Reduce Your Student Loan Burden: A Financial Planner's Recommendations

Table of Contents

Understanding Your Student Loan Landscape

Before you can effectively tackle your student loan debt, you need a clear understanding of your current situation. This involves identifying your loan types, interest rates, and calculating your total debt.

Identify Your Loan Types and Interest Rates

Knowing the specifics of your loans is crucial. Federal loans and private loans differ significantly in their terms and conditions. Federal loans, such as Stafford Loans (subsidized and unsubsidized), Perkins Loans, and Direct PLUS Loans, often come with more flexible repayment options and protections. Private student loans, on the other hand, are offered by banks and credit unions and typically have less favorable terms.

- Stafford Loans: Subsidized Stafford Loans don't accrue interest while you're in school, grace periods, or deferment. Unsubsidized Stafford Loans accrue interest during these periods.

- Perkins Loans: Federal loans with low interest rates, primarily for undergraduate students with exceptional financial need.

- Private Student Loans: Loans from banks or credit unions with varying interest rates and repayment terms.

Understanding your interest rates is vital because they directly impact the total amount you'll pay over the life of your loan. Interest capitalization, where accumulated interest is added to your principal balance, can significantly increase your overall debt. You can find detailed information about your federal student loans through the National Student Loan Data System (NSLDS).

Calculate Your Total Debt and Monthly Payments

Knowing your total student loan debt—including principal and accumulated interest—is the first step toward developing a repayment strategy. This gives you a clear picture of the challenge ahead.

- Gather your loan information: Collect statements from each lender detailing your loan balance, interest rate, and monthly payment.

- Calculate the total principal: Add up the principal balance of all your loans.

- Factor in accrued interest: Determine how much interest has already accrued on each loan. Add this to your total principal balance to get your total debt.

- Calculate your monthly payment: Use an online loan calculator to determine your current monthly payments for each loan. Sum these payments to find your total monthly student loan payment.

Many online loan calculators are available to simplify this process. Using these tools can provide a realistic view of your current financial situation, helping you to plan and prioritize your financial goals.

Strategies to Reduce Your Student Loan Burden

Now that you understand your student loan landscape, let's explore strategies to reduce your burden.

Refinance Your Student Loans

Refinancing your student loans involves replacing your existing loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total amount you pay over time. However, refinancing has drawbacks. You might lose access to federal student loan benefits, such as income-driven repayment plans and forgiveness programs.

- Eligibility: Your eligibility for refinancing depends on your credit score, debt-to-income ratio, and income.

- Finding a Lender: Shop around and compare offers from different lenders. Be wary of predatory lenders offering deceptively low rates with hidden fees.

- Risks: Carefully consider the terms and conditions before refinancing. Ensure you understand the implications of losing federal loan protections.

Explore Income-Driven Repayment Plans (IDRs)

Income-driven repayment plans adjust your monthly payments based on your income and family size. Several IDR plans are available, including ICR (Income-Contingent Repayment), PAYE (Pay As You Earn), REPAYE (Revised Pay As You Earn), and IBR (Income-Based Repayment). Each plan has its own eligibility requirements and repayment terms.

- Pros: Lower monthly payments, potentially leading to loan forgiveness after 20 or 25 years (depending on the plan).

- Cons: Longer repayment periods, potentially leading to paying more interest over the life of the loan.

It’s vital to research and compare these plans to find the one best suited to your individual circumstances. The official government websites provide detailed information on each plan.

Consider Student Loan Forgiveness Programs

While not a guaranteed solution, some professions qualify for student loan forgiveness programs. The Public Service Loan Forgiveness (PSLF) program, for example, forgives the remaining balance of your federal student loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Teacher Loan Forgiveness is another option available to teachers who meet specific requirements.

- Eligibility Requirements: Each program has strict eligibility requirements. Meeting these requirements requires careful planning and documentation.

- Application Process: The application process can be complex and time-consuming.

- Program Changes: Stay updated on any changes to these programs, as eligibility criteria and rules can change.

Budgeting and Debt Management Techniques

A realistic budget is essential for effectively managing your student loans. Prioritize loan repayment within your budget and explore debt management strategies.

- Create a Budget: Track your income and expenses to identify areas where you can cut back and allocate more funds towards loan repayment.

- Debt Management Strategies: Consider the debt snowball method (paying off the smallest debt first) or the debt avalanche method (paying off the debt with the highest interest rate first).

- Budgeting Apps: Use budgeting apps like Mint or YNAB (You Need A Budget) to track your spending and manage your finances.

Conclusion

Reducing your student loan burden requires a proactive approach. By understanding your loans, exploring refinancing options, considering income-driven repayment plans and forgiveness programs, and implementing effective budgeting techniques, you can take control of your financial future. Start reducing your student loan burden today by assessing your loan situation and exploring the repayment options available to you. Visit the official government websites for detailed information on federal student loan programs or contact a financial advisor for personalized guidance. Remember, proactive financial planning is key to achieving long-term financial stability.

Featured Posts

-

Crucial Foul Call Missed Nba Refs Admit Error In Knicks Pistons Game

May 17, 2025

Crucial Foul Call Missed Nba Refs Admit Error In Knicks Pistons Game

May 17, 2025 -

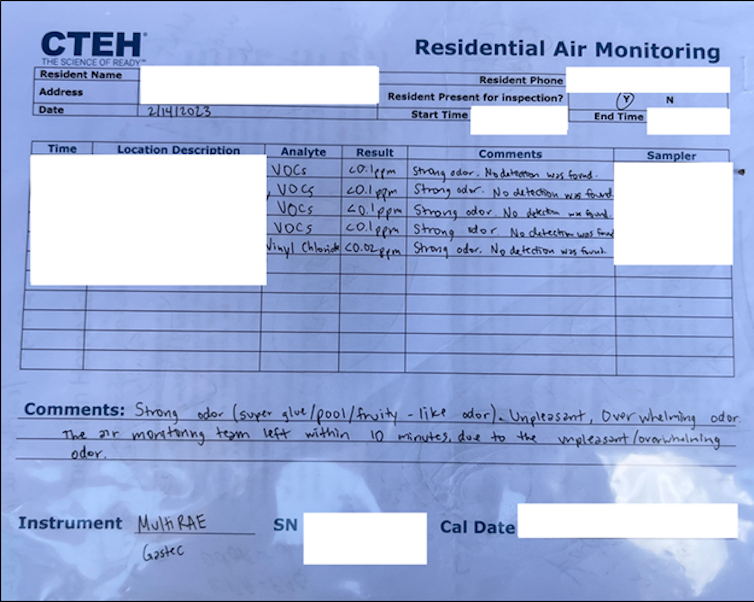

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 17, 2025

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 17, 2025 -

Giants Vs Mariners Key Injuries Impacting The Series April 4 6

May 17, 2025

Giants Vs Mariners Key Injuries Impacting The Series April 4 6

May 17, 2025 -

Find The Best Online Casino In Ontario Mirax Casinos Winning Strategy

May 17, 2025

Find The Best Online Casino In Ontario Mirax Casinos Winning Strategy

May 17, 2025 -

Japans Economic Slowdown First Quarter Results And Future Outlook

May 17, 2025

Japans Economic Slowdown First Quarter Results And Future Outlook

May 17, 2025

Latest Posts

-

Comparing Waymo And Ubers Autonomous Ride Services In Austin

May 17, 2025

Comparing Waymo And Ubers Autonomous Ride Services In Austin

May 17, 2025 -

Taking Your Pet On Uber In Mumbai Steps And Requirements

May 17, 2025

Taking Your Pet On Uber In Mumbai Steps And Requirements

May 17, 2025 -

Autonomous Vehicles Waymo And Ubers Austin Expansion

May 17, 2025

Autonomous Vehicles Waymo And Ubers Austin Expansion

May 17, 2025 -

Mumbai Uber New Pet Friendly Travel Options Explained

May 17, 2025

Mumbai Uber New Pet Friendly Travel Options Explained

May 17, 2025 -

The Future Of Ridesharing Waymo And Ubers Autonomous Vehicles In Austin

May 17, 2025

The Future Of Ridesharing Waymo And Ubers Autonomous Vehicles In Austin

May 17, 2025