Regulatory Relief Requested: Indian Insurers And Bond Forwards

Table of Contents

Current Regulatory Constraints Facing Indian Insurers in Bond Forwards

Indian insurers currently face a multitude of regulatory constraints that limit their involvement in the bond forwards market. These constraints significantly impact their ability to optimize investment strategies and contribute to the overall growth of the Indian bond market.

Capital Adequacy Ratio (CAR) Requirements

Current CAR regulations disproportionately impact insurers' ability to invest in bond forwards. The higher capital allocation required for bond forwards compared to other asset classes restricts investment capacity.

- Higher capital allocation: Insurers need to set aside a significantly larger portion of their capital for bond forward investments compared to traditional bond holdings, reducing their available capital for other potentially profitable ventures.

- Impact on profitability: The increased capital requirements directly impact profitability, potentially making bond forward investments less attractive compared to alternatives.

- Limitations on risk appetite: The stringent CAR requirements limit the risk appetite of insurers, restricting their ability to leverage the potential benefits of strategic bond forward trading.

Investment Restrictions

Specific restrictions on insurers' investment portfolios concerning derivatives, including bond forwards, further limit their participation. These restrictions are designed to mitigate risk, but they also hinder growth and diversification.

- Limits on exposure to specific instruments: Regulations often impose limits on the overall exposure to bond forwards and specific counterparties, restricting investment flexibility.

- Restrictions on counterparty risk: Concerns over counterparty risk lead to strict regulations on the types of entities insurers can engage with for bond forward transactions.

- Compliance burdens: The complex regulations surrounding bond forward investments create significant compliance burdens for insurers, demanding substantial resources for monitoring and reporting.

Lack of Clear Regulatory Framework

Ambiguities and inconsistencies in existing regulations regarding bond forwards and their interaction with insurance investments create uncertainty and risk aversion.

- Difficulty in interpreting rules: The lack of clear and concise guidelines makes it challenging for insurers to interpret and apply the regulations correctly.

- Inconsistencies between different regulatory bodies: Overlapping or conflicting regulations from different regulatory bodies add to the confusion and complexity.

- Uncertainty leading to risk aversion: The lack of clarity creates uncertainty, encouraging risk-averse behavior and limiting insurers' willingness to explore bond forward investment opportunities.

Reasons for Seeking Regulatory Relief

Indian insurers are seeking regulatory relief primarily to enhance portfolio diversification, improve investment returns, and contribute to broader economic growth.

Enhanced Portfolio Diversification

Access to the bond forwards market allows insurers to significantly enhance their portfolio diversification and improve risk management.

- Hedging interest rate risk: Bond forwards offer effective tools for hedging interest rate risk, protecting insurers from adverse movements in interest rates.

- Improving returns: Strategic use of bond forwards can potentially enhance overall portfolio returns, boosting profitability.

- Smoothing out investment performance: Bond forwards can help stabilize investment performance by providing a buffer against market volatility.

Improved Investment Returns

The strategic use of bond forwards offers the potential for higher investment returns compared to traditional fixed-income investments.

- Arbitrage opportunities: Bond forwards can create arbitrage opportunities, allowing insurers to profit from price discrepancies in different markets.

- Yield enhancement: Bond forwards provide the potential for yield enhancement, improving the overall return on investment.

- Potential for superior risk-adjusted returns: When implemented correctly, bond forwards can generate superior risk-adjusted returns compared to other asset classes.

Supporting Economic Growth

Increased insurer participation in the bond market can significantly benefit the broader Indian economy.

- Increased liquidity in the bond market: Greater insurer involvement would increase liquidity in the bond market, making it more efficient and attractive for borrowers.

- Lower borrowing costs for corporates: Increased liquidity would likely lead to lower borrowing costs for corporations, stimulating investment and economic activity.

- Stimulating investment: Improved access to capital through a more efficient bond market can stimulate investment across various sectors of the Indian economy.

Proposed Regulatory Changes and Their Potential Impact

The proposed regulatory changes aim to address the current constraints and unlock the full potential of bond forward investments for Indian insurers.

Relaxing CAR Requirements for Bond Forwards

Adjusting the CAR calculations for bond forwards is crucial for increasing participation.

- Lower capital charges for specific types of bond forwards: Differentiated capital charges based on the risk profile of specific bond forwards would reduce the capital burden for insurers.

- Risk-based capital allocation framework: Implementing a more sophisticated risk-based framework would allow for a more accurate assessment of capital needs.

- Potential for increased investment: Lower capital requirements would encourage greater investment in bond forwards, increasing market liquidity and efficiency.

Clarifying Investment Guidelines

Improving the regulatory framework is crucial for reducing ambiguity and simplifying compliance.

- Clearer definitions and classifications: Clearer definitions of bond forwards and related instruments would remove ambiguity and reduce confusion.

- Simplified compliance procedures: Streamlining compliance procedures would significantly reduce the administrative burden for insurers.

- Reduced ambiguity: A well-defined framework would reduce uncertainty, encouraging greater participation by insurers.

Strengthening Supervisory Oversight

Increased regulatory supervision is essential to mitigate potential risks associated with increased bond forward trading.

- Enhanced risk management frameworks: Stronger risk management frameworks would ensure that insurers have appropriate mechanisms in place to manage potential risks.

- Greater transparency: Increased transparency in reporting and disclosure requirements would enhance accountability and trust in the market.

- Effective monitoring of insurer activities: Robust monitoring and oversight by regulatory bodies would maintain the stability and integrity of the market.

Conclusion

The Indian insurance sector's request for regulatory relief concerning bond forwards is a critical step towards modernizing its investment strategies and contributing to the overall economic development of India. Easing current restrictions, clarifying regulations, and implementing a robust supervisory framework will enable insurers to effectively manage risk, diversify their portfolios, and achieve superior investment returns. This will not only benefit insurance companies but also contribute to a more dynamic and efficient bond market in India. Further dialogue and collaboration between regulators and the insurance industry are essential to implement effective measures addressing the concerns around Indian Insurers Bond Forwards. A clear roadmap is necessary to fully unlock the potential of this vital market segment. Let's work together to create a more supportive environment for Indian Insurers Bond Forwards.

Featured Posts

-

Investing In Palantir A Risk Assessment And Buying Guide

May 09, 2025

Investing In Palantir A Risk Assessment And Buying Guide

May 09, 2025 -

Wynne Evans And Girlfriend Liz Enjoy Cosy Day Date Amidst Bbc Meeting Postponement

May 09, 2025

Wynne Evans And Girlfriend Liz Enjoy Cosy Day Date Amidst Bbc Meeting Postponement

May 09, 2025 -

Is Doohan The Future For Williams Colapintos Influence Explained

May 09, 2025

Is Doohan The Future For Williams Colapintos Influence Explained

May 09, 2025 -

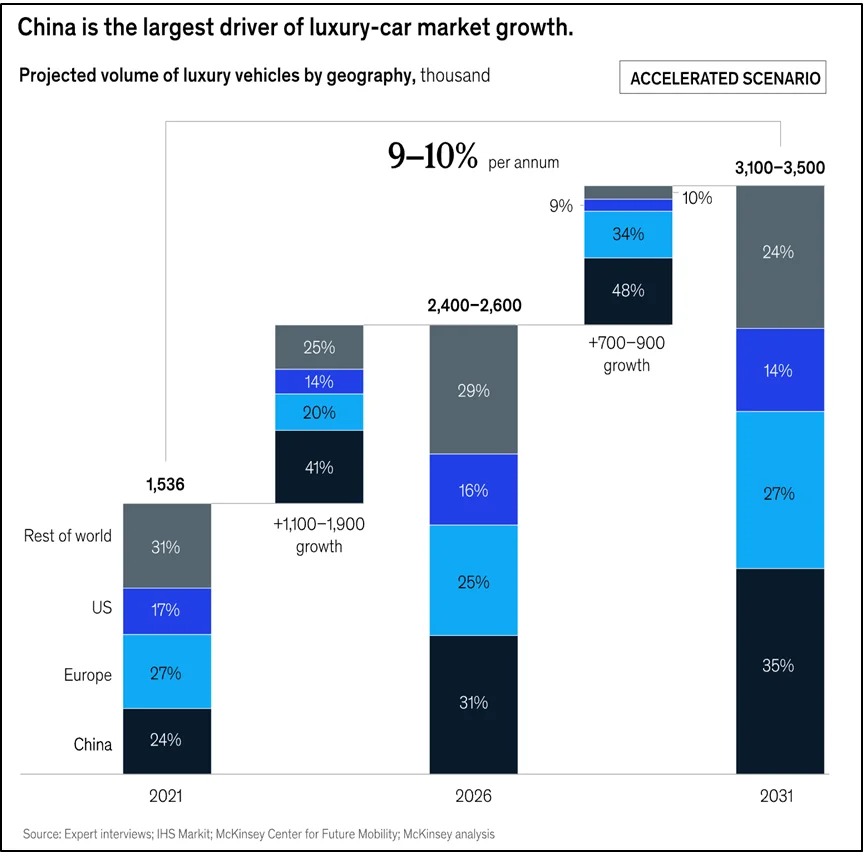

Are Bmw And Porsche Losing Ground In China A Market Analysis

May 09, 2025

Are Bmw And Porsche Losing Ground In China A Market Analysis

May 09, 2025 -

Kaitlin Olson And The Abc March 2025 Repeat Episodes A Deeper Look

May 09, 2025

Kaitlin Olson And The Abc March 2025 Repeat Episodes A Deeper Look

May 09, 2025