Recent Developments: PwC Ceases Operations In Nine African Countries

Table of Contents

Which Countries are Affected by the PwC Africa Withdrawal?

PwC's recent decision directly impacts nine African countries. The geographical diversity of these nations highlights the broad scope of this withdrawal. The affected countries are:

- Country A

- Country B

- Country C

- Country D

- Country E

- Country F

- Country G

- Country H

- Country I

(Note: Replace Country A-I with the actual names of the nine countries. Include a map showing the locations of these countries to improve visual engagement and SEO with the keyword "PwC Africa map.")

Reasons Behind PwC's Decision to Cease Operations in Africa

The reasons behind PwC's decision to withdraw from these nine African countries are likely multifaceted and complex. Several factors could be contributing to this strategic shift:

-

PwC Africa Profitability: Economic factors play a significant role. Low profitability in certain regions, coupled with economic instability and fluctuating currency exchange rates, may have rendered operations unsustainable. Analyzing the PwC Africa profitability in these specific countries is crucial to understanding the decision.

-

PwC Africa Regulation: Navigating the regulatory landscape in Africa presents unique challenges. Compliance costs, varying accounting standards across different countries, and changes in local regulations can significantly impact operational efficiency and profitability. Understanding the complexities of PwC Africa regulation is essential.

-

PwC Global Strategy: This withdrawal might be part of a broader strategic restructuring by PwC, focusing resources on core markets and aligning with its global business strategy. This PwC global strategy prioritizes high-growth and stable markets, potentially leading to the divestment from less profitable regions.

Impact of PwC's Withdrawal on the African Business Landscape

The impact of PwC's withdrawal extends far beyond the immediate loss of services. Several key areas will experience significant consequences:

-

PwC Africa Clients: Businesses that relied on PwC for auditing, consulting, and tax services will need to find alternative providers. This transition could disrupt operations, increase costs, and create uncertainty. The impact on PwC Africa clients will vary based on their size and industry.

-

Africa Audit Market: The overall auditing and consulting sector in Africa will feel the ripple effects. The departure of a major player like PwC will alter the competitive landscape, potentially increasing the market share of remaining firms. The shift in the Africa audit market requires close monitoring.

-

PwC Africa Job Losses: The withdrawal will inevitably lead to job losses, both directly within PwC and indirectly among associated businesses. This will create economic disruption, particularly in the affected countries. Understanding the scale of PwC Africa job losses and the resultant social-economic impact is critical.

Future Implications and Potential Alternatives for Businesses in Africa

Businesses in Africa will need to adapt to this shift and find suitable alternatives for auditing and consulting services.

-

Competing Audit Firms Africa: Several other major players exist in the African market, including Deloitte, EY, and KPMG. These firms are likely to see increased demand and will need to adjust their strategies to accommodate the influx of new clients. This will impact the dynamics of competing audit firms Africa.

-

Foreign Investment Africa: The long-term implications for foreign investment Africa remain uncertain. The withdrawal of a global giant like PwC might signal increased risk perceptions for some investors, while others might see opportunities in a reshaped market.

The increased competition or potential consolidation within the industry will shape the future of the African auditing and consulting sector.

Conclusion

PwC's withdrawal from nine African countries represents a significant development with potential wide-ranging implications for the African business landscape. The reasons behind this decision are multifaceted, and the consequences will likely be felt across various sectors. Understanding the implications of this PwC Africa withdrawal is crucial for businesses and investors in Africa. Stay informed on further developments concerning the PwC Africa withdrawal and its impact on the continent. For further analysis and insights on this significant development, continue to follow reputable news sources and industry publications.

Featured Posts

-

Impact Of River Road Construction On Louisvilles Restaurant Scene

Apr 29, 2025

Impact Of River Road Construction On Louisvilles Restaurant Scene

Apr 29, 2025 -

Why Middle Managers Are Crucial For Company Success And Employee Well Being

Apr 29, 2025

Why Middle Managers Are Crucial For Company Success And Employee Well Being

Apr 29, 2025 -

Exclusive Huawei Develops Cutting Edge Ai Chip To Compete With Nvidia

Apr 29, 2025

Exclusive Huawei Develops Cutting Edge Ai Chip To Compete With Nvidia

Apr 29, 2025 -

Mesa Welcomes Shen Yuns Return

Apr 29, 2025

Mesa Welcomes Shen Yuns Return

Apr 29, 2025 -

Porsche Popularity A Global Perspective With A Focus On Australia

Apr 29, 2025

Porsche Popularity A Global Perspective With A Focus On Australia

Apr 29, 2025

Latest Posts

-

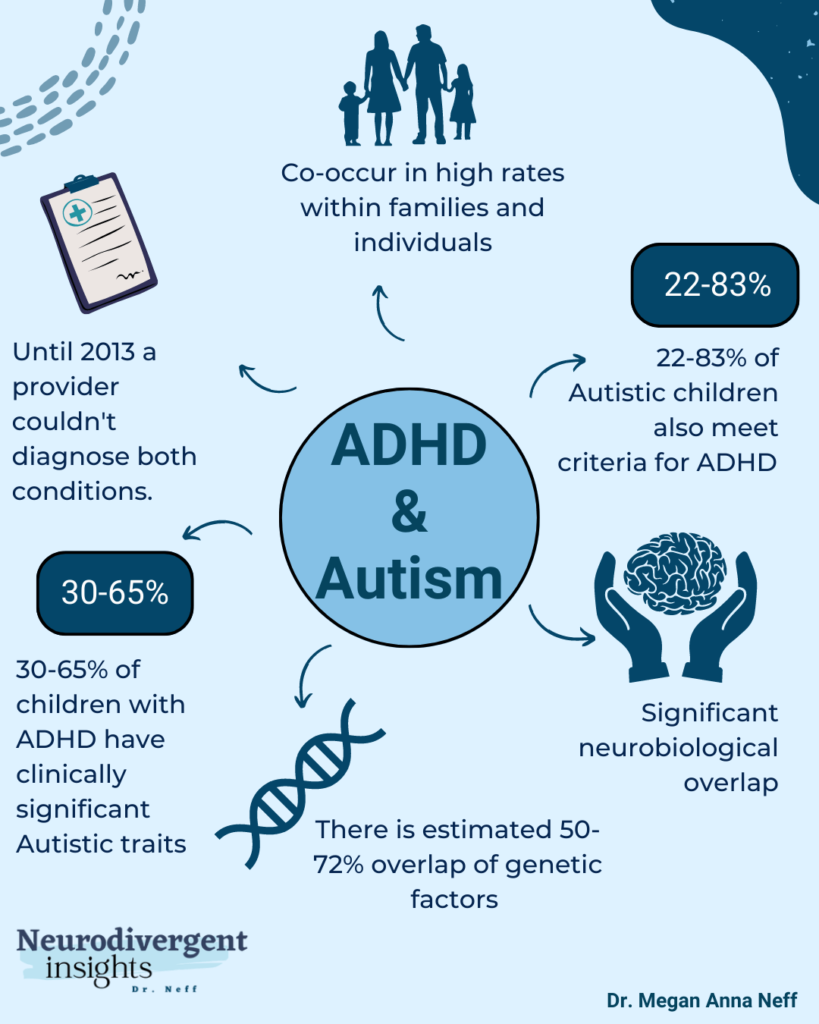

Adult Adhd Diagnosis Next Steps And Support

Apr 29, 2025

Adult Adhd Diagnosis Next Steps And Support

Apr 29, 2025 -

You Think You Have Adult Adhd Now What

Apr 29, 2025

You Think You Have Adult Adhd Now What

Apr 29, 2025 -

Increased Adhd Prevalence Found In Adults With Autism And Intellectual Disabilities A Recent Study

Apr 29, 2025

Increased Adhd Prevalence Found In Adults With Autism And Intellectual Disabilities A Recent Study

Apr 29, 2025 -

Autism Intellectual Disability And Adhd A Study On Co Occurring Conditions

Apr 29, 2025

Autism Intellectual Disability And Adhd A Study On Co Occurring Conditions

Apr 29, 2025 -

Adhd In Adults A Study On The Prevalence In Those With Autism And Intellectual Disabilities

Apr 29, 2025

Adhd In Adults A Study On The Prevalence In Those With Autism And Intellectual Disabilities

Apr 29, 2025