PwC's Departure: Assessing The Implications For Senegal, Gabon, Madagascar, And Others

Table of Contents

Economic Impact of PwC's Withdrawal

PwC's presence in Africa provided substantial economic benefits. Its departure creates a ripple effect with significant consequences.

Loss of Expertise and Capacity

PwC provided crucial expertise across various sectors, including finance, energy, and infrastructure. Its withdrawal creates a significant skills gap.

- Loss of highly skilled auditors and tax advisors: The departure means a loss of professionals with deep understanding of local regulations and international best practices. This impacts the quality of audits and financial advisory services.

- Reduced capacity for complex financial transactions and audits: The expertise needed for complex transactions, particularly in the energy and infrastructure sectors, is diminished. This may delay or hinder major projects.

- Potential for increased cost of securing comparable expertise internationally: Finding replacement expertise may be costly, potentially impacting both the public and private sectors. Smaller firms may struggle to compete for talent.

Impact on Foreign Investment

The absence of a globally recognized firm like PwC may significantly deter foreign direct investment (FDI).

- Negative perception of the investment climate: The departure might signal a lack of confidence in the regulatory environment or the stability of the countries involved. This could lead to a decrease in investor interest.

- Increased due diligence costs for potential investors: Investors may incur increased costs due to the need to rely on less established audit firms and conduct more extensive due diligence processes.

- Potential for a decline in FDI inflows: The cumulative effect could be a decrease in foreign investment, impacting economic growth and job creation.

Effect on Government Revenue

PwC played a critical role in supporting government revenue collection through tax advisory services. Its departure poses challenges to fiscal management.

- Potential for reduced tax revenue collection: The loss of expertise in tax compliance and auditing may lead to reduced tax collection, impacting government budgets.

- Increased difficulty in combating tax evasion: PwC's departure weakens the capacity to effectively combat sophisticated tax evasion schemes.

- Need for enhanced capacity building within government tax agencies: Governments will need to invest significantly in training and capacity building to fill the gap left by PwC.

Implications for Governance and Transparency

PwC's departure also carries significant implications for governance and transparency within the affected countries.

Reduced Accountability

PwC played a crucial role in ensuring financial transparency and accountability. Its absence increases the risk of opacity and potential misuse of funds.

- Potential for increased corruption and mismanagement of public funds: The reduced oversight may create an environment where corruption and mismanagement are more likely to occur.

- Weakening of corporate governance standards: The departure could lead to a decline in corporate governance standards, particularly in publicly listed companies.

- Decreased investor confidence due to reduced transparency: Reduced transparency will likely erode investor confidence, further impacting economic growth and FDI.

Impact on Public Sector Audits

The withdrawal directly impacts the quality and independence of public sector audits, a cornerstone of good governance.

- Difficulty in securing equally reputable audit firms to replace PwC: Finding firms with equivalent global standing and expertise will be challenging.

- Increased risk of undetected financial irregularities: Reduced auditing capacity increases the risk of undetected financial irregularities and mismanagement of public funds.

- Potential for negative consequences on government credibility: The lack of robust auditing may damage the credibility and reputation of the affected governments.

Opportunities for Local Firms and Competitors

While the departure presents challenges, it also creates opportunities for local firms and other global players.

Growth Potential for Local Accounting Firms

PwC's withdrawal presents a significant opportunity for indigenous accounting firms to expand their services and market share.

- Need for increased capacity building and training for local firms: Local firms will need significant investment in training and development to meet the increased demand.

- Opportunity to attract international partnerships and collaborations: This provides opportunities to collaborate with international firms, gaining valuable expertise and expanding their network.

- Potential for increased competition and improved services: Increased competition can stimulate innovation and improvement in services offered by local firms.

Increased Market Share for Other Global Firms

Other multinational accounting firms, such as Deloitte, EY, and KPMG, are likely to benefit from increased market share in the region.

- Increased competition among multinational firms for new clients: The departure will likely lead to increased competition amongst the remaining global players.

- Potential for consolidation within the accounting sector in Africa: The market shift could lead to mergers and acquisitions within the accounting sector in Africa.

Conclusion

PwC's departure from Senegal, Gabon, Madagascar, and other African nations presents a complex landscape of challenges and opportunities. While the loss of expertise and potential negative impacts on foreign investment are substantial concerns, the situation also creates space for local firm growth and expansion for other global players. Addressing the implications of PwC's departure in Africa necessitates proactive measures. Governments in affected countries must prioritize addressing the skills gap, enhancing local capacity, and fostering a robust and transparent business environment to mitigate the negative consequences. Understanding the long-term effects of PwC's withdrawal from Africa is paramount for fostering sustainable economic growth and development. Continued research and open dialogue on this issue are crucial for informed policymaking and strategic planning to navigate this significant shift in the African business landscape.

Featured Posts

-

Will Trump Pardon Pete Rose The Push For Baseball Hall Of Fame Entry

Apr 29, 2025

Will Trump Pardon Pete Rose The Push For Baseball Hall Of Fame Entry

Apr 29, 2025 -

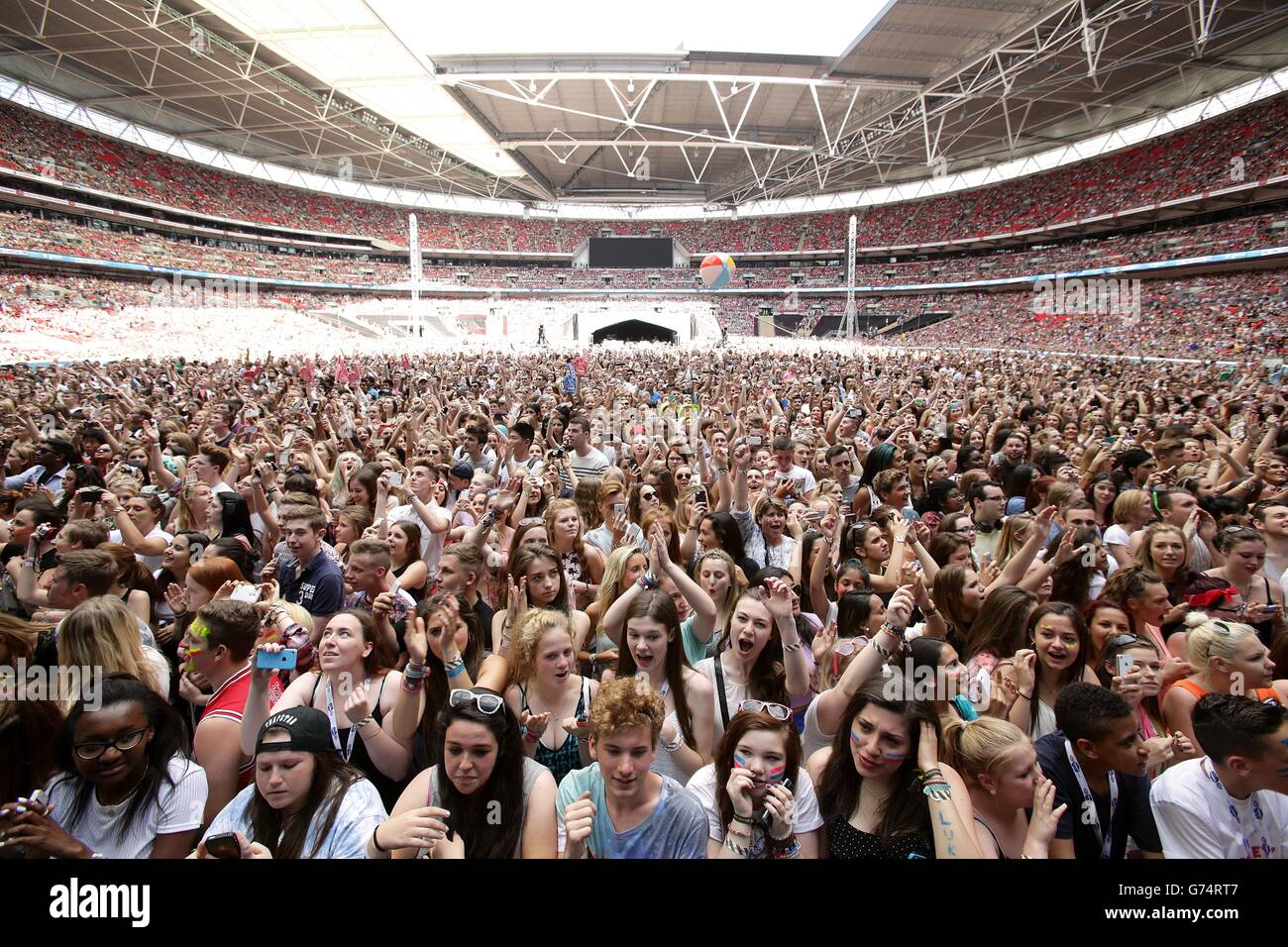

Capital Summertime Ball 2025 Tickets A Complete Guide For Braintree And Witham Residents

Apr 29, 2025

Capital Summertime Ball 2025 Tickets A Complete Guide For Braintree And Witham Residents

Apr 29, 2025 -

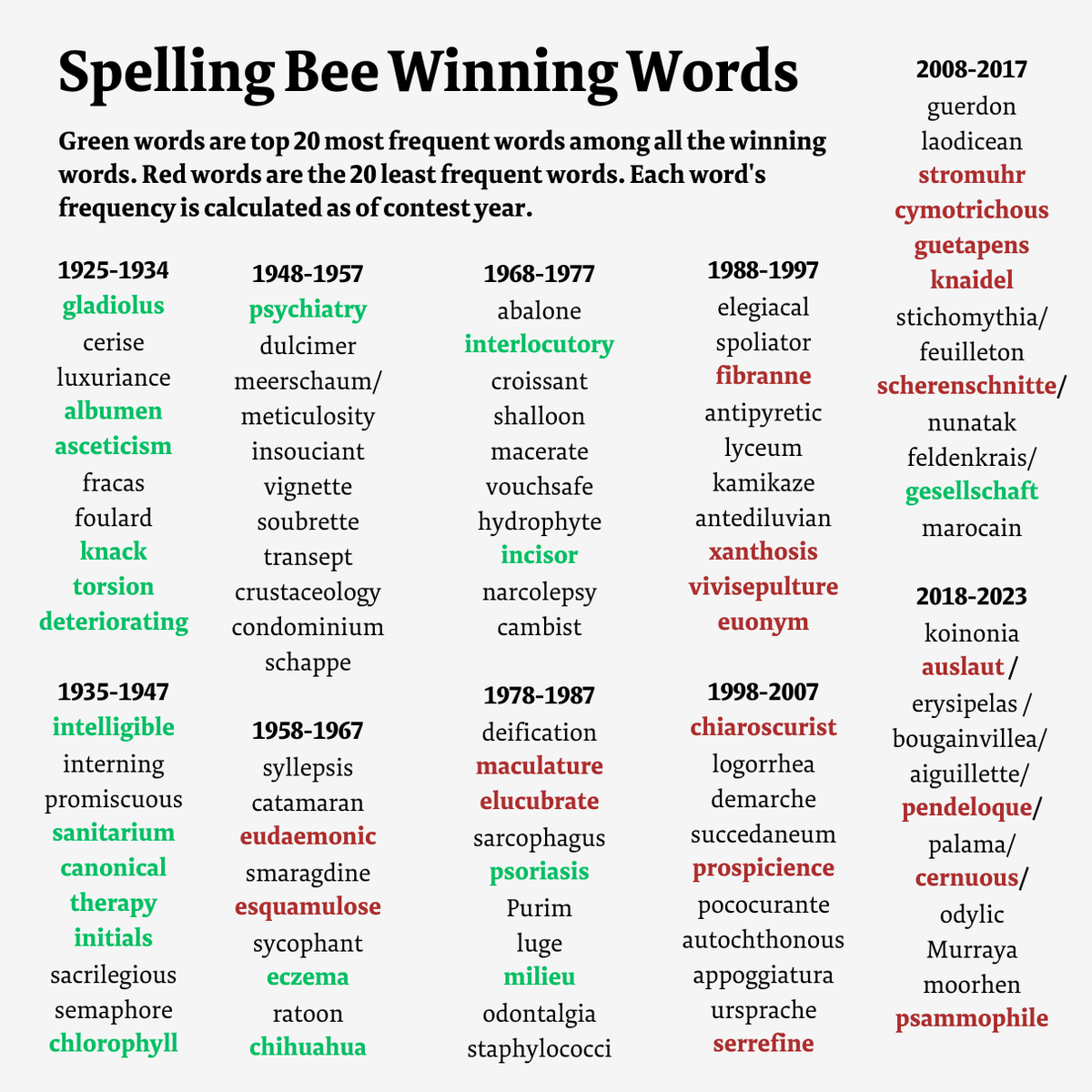

Nyt Spelling Bee February 25 2025 Clues Answers And Pangram

Apr 29, 2025

Nyt Spelling Bee February 25 2025 Clues Answers And Pangram

Apr 29, 2025 -

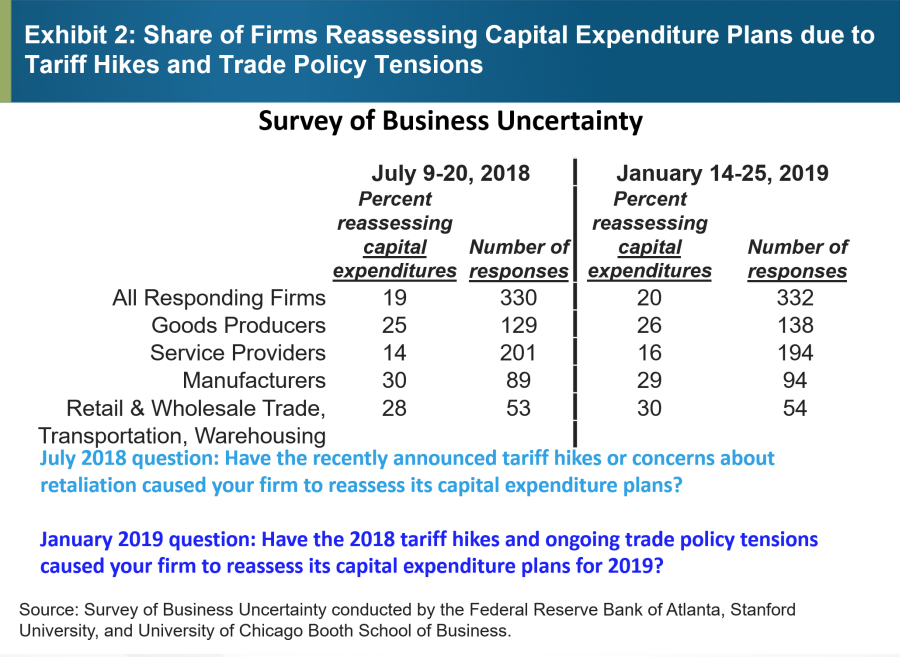

U S Businesses Implement Cost Cutting Strategies In Face Of Tariff Volatility

Apr 29, 2025

U S Businesses Implement Cost Cutting Strategies In Face Of Tariff Volatility

Apr 29, 2025 -

Seven Days Missing British Paralympian Vanishes In Las Vegas

Apr 29, 2025

Seven Days Missing British Paralympian Vanishes In Las Vegas

Apr 29, 2025

Latest Posts

-

Anomalnoe Teplo Privelo K Zakrytiyu Gorok V Chelyabinske

Apr 30, 2025

Anomalnoe Teplo Privelo K Zakrytiyu Gorok V Chelyabinske

Apr 30, 2025 -

Nebraska Senators Express Concerns Over Proposed Gretna Development

Apr 30, 2025

Nebraska Senators Express Concerns Over Proposed Gretna Development

Apr 30, 2025 -

Iz Za Tepla V Chelyabinske Zakryty Vse Gorki

Apr 30, 2025

Iz Za Tepla V Chelyabinske Zakryty Vse Gorki

Apr 30, 2025 -

Biker Hospitalized After Serious Accident Involving A Lorry

Apr 30, 2025

Biker Hospitalized After Serious Accident Involving A Lorry

Apr 30, 2025 -

Doubt Cast On Gretna Mega Development By Nebraska Lawmakers

Apr 30, 2025

Doubt Cast On Gretna Mega Development By Nebraska Lawmakers

Apr 30, 2025