Retirement Investment Strategy: Is This New Idea A Good Or Bad Choice?

Table of Contents

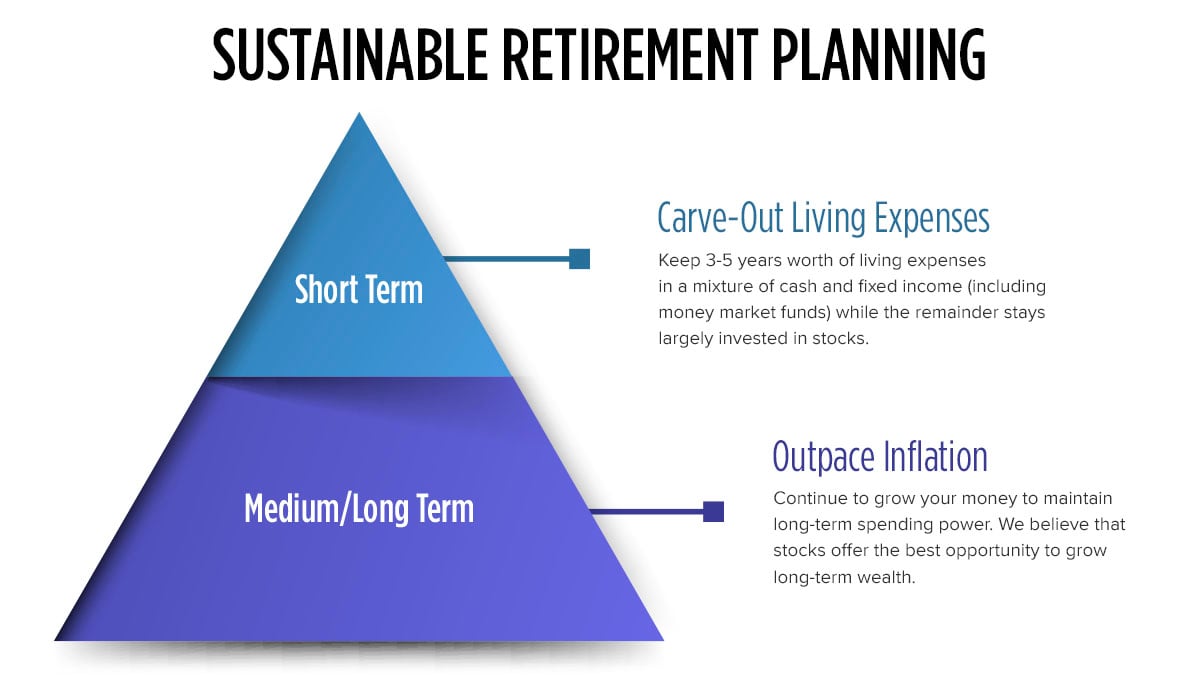

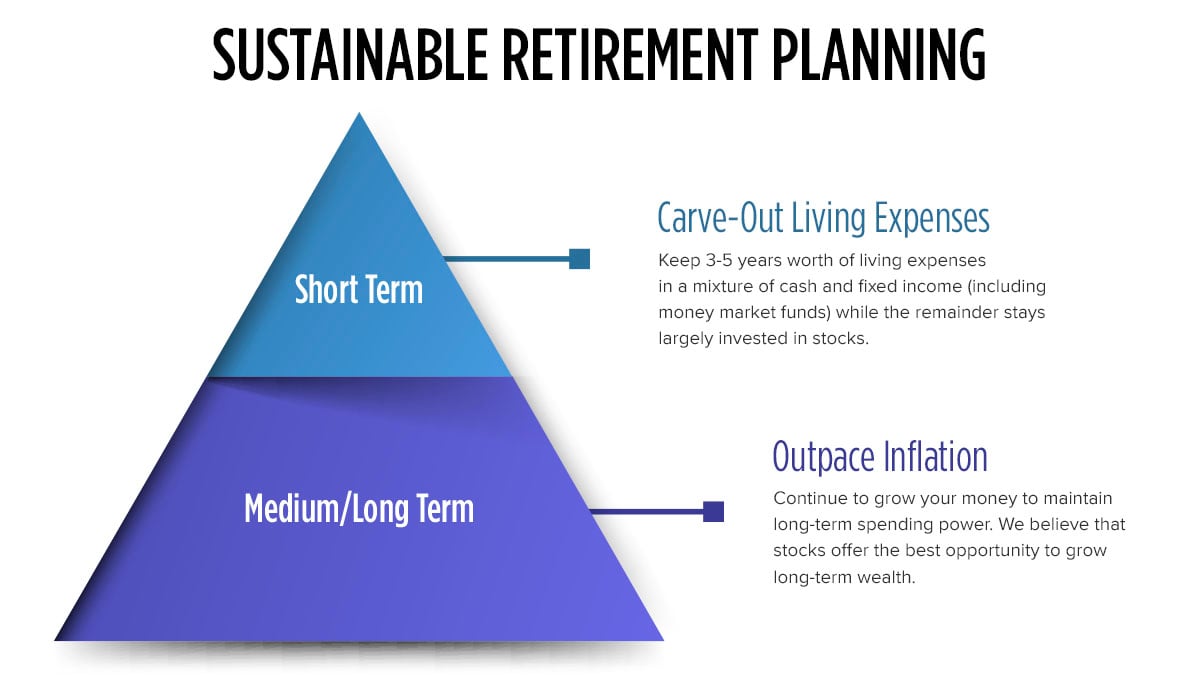

Understanding Your Retirement Goals and Risk Tolerance

Before diving into any specific investment, you must understand your retirement goals and risk tolerance. This crucial first step in your retirement planning lays the foundation for a successful strategy. A clear understanding of your personal circumstances will guide your investment choices and ensure they align with your long-term financial objectives.

- Define your retirement timeline: When do you plan to retire? This significantly impacts your investment choices; longer timelines allow for higher-risk, potentially higher-reward investments.

- Calculate your estimated retirement expenses: Consider housing, healthcare, travel, and everyday living costs. This calculation helps determine how much you need to save.

- Determine your comfort level with potential investment losses: Are you comfortable with the possibility of short-term losses in pursuit of long-term growth? This determines your appropriate risk level.

- Consider your current financial situation and assets: Assess your current savings, debts, and other assets to understand your starting point.

The New Investment Idea: A Detailed Analysis: Index Fund Investing

For this analysis, we'll examine index fund investing. Index funds are mutual funds or ETFs that track a specific market index, such as the S&P 500. They offer diversification by investing in a basket of companies, reducing the risk associated with investing in individual stocks.

- Mechanics: Index funds passively track an index, buying and selling shares to mirror its composition. This keeps management fees low compared to actively managed funds.

- Potential Returns: Historically, index funds have delivered competitive returns, often outperforming actively managed funds over the long term. However, past performance is not indicative of future results.

- Associated Risks: While diversification minimizes risk, index funds are still subject to market fluctuations. A significant market downturn will impact the value of your investment.

- Comparison to Traditional Options: Compared to individual stocks or bonds, index funds offer greater diversification at lower cost. They also provide a simpler way to invest compared to actively managed mutual funds that require expertise to select.

- Tax Implications: Capital gains taxes apply when you sell shares at a profit. However, many index funds minimize this by employing tax-efficient strategies.

Comparing the New Idea to Traditional Retirement Investment Strategies

Index fund investing can be compared to several traditional retirement investment strategies:

- 401(k)s and IRAs: These tax-advantaged accounts often offer index fund options as part of their investment menus. The tax benefits can significantly boost long-term returns.

- Roth IRAs: Similar to traditional IRAs, but contributions are made after tax, and withdrawals in retirement are tax-free. Index funds are a suitable investment for Roth IRAs.

- Pension Plans: These defined-benefit plans provide a guaranteed income stream in retirement, but they are becoming less common.

- Annuities: Annuities offer guaranteed income, but often come with higher fees and less flexibility than index funds.

Is Diversification Still Important?

Absolutely! Diversification remains a cornerstone of sound retirement investment strategy, regardless of whether you're using index funds. By spreading your investments across different asset classes (stocks, bonds, real estate, etc.), you reduce the impact of any single investment's poor performance on your overall portfolio. Even within index funds, consider diversifying across different market sectors or geographies.

Seeking Professional Financial Advice

While this article provides information on index fund investing, it's crucial to remember that every individual's financial situation is unique. Consulting with a qualified financial advisor is vital before making significant investment decisions, especially those concerning your retirement.

- Personalized Financial Advice: A financial advisor can help you create a personalized retirement plan tailored to your specific goals, timeline, and risk tolerance.

- Tailored Strategy: They'll consider your existing assets, debts, and income to develop a strategy that maximizes your retirement savings.

- Due Diligence: Thoroughly research and vet any financial advisor before entrusting them with your retirement planning.

Conclusion

Index fund investing offers a relatively low-cost, diversified approach to retirement planning, making it a potentially good choice for many. However, its success within your retirement investment strategy depends heavily on understanding your personal retirement goals, risk tolerance, and incorporating it into a well-diversified portfolio. Remember, seeking professional financial advice is essential. Don't rely solely on online articles; schedule a consultation with a financial advisor to create a personalized retirement investment strategy that aligns with your unique circumstances. Begin building your secure financial future today by carefully evaluating your options and taking proactive steps towards a comfortable retirement.

Featured Posts

-

Reddit Takes Action Addressing Upvotes For Violent Content

May 18, 2025

Reddit Takes Action Addressing Upvotes For Violent Content

May 18, 2025 -

Home Renovation Stress A House Therapist Can Help You Reclaim Your Peace

May 18, 2025

Home Renovation Stress A House Therapist Can Help You Reclaim Your Peace

May 18, 2025 -

Top New Music Releases This Week Featuring Ezra Furman Billy Nomates And Damiano David

May 18, 2025

Top New Music Releases This Week Featuring Ezra Furman Billy Nomates And Damiano David

May 18, 2025 -

Taran Killam Discusses His Relationship With Amanda Bynes

May 18, 2025

Taran Killam Discusses His Relationship With Amanda Bynes

May 18, 2025 -

Bowen Yang On Ego Nwodims Risque Snl Sketch No Fine Intended

May 18, 2025

Bowen Yang On Ego Nwodims Risque Snl Sketch No Fine Intended

May 18, 2025

Latest Posts

-

Post Only Fans Launch Amanda Bynes Spotted Out And About

May 18, 2025

Post Only Fans Launch Amanda Bynes Spotted Out And About

May 18, 2025 -

Amanda Bynes Seen With Friend After Only Fans Launch

May 18, 2025

Amanda Bynes Seen With Friend After Only Fans Launch

May 18, 2025 -

Amanda Bynes Steps Out New Only Fans Content Revealed

May 18, 2025

Amanda Bynes Steps Out New Only Fans Content Revealed

May 18, 2025 -

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025 -

Amanda Bynes Only Fans A Look At Her Recent Public Appearance

May 18, 2025

Amanda Bynes Only Fans A Look At Her Recent Public Appearance

May 18, 2025