Recent Tesla Stock Decline: Its Ripple Effect On The Dogecoin Market

Table of Contents

Tesla's Influence on Dogecoin

The connection between Tesla's stock performance and Dogecoin's price is undeniable, largely due to a single, powerful factor: Elon Musk.

Elon Musk's Impact

Elon Musk's pronouncements about Tesla and Dogecoin have historically driven significant price swings in both. His tweets, endorsements, and even seemingly unrelated actions have profoundly affected investor sentiment.

- Musk's past endorsements have caused massive Dogecoin price surges. His tweets mentioning Dogecoin have, in the past, resulted in dramatic increases in its value, attracting new investors and driving up trading volume.

- Negative Tesla news can create uncertainty, impacting investor confidence in Dogecoin. When news about Tesla is negative – be it production delays, financial setbacks, or regulatory challenges – it can create a climate of uncertainty that spills over into the crypto market, affecting investor confidence in Dogecoin.

- Musk's influence transcends traditional market analysis. His impact on Dogecoin's price is often unpredictable and doesn't always follow traditional market logic, making it a highly speculative investment.

Tesla's Financial Health and Investor Sentiment

When Tesla experiences financial difficulties, investors may become risk-averse, potentially leading them to sell off assets, including cryptocurrencies like Dogecoin. This creates a sell-off pressure, driving down the price.

- Negative Tesla earnings reports often correlate with decreased Dogecoin value. Poor financial performance from Tesla can signal broader economic concerns, leading investors to liquidate riskier assets like Dogecoin.

- Fear, uncertainty, and doubt (FUD) surrounding Tesla can spill over to Dogecoin. Negative sentiment towards Tesla can easily translate into negative sentiment towards Dogecoin, creating a domino effect.

- Overall market sentiment influences both Tesla and Dogecoin. Broad market trends, such as investor confidence or fear, significantly influence both traditional stocks like Tesla and cryptocurrencies like Dogecoin.

Correlation vs. Causation

While a correlation exists between Tesla's stock performance and Dogecoin's price, it's crucial to understand that correlation doesn't equal causation. Other market factors, macroeconomic conditions, and news events can influence both independently.

Macroeconomic Factors

Broader economic trends significantly impact both traditional markets and cryptocurrencies.

- Recession fears impact both stock and crypto markets. Concerns about an economic downturn often lead investors to sell off riskier assets, including both Tesla stock and Dogecoin.

- Regulatory changes affect both Tesla’s operations and cryptocurrency trading. New regulations impacting either the automotive industry or the cryptocurrency space can cause price volatility in both Tesla stock and Dogecoin.

- General investor confidence affects both asset classes. Periods of high investor confidence tend to benefit both stock and crypto markets, while periods of low confidence lead to sell-offs.

Other Crypto Market Influences

Dogecoin's price is also influenced by factors independent of Tesla, such as technological developments, adoption rates, and competition from other cryptocurrencies.

- New cryptocurrency projects can divert investor attention from Dogecoin. The emergence of new and potentially more promising cryptocurrencies can lead investors to shift their funds away from Dogecoin.

- Regulatory developments specific to cryptocurrencies can affect Dogecoin's price. Changes in cryptocurrency regulations can significantly impact the price and trading volume of Dogecoin.

- Social media trends and online discussions influence Dogecoin trading volume. Viral trends and online discussions can significantly influence the price of Dogecoin, regardless of Tesla's performance.

Investing Strategies Amidst the Volatility

Understanding the intricate relationship between Tesla's stock and Dogecoin's price is crucial for investors looking to navigate the volatile markets. Diversification and risk management are paramount.

Diversification

Don't put all your eggs in one basket. Spread your investments across different assets to mitigate risk. This reduces the impact of any single investment's poor performance on your overall portfolio.

Risk Management

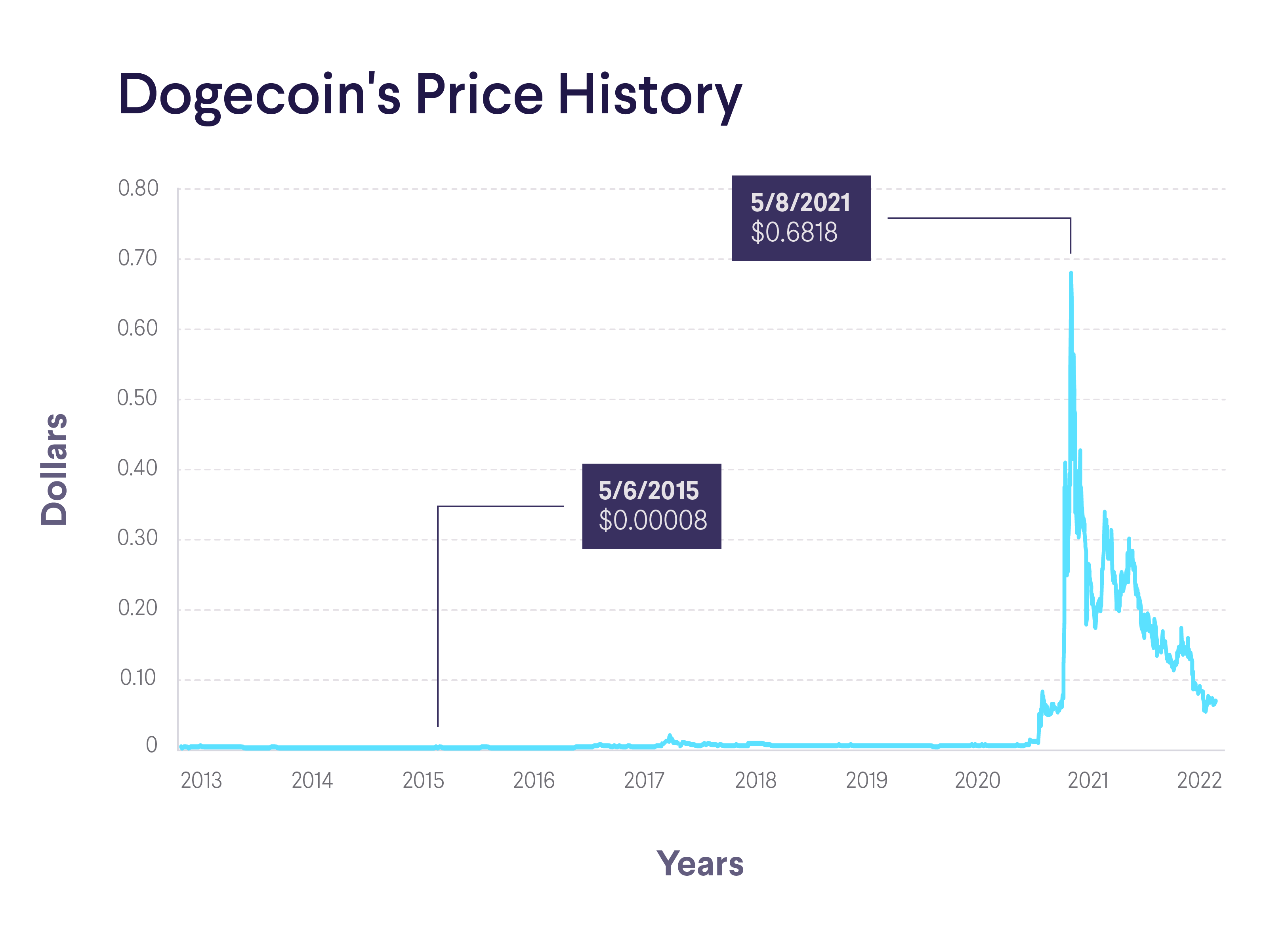

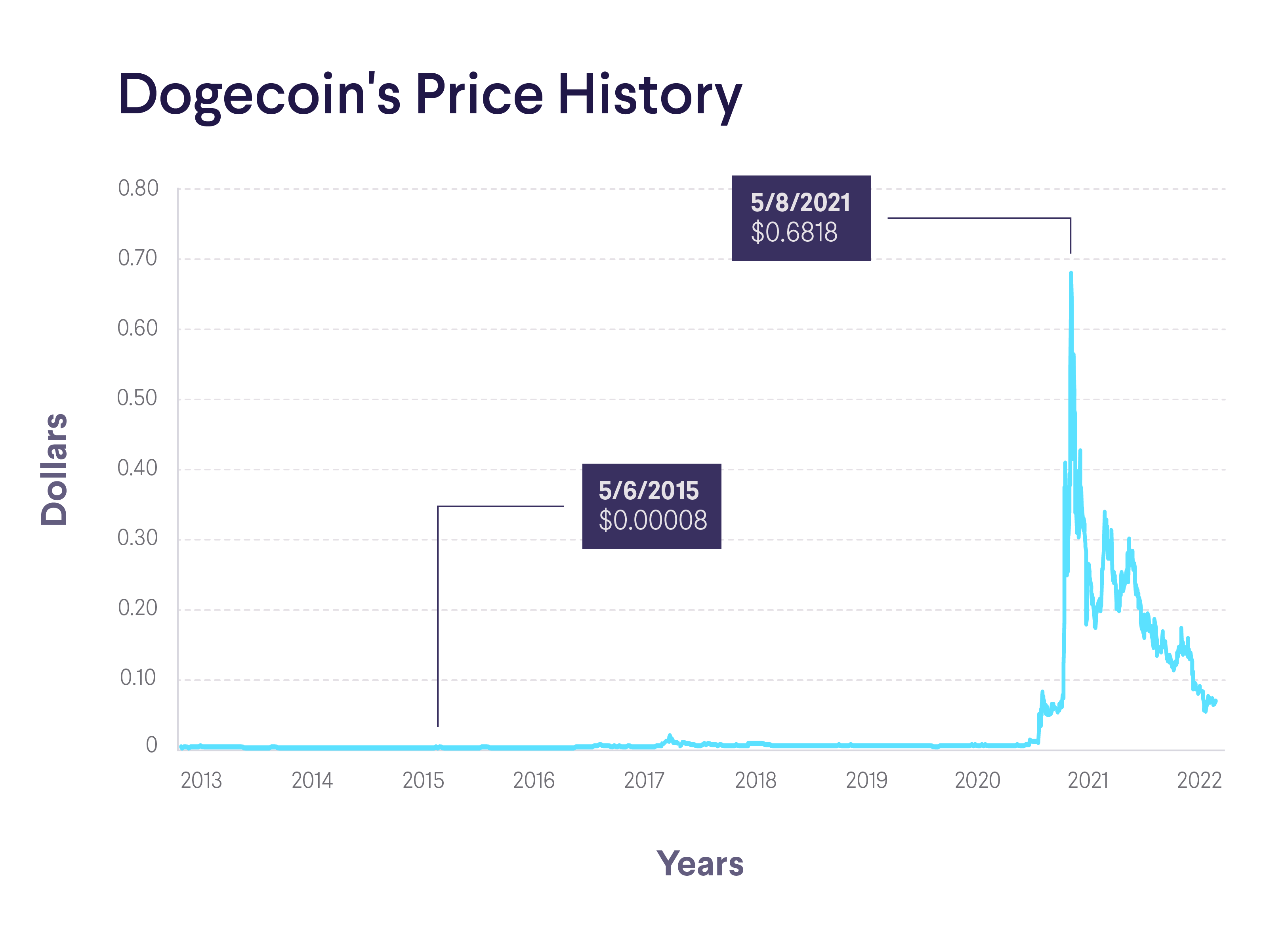

Thoroughly research before investing in either Tesla or Dogecoin. Understand the inherent risks involved. Dogecoin, in particular, is a highly volatile asset, and its price can fluctuate dramatically in short periods.

Conclusion

The recent decline in Tesla stock has undoubtedly had a noticeable impact on the Dogecoin market, highlighting the complex and interconnected nature of the financial world. While Elon Musk's influence and investor sentiment play significant roles, it's important to remember that many factors contribute to price fluctuations in both assets. By understanding the correlation, but not assuming causation, and employing sound investment strategies like diversification and risk management, investors can better navigate the volatility surrounding Tesla stock and its ripple effect on the Dogecoin market. Careful monitoring of both Tesla's financial performance and broader macroeconomic trends is crucial for anyone interested in investing in either Tesla stock or Dogecoin. Remember to always conduct thorough research and understand the inherent risks before making any investment decisions related to the Tesla stock decline and its impact on the Dogecoin market.

Featured Posts

-

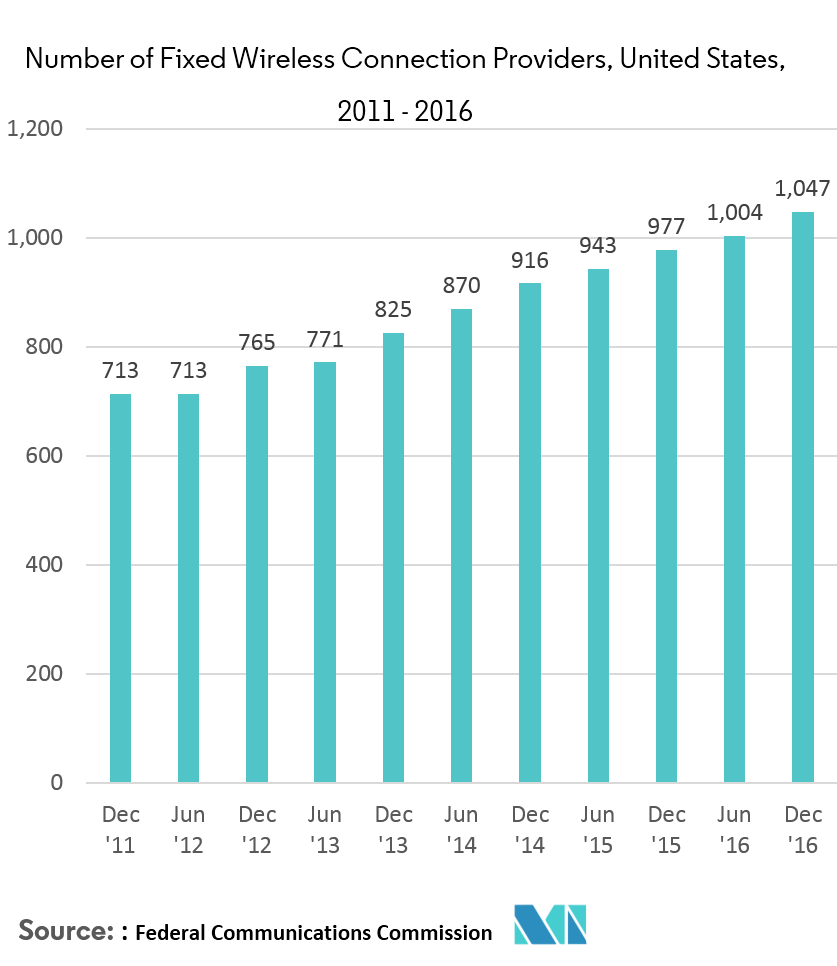

The Expanding Wireless Mesh Networks Market A 9 8 Cagr Forecast

May 09, 2025

The Expanding Wireless Mesh Networks Market A 9 8 Cagr Forecast

May 09, 2025 -

Blue Origin Rocket Launch Delayed Subsystem Issue Identified

May 09, 2025

Blue Origin Rocket Launch Delayed Subsystem Issue Identified

May 09, 2025 -

Nottingham Survivors First Accounts Of The Attacks

May 09, 2025

Nottingham Survivors First Accounts Of The Attacks

May 09, 2025 -

Increased English Language Requirement For Uk Immigration

May 09, 2025

Increased English Language Requirement For Uk Immigration

May 09, 2025 -

Is Franco Colapinto The Next Red Bull Star Liam Lawsons Position Under Scrutiny

May 09, 2025

Is Franco Colapinto The Next Red Bull Star Liam Lawsons Position Under Scrutiny

May 09, 2025