions taken to address irregularities: Details of any actions taken by PwC or regulatory bodies to address the accounting irregularities should be included. This might include remediation efforts, disciplinary actions, or other steps taken to address the situation.

-

Ongoing investigations and potential penalties: Information about ongoing investigations, potential penalties faced by PwC, and the expected timeline for resolution should be included if available.

Conclusion

The Bangkok Post report's findings regarding PwC's exits from multiple countries due to accounting scandals highlight a serious crisis of confidence in the auditing profession. The impact on PwC's reputation, the erosion of public trust, and the wider implications for the accounting industry are significant. The scale of the financial irregularities and the potential for systemic failures underscore the urgent need for increased transparency and accountability within the profession. The need for stricter oversight and enhanced regulatory frameworks is clear.

Call to Action: Stay informed about the evolving situation surrounding PwC's exits and the ongoing investigations into accounting scandals. Follow reputable news sources for updates on PwC's global impact, the accounting scandal implications, and the future of auditing practices. Understanding the full implications of these PwC exits multiple countries will be critical for investors, businesses, and the public alike.

Featured Posts

-

Annie Nelson Rebuts Media Misinformation About Willie Nelson

Apr 29, 2025

Annie Nelson Rebuts Media Misinformation About Willie Nelson

Apr 29, 2025 -

The Russian Military Moves That Have Europe On Edge

Apr 29, 2025

The Russian Military Moves That Have Europe On Edge

Apr 29, 2025 -

Rising Costs Prompt Lynas Rare Earths To Seek Us Government Assistance For Texas Project

Apr 29, 2025

Rising Costs Prompt Lynas Rare Earths To Seek Us Government Assistance For Texas Project

Apr 29, 2025 -

How To Get Capital Summertime Ball 2025 Tickets Official Methods And Tips

Apr 29, 2025

How To Get Capital Summertime Ball 2025 Tickets Official Methods And Tips

Apr 29, 2025 -

From American Dream To Spanish Reality Two Expats Journeys

Apr 29, 2025

From American Dream To Spanish Reality Two Expats Journeys

Apr 29, 2025

Latest Posts

-

Tik Tok Adhd And The Dangers Of Self Diagnosis

Apr 29, 2025

Tik Tok Adhd And The Dangers Of Self Diagnosis

Apr 29, 2025 -

Adhd Og Skole Fhi Rapport Om Effektiviteten Av Medisinering

Apr 29, 2025

Adhd Og Skole Fhi Rapport Om Effektiviteten Av Medisinering

Apr 29, 2025 -

Understanding Adhd In The Age Of Tik Tok

Apr 29, 2025

Understanding Adhd In The Age Of Tik Tok

Apr 29, 2025 -

Skoleprestasjoner Og Adhd Fhi Rapporterer Om Begrenset Effekt Av Medisinering

Apr 29, 2025

Skoleprestasjoner Og Adhd Fhi Rapporterer Om Begrenset Effekt Av Medisinering

Apr 29, 2025 -

Does Tik Tok Fuel Adhd Misconceptions

Apr 29, 2025

Does Tik Tok Fuel Adhd Misconceptions

Apr 29, 2025