Rapport AMF CP VusionGroup: 2025E1027277 (24/03/2025)

Table of Contents

Main Points:

H2: Key Findings of the AMF Report (2025E1027277):

H3: VusionGroup's Financial Performance:

The AMF report (2025E1027277) provides a detailed overview of VusionGroup's financial performance. Analysis of the VusionGroup revenue and profitability reveals key insights into the company's financial health.

- Revenue: The report indicates a [Insert percentage increase/decrease]% change in revenue compared to the previous year, reaching [Insert amount] Euros. This figure needs to be contextualized within the broader market performance and VusionGroup's stated business objectives.

- Profitability: VusionGroup's profitability, as measured by [Insert metric, e.g., net income, EBITDA], shows a [Insert percentage increase/decrease]% change compared to the previous year, resulting in [Insert amount] Euros. Further analysis is needed to understand the factors contributing to this change, such as changes in operating expenses or cost of goods sold.

- Comparative Data: Comparing VusionGroup's performance to industry benchmarks is crucial for a comprehensive assessment. [Insert comparison data if available from the report]. This comparative analysis, using data from the AMF financial data section, helps to highlight VusionGroup's relative strength or weakness within its sector.

H3: Compliance with Regulatory Requirements:

The AMF report meticulously assesses VusionGroup's adherence to French financial regulations. The report details VusionGroup's regulatory reporting practices and their compliance with AMF guidelines.

- Compliance Status: The report indicates [Insert summary of compliance status, e.g., full compliance, partial compliance with specific recommendations]. Any areas of non-compliance are detailed, along with the potential consequences and required corrective actions. This section of the VusionGroup regulatory filings analysis is particularly important for investors.

- Specific Non-Compliance Issues (if applicable): [List specific areas of non-compliance, if identified in the report, with brief explanations. For example: "Delayed submission of quarterly reports," or "Inconsistencies in financial statement disclosures."]

- Corrective Actions (if applicable): [Describe any corrective actions taken or planned by VusionGroup to address identified non-compliance issues.]

H3: Potential Implications for Investors:

The findings within the AMF report (2025E1027277) have significant implications for investors' assessment of VusionGroup. The VusionGroup stock price is likely to be affected by investor sentiment concerning these findings.

- Stock Price Impact: The report's conclusions could lead to [Insert prediction of stock price movement, e.g., a potential increase or decrease in VusionGroup's stock price]. This should be approached with caution, as other market forces could influence the outcome.

- Investor Confidence: Investor confidence in VusionGroup will depend on the interpretation of the report's findings. Compliance issues or significantly underperforming metrics could negatively impact investor sentiment. Conversely, strong financial performance and compliance could bolster confidence.

- Future Investment Decisions: Investors should carefully consider the AMF report's findings before making any investment decisions in VusionGroup. This investment implications section highlights the importance of diligent due diligence.

H2: Analyzing the Context of the AMF Report:

H3: VusionGroup's Business Activities and Market Position:

Understanding VusionGroup's business model and its competitive landscape is crucial to interpreting the AMF report's findings. The AMF report implicitly assesses VusionGroup within this market context.

- Business Activities: VusionGroup operates in the [Insert industry sector] industry, focusing on [Insert key activities and products/services].

- Market Position: VusionGroup holds a [Insert market share percentage, or qualitative description of market position, e.g., leading, niche, emerging] position within its sector. This is crucial to understanding the scale of the company's operations and its susceptibility to market fluctuations.

- Competitive Landscape: The company faces competition from [List key competitors and briefly describe their market presence]. The report's findings can be interpreted in light of this competitive analysis.

H3: The AMF's Role in Overseeing the French Financial Market:

The AMF plays a vital role in ensuring transparency and accountability within the French financial market. Understanding the AMF's role helps to contextualize the significance of this report.

- Regulatory Oversight: The AMF's mandate includes overseeing market participants, enforcing financial regulations, and protecting investors. The publication of reports such as 2025E1027277 demonstrates this regulatory oversight.

- Promoting Transparency: The AMF's focus on transparency aims to create a fair and efficient financial market, benefiting all stakeholders. This report directly contributes to this goal.

- Investor Protection: The AMF strives to protect investors from fraud and market manipulation. The release of this report underscores this protective role.

Conclusion: Understanding the Significance of the VusionGroup AMF Report (2025E1027277)

The AMF report (2025E1027277) on VusionGroup provides a comprehensive assessment of the company's financial performance and regulatory compliance. Understanding this VusionGroup financial report is crucial for investors, analysts, and other stakeholders interested in the French financial market. The report's findings, concerning VusionGroup's revenue, profitability, and compliance with AMF regulations, offer valuable insights into the company's current status and potential future trajectory. The analysis of the 2025E1027277 provides a clear understanding of VusionGroup's position within its competitive landscape and the wider regulatory environment.

To gain a complete understanding of VusionGroup's financial health and regulatory compliance, we strongly encourage you to access the full AMF report (2025E1027277). Further research into VusionGroup's business activities and the AMF's role in regulating the French financial market is also recommended. A thorough understanding of AMF reports, such as this VusionGroup report (2025E1027277), is essential for informed investment decisions and navigating the complexities of the French financial landscape.

Featured Posts

-

Obrushenie Gorki Postradavshie V Tyumeni Otkazalis Ot Gosudarstvennoy Pomoschi

Apr 30, 2025

Obrushenie Gorki Postradavshie V Tyumeni Otkazalis Ot Gosudarstvennoy Pomoschi

Apr 30, 2025 -

The Ongoing Relationship Between Amanda And Clive Owen An Our Yorkshire Farm Update

Apr 30, 2025

The Ongoing Relationship Between Amanda And Clive Owen An Our Yorkshire Farm Update

Apr 30, 2025 -

Anomalnoe Poteplenie Gorki Chelyabinska Snova Zakryty

Apr 30, 2025

Anomalnoe Poteplenie Gorki Chelyabinska Snova Zakryty

Apr 30, 2025 -

Document Amf Ubisoft Cp 2025 E1027692 Decryptage Et Analyse

Apr 30, 2025

Document Amf Ubisoft Cp 2025 E1027692 Decryptage Et Analyse

Apr 30, 2025 -

O Gallos Ypoyrgos Oikonomias Zita Patriotismo Apenanti Stoys Dasmoys Tramp

Apr 30, 2025

O Gallos Ypoyrgos Oikonomias Zita Patriotismo Apenanti Stoys Dasmoys Tramp

Apr 30, 2025

Latest Posts

-

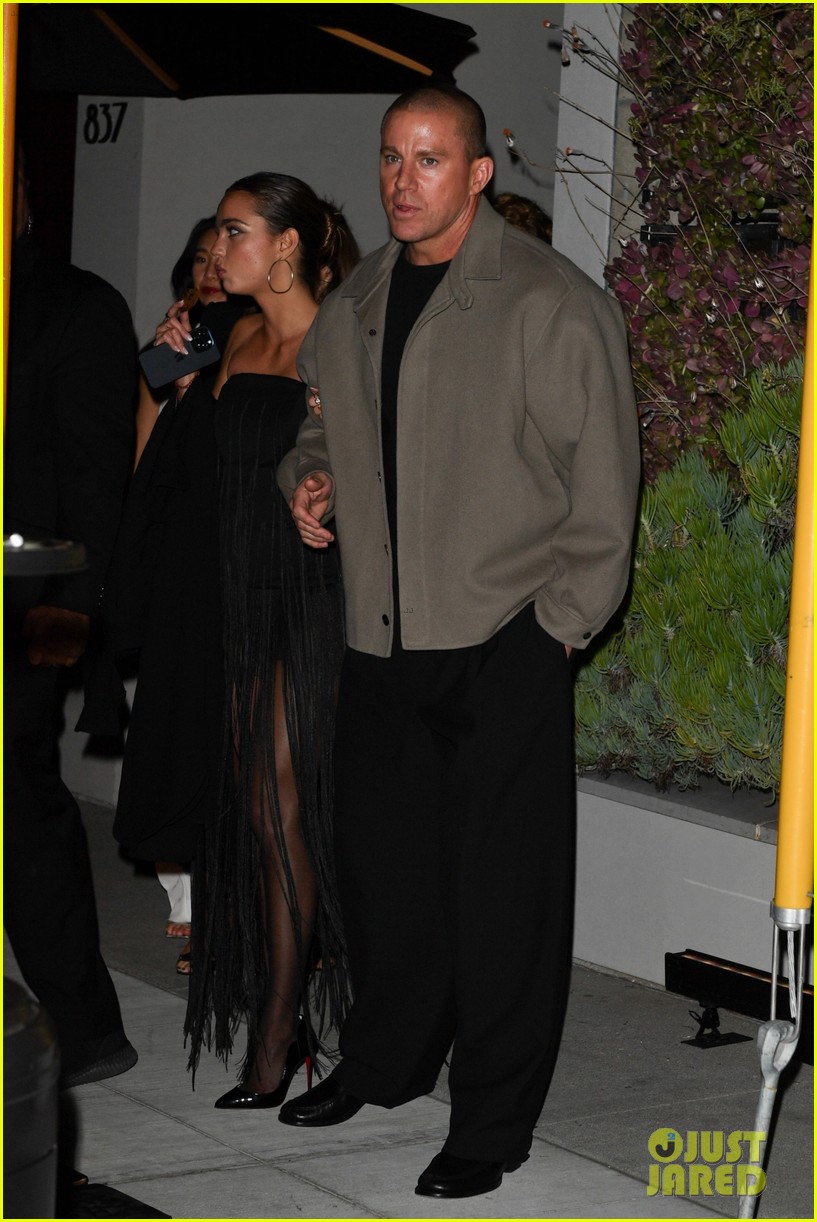

Channing Tatum Moves On Romance With Inka Williams After Zoe Kravitz Split

Apr 30, 2025

Channing Tatum Moves On Romance With Inka Williams After Zoe Kravitz Split

Apr 30, 2025 -

Channing Tatums New Girlfriend Inka Williams And Their Public Display Of Affection

Apr 30, 2025

Channing Tatums New Girlfriend Inka Williams And Their Public Display Of Affection

Apr 30, 2025 -

Channing Tatum 44 And Inka Williams 25 New Romance Confirmed

Apr 30, 2025

Channing Tatum 44 And Inka Williams 25 New Romance Confirmed

Apr 30, 2025 -

Exploring The Zoe Kravitz And Noah Centineo Dating Speculation

Apr 30, 2025

Exploring The Zoe Kravitz And Noah Centineo Dating Speculation

Apr 30, 2025 -

Channing Tatum Dating Australian Model Inka Williams Following Zoe Kravitz Breakup

Apr 30, 2025

Channing Tatum Dating Australian Model Inka Williams Following Zoe Kravitz Breakup

Apr 30, 2025