Real Estate Crisis: Home Sales At Record Lows, Report Says

Table of Contents

High Interest Rates Stifle Buyer Demand

Rising interest rates are the primary culprit behind the dramatic decrease in home sales. The increased cost of borrowing money significantly reduces affordability for potential homebuyers. Even with stable incomes, higher interest rates translate to substantially higher monthly mortgage payments. This makes homeownership a less attainable goal for many, leading to a sharp decline in demand.

- Increased monthly mortgage payments: A 1% increase in interest rates can significantly increase the monthly payment, pricing many buyers out of the market.

- Reduced purchasing power: Higher interest rates effectively reduce the amount a buyer can borrow, limiting the price range of homes they can afford.

- Shift in buyer behavior: Potential buyers are adopting a more cautious approach, delaying purchases or opting to rent instead of buy.

- Data illustrating the correlation: Recent data shows a strong negative correlation between interest rate hikes and the number of homes sold, demonstrating a direct impact on buyer demand. (Insert graph or chart here visually representing this data)

Inflation Erodes Purchasing Power

Inflation is another major factor fueling the real estate crisis. The rising cost of living is impacting disposable income, leaving less money available for home purchases. This decrease in purchasing power is affecting both buyers and sellers.

- Increased cost of living: Inflation erodes the value of savings and reduces the amount available for a down payment and closing costs.

- Seller hesitancy: Sellers are less willing to lower their asking prices due to the increased cost of goods and services, further hindering transactions.

- Impact on construction costs: Inflation is also driving up the cost of building new homes, contributing to the limited inventory.

- Statistics highlighting inflation's impact: Data clearly shows the link between rising inflation and the slowdown in home sales. (Include statistics comparing inflation rates and housing market activity).

Limited Housing Inventory Exacerbates the Problem

The current real estate crisis is further worsened by a severe shortage of available homes for sale. This scarcity of inventory creates a seller's market, even with the overall decline in sales. Fewer homes available means increased competition among buyers, potentially leading to price escalation in certain areas.

- Factors contributing to low inventory: Construction slowdowns, supply chain disruptions, and a reluctance by homeowners to sell (due to fear of not finding another suitable home) all play a role.

- Impact on competition: Buyers often find themselves in bidding wars, further increasing the final price and affordability challenges.

- Data illustrating the shortage: Current data indicates a significant gap between supply and demand in many housing markets, creating intense competition. (Insert a map here visually representing areas most affected by low inventory).

Potential Long-Term Consequences of the Real Estate Crisis

The current downturn in the real estate market has far-reaching implications that extend beyond the housing sector itself. This real estate crisis could trigger a broader economic slowdown.

- Impact on related industries: The construction industry, along with finance and related sectors, will likely experience negative effects due to reduced activity in the housing market.

- Potential ripple effects: A prolonged housing market downturn could affect consumer confidence and spending, impacting the overall economy.

- Predictions for future trends: Experts predict varying scenarios, with some forecasting a prolonged period of low sales and others anticipating a market rebound once interest rates stabilize.

Conclusion

The current real estate crisis, characterized by record low home sales, is a complex issue stemming from the confluence of high interest rates, rampant inflation, and a severe shortage of available homes. These factors combine to create a challenging environment for both buyers and sellers. Understanding the intricacies of this real estate crisis is crucial for navigating these challenging times. The significant impact of high interest rates, inflation, and limited inventory underlines the severity of the situation. Stay updated on the latest market trends and consult with real estate professionals to make informed decisions. Learn more about the current state of the housing market downturn and how it affects you. The real estate market crisis demands careful attention and proactive strategies to mitigate its impact.

Featured Posts

-

Munguias Dominant Win Revenge Against Carrer

May 31, 2025

Munguias Dominant Win Revenge Against Carrer

May 31, 2025 -

Today In History March 26 The Impact Of Princes Death

May 31, 2025

Today In History March 26 The Impact Of Princes Death

May 31, 2025 -

Macaristan Da Haciosmanoglu Goeruesmeler Ve Anlasmalar

May 31, 2025

Macaristan Da Haciosmanoglu Goeruesmeler Ve Anlasmalar

May 31, 2025 -

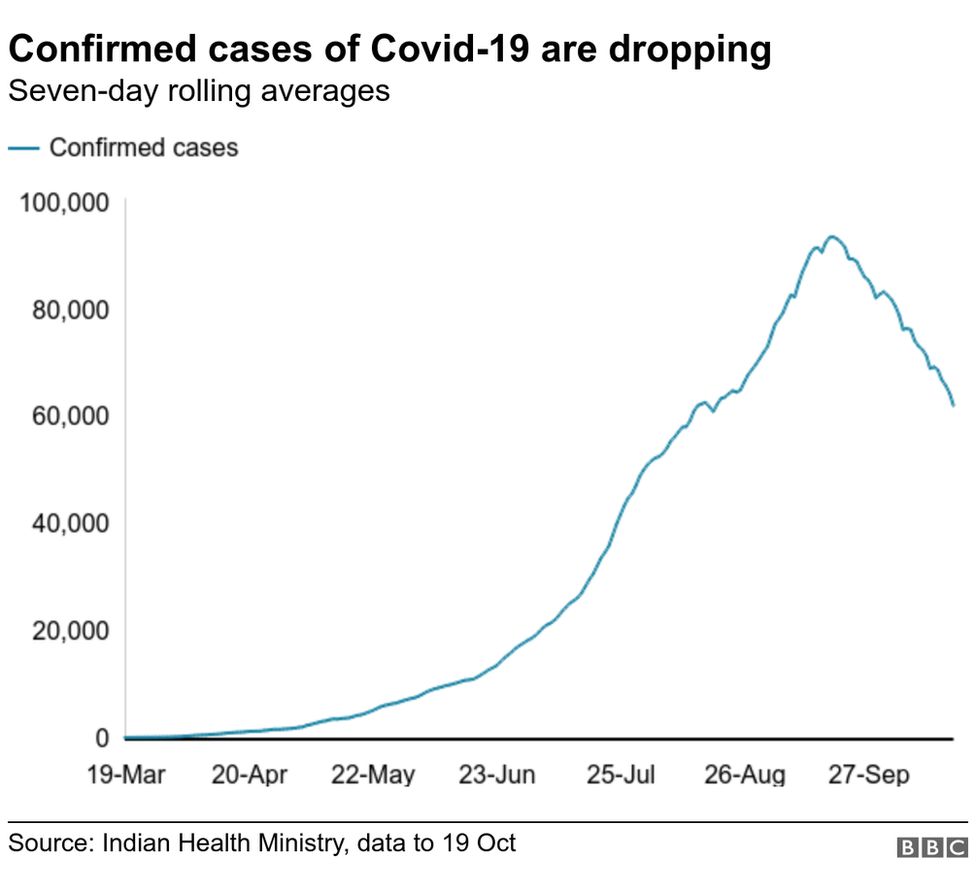

Who Warns New Covid 19 Variant Fueling Case Surges Globally

May 31, 2025

Who Warns New Covid 19 Variant Fueling Case Surges Globally

May 31, 2025 -

Tomorrow Is A New Day Pw Talks With Molly Jong A Podcast Interview

May 31, 2025

Tomorrow Is A New Day Pw Talks With Molly Jong A Podcast Interview

May 31, 2025