Retirement Planning: Evaluating The Risks Of This New Investment

Table of Contents

Understanding Your Risk Tolerance in Retirement Planning

Before diving into any investment, assessing your individual risk profile is paramount. Your risk tolerance determines how much fluctuation you're comfortable with in your investments. This is crucial for successful retirement planning, as a poorly matched risk profile can lead to significant anxiety and potentially poor investment outcomes.

- Defining your risk tolerance: Are you a conservative, moderate, or aggressive investor? Conservative investors prioritize capital preservation, opting for lower-return, lower-risk investments. Moderate investors seek a balance between risk and return, while aggressive investors are willing to accept higher risk for potentially higher returns.

- Considering your time horizon: How many years do you have until retirement? A longer time horizon allows for greater risk-taking, as there's more time to recover from potential losses. Shorter time horizons usually necessitate a more conservative approach.

- Evaluating your current financial situation: Your current debt levels, savings, and emergency fund significantly impact your risk tolerance. High debt levels typically require a more conservative investment strategy.

- Understanding your emotional response: How do you react to market fluctuations? Understanding your emotional response to market volatility is crucial in determining your appropriate risk level. A risk tolerance questionnaire can help gauge this.

Many online questionnaires can help define your risk tolerance. These typically involve a series of questions about your investment goals, time horizon, and comfort level with potential losses. For example, a conservative investor might primarily invest in government bonds and certificates of deposit (CDs), while an aggressive investor might allocate a larger portion of their portfolio to stocks.

Identifying Potential Risks of New Investments in Retirement Planning

Newer investment strategies, while potentially offering higher returns, often carry elevated risks. Understanding these risks is critical for responsible retirement planning.

- Lack of historical data: New investment vehicles lack the long-term historical data necessary for accurate performance analysis. This makes predicting future returns challenging and increases uncertainty.

- Higher volatility: Newer investments tend to be more volatile than established ones, meaning their value can fluctuate significantly in shorter periods. This increased volatility can be particularly stressful for those nearing retirement.

- Regulatory changes: Regulatory landscapes are constantly evolving. Changes in regulations can significantly impact the performance and viability of newer investment products.

- Complexity and information scarcity: Many newer investments are complex and lack readily available, easily understood information. This makes due diligence more difficult and increases the risk of uninformed investment decisions.

- Counterparty risk: In alternative investments like private equity or hedge funds, counterparty risk – the risk that the other party in a transaction will default – is a significant concern.

For instance, certain cryptocurrencies have experienced extreme price volatility, presenting substantial risk for retirement investors. Similarly, some Fintech products, while innovative, might lack the established track record necessary to confidently assess their long-term viability for retirement planning. Thorough due diligence, including understanding the investment's underlying mechanics and associated risks, is crucial before committing funds.

Diversification Strategies for Retirement Planning Risk Mitigation

Diversification is a cornerstone of sound retirement planning. By spreading your investments across different asset classes, you can reduce the overall risk of your portfolio.

- Asset allocation: Allocate your investments across various asset classes like stocks, bonds, real estate, and alternative investments. The specific allocation will depend on your risk tolerance and time horizon.

- Geographic diversification: Don't put all your eggs in one geographical basket. Investing in different countries can mitigate the risk associated with regional economic downturns.

- Sector diversification: Diversify across different economic sectors to avoid overexposure to a single industry. This helps reduce the impact of sector-specific shocks.

- Reducing portfolio volatility: Diversification aims to smooth out the ups and downs of your portfolio, reducing overall volatility.

- Utilizing different investment vehicles: Employing various investment vehicles—mutual funds, ETFs, individual stocks, etc.—helps diversify your risk exposure.

A well-diversified portfolio for a conservative investor might consist primarily of bonds and low-risk stocks, while a more aggressive investor might include a larger allocation to higher-growth stocks and potentially alternative investments. The key is to find the right balance that aligns with your risk profile and retirement goals.

Seeking Professional Advice for Retirement Planning

While this article provides valuable information, seeking professional financial advice is strongly recommended. A qualified financial advisor can provide personalized guidance tailored to your specific circumstances.

- Qualified financial advisor: A financial advisor can help you assess your risk tolerance, create a personalized retirement plan, and select appropriate investments.

- Personalized plan: A financial advisor can help you develop a plan considering your goals, time horizon, and risk tolerance, ensuring alignment between your investments and your retirement aspirations.

- Portfolio reviews and adjustments: Regular portfolio reviews and adjustments are essential to adapt your investment strategy to changing market conditions and life circumstances.

- Unbiased information: Advisors provide unbiased information and guidance, helping you navigate the complexities of the investment world.

- Advisor qualifications and fees: It is important to carefully consider an advisor's qualifications, experience, and fee structure before engaging their services. Understand whether they are fee-only or commission-based advisors.

The difference between fee-only and commission-based advisors is significant. Fee-only advisors charge fees based on their services, while commission-based advisors earn commissions on the products they sell. Choosing a reputable financial advisor with a transparent fee structure is crucial for effective retirement planning.

Conclusion

Successfully navigating retirement planning requires a thorough understanding of potential risks, especially when considering newer investment options. By carefully assessing your risk tolerance, diversifying your portfolio, and seeking professional guidance, you can significantly improve your chances of achieving a secure and comfortable retirement. Remember, proactive and informed retirement planning is crucial for securing your financial future. Don't hesitate to consult with a financial advisor to develop a comprehensive retirement planning strategy tailored to your specific needs and risk profile. Start planning your retirement today!

Featured Posts

-

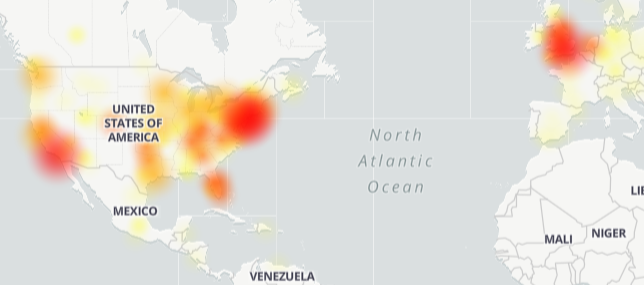

Global Reddit Outage Users Report Issues Accessing The Platform

May 18, 2025

Global Reddit Outage Users Report Issues Accessing The Platform

May 18, 2025 -

Boulder Countys Switzerland Trail A Mining History

May 18, 2025

Boulder Countys Switzerland Trail A Mining History

May 18, 2025 -

Kardashian And Censori New Alliance To Confront Kanye West

May 18, 2025

Kardashian And Censori New Alliance To Confront Kanye West

May 18, 2025 -

Report Canada Post Facing Bankruptcy Door To Door Mail Delivery Under Threat

May 18, 2025

Report Canada Post Facing Bankruptcy Door To Door Mail Delivery Under Threat

May 18, 2025 -

Inmate Escape Caught On Camera New Orleans Jail Video Released

May 18, 2025

Inmate Escape Caught On Camera New Orleans Jail Video Released

May 18, 2025

Latest Posts

-

Amanda Bynes Comeback A New Showbiz Project After 15 Years

May 18, 2025

Amanda Bynes Comeback A New Showbiz Project After 15 Years

May 18, 2025 -

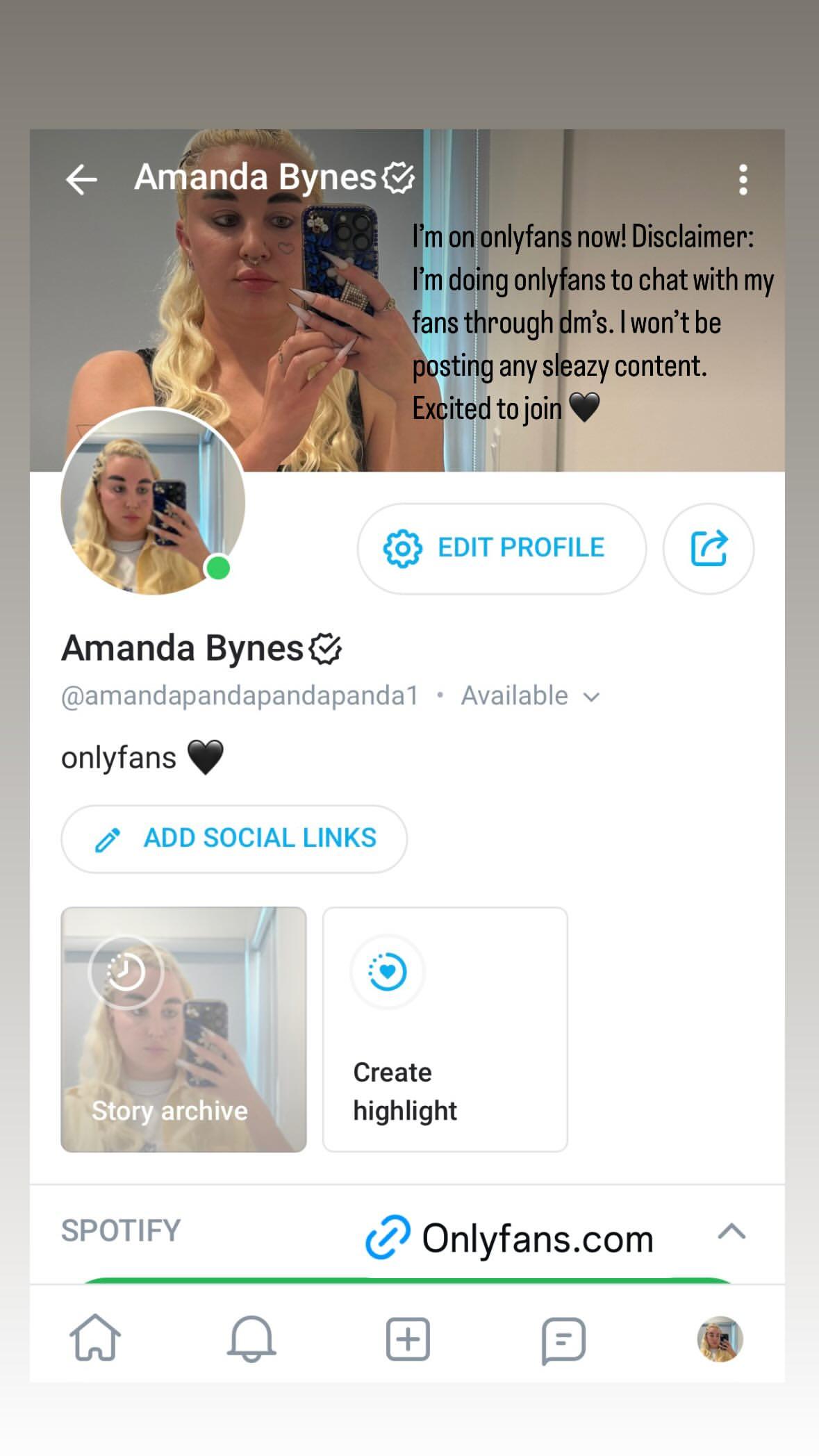

Amanda Bynes Launches Only Fans A New Chapter At 50 Month

May 18, 2025

Amanda Bynes Launches Only Fans A New Chapter At 50 Month

May 18, 2025 -

Amanda Bynes Only Fans 50 Monthly Subscription After 15 Year Acting Hiatus

May 18, 2025

Amanda Bynes Only Fans 50 Monthly Subscription After 15 Year Acting Hiatus

May 18, 2025 -

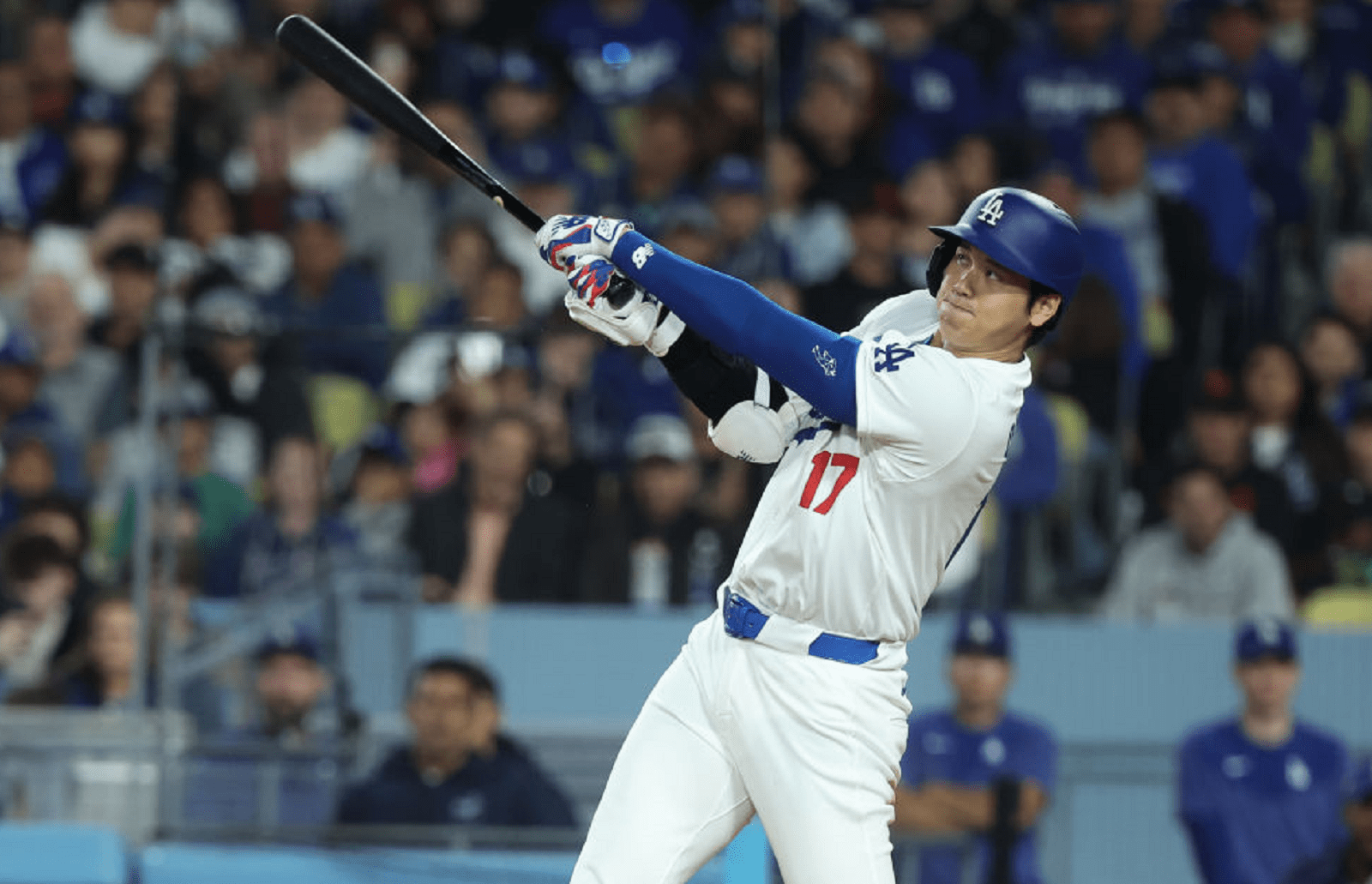

Dodgers Beat Mariners 6 4 Confortos First Home Run For La

May 18, 2025

Dodgers Beat Mariners 6 4 Confortos First Home Run For La

May 18, 2025 -

Confortos First Dodgers Home Run Powers 6 4 Win Over Mariners

May 18, 2025

Confortos First Dodgers Home Run Powers 6 4 Win Over Mariners

May 18, 2025