Real Estate Market Collapse: Are Home Sales At Crisis Levels?

Table of Contents

Signs of a Slowdown: Declining Home Sales and Rising Inventory

The real estate market is undeniably experiencing a slowdown. Several key indicators point to a significant shift from the seller's market of recent years.

Falling Home Sales Numbers

Recent data reveals a concerning trend of falling home sales across many regions.

- National Sales Figures: National Association of Realtors (NAR) data shows a year-over-year decline in existing home sales, indicating a weakening demand. (Insert relevant chart or graph here showing sales decline).

- Regional Variations: While some regions experience steeper declines in home sales decline, others show more moderate slowdowns, highlighting the uneven impact of the market shift. For instance, (cite specific examples of regions experiencing significant drops vs. those remaining relatively stable).

- Year-over-Year Comparisons: Comparing current sales figures to those of the previous year paints a clearer picture of the housing market slowdown. The magnitude of the year-over-year decrease underscores the severity of the slowdown.

These numbers underscore a significant decrease in decreased property transactions, suggesting a potential shift in market dynamics.

Increasing Inventory Levels

Alongside falling sales, the market is witnessing a notable rise in unsold homes. This increase in unsold homes signifies a shift towards a buyer's market.

- Months of Inventory Data: The months of supply metric, which measures the time it would take to sell all current listings at the current sales rate, is steadily increasing. A higher months-of-inventory indicates a less competitive seller's market and more negotiating power for buyers.

- Impact on Seller's Market Dynamics: The shift from a seller's market to a more balanced or even buyer's market is impacting seller expectations and pricing strategies. Homes are taking longer to sell, and sellers often need to adjust prices to attract buyers.

- Regional Differences in Inventory Levels: The increase in inventory surplus isn't uniform across all regions. Some areas are experiencing a more pronounced increase in inventory than others, further emphasizing the importance of local market analysis. This market saturation in specific areas might accelerate price corrections.

Economic Factors Fueling Concerns: Interest Rates and Inflation

Two major economic factors are significantly influencing the housing market: rising interest rates and persistent inflation.

The Impact of Rising Interest Rates

The Federal Reserve's efforts to combat inflation have led to a series of interest rate hikes. These hikes directly impact mortgage affordability.

- Correlation between Interest Rates and Mortgage Applications: Higher mortgage rates translate to higher monthly payments, reducing the number of potential buyers who can afford a home. Data shows a strong negative correlation between interest rate increases and mortgage applications.

- Impact on Buyer Purchasing Power: The increase in interest rates significantly reduces buyer purchasing power. This reduced affordability is a key driver of the housing market slowdown. Buyers can now afford less expensive homes, impacting overall market demand.

Inflation's Role in the Housing Market

Persistent inflation erodes consumer purchasing power and impacts overall economic confidence.

- Impact of Inflation on Consumer Confidence: High inflation leads to decreased consumer confidence, making people hesitant to make large purchases, including homes. This uncertainty influences consumer spending and dampens demand in the housing sector.

- Relationship between Inflation and Housing Prices: While housing prices have historically acted as a hedge against inflation, the current economic climate suggests that this relationship may be weakening. High inflation, coupled with higher interest rates, may lead to a decrease in housing prices.

Regional Variations: Are All Markets Equally Affected?

The effects of the housing market slowdown are not uniform across all geographic areas.

Analyzing Regional Differences

Understanding the regional housing market is crucial. Some areas are experiencing more significant declines in home sales and price growth than others.

- Examples of Strong and Weak Markets: (Provide specific examples of regions performing well versus those experiencing significant declines, referencing local economic factors and market specificities).

- Factors Contributing to Regional Disparities: The variations in performance stem from differences in local economic conditions, job markets, population growth, and regulatory environments.

Local Market Specifics

Analyzing local real estate trends is essential for a comprehensive understanding of the current situation.

- Importance of Local Economic Factors: Local economic conditions, such as job growth and employment rates, heavily influence real estate market performance. A strong local economy tends to support a more robust housing market.

- Specific Regulations Impacting Local Markets: Local regulations, such as zoning laws and building codes, play a role in shaping supply and demand dynamics. Understanding these hyperlocal real estate influences is crucial. Analyzing neighborhood trends will reveal further nuances.

Conclusion: Navigating the Current Real Estate Landscape

The current slowdown in the housing market is substantial, raising concerns about a potential real estate market collapse. However, while some regions and market segments are experiencing significant challenges, others remain relatively stable. Whether we’re facing a full-blown crisis or a market correction is dependent on several interconnected factors. This is not a uniform housing market crisis but rather a complex and evolving situation.

For buyers, this may present opportunities in a more balanced market with potentially lower prices and less competition. For sellers, it necessitates a more strategic approach with realistic pricing and marketing efforts. Investors should carefully analyze specific markets and adopt a more cautious approach.

Don't navigate the complexities of the current real estate market alone. Consult with a real estate expert today to understand how the potential for a real estate market collapse might impact your specific situation. Stay informed by following reputable sources and analyzing housing market trends to make informed decisions.

Featured Posts

-

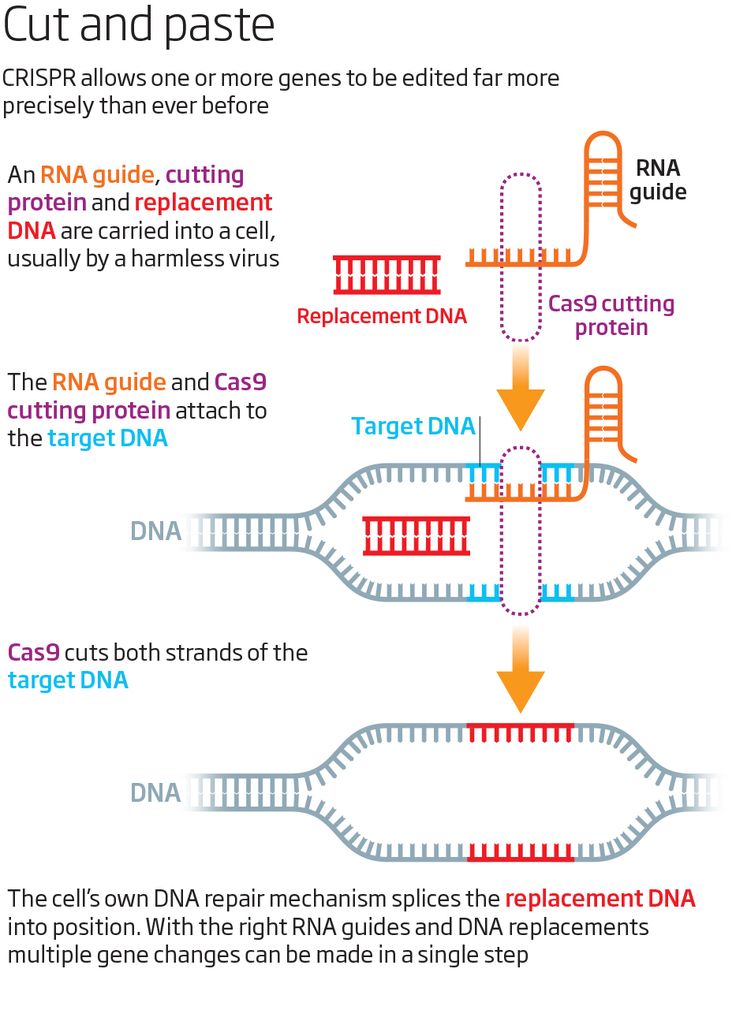

Using Crispr For Precise Whole Gene Insertion In Human Genome Editing

May 30, 2025

Using Crispr For Precise Whole Gene Insertion In Human Genome Editing

May 30, 2025 -

Tennis Governance Under Fire Djokovics Union Launches Legal Action

May 30, 2025

Tennis Governance Under Fire Djokovics Union Launches Legal Action

May 30, 2025 -

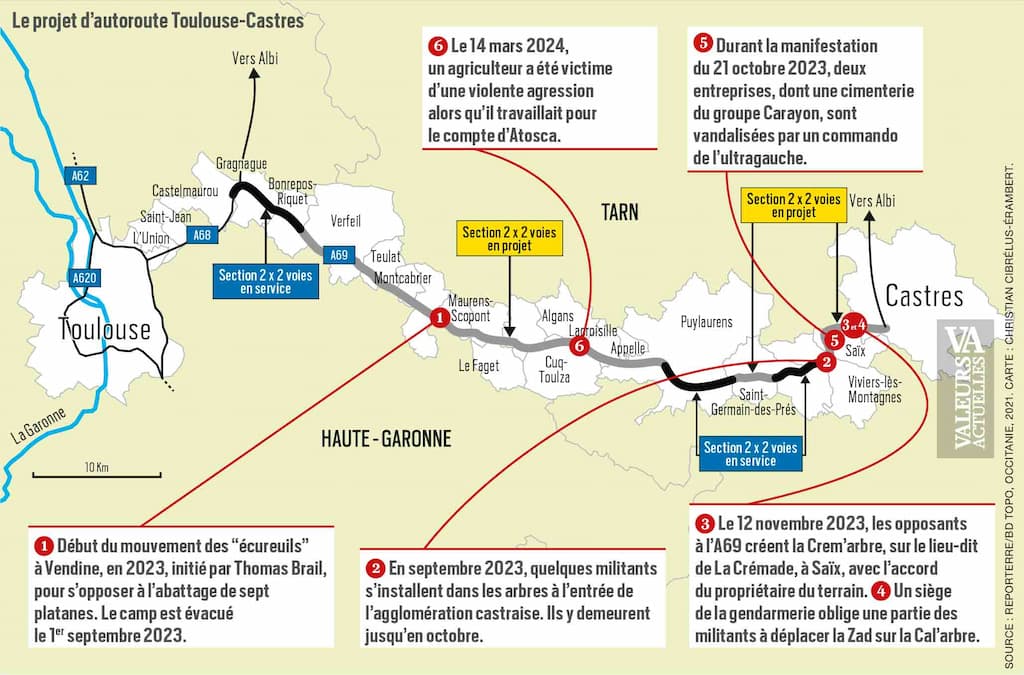

A69 Annulation Du Chantier L Etat Conteste La Decision

May 30, 2025

A69 Annulation Du Chantier L Etat Conteste La Decision

May 30, 2025 -

Djokovic Player Unions Legal Challenge To Tennis Governance

May 30, 2025

Djokovic Player Unions Legal Challenge To Tennis Governance

May 30, 2025 -

Ruben Amorim To Block Manchester United Transfer

May 30, 2025

Ruben Amorim To Block Manchester United Transfer

May 30, 2025

Latest Posts

-

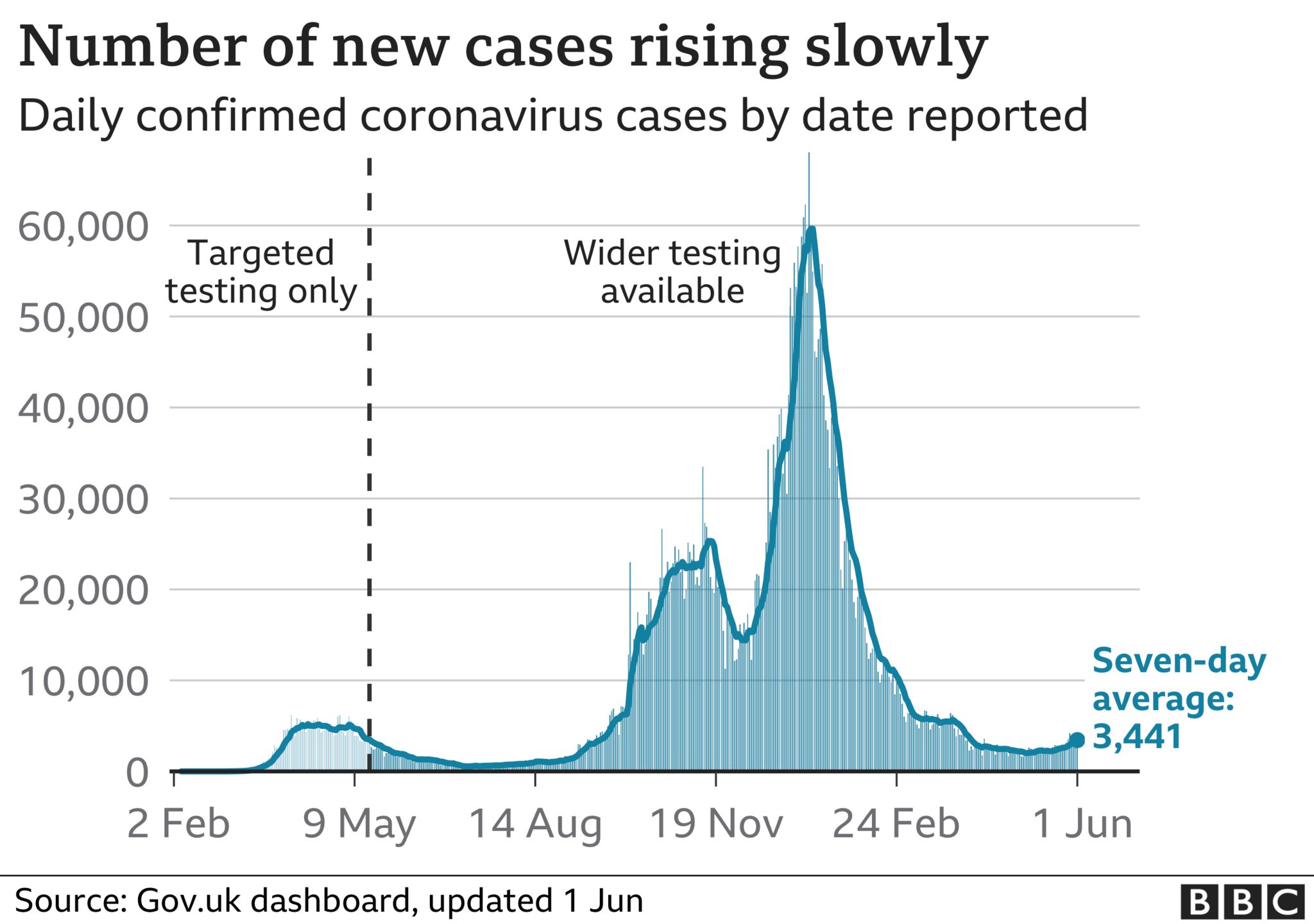

Increased Covid 19 Cases Is A New Variant To Blame Who Update

May 31, 2025

Increased Covid 19 Cases Is A New Variant To Blame Who Update

May 31, 2025 -

Rising Covid 19 Infections Who Investigates Potential New Variant

May 31, 2025

Rising Covid 19 Infections Who Investigates Potential New Variant

May 31, 2025 -

Sheltons Victory Over Darderi Sends Him To Munich Semifinals

May 31, 2025

Sheltons Victory Over Darderi Sends Him To Munich Semifinals

May 31, 2025 -

Covid 19 Case Surge Is A New Variant To Blame Whos Assessment

May 31, 2025

Covid 19 Case Surge Is A New Variant To Blame Whos Assessment

May 31, 2025 -

Covid 19 Case Rise Who Identifies Potential New Variant

May 31, 2025

Covid 19 Case Rise Who Identifies Potential New Variant

May 31, 2025