Reshaping India's Insurance Landscape: The Transformative Potential Of Ind AS 117

Table of Contents

Understanding Ind AS 117 and its Implications

Key Changes Introduced by Ind AS 117

Ind AS 117 represents a paradigm shift in insurance accounting. It moves away from the previous, often criticized, methods of recognizing, measuring, and presenting insurance contracts. The core change lies in how insurance liabilities are valued. Instead of simpler, potentially less realistic methods, Ind AS 117 mandates a more comprehensive approach, leading to a more accurate reflection of an insurer's financial position.

- Contractual Service Margin (CSM): This represents the insurer's expected profit margin from a contract over its lifetime, calculated based on the best estimate of future cash flows and risk adjustments. This is a key innovation, providing a more realistic view of profitability.

- Fulfillment Cash Flows: Ind AS 117 necessitates a detailed analysis of expected cash flows associated with fulfilling the insurance contract. This granular approach enhances the accuracy of liability valuation.

- Risk Adjustment: The standard incorporates a significant risk adjustment to reflect the uncertainties inherent in long-term insurance contracts. This adjustment accounts for the potential variability in future outcomes.

- Expected Credit Losses (ECL): Ind AS 117 requires insurers to estimate and account for potential losses arising from the failure of policyholders to pay premiums or the inability of reinsurers to meet their obligations.

Impact on Financial Reporting and Transparency

The adoption of Ind AS 117 significantly enhances the transparency and comparability of financial statements within the Indian insurance sector. This improved transparency allows investors to better understand the financial performance and risk profile of insurance companies, fostering more informed decision-making.

- Easier comparison across insurers: The standardized accounting approach facilitates a more accurate comparison of insurers' financial health and performance.

- Enhanced investor confidence: Improved transparency leads to increased trust and confidence among investors, attracting greater investment in the sector.

- Improved regulatory oversight: Regulators gain a clearer picture of the financial strength of insurance companies, enabling more effective supervision and risk management.

Challenges and Adaptations in Implementing Ind AS 117

Technological and Operational Challenges

Implementing Ind AS 117 presents considerable technological and operational challenges for Indian insurance companies. Upgrading existing IT infrastructure and systems to handle the complex calculations and data management requirements is crucial.

- System upgrades: Insurance companies need to invest heavily in new or upgraded software and systems capable of handling the intricate calculations mandated by Ind AS 117.

- Data migration: Migrating vast amounts of historical data to the new system is a major undertaking, requiring careful planning and execution.

- Actuarial expertise: The complex calculations and risk assessments inherent in Ind AS 117 require specialized actuarial expertise, which may be in short supply in some organizations.

Impact on Capital Requirements and Solvency

Ind AS 117's impact on capital adequacy ratios and solvency is a critical concern. The more realistic valuation of liabilities might lead to higher capital requirements for some insurers.

- Higher capital requirements: The increased accuracy in liability measurement may necessitate a larger capital buffer to meet solvency requirements.

- Potential impact on pricing: Changes in capital requirements might influence insurance pricing strategies, potentially affecting both policyholders and insurers.

- Changes in reinsurance strategies: Insurers may need to reassess their reinsurance strategies to manage the increased capital needs.

Opportunities Created by Ind AS 117

Enhanced Investor Confidence and Foreign Investment

The improved transparency and comparability achieved through Ind AS 117 are expected to attract significant foreign investment into the Indian insurance market.

- Attracting foreign capital: The increased confidence in the accuracy and reliability of financial reporting will entice global investors.

- Increased market efficiency: A more transparent and efficient market will foster greater competition and innovation.

- Improved reputation: The adoption of international best practices in accounting enhances the overall reputation of the Indian insurance sector globally.

Improved Risk Management and Corporate Governance

Ind AS 117's focus on comprehensive risk assessment and disclosure fosters improved risk management practices and stronger corporate governance.

- Improved risk assessment: The detailed analysis of risks associated with insurance contracts enables more robust risk management strategies.

- Better strategic decision-making: The enhanced transparency empowers insurers to make better-informed strategic decisions.

- Enhanced corporate governance: The increased accountability and transparency improve corporate governance within the insurance sector.

Conclusion

Ind AS 117 is a pivotal step in modernizing the Indian insurance sector. While its implementation presents significant challenges, the long-term benefits – increased investor confidence, improved risk management, and enhanced global competitiveness – are substantial. Successfully navigating the transition to Ind AS 117 requires proactive adaptation, investment in technology and expertise, and a commitment to robust corporate governance. Insurance companies must embrace this change, seeking professional guidance to effectively implement Ind AS 117 and unlock its transformative potential for success in the reformed Indian insurance market. Failing to address the complexities of Ind AS 117 could significantly hinder growth and competitiveness. Therefore, strategic planning and expert consultation concerning Ind AS 117 implementation are paramount.

Featured Posts

-

Ndukwe Shatters School Record Earns Pbc Tournament Mvp

May 15, 2025

Ndukwe Shatters School Record Earns Pbc Tournament Mvp

May 15, 2025 -

Toronto Maple Leafs On Verge Of Playoffs After Florida Game

May 15, 2025

Toronto Maple Leafs On Verge Of Playoffs After Florida Game

May 15, 2025 -

Nba And Nhl Playoff Betting Best Bets Round 2

May 15, 2025

Nba And Nhl Playoff Betting Best Bets Round 2

May 15, 2025 -

Hyeseong Kim Zyhir Hope Evan Phillips Bobby Miller The Future Of The Dodgers

May 15, 2025

Hyeseong Kim Zyhir Hope Evan Phillips Bobby Miller The Future Of The Dodgers

May 15, 2025 -

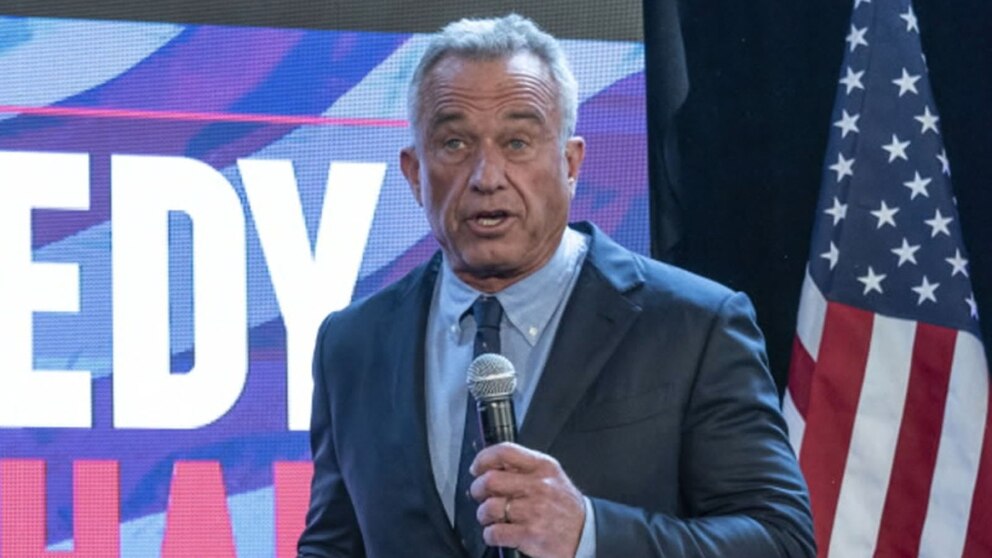

Rfk Jr S Family Swim In Bacteria Contaminated Rock Creek Park

May 15, 2025

Rfk Jr S Family Swim In Bacteria Contaminated Rock Creek Park

May 15, 2025