Retail Sales Growth: Implications For Bank Of Canada Interest Rates

Table of Contents

How Retail Sales Growth Impacts Inflation

Strong retail sales often indicate increased consumer spending and demand. This can lead to demand-pull inflation, pushing prices higher. The Bank of Canada monitors retail sales data closely as a key indicator of inflationary pressures. Understanding this relationship is key to predicting potential interest rate changes. The connection between consumer spending and inflation is complex but undeniable.

- Rising retail sales can signal overheating in the economy, necessitating interest rate hikes to cool down demand. When the economy grows too quickly, it can lead to shortages and increased prices across various goods and services. The Bank of Canada aims to prevent this through proactive monetary policy adjustments.

- Persistent high retail sales growth, coupled with rising inflation, forces the Bank of Canada to act proactively. The central bank's mandate includes price stability, and sustained high inflation erodes purchasing power. Retail sales data provides a crucial piece of the puzzle in assessing the severity of inflationary pressures.

- The Bank of Canada uses the Consumer Price Index (CPI) alongside retail sales data to gauge inflationary trends. The CPI measures changes in the price of a basket of consumer goods and services. Combining this data with retail sales figures gives a more comprehensive view of inflationary pressures and consumer behavior.

The Bank of Canada's Response to Retail Sales Trends

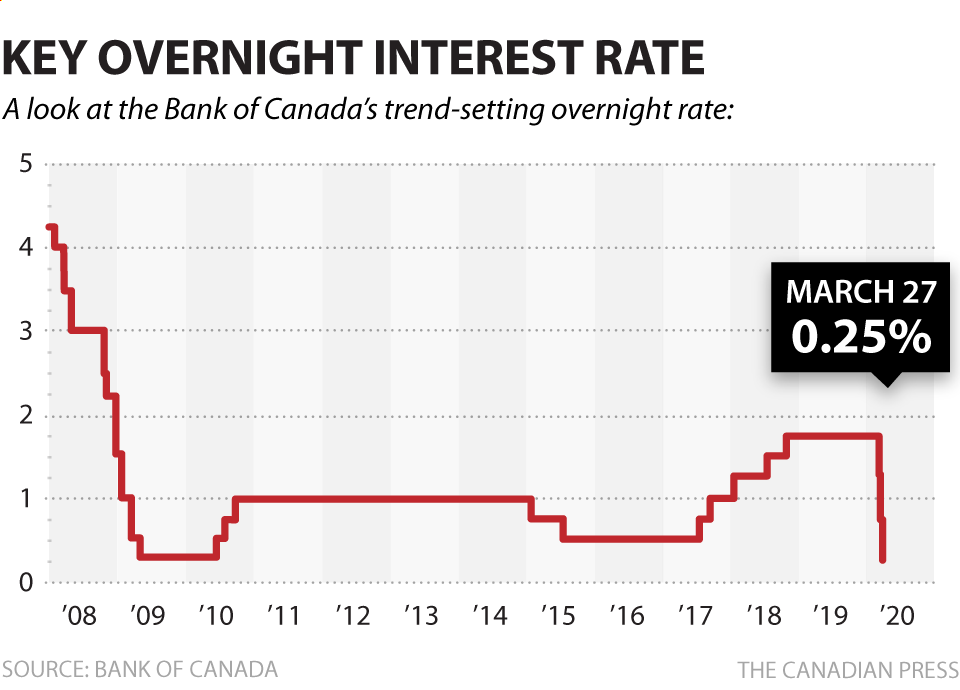

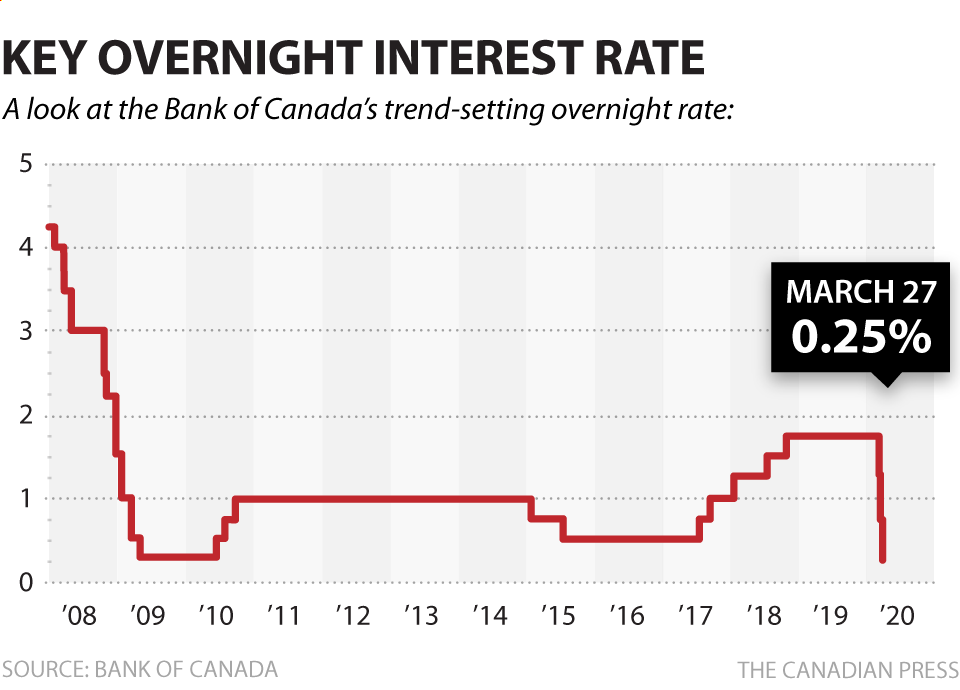

The Bank of Canada uses retail sales figures, alongside other economic indicators, to inform its monetary policy decisions. Strong retail sales might lead to interest rate hikes to curb inflation, while weak sales might prompt interest rate cuts to stimulate the economy. This reactive, yet data-driven, approach aims to maintain economic stability.

- Interest rate hikes aim to increase borrowing costs, reducing consumer spending and slowing down economic growth. Higher interest rates make borrowing more expensive, discouraging consumers from taking out loans for large purchases, thus reducing demand.

- Interest rate cuts aim to decrease borrowing costs, encouraging investment and consumer spending. Lower interest rates make borrowing cheaper, stimulating economic activity by encouraging businesses to invest and consumers to spend.

- The Bank of Canada's response is not solely based on retail sales but considers a range of factors including employment, housing market activity, and global economic conditions. Retail sales are just one piece of a larger economic puzzle. The central bank uses a multifaceted approach to inform its decision-making process.

Understanding the Lag Effect

Retail sales data is considered a lagging indicator; it reflects past economic activity rather than predicting future trends. This means the Bank of Canada's response might not be immediate. Understanding this lag is crucial in interpreting the data and anticipating future policy changes.

- The Bank must carefully analyze the data and consider other leading indicators to anticipate future economic shifts. Leading indicators, such as consumer confidence indices, can help predict future retail sales trends and inform more timely policy responses.

- The lag effect requires the Bank to anticipate future trends based on current data and expert analysis. The Bank's economists use sophisticated models and forecasting techniques to interpret the data and predict potential future economic scenarios.

Other Factors Influencing Interest Rate Decisions

While retail sales growth is significant, the Bank of Canada considers numerous other factors when setting interest rates. Global economic conditions, exchange rates, oil prices, and unemployment rates all play a crucial role in shaping monetary policy.

- Global economic uncertainty can impact Canadian consumer confidence and spending, influencing retail sales. External shocks, such as global recessions or geopolitical instability, can affect consumer sentiment and spending habits within Canada.

- Fluctuations in oil prices, a major export for Canada, affect economic growth and inflation. Changes in oil prices significantly impact Canada's economy, influencing inflation and overall economic performance.

- Unemployment figures provide insights into consumer spending potential and inflationary pressures. High unemployment can lead to reduced consumer spending and potentially deflationary pressures, while low unemployment can contribute to inflationary pressures.

Conclusion

Retail sales growth is a critical element influencing the Bank of Canada's interest rate decisions. While not the sole determinant, strong retail sales often correlate with inflationary pressures, potentially leading to interest rate hikes. Conversely, weak retail sales might prompt interest rate cuts to stimulate economic activity. Understanding the interplay between retail sales growth and the Bank of Canada's monetary policy is crucial for navigating the Canadian economic landscape. Stay informed about retail sales figures and their implications for retail sales growth and Bank of Canada interest rates to make informed financial decisions.

Featured Posts

-

Elever Des Enfants Avec De Grands Ecarts D Age Le Temoignage De Melanie Thierry Et Raphael

May 26, 2025

Elever Des Enfants Avec De Grands Ecarts D Age Le Temoignage De Melanie Thierry Et Raphael

May 26, 2025 -

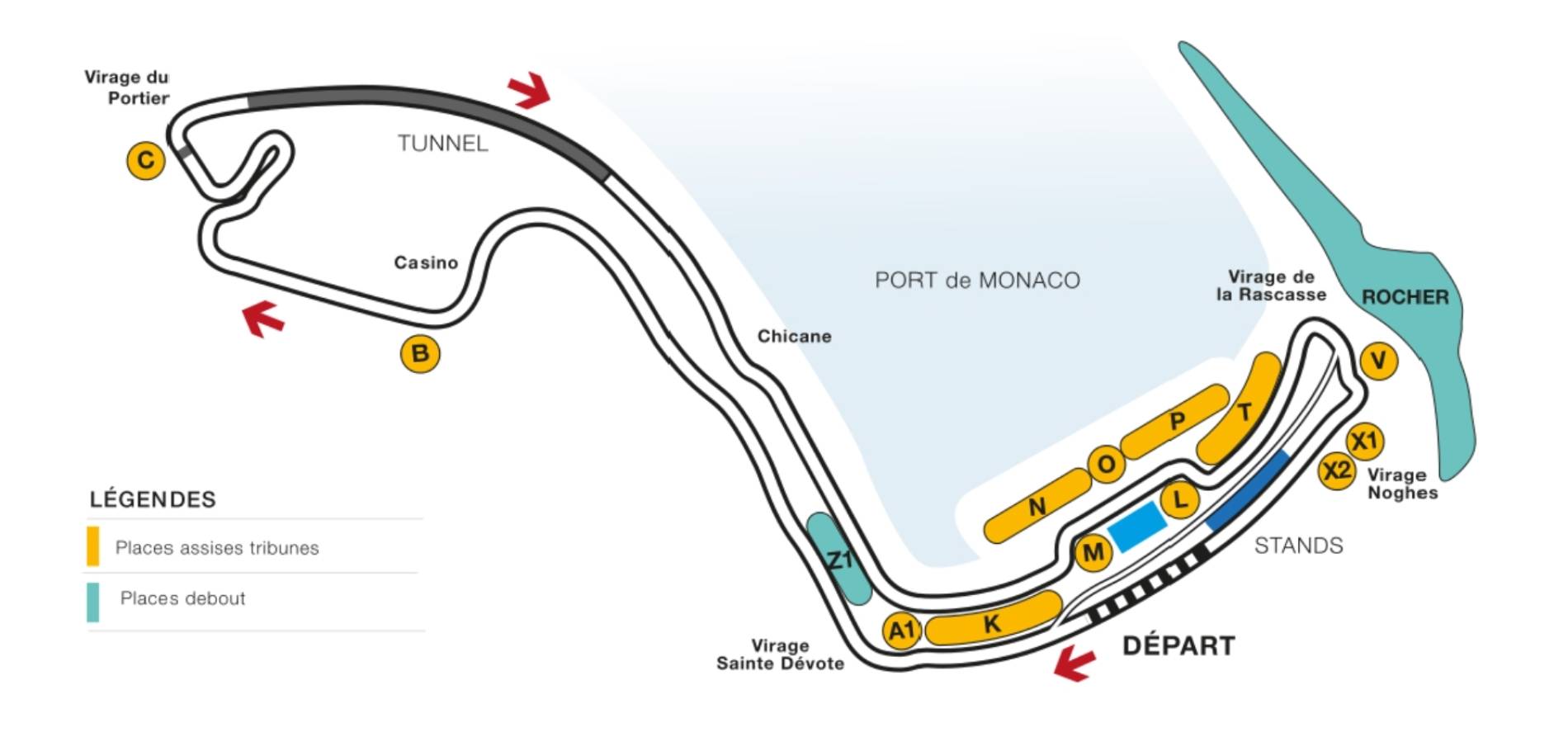

Monaco Grand Prix 2025 Your Complete Guide To Watching Live

May 26, 2025

Monaco Grand Prix 2025 Your Complete Guide To Watching Live

May 26, 2025 -

Todays Top Tv And Streaming Picks The Skinny Jab Revolution Black 47 And Roosters

May 26, 2025

Todays Top Tv And Streaming Picks The Skinny Jab Revolution Black 47 And Roosters

May 26, 2025 -

New York Rangers Fire Coach Peter Laviolette Post Playoff Dismissal

May 26, 2025

New York Rangers Fire Coach Peter Laviolette Post Playoff Dismissal

May 26, 2025 -

Neuer Injury Bayern Munich Goalkeeper Faces Setback Future Uncertain

May 26, 2025

Neuer Injury Bayern Munich Goalkeeper Faces Setback Future Uncertain

May 26, 2025

Latest Posts

-

Tottenham Target Ligue 1 Winger Confirmed Departure Fuels Transfer Race

May 28, 2025

Tottenham Target Ligue 1 Winger Confirmed Departure Fuels Transfer Race

May 28, 2025 -

Discover The Shop Where A Winning Lotto Ticket Was Sold Claim Your Fortune

May 28, 2025

Discover The Shop Where A Winning Lotto Ticket Was Sold Claim Your Fortune

May 28, 2025 -

Liverpool Transfer News Winger Targets And The Importance Of Salahs Contract

May 28, 2025

Liverpool Transfer News Winger Targets And The Importance Of Salahs Contract

May 28, 2025 -

Ligue 1 Starlet Arsenal And Newcastle In Transfer Pursuit

May 28, 2025

Ligue 1 Starlet Arsenal And Newcastle In Transfer Pursuit

May 28, 2025 -

Another Bid For Cherki Liverpool And Manchester Uniteds Transfer Plans

May 28, 2025

Another Bid For Cherki Liverpool And Manchester Uniteds Transfer Plans

May 28, 2025