Recordati's Strategic Response To Tariff Fluctuations: Mergers And Acquisitions

Table of Contents

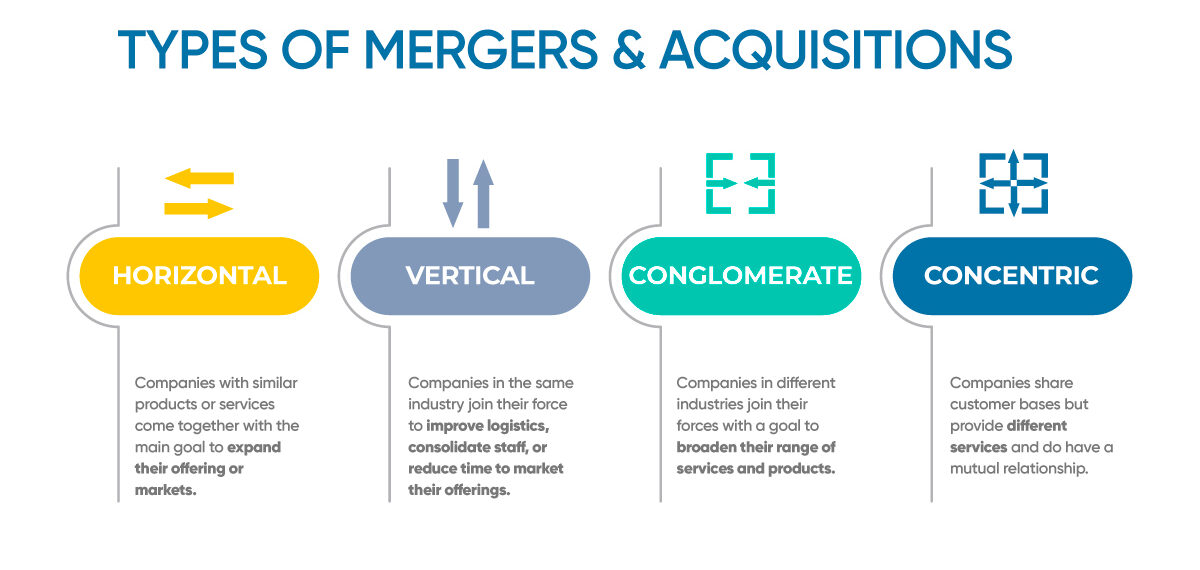

Recordati, a leading player in the pharmaceutical industry, faces the ever-present challenge of navigating the complexities of global trade and the unpredictable nature of tariff fluctuations. This article examines how Recordati has cleverly utilized mergers and acquisitions (M&A) as a strategic response to mitigate risks associated with these fluctuating tariffs and ensure sustained growth in a dynamic market environment. We will delve into the key drivers behind this successful strategy and analyze its effectiveness in building a resilient and competitive business model.

Mitigating Tariff Risks through Diversification

Recordati's M&A strategy hinges on diversification – both geographically and in its product portfolio – to lessen its vulnerability to the impact of fluctuating tariffs.

Geographic Diversification

Recordati's acquisitions have strategically expanded its geographic footprint, reducing its over-reliance on any single market susceptible to specific tariff policies.

- Reduced vulnerability to regional tariff changes: Acquisitions in diverse regions ensure that the impact of tariffs imposed in one area is significantly minimized. The company is not heavily reliant on a single region for revenue generation.

- Diversified import/export routes: A broader geographic reach allows Recordati to utilize a wider range of import and export routes, reducing dependence on any single, potentially tariff-affected pathway.

- Access to new markets and patients: Expansion into new markets through M&A grants access to previously untapped patient populations, offering significant growth opportunities and revenue streams less exposed to tariff volatility.

- Example: Recordati's acquisitions in emerging markets like [Region A – e.g., Latin America] and established markets like [Region B – e.g., Western Europe] exemplify its successful diversification strategy, creating a more resilient global presence.

Product Portfolio Diversification

Acquisitions have also broadened Recordati's product portfolio, reducing its dependence on specific products that might be significantly impacted by tariffs.

- Reduced vulnerability to tariff changes targeting specific drug classes: A diversified portfolio mitigates the risk of heavy losses resulting from tariffs focused on specific drug categories.

- Enhanced resilience to price pressures: A diverse product portfolio provides a buffer against price pressures and market fluctuations that might be triggered by tariff changes in specific areas.

- Increased revenue generation: Multiple product lines across different therapeutic areas ensure a more stable and robust revenue stream, less susceptible to fluctuations driven by tariff adjustments on individual products.

- Example: The acquisition of a company specializing in [Product Category A – e.g., cardiovascular drugs] complemented Recordati’s existing portfolio in [Product Category B – e.g., central nervous system drugs], creating a more resilient product mix.

Enhancing Competitive Advantage through Synergies

Beyond risk mitigation, Recordati's M&A strategy has created significant synergies that enhance its competitive advantage and further buffer against tariff impacts.

Operational Synergies

Mergers have enabled streamlined operations, substantial cost reductions, and increased efficiency, all of which mitigate the negative financial consequences of tariff increases.

- Economies of scale: Combining production facilities has resulted in economies of scale, leading to lower manufacturing costs per unit.

- Shared resources and expertise: Merged operations allow for the sharing of resources and expertise, streamlining processes and reducing operational overhead.

- Improved supply chain management and logistics: Integrating supply chains leads to greater efficiency and improved logistics, reducing vulnerability to disruptions caused by tariffs on specific import/export routes.

- Example: The consolidation of manufacturing facilities following the acquisition of [Company Name] allowed Recordati to achieve significant cost savings and operational efficiencies.

R&D Synergies

Combining research and development capabilities through M&A accelerates innovation and product development, creating new revenue streams less vulnerable to tariff-related disruptions.

- Access to new technologies and expertise: Acquisitions provide access to new technologies, scientific expertise, and innovative research methodologies.

- Faster development of new drugs: Combined R&D efforts allow for faster development timelines for new drugs and therapies, quickly bringing new revenue streams online.

- Reduced R&D costs: Sharing resources and facilities reduces overall R&D costs, increasing profitability and competitiveness.

- Example: Joint research projects following a merger resulted in the development of a novel drug with a unique mechanism of action, minimizing its susceptibility to tariff impacts.

Strategic Alignment and Long-Term Growth

Recordati's success in navigating tariff fluctuations through M&A is rooted in its strategic alignment and long-term vision.

Strategic Fit and Market Positioning

Recordati’s M&A strategy is characterized by the careful selection of target companies that strategically align with its overall business objectives, ensuring sustained long-term growth.

- Acquisition of companies with strong market positions: Recordati prioritizes acquiring companies with established market presence and significant growth potential in their respective therapeutic areas.

- Synergies creating enhanced market share: Strategic acquisitions lead to enhanced market share and a stronger competitive position, further insulating the company from tariff pressures.

- Alignment with long-term strategic vision: All acquisitions are carefully vetted to align with Recordati’s overarching strategic goals and long-term vision for growth and expansion.

- Example: The acquisition of [Company Name], a specialist in [Therapeutic Area], perfectly complemented Recordati's existing portfolio and enhanced its market leadership position.

Financial Strength and Due Diligence

The successful execution of Recordati's M&A strategy hinges on its robust financial strength and a rigorous due diligence process preceding each acquisition.

- Access to capital markets: Strong financial standing allows Recordati to readily access capital markets, facilitating strategic acquisitions.

- Thorough assessment of targets: A rigorous due diligence process ensures a thorough financial and operational assessment of potential acquisition targets, minimizing risks.

- Minimizing integration risks: Careful planning and execution minimize the integration risks associated with merging companies, ensuring a smooth transition and maximizing value creation.

- Example: Recordati's meticulous due diligence process, involving comprehensive financial modeling and operational assessments, significantly reduces the likelihood of post-acquisition challenges.

Conclusion

Recordati's strategic use of mergers and acquisitions as a response to tariff fluctuations represents a proactive and highly effective approach to mitigating risk and driving sustained growth in the pharmaceutical industry. Through geographic and product portfolio diversification, the realization of operational and R&D synergies, and the careful selection of acquisition targets, Recordati has crafted a more resilient and competitive business model. This case study provides invaluable insights for other companies seeking to navigate the challenges of global trade and leverage M&A strategies for long-term success. To further explore effective M&A strategies within the pharmaceutical sector and learn how to manage the complexities of global tariffs, we recommend further research into pharmaceutical industry mergers and acquisitions and their impact on global competitiveness.

Featured Posts

-

Canadian Dollar Exchange Rate The Minority Government Factor

Apr 30, 2025

Canadian Dollar Exchange Rate The Minority Government Factor

Apr 30, 2025 -

The Best Summer Slides Of 2025 A Buyers Review

Apr 30, 2025

The Best Summer Slides Of 2025 A Buyers Review

Apr 30, 2025 -

Bong Da Sinh Vien Tran Mo Man Chung Ket Hap Dan Khan Gia

Apr 30, 2025

Bong Da Sinh Vien Tran Mo Man Chung Ket Hap Dan Khan Gia

Apr 30, 2025 -

F 35 Inventory Shortfalls Key Findings From The Pentagons Audit

Apr 30, 2025

F 35 Inventory Shortfalls Key Findings From The Pentagons Audit

Apr 30, 2025 -

Beyonce En Jay Z Namen Geschrapt Uit Aanklacht Tegen Diddy

Apr 30, 2025

Beyonce En Jay Z Namen Geschrapt Uit Aanklacht Tegen Diddy

Apr 30, 2025

Latest Posts

-

Alteawn Khtt Mtynt Ltezyz Alslslt Almmyzt Dd Mnafst Alshbab

Apr 30, 2025

Alteawn Khtt Mtynt Ltezyz Alslslt Almmyzt Dd Mnafst Alshbab

Apr 30, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Nha Vo Dich Dau Tien Va Hanh Trinh Lich Su

Apr 30, 2025

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Nha Vo Dich Dau Tien Va Hanh Trinh Lich Su

Apr 30, 2025 -

Astratyjyt Alteawn Ltezyz Slslth Almmyzt Fy Mwajht Alshbab

Apr 30, 2025

Astratyjyt Alteawn Ltezyz Slslth Almmyzt Fy Mwajht Alshbab

Apr 30, 2025 -

Kham Pha Nha Vo Dich Dau Tien Giai Bong Da Thanh Nien Sinh Vien Quoc Te

Apr 30, 2025

Kham Pha Nha Vo Dich Dau Tien Giai Bong Da Thanh Nien Sinh Vien Quoc Te

Apr 30, 2025 -

Alteawn Yezz Slslt Mmyzth Dd Alshbab

Apr 30, 2025

Alteawn Yezz Slslt Mmyzth Dd Alshbab

Apr 30, 2025