Quantum Computing Stock Investment: D-Wave Quantum (QBTS) Evaluation

Table of Contents

Understanding D-Wave Quantum's Business Model and Technology

D-Wave Quantum, trading under the ticker symbol QBTS, distinguishes itself in the quantum computing arena with its unique approach: quantum annealing. Unlike gate-based quantum computers that operate on qubits using logic gates, D-Wave's systems solve specific types of optimization problems by finding the lowest energy state of a quantum system. This makes them particularly well-suited for tackling complex challenges in areas like logistics, materials science, and artificial intelligence.

D-Wave's target market primarily consists of organizations facing computationally intensive optimization problems. They've successfully forged partnerships with leading companies across various sectors, leveraging their quantum annealers to improve efficiency and decision-making.

-

Types of problems solved by D-Wave's quantum annealers:

- Financial modeling and portfolio optimization

- Drug discovery and materials design

- Supply chain optimization and logistics planning

- Machine learning model training

-

Examples of successful D-Wave implementations:

- Volkswagen uses D-Wave systems to optimize traffic flow.

- Los Alamos National Laboratory utilizes D-Wave for materials science research.

- Several financial institutions employ D-Wave for portfolio optimization strategies.

-

Comparison with other quantum computing approaches (gate-based): While gate-based quantum computers offer greater versatility, D-Wave's annealing approach provides a specialized and potentially faster solution for specific types of problems. This niche focus is a key element of their business strategy.

Analyzing D-Wave Quantum's Financial Performance and Growth Potential

Analyzing D-Wave's financial performance requires careful consideration of its stage of development. As a relatively young company in a nascent industry, profitability isn't yet a primary focus. However, examining key financial metrics such as revenue growth, research and development expenditures, and overall market capitalization offers insights into its growth trajectory.

-

Key financial metrics (revenue growth, EBITDA, etc.): Closely monitoring D-Wave's quarterly and annual reports is crucial to assessing their financial health and progress. Investors should look for consistent revenue growth and decreasing reliance on funding rounds.

-

Potential risks and challenges to D-Wave's growth: Competition from other quantum computing companies, technological hurdles, and the overall market acceptance of quantum annealing are significant risks.

-

Comparison with competitors' financial performance: Comparing D-Wave's financials with those of companies like IonQ and Rigetti provides a valuable benchmark, highlighting their relative strengths and weaknesses within the quantum computing stocks sector. Careful analysis of these quantum computing company financials is essential for a comprehensive investment analysis.

Evaluating the Risks and Rewards of Investing in QBTS

Investing in QBTS, like any quantum computing stock, carries substantial risk. The quantum computing industry is still in its early stages, and the technology is inherently volatile.

-

Risk factors (technology risk, market risk, financial risk): Technology risk involves the possibility of technological limitations or breakthroughs by competitors. Market risk stems from the uncertainty surrounding the overall adoption and growth of quantum computing technologies. Financial risk is inherent in the company's stage of development and potential for losses.

-

Potential rewards (high growth potential, early-mover advantage): Successful establishment as a leading player in the quantum annealing market could yield significant returns. Being an early mover offers the potential for substantial market share and competitive advantage.

-

Diversification strategies for mitigating risk: Diversifying your investment portfolio across different asset classes and quantum computing stocks can help mitigate the risk associated with QBTS.

Comparing QBTS with other Quantum Computing Stocks

To gain a comprehensive understanding of D-Wave's position in the market, it's crucial to compare it to other major players in the quantum computing stocks arena. Companies like IonQ and Rigetti are developing gate-based quantum computing systems, targeting a broader range of applications.

-

Comparison table of key quantum computing companies: A table outlining key metrics (market capitalization, revenue, technology, target market) for D-Wave, IonQ, Rigetti, and others provides a valuable comparative analysis.

-

Analysis of strengths and weaknesses of each company: Identifying the unique strengths and weaknesses of each quantum computing company helps in determining which aligns best with your investment strategy and risk tolerance.

-

Recommendation based on risk tolerance and investment goals: The choice between investing in D-Wave or other quantum computing stocks depends heavily on your individual risk tolerance and investment goals.

Making Informed Decisions about Quantum Computing Stock Investment: QBTS and Beyond

This analysis of D-Wave Quantum (QBTS) highlights the significant potential and considerable risks inherent in quantum computing stock investment. While D-Wave's unique approach to quantum annealing offers a specialized advantage, the early stage of the industry and the competitive landscape present substantial challenges. Remember that successful quantum computing investment requires careful due diligence and a deep understanding of the technology and its market potential.

Therefore, before making any investment decisions regarding quantum computing stocks, particularly D-Wave Quantum (QBTS), conduct thorough research, consult with a financial advisor, and develop a responsible quantum computing stock investment strategy that aligns with your risk tolerance and financial objectives. The quantum computing field is evolving rapidly, making continuous monitoring and reassessment crucial for successful navigation of this dynamic market.

Featured Posts

-

Van Rekening Naar Tikkie De Complete Gids Voor Nederlandse Betalingen

May 21, 2025

Van Rekening Naar Tikkie De Complete Gids Voor Nederlandse Betalingen

May 21, 2025 -

Understanding Mondays Increase In D Wave Quantum Qbts Stock Price

May 21, 2025

Understanding Mondays Increase In D Wave Quantum Qbts Stock Price

May 21, 2025 -

Washington County Breeders 49 Dogs Removed Investigation Underway

May 21, 2025

Washington County Breeders 49 Dogs Removed Investigation Underway

May 21, 2025 -

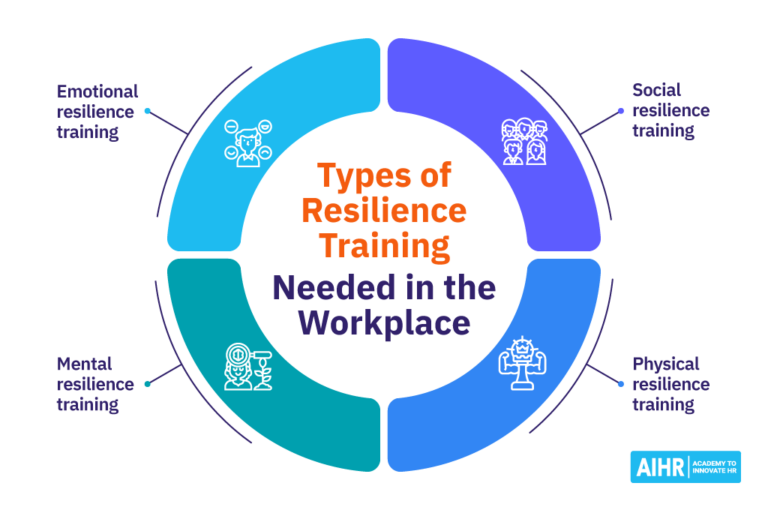

Finding Resilience Strategies For Mental Wellbeing

May 21, 2025

Finding Resilience Strategies For Mental Wellbeing

May 21, 2025 -

Foersta Matchen Foersta Segern Jacob Friis Startar Starkt

May 21, 2025

Foersta Matchen Foersta Segern Jacob Friis Startar Starkt

May 21, 2025

Latest Posts

-

8 6 Thriller Tigers Prove Doubters Wrong Against Rockies

May 22, 2025

8 6 Thriller Tigers Prove Doubters Wrong Against Rockies

May 22, 2025 -

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025 -

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025 -

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025 -

Lucy Connollys Appeal Against Racial Hatred Sentence Denied

May 22, 2025

Lucy Connollys Appeal Against Racial Hatred Sentence Denied

May 22, 2025