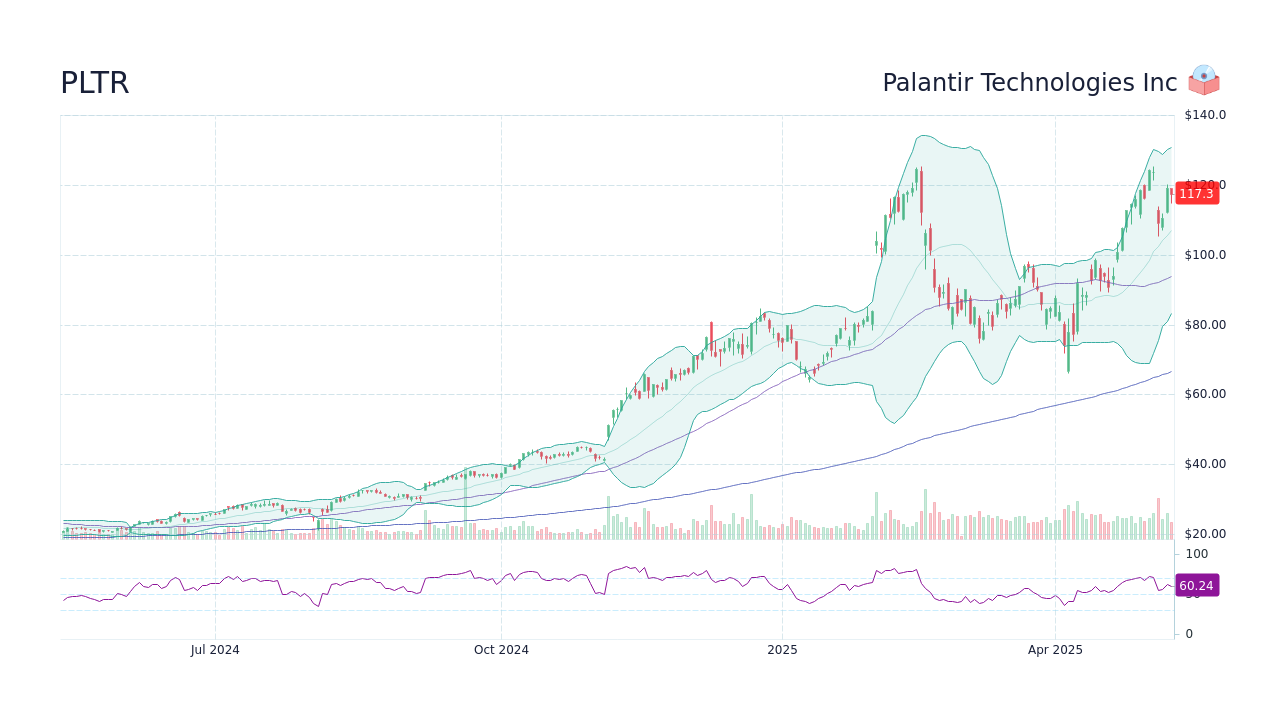

Revised Palantir Stock Predictions: Analyzing The Current Market Trend

Table of Contents

Recent Financial Performance and Key Metrics

Analyzing Palantir's financial health is paramount for accurate Palantir stock predictions. We'll examine key performance indicators (KPIs) to understand the company's current standing and future potential.

Revenue Growth and Profitability

Palantir's recent financial reports reveal a mixed bag. While revenue growth has been positive, profitability remains a key area of focus for investors. Analyzing quarterly reports helps build more informed Palantir stock predictions.

- Q[Insert Most Recent Quarter]: Revenue increased by [Insert Percentage]% compared to the previous quarter, reaching $[Insert Revenue Figure]. However, operating margins remained relatively flat at [Insert Percentage]%.

- Government vs. Commercial: Government contracts continue to be a significant revenue driver, accounting for [Insert Percentage]% of total revenue. Growth in commercial sales is crucial for long-term sustainability and accurate Palantir stock predictions. Increased diversification is key.

- Profitability Trends: While showing consistent revenue growth, profitability remains a challenge. The company's focus on scaling operations and achieving profitability will significantly influence future Palantir stock predictions.

Customer Acquisition and Retention

Palantir's ability to attract and retain clients is a significant factor in its future growth and, consequently, in reliable Palantir stock predictions.

- Key Customer Wins: Recent notable customer acquisitions include [List examples, if available, including industry and size of the client]. These wins demonstrate Palantir's expanding reach and market penetration.

- Customer Retention: The percentage of customers renewing contracts is [Insert Percentage]%, indicating a relatively strong level of customer satisfaction and loyalty. Long-term contracts provide revenue predictability, essential for accurate Palantir stock predictions.

- Customer Base Diversification: The diversity of Palantir's customer base across various sectors (government, commercial, etc.) mitigates risk and contributes to more stable future growth, impacting Palantir stock predictions positively.

Market Sentiment and Analyst Ratings

Understanding market sentiment and analyst opinions is crucial for forming realistic Palantir stock predictions.

Analyst Price Targets and Upgrades/Downgrades

Analyst ratings provide valuable insight into market expectations. However, it's crucial to remember that these are merely predictions and should be considered alongside other factors.

- Average Price Target: The average price target among leading financial analysts is currently $[Insert Average Price Target].

- Upgrades/Downgrades: Recent analyst actions include [List specific analyst firms, their actions (upgrade, downgrade, hold), and the rationale behind their decisions]. These changes reflect shifting market sentiment and contribute to the evolution of Palantir stock predictions.

- Rationale behind Predictions: Analysts’ predictions often incorporate assumptions about revenue growth, profitability, competition, and geopolitical factors. Understanding these assumptions is crucial for interpreting their forecasts and making informed Palantir stock predictions.

Investor Confidence and Trading Volume

Monitoring investor sentiment and trading volume provides additional context for Palantir stock predictions.

- Social Media Sentiment: Social media discussions surrounding Palantir exhibit [Describe the overall sentiment: positive, negative, neutral, etc.]. This can indicate a shift in investor confidence.

- Trading Volume: High trading volume suggests significant investor interest and potential volatility. Low volume can indicate a lack of interest or consolidation.

- Short Interest: The level of short interest in PLTR stock [Insert Percentage]% represents the proportion of shares bet against the company's success. This can impact price volatility and should be considered in Palantir stock predictions.

Factors Influencing Future Palantir Stock Price

Several factors beyond current financial performance influence future Palantir stock predictions.

Government Contracts and Geopolitical Events

Palantir's reliance on government contracts makes it susceptible to geopolitical events and shifts in government priorities.

- Geopolitical Risk: [Mention specific geopolitical events that could impact Palantir's contracts and revenue].

- Contract Diversification: The extent of Palantir's contract diversification across various government agencies and countries is vital to mitigating this risk and for more reliable Palantir stock predictions.

- Future Contract Awards: The success of future bids for government contracts will significantly impact the company’s growth trajectory and influence Palantir stock predictions.

Competition and Technological Advancements

The competitive landscape and technological advancements impact Palantir's long-term prospects and contribute to the overall uncertainty surrounding Palantir stock predictions.

- Key Competitors: Palantir faces competition from [List key competitors and their strengths and weaknesses].

- Technological Disruption: The potential for disruptive technologies to challenge Palantir's market position must be considered.

- R&D Investment: Palantir’s investment in research and development is vital for maintaining its competitive edge, and this should be considered when formulating accurate Palantir stock predictions.

Conclusion

Predicting Palantir's stock price requires a careful consideration of its financial performance, market sentiment, and external factors. While the company exhibits strong revenue growth, profitability and competition remain significant challenges. Geopolitical events and technological advancements introduce further uncertainty. Forming informed Palantir stock predictions requires a thorough analysis of these factors, along with a realistic assessment of the inherent risks and rewards. Therefore, before investing in Palantir, conduct thorough independent research and consider consulting a financial advisor. Only with meticulous due diligence can you make accurate Palantir stock predictions and investment decisions aligned with your risk tolerance. Remember, this information is for educational purposes and does not constitute financial advice.

Featured Posts

-

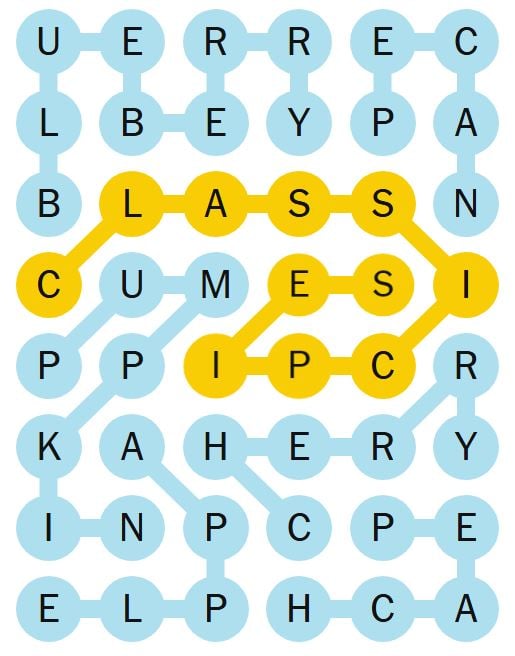

Nyt Spelling Bee April 9 2025 Complete Solution And Strategy Guide

May 09, 2025

Nyt Spelling Bee April 9 2025 Complete Solution And Strategy Guide

May 09, 2025 -

Stephen Kings Comments On The Stranger Things It Connection

May 09, 2025

Stephen Kings Comments On The Stranger Things It Connection

May 09, 2025 -

Eye Tooth Restaurant Finally Opens Anchorage Welcomes New Candle Studio Alaska Airlines Lounge And Korean Bbq

May 09, 2025

Eye Tooth Restaurant Finally Opens Anchorage Welcomes New Candle Studio Alaska Airlines Lounge And Korean Bbq

May 09, 2025 -

Nyt Strands Game 376 Hints And Solutions For Friday March 14

May 09, 2025

Nyt Strands Game 376 Hints And Solutions For Friday March 14

May 09, 2025 -

Maddie Mc Cann Polonesa Presa No Reino Unido Por Possivel Impostura

May 09, 2025

Maddie Mc Cann Polonesa Presa No Reino Unido Por Possivel Impostura

May 09, 2025