Recent Survey: A Look At Changing Parental Attitudes Toward College Costs

Table of Contents

The Growing Burden of College Tuition: Parental Perceptions and Financial Strain

The survey highlights a growing awareness among parents regarding the escalating cost of college tuition. This increased awareness is significantly impacting family finances and shaping parental decisions.

Increased Awareness of College Costs

- 78% of parents surveyed reported finding the cost of college unaffordable or a significant financial burden.

- The average expected parental contribution to college costs has increased by 15% in the last five years.

- 45% of parents reported delaying major purchases or investments to save for college.

This heightened awareness stems from several factors. Media coverage frequently highlights the increasing cost of higher education, and personal experiences of friends and family facing significant student loan debt further amplify the issue. The sheer magnitude of tuition increases, often outpacing inflation, makes the financial burden increasingly difficult for many families to bear.

Impact on Family Savings and Spending Habits

The rising cost of tuition isn't just impacting college savings; it's affecting overall family spending. The survey reveals significant changes in family financial habits:

- 62% of parents are cutting back on discretionary spending, such as entertainment and vacations, to save for college.

- 35% are utilizing retirement savings to contribute to college costs.

- 10% are delaying retirement plans altogether.

These sacrifices have significant long-term financial implications for families. The pressure to prioritize college funding often comes at the expense of other important financial goals, such as retirement security and homeownership. The financial strain placed on families by college tuition is undeniable and far-reaching.

Shifting Priorities: How Parents Are Adapting to the Rising Costs of Higher Education

Faced with the increasing financial burden, parents are adapting their approach to higher education. This shift involves a greater emphasis on value, exploration of alternative pathways, and growing concerns about student loan debt.

Increased Emphasis on Value and Return on Investment (ROI)

The survey indicates a clear shift toward prioritizing colleges offering a strong return on investment (ROI). Parents are increasingly focused on:

- Career services: 80% of parents cited strong career services and job placement rates as crucial factors in college selection.

- Practical skills: 70% prioritized programs that equip students with in-demand job skills.

- Affordability: Cost-effectiveness remains a primary concern, with parents actively seeking scholarships and financial aid opportunities.

This shift in focus has significant implications for both students and institutions. Colleges and universities are under increasing pressure to demonstrate the value of their programs and the potential for future employment.

Exploring Alternative Education Pathways

The survey revealed a significant rise in parental interest in alternatives to traditional four-year colleges. This reflects a growing recognition that higher education doesn't always require a four-year degree.

- Community Colleges: 40% of parents expressed interest in community colleges as a more affordable option.

- Vocational Schools: 25% considered vocational schools, emphasizing the development of practical skills.

- Online Learning: 15% explored online learning options for flexibility and affordability.

These alternative pathways offer potentially more affordable routes to employment, and parents are increasingly seeing them as viable solutions.

The Rise of Student Loan Debt and Parental Concerns

The survey revealed significant anxieties among parents regarding student loan debt. This concern is shaping parental decisions regarding co-signing loans and supporting their children's repayment.

- Only 50% of parents surveyed were willing to co-sign student loans.

- 75% expressed concerns about their children's ability to repay loans.

- 30% planned to assist their children with loan repayment after graduation.

This highlights a growing awareness of the long-term financial implications of student loan debt, both for students and their families. The weight of student loan repayment is a significant factor in parental decision-making around higher education.

Implications for Colleges and Universities: Responding to Evolving Parental Expectations

The changing parental attitudes toward college costs demand a response from colleges and universities. Institutions need to adapt their strategies to address the growing concerns regarding affordability and value.

The Need for Transparency in Pricing and Financial Aid

Colleges must improve transparency regarding pricing and financial aid options to better inform prospective students and their parents.

- User-friendly net price calculators: Colleges should provide easy-to-use tools that calculate the actual cost of attendance after financial aid.

- Clear financial aid information: Information regarding scholarships, grants, and loans should be readily accessible and straightforward.

- Simplified financial aid applications: Streamlining the application process can help alleviate some of the stress and complexity associated with financial aid.

Increased transparency can increase enrollment and instill confidence in prospective students and families.

Innovation in Curriculum and Delivery Methods

To better meet parental and student needs, colleges must innovate in their curriculum and delivery methods.

- Online courses: Offering flexible online learning options can increase accessibility and affordability.

- Skills-based training: Focusing on practical job skills can enhance the ROI of college education.

- Partnerships with employers: Collaborating with businesses can provide internship opportunities and improve job placement rates.

Adapting to the changing landscape of higher education requires innovation and a commitment to providing students with the knowledge and skills needed to succeed in the modern job market.

Conclusion: Navigating the Changing Landscape of College Costs: A Call to Action

This survey underscores a significant shift in parental attitudes toward college costs. The growing financial burden is forcing families to re-evaluate their priorities and explore alternative pathways to higher education. Colleges and universities must respond by improving transparency, innovating their offerings, and demonstrating the value of their programs. Understanding changing parental attitudes toward college costs is crucial for navigating the complex landscape of higher education. Stay informed about the latest trends and resources to make informed decisions about financing your education. Explore available financial aid options and consider alternative educational pathways to find the best fit for your individual circumstances.

Featured Posts

-

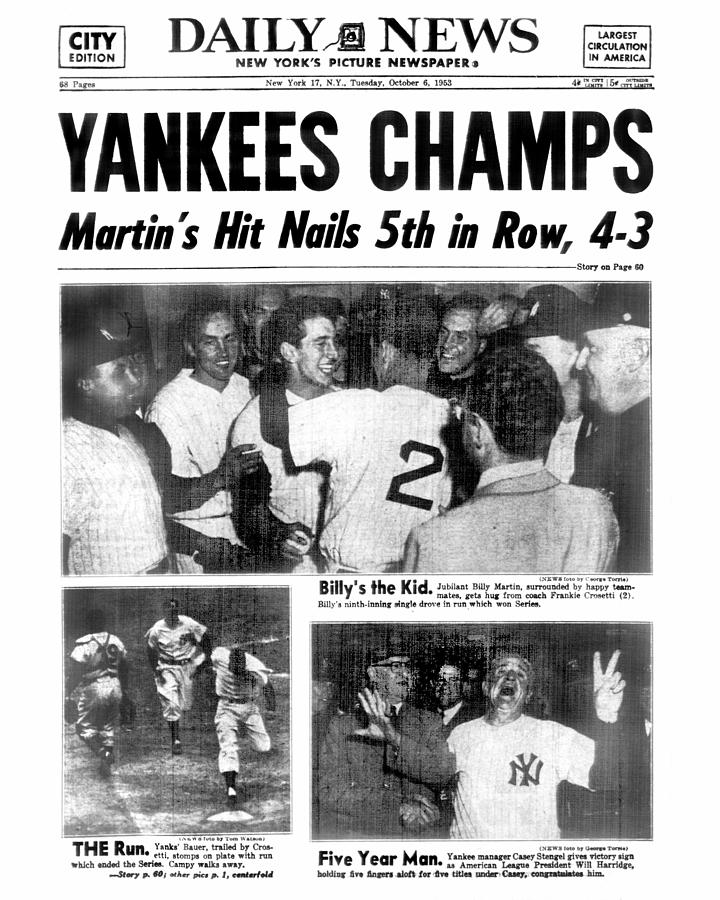

Researching The New York Daily News May 2025 Back Issues

May 17, 2025

Researching The New York Daily News May 2025 Back Issues

May 17, 2025 -

I Saoydiki Aravia Ypodexetai Ton Tramp Leptomereies Apo Tin Entyposiaki Teleti

May 17, 2025

I Saoydiki Aravia Ypodexetai Ton Tramp Leptomereies Apo Tin Entyposiaki Teleti

May 17, 2025 -

Tuerkiye Nin Subat 2024 Uluslararasi Yatirim Pozisyonu Verileri Inceleme Ve Analiz

May 17, 2025

Tuerkiye Nin Subat 2024 Uluslararasi Yatirim Pozisyonu Verileri Inceleme Ve Analiz

May 17, 2025 -

Josh Cavallo Challenging Norms And Fostering Acceptance In Football

May 17, 2025

Josh Cavallo Challenging Norms And Fostering Acceptance In Football

May 17, 2025 -

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025

Latest Posts

-

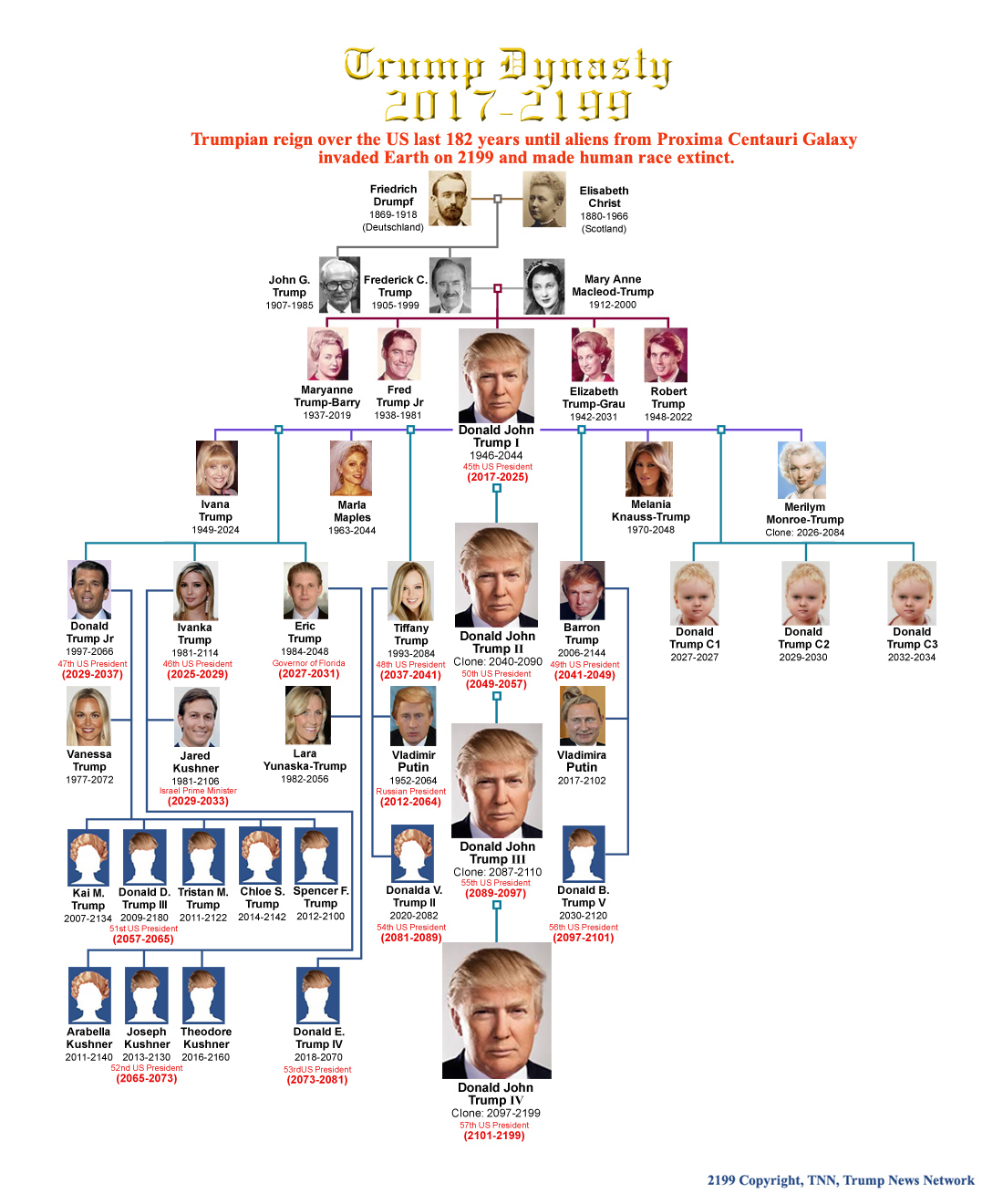

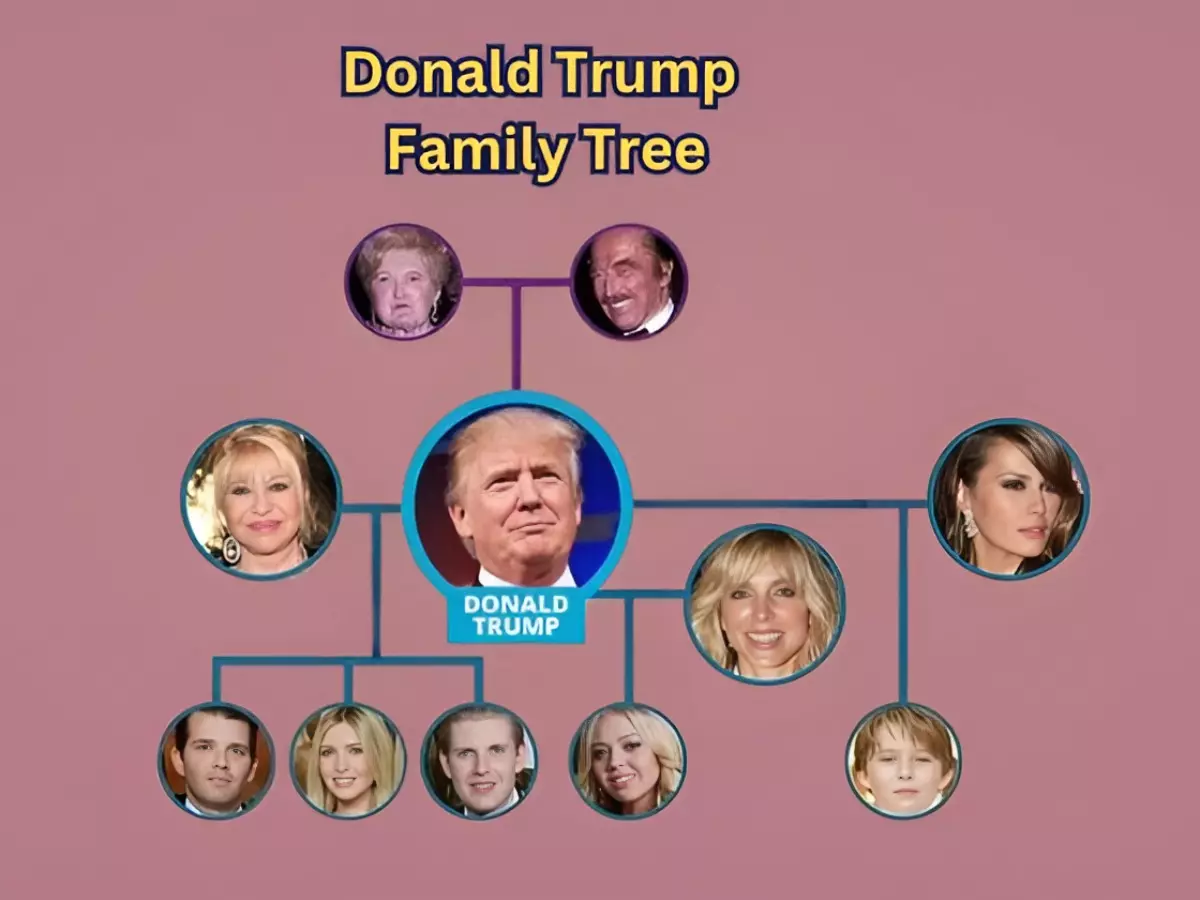

Donald Trump Family Tree Update Tiffany And Michaels Son Alexander

May 17, 2025

Donald Trump Family Tree Update Tiffany And Michaels Son Alexander

May 17, 2025 -

A Look At The Trump Family Tree New Addition Alexander Arrives

May 17, 2025

A Look At The Trump Family Tree New Addition Alexander Arrives

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child Expanding The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child Expanding The Trump Family Tree

May 17, 2025 -

Donald Trumps Family Tree Grows Tiffany And Michaels Baby Alexander

May 17, 2025

Donald Trumps Family Tree Grows Tiffany And Michaels Baby Alexander

May 17, 2025 -

Donald Trump And The Politics Of Sexual Misconduct An Examination Of Multiple Affairs And Their Impact

May 17, 2025

Donald Trump And The Politics Of Sexual Misconduct An Examination Of Multiple Affairs And Their Impact

May 17, 2025