Riot Platforms, Inc.: Early Warning Report And Proxy Statement

Table of Contents

H2: Key Highlights from the Riot Platforms, Inc. Early Warning Report

Early warning reports, often filed with the Securities and Exchange Commission (SEC), alert investors to significant corporate developments. The Riot Platforms, Inc. Early Warning Report likely contains crucial information impacting its financial health and shareholder value. Let's delve into the key areas:

H3: Significant Events and Developments

The Early Warning Report may detail several material events. These could include:

- Acquisitions or Divestitures: The report might disclose the acquisition of new mining equipment, facilities, or even smaller mining companies, significantly impacting Riot's operational capacity and future Bitcoin production. Conversely, divestitures of assets could indicate a strategic shift.

- Litigation: Any ongoing or newly initiated legal battles could impact the company's financial position and reputation.

- Regulatory Changes: Changes in cryptocurrency regulations, particularly those affecting Bitcoin mining, could substantially influence Riot Platforms’ operations and profitability. This includes changes in energy policies, taxation, or environmental regulations.

- Significant Contracts: New contracts for electricity supply or equipment purchases could be highlighted, impacting operating costs and production capacity.

Access the official SEC filing for the complete details. [Insert Link to SEC Filing Here]

H3: Risk Factors and Challenges

The report will likely highlight several risk factors inherent to the Bitcoin mining business. These include:

- Bitcoin Price Volatility: The price of Bitcoin is highly volatile, directly impacting the value of Riot's holdings and revenue.

- Energy Costs: Bitcoin mining is energy-intensive. Fluctuations in electricity prices directly affect the profitability of mining operations.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, posing a significant risk to the industry as a whole.

- Hardware Obsolescence: Mining equipment has a limited lifespan. The cost of replacing outdated equipment can be substantial.

- Competition: The Bitcoin mining industry is becoming increasingly competitive.

Mitigation strategies mentioned in the report might focus on hedging against Bitcoin price volatility, securing long-term energy contracts at favorable rates, and proactive engagement with regulators.

H3: Financial Performance and Outlook

The Early Warning Report might provide an overview of Riot Platforms' financial performance, including:

- Mining Production: The amount of Bitcoin mined, usually expressed in Bitcoin or Bitcoin Hashrate.

- Operating Costs: Including electricity costs, personnel costs, and maintenance expenses.

- Revenue: Generated from Bitcoin mining and potentially other revenue streams.

- Profitability: Metrics such as gross profit margin and net income will highlight the financial health of the operation.

Comparisons with previous periods are crucial for identifying trends and assessing the company's overall performance. The report will likely also include the company’s projections for future Bitcoin production and profitability, offering a look into their strategic outlook.

H2: Understanding the Riot Platforms, Inc. Proxy Statement

The proxy statement provides information crucial for shareholders involved in company governance. It offers insights into leadership, strategy, and upcoming decisions.

H3: Shareholder Proposals and Voting Rights

The proxy statement will outline any shareholder proposals up for a vote. These proposals might concern:

- Environmental, Social, and Governance (ESG) initiatives: Proposals related to sustainability or corporate social responsibility.

- Executive compensation: Proposals regarding executive pay and benefits packages.

- Strategic direction: Proposals related to the company's future plans and investments.

Understanding these proposals and the company's response is crucial for shareholders to exercise their voting rights effectively.

H3: Executive Compensation and Board Composition

The proxy statement typically details:

- Executive compensation: Salaries, bonuses, stock options, and other benefits received by Riot Platforms' executives.

- Board of Directors composition: Backgrounds and expertise of board members. Potential conflicts of interest are also usually disclosed.

Analyzing this information helps assess the effectiveness of corporate governance and alignment of interests between management and shareholders.

H3: Upcoming Elections and Meetings

The proxy statement informs shareholders about:

- Shareholder meetings: Dates, location, and agenda of upcoming meetings.

- Board elections: Information on directors standing for reelection.

Understanding these details is vital for shareholders to participate effectively in company governance and exercise their voting rights.

3. Conclusion

The Riot Platforms, Inc. Early Warning Report and Proxy Statement provide critical information for making well-informed investment decisions. By carefully reviewing these documents, investors gain insights into the company's operational performance, financial health, strategic direction, and governance structure. Understanding the significant events, risk factors, financial performance, shareholder proposals, executive compensation, and upcoming meetings outlined in these filings is crucial. Staying informed about these crucial documents is essential for navigating the complexities of the cryptocurrency mining market. To obtain a complete picture of Riot Platforms' performance and strategy, carefully review the official Riot Platforms, Inc. Early Warning Report and Proxy Statement, available through the SEC's EDGAR database [Insert Link to SEC EDGAR database here]. Staying updated on future filings is also highly recommended for continued due diligence.

Featured Posts

-

Rsalt Eajlt Ila Slah Mn Jw 24 Twqf En Almkhatrt Bwdek

May 03, 2025

Rsalt Eajlt Ila Slah Mn Jw 24 Twqf En Almkhatrt Bwdek

May 03, 2025 -

Rashford To Aston Villa Souness Weighs In

May 03, 2025

Rashford To Aston Villa Souness Weighs In

May 03, 2025 -

End Of School Desegregation Order A Turning Point In Education Equity

May 03, 2025

End Of School Desegregation Order A Turning Point In Education Equity

May 03, 2025 -

Katapolemisi Tis Diafthoras Stis Poleodomies Bimata Gia Ena Dikaio Kai Diafanes Kratos

May 03, 2025

Katapolemisi Tis Diafthoras Stis Poleodomies Bimata Gia Ena Dikaio Kai Diafanes Kratos

May 03, 2025 -

Great Yarmouth Takes Center Stage Rupert Lowes Post Reform Focus

May 03, 2025

Great Yarmouth Takes Center Stage Rupert Lowes Post Reform Focus

May 03, 2025

Latest Posts

-

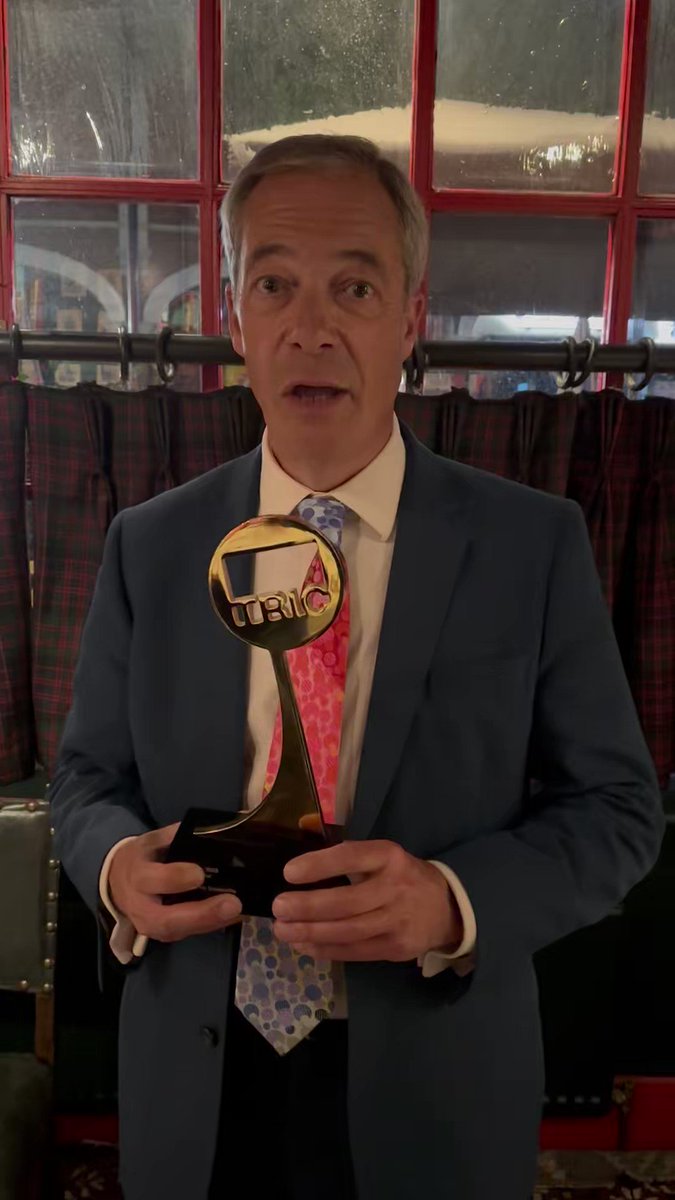

Nigel Farage Under Fire For Controversial Zelenskyy Comments

May 04, 2025

Nigel Farage Under Fire For Controversial Zelenskyy Comments

May 04, 2025 -

Press Conference An Account Of Nigel Farages Recent Event

May 04, 2025

Press Conference An Account Of Nigel Farages Recent Event

May 04, 2025 -

My Experience At Nigel Farages Press Conference

May 04, 2025

My Experience At Nigel Farages Press Conference

May 04, 2025 -

Inside Nigel Farages Press Conference A First Hand Report

May 04, 2025

Inside Nigel Farages Press Conference A First Hand Report

May 04, 2025 -

Holyrood Election 2024 Farages Unexpected Alliance With Snp

May 04, 2025

Holyrood Election 2024 Farages Unexpected Alliance With Snp

May 04, 2025