Rate Cut Optimism Among Bond Traders Subdued By Powell's Remarks

Table of Contents

Powell's Hawkish Stance and its Impact on Rate Cut Expectations

Powell's recent pronouncements have shifted the market's perception of the Federal Reserve's near-term plans, significantly impacting rate cut optimism. His emphasis on persistent inflation and the need for further monetary policy tightening has surprised many who anticipated a more dovish approach. This "hawkish" stance contrasts sharply with the prevailing market expectations leading up to his speech.

-

Powell's emphasis on persistent inflation and the need for further tightening: Powell repeatedly highlighted the lingering threat of inflation, suggesting that the Fed's fight against rising prices is far from over. This directly contradicts the expectations of many bond traders who anticipated imminent rate cuts.

-

Market reaction to Powell's less-dovish tone than anticipated: The bond market reacted swiftly to Powell's less-dovish-than-expected tone, with treasury yields immediately rising. This indicates a reduced expectation of rate cuts and a higher perceived risk of sustained higher interest rates.

-

Analysis of specific quotes from Powell's speech that shifted market sentiment: Specific quotes emphasizing the need for "data dependency" and the willingness to maintain a restrictive monetary policy until inflation is decisively lowered were particularly impactful, dampening rate cut optimism.

-

Discussion of the impact of recent economic data (e.g., inflation reports, employment figures) on the Fed's decision-making: Recent economic data, including stubbornly high inflation figures and a robust labor market, have likely reinforced the Fed's commitment to a tighter monetary policy, further undermining rate cut optimism among bond traders.

The Bond Market's Response: Shifting Yields and Investor Sentiment

The bond market's response to Powell's remarks has been swift and significant, reflecting a shift in investor sentiment and increased market volatility. The immediate impact was a rise in bond yields, particularly in longer-term treasury bonds.

-

How bond yields reacted to Powell's statements (e.g., increased yields indicating less optimism): Increased bond yields directly reflect reduced rate cut optimism. Investors are pricing in a higher probability of higher interest rates for a longer period, impacting the value of existing bonds.

-

Examination of the shifts in investor sentiment: increased risk aversion, reduced appetite for riskier bonds: The less optimistic outlook has led to increased risk aversion among investors. This has reduced the appetite for riskier assets, including corporate bonds, and shifted investment towards safer government bonds, a classic "flight to safety" response.

-

Analysis of the flight-to-safety phenomenon and its impact on government bond prices: The flight to safety has driven up the prices of government bonds, like treasury bonds, considered low-risk investments, further influencing bond market dynamics.

-

Discussion on the potential for further volatility in the bond market based on future Fed actions: Future Federal Reserve actions and incoming economic data will continue to influence bond market volatility. The uncertainty surrounding the future path of interest rates creates a less stable environment for bond traders.

Analyzing the Disparity Between Market Expectations and Fed Policy

A significant divergence exists between market expectations regarding rate cuts and the Federal Reserve's communicated intentions. This gap highlights the challenges of accurately predicting central bank policy and underscores the importance of closely monitoring official pronouncements.

-

Comparison of market-implied probabilities of rate cuts versus the Fed's communicated intentions: Market-implied probabilities, derived from pricing in derivatives markets, often differed significantly from the Fed's explicit guidance, revealing a misalignment in expectations.

-

Exploration of potential reasons for the divergence between market expectations and Fed policy: This divergence may stem from differing interpretations of economic data, varying inflation forecasts, or a misunderstanding of the Fed's commitment to price stability.

-

Examination of differing inflation forecasts and their role in shaping expectations: Divergent inflation forecasts among market participants and the Fed itself play a major role in shaping expectations regarding future interest rate movements.

Implications for Investors and Future Outlook

The subdued rate cut optimism necessitates adjustments to investment strategies and a more cautious approach to risk management within the bond market.

-

Advice for investors on adapting their bond portfolios in light of the changed outlook: Investors may consider adjusting their portfolios towards shorter-term bonds to reduce interest rate risk or diversifying into other asset classes.

-

Discussion of potential hedging strategies to mitigate risk in a less certain environment: Hedging strategies, such as using interest rate derivatives, can help mitigate potential losses from unexpected interest rate movements.

-

Analysis of various scenarios and their potential impact on bond markets: Various scenarios, including persistent inflation, a recession, or a quicker-than-expected cooling of inflation, need consideration when evaluating potential impacts on bond markets.

-

Exploration of the long-term outlook for interest rates and their impact on the bond market: The long-term outlook for interest rates remains uncertain, making careful analysis of macroeconomic trends critical for informed investment decisions.

Conclusion

Powell's recent comments have significantly tempered rate cut optimism among bond traders, leading to increased volatility and a reassessment of investment strategies. The divergence between market expectations and the Fed's stated policy highlights the challenges in accurately predicting future monetary policy. Understanding the nuanced implications of Powell's remarks is crucial for navigating the current bond market landscape. Stay informed on Federal Reserve pronouncements and economic data to effectively manage your investment portfolio in the face of fluctuating rate cut optimism. Stay tuned for further updates on shifts in rate cut optimism and their impact on the bond market.

Featured Posts

-

Ligue Des Champions Bayern Vs Inter L Impact De Mueller

May 12, 2025

Ligue Des Champions Bayern Vs Inter L Impact De Mueller

May 12, 2025 -

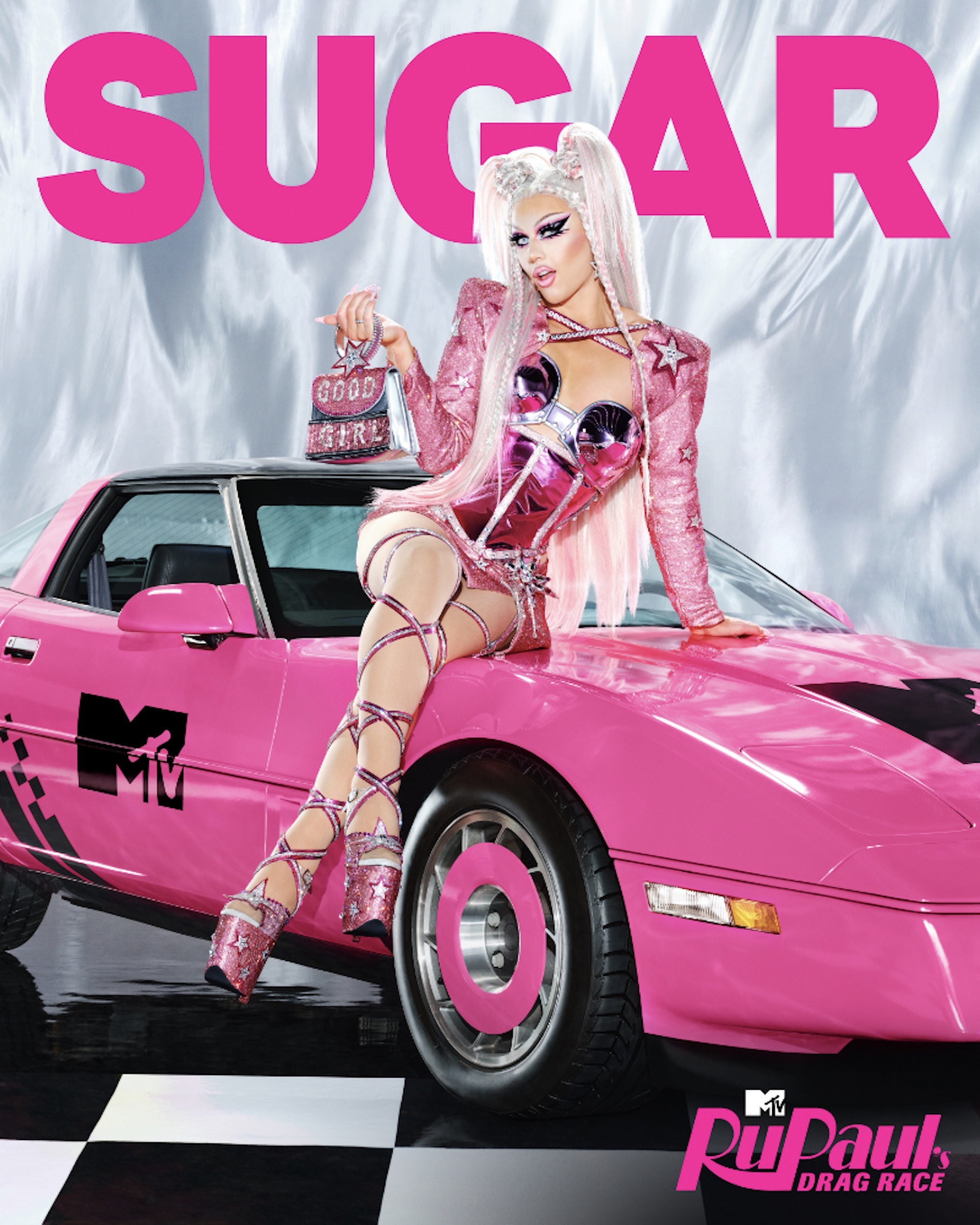

Ru Pauls Drag Race S17 E13 Drag Baby Mamas Episode Preview

May 12, 2025

Ru Pauls Drag Race S17 E13 Drag Baby Mamas Episode Preview

May 12, 2025 -

Hailstorm Damage Protecting Your Pool And Lawn This Summer

May 12, 2025

Hailstorm Damage Protecting Your Pool And Lawn This Summer

May 12, 2025 -

Full List Famous Residents Affected By The Palisades Fires

May 12, 2025

Full List Famous Residents Affected By The Palisades Fires

May 12, 2025 -

Celtic Loanee Targets Top Spot News And Analysis

May 12, 2025

Celtic Loanee Targets Top Spot News And Analysis

May 12, 2025

Latest Posts

-

The Kyle Tucker Report What It Means For The Chicago Cubs

May 13, 2025

The Kyle Tucker Report What It Means For The Chicago Cubs

May 13, 2025 -

Portola Valley Preserve Search 79 Year Old Woman Still Missing

May 13, 2025

Portola Valley Preserve Search 79 Year Old Woman Still Missing

May 13, 2025 -

Search Continues For Missing 79 Year Old Woman In Portola Valley Preserve

May 13, 2025

Search Continues For Missing 79 Year Old Woman In Portola Valley Preserve

May 13, 2025 -

Sue Crane 92 Dedicated Portola Valley Public Servant Dies

May 13, 2025

Sue Crane 92 Dedicated Portola Valley Public Servant Dies

May 13, 2025 -

Cubs Fans React To Kyle Tucker Report A Detailed Analysis

May 13, 2025

Cubs Fans React To Kyle Tucker Report A Detailed Analysis

May 13, 2025