Record Low In Indonesia's Reserves: Rupiah Depreciation And Economic Implications

Table of Contents

Factors Contributing to the Record Low Reserves

Several interconnected factors have contributed to the decline in Indonesia's foreign exchange reserves and the weakening of the Rupiah.

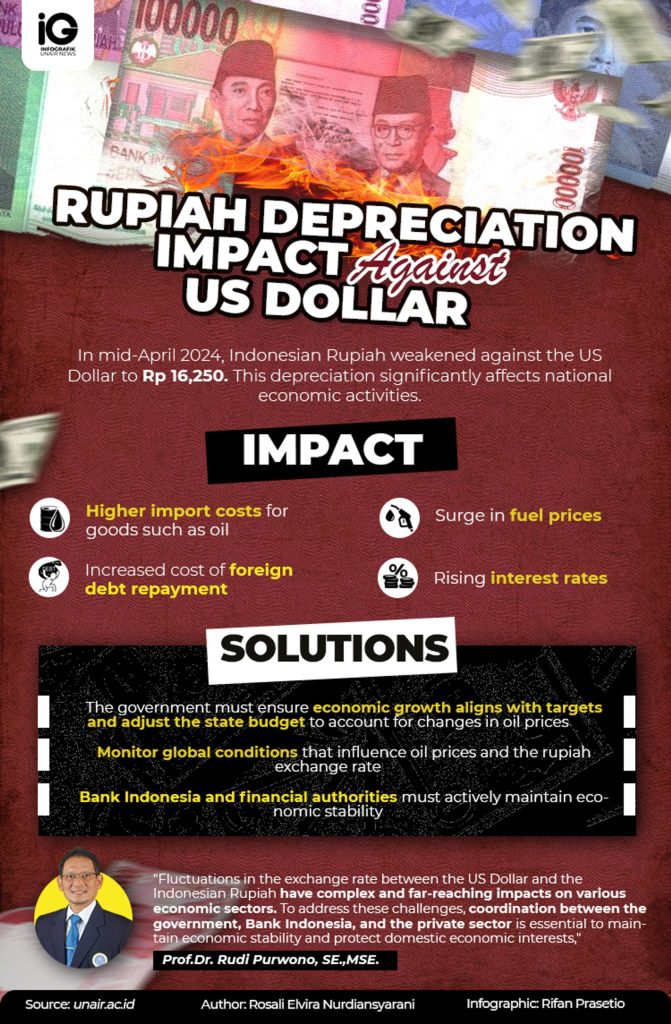

Weakening Rupiah

The Rupiah's depreciation is a primary driver of the low foreign currency reserves. Several factors are at play:

- Global Economic Slowdown: The global economic slowdown, marked by reduced demand for Indonesian exports and increased uncertainty in international markets, has negatively impacted the Rupiah. This decreased demand weakens the currency's value.

- Rising US Interest Rates: The increase in US interest rates makes US dollar-denominated assets more attractive to global investors, leading to capital flight from emerging markets like Indonesia and further depressing the Rupiah. This outflow of capital directly impacts foreign exchange reserves.

- Current Account Deficit: Indonesia's persistent current account deficit, where imports exceed exports, puts continuous pressure on the Rupiah. This imbalance necessitates using foreign exchange reserves to cover the shortfall.

Statistics show the Rupiah has significantly weakened against the US dollar and other major currencies in recent months. This decline is a major concern for Indonesia's economic stability.

- Increased import costs: A weaker Rupiah makes imports more expensive, increasing the cost of goods and services for Indonesian consumers and businesses.

- Reduced export competitiveness: Indonesian exports become less competitive on the global market, potentially hindering economic growth and further pressuring the current account balance.

- Capital flight: Investors may move their funds to other currencies, further reducing the demand for and value of the Rupiah.

Trade Deficit

Indonesia's widening trade deficit significantly contributes to the depletion of foreign exchange reserves. This imbalance arises from several factors:

- Rising energy import costs: Indonesia's reliance on energy imports, coupled with rising global energy prices, exacerbates the trade deficit. This necessitates increased spending in foreign currency, further depleting reserves.

- Dependence on commodity exports: Indonesia's economy remains heavily reliant on commodity exports, making it vulnerable to fluctuations in global commodity prices. A downturn in global demand for these commodities directly affects export earnings and the foreign exchange reserves.

- Lack of diversification: The lack of sufficient economic diversification limits Indonesia's ability to offset declines in specific sectors, leaving it vulnerable to external shocks.

Global Economic Uncertainty

Global economic uncertainty, including high inflation and geopolitical tensions, further impacts Indonesia's reserves.

- Uncertainty surrounding the global economy: The current global economic climate, marked by uncertainty and volatility, leads to increased risk aversion among investors. This makes them less willing to invest in emerging markets like Indonesia.

- Increased risk aversion: Investors, wary of geopolitical risks and global economic instability, are likely to withdraw investments from emerging markets, leading to capital flight and putting downward pressure on the Rupiah.

- Investor sentiment: Negative investor sentiment towards emerging markets, driven by global uncertainty, further contributes to capital outflow and weakens the Rupiah.

Economic Implications of Low Reserves and Rupiah Depreciation

The low foreign exchange reserves and the weakening Rupiah have far-reaching economic implications for Indonesia.

Inflationary Pressures

A weaker Rupiah directly contributes to inflationary pressures:

- Rising food and energy prices: The increased cost of imported food and energy products directly impacts consumer prices, leading to higher inflation.

- Reduced consumer spending: Higher prices reduce consumer purchasing power, leading to decreased consumer spending and potentially slowing down economic growth.

- Increased cost of living: The overall cost of living increases, impacting lower-income households disproportionately.

Impact on Investment

The weakening Rupiah negatively affects foreign direct investment (FDI):

- Reduced attractiveness of Indonesian assets: A weaker currency makes Indonesian assets less attractive to foreign investors, potentially leading to decreased FDI.

- Increased risk for foreign investors: Currency fluctuations introduce additional risk for foreign investors, making them more hesitant to commit capital.

- Potential capital outflow: Existing foreign investors might be incentivized to repatriate their investments, further depleting foreign exchange reserves.

Debt Servicing Challenges

The depreciation of the Rupiah increases the cost of servicing Indonesia's foreign currency debt:

- Increased cost of borrowing: Repaying foreign debt becomes more expensive as the Rupiah weakens, requiring more Rupiah to repay the same amount of foreign currency.

- Potential difficulties in repaying foreign debt: This could lead to difficulties in servicing existing debt obligations and potentially increase the risk of debt default.

- Credit rating downgrade risk: A persistent weakening of the Rupiah and low reserves could lead to credit rating downgrades, making it more expensive for Indonesia to borrow in the future.

Potential Solutions and Policy Responses

Addressing the current economic challenges requires a multi-pronged approach:

Strengthening Monetary Policy

Bank Indonesia plays a crucial role in managing the Rupiah and reserves:

- Interest rate adjustments: Raising interest rates can attract foreign investment and support the Rupiah, but this can also slow economic growth.

- Intervention in the foreign exchange market: Bank Indonesia may intervene in the foreign exchange market to manage the Rupiah's volatility, using its foreign exchange reserves to buy Rupiah and support its value.

- Strengthening financial regulations: Improved financial regulations can increase investor confidence and attract more foreign investment.

Fiscal Consolidation

Fiscal discipline and reducing the budget deficit are crucial:

- Tax reforms: Implementing effective tax reforms can boost government revenue and reduce reliance on foreign borrowing.

- Spending cuts: Careful management of government spending can reduce the budget deficit and free up resources for other priorities.

- Improved efficiency in government spending: Improving the efficiency of government spending can maximize the impact of public funds.

Diversifying the Economy

Reducing dependence on commodity exports is vital for long-term stability:

- Investment in infrastructure: Investing in infrastructure can boost other sectors of the economy, reducing reliance on commodities.

- Support for small and medium-sized enterprises (SMEs): SMEs can be a vital engine for economic diversification and job creation.

- Development of new industries: Promoting investment and growth in new industries can create a more resilient economy.

Conclusion

The record low in Indonesia's foreign exchange reserves, coupled with the depreciation of the Rupiah, presents a significant challenge to the Indonesian economy. The contributing factors are multifaceted, ranging from global economic uncertainty to Indonesia’s own trade deficit and reliance on commodity exports. The economic consequences are equally far-reaching, potentially leading to increased inflation, reduced investment, and difficulties in servicing foreign debt.

Addressing this situation requires a multi-pronged approach involving robust monetary policy, fiscal consolidation, and a concerted effort to diversify the Indonesian economy. Understanding the complexities of Indonesia's foreign exchange reserves and the implications of Rupiah depreciation is crucial for navigating this challenging period. Stay informed on the latest developments regarding Indonesia's foreign exchange reserves and the stability of the Rupiah to make informed decisions.

Featured Posts

-

The Debate Over Due Process Jeanine Pirros Position On El Salvador Prison Transfers For Americans

May 09, 2025

The Debate Over Due Process Jeanine Pirros Position On El Salvador Prison Transfers For Americans

May 09, 2025 -

Jayson Tatum Ankle Injury Updates On Celtics Stars Status

May 09, 2025

Jayson Tatum Ankle Injury Updates On Celtics Stars Status

May 09, 2025 -

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025 -

Dakota Johnson Paaiskinimas Del Kraujingu Plintos Nuotrauku

May 09, 2025

Dakota Johnson Paaiskinimas Del Kraujingu Plintos Nuotrauku

May 09, 2025 -

Netflix Predstoyasch Rimeyk Na Klasika Na Stivn King

May 09, 2025

Netflix Predstoyasch Rimeyk Na Klasika Na Stivn King

May 09, 2025