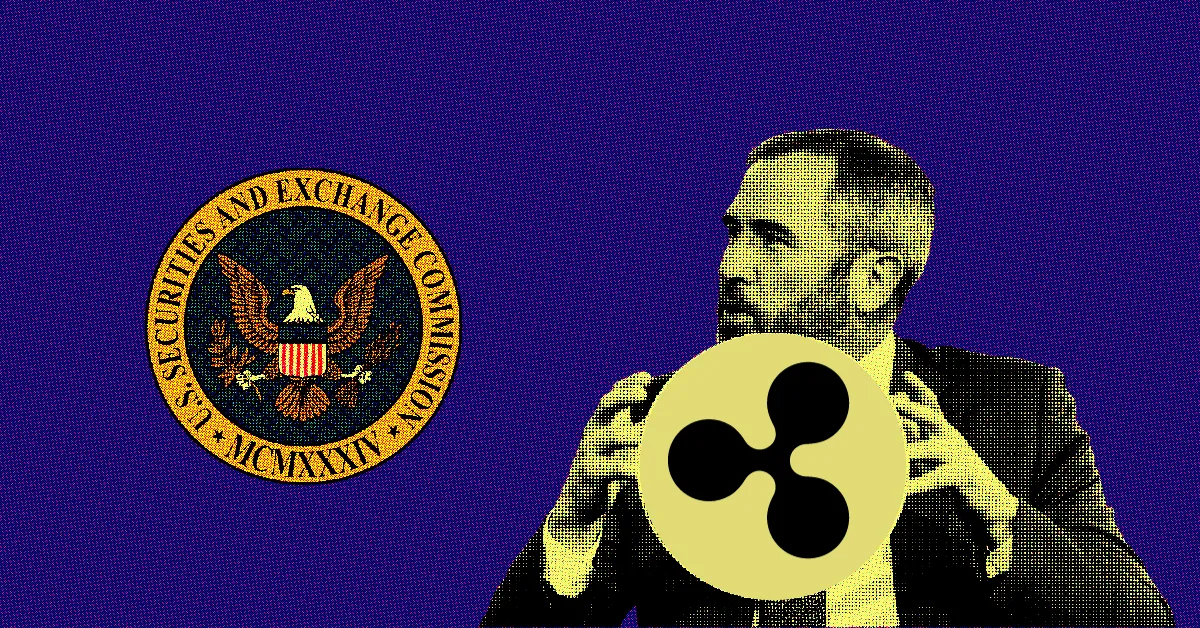

Ripple Vs. SEC: The Impact Of The Reduced $50M Settlement On XRP And The Crypto Market

Table of Contents

H2: The Ripple-SEC Lawsuit: A Brief Recap

The core of the Ripple vs. SEC lawsuit centers on the SEC's allegation that Ripple sold unregistered securities in the form of XRP, its native cryptocurrency. The SEC argued that Ripple's distribution of XRP constituted an ongoing securities offering, violating federal securities laws. This legal action, initiated in December 2020, has been closely followed by the crypto community and beyond.

Key events leading up to the settlement included numerous court filings, expert testimony, and procedural battles. The case hinged on the "Howey Test," a legal framework used to determine whether an investment contract qualifies as a security.

-

SEC's arguments: The SEC contended that XRP sales were unregistered securities offerings, citing Ripple's control over XRP's distribution and the expectation of profit by investors. They emphasized the centralized nature of XRP's creation and distribution compared to a decentralized cryptocurrency.

-

Ripple's defense: Ripple maintained that XRP is a digital asset or currency, not a security. They argued that most XRP sales were conducted on decentralized exchanges, outside their direct control, and that investors didn't have a reasonable expectation of profit based solely on Ripple's efforts.

-

Key court rulings and their significance: The court's rulings on various motions, particularly those regarding the classification of XRP sales on different exchanges, significantly shaped the trajectory of the case and ultimately influenced the settlement negotiations.

H2: The $50M Settlement: A Victory or a Compromise?

The final settlement, significantly reduced from potential penalties, saw Ripple pay $50 million without admitting or denying wrongdoing. This seemingly modest amount brings a definitive end to the SEC's lawsuit against Ripple. However, the implications are far-reaching.

For Ripple, the financial impact is relatively manageable, but the reputational damage has been considerable. The settlement avoids further costly and uncertain legal battles. However, it leaves the question of XRP's classification unresolved.

-

Ripple's perspective on the settlement: Ripple has framed the settlement as a strategic move to avoid further legal costs and uncertainties, allowing them to focus on future innovation and development.

-

SEC's perspective on the settlement: The SEC likely viewed the settlement as a significant win, achieving a financial penalty and setting a precedent for future enforcement actions against crypto projects.

-

Legal experts' opinions on the outcome: Legal experts are divided. Some see it as a victory for Ripple, avoiding a potentially devastating judgment. Others criticize it as a sign that even the SEC struggles to definitively regulate the crypto space.

H2: Impact on XRP Price and Market Sentiment

The Ripple-SEC lawsuit significantly impacted XRP's price. Initially, the price plummeted after the lawsuit's filing. The settlement announcement triggered a surge in XRP's price, though the long-term effects are still unfolding.

-

Price fluctuations before, during, and after the settlement: XRP's price experienced volatility throughout the legal battle, demonstrating the strong correlation between legal developments and market sentiment.

-

Trading volume changes: The trading volume of XRP increased significantly following major developments in the case, showcasing investor interest and market activity tied to the lawsuit's progress.

-

Investor confidence and future outlook: Investor confidence in XRP remains mixed. While the settlement removes a significant regulatory uncertainty, the lack of clear legal clarity on XRP's classification as a security or commodity remains a key concern.

H2: Broader Implications for the Crypto Market

The Ripple vs. SEC settlement holds significant implications for the broader crypto market. While it concludes a specific case, it provides little definitive regulatory clarity.

-

Potential impact on other cryptocurrencies facing similar regulatory scrutiny: The outcome may influence the strategies of other crypto projects facing similar regulatory challenges. Some may choose to engage in protracted legal battles, while others may opt for settlements to limit financial and reputational risks.

-

Influence on future SEC enforcement actions: The settlement's terms may set a precedent for future SEC enforcement actions against crypto projects, potentially impacting how the SEC approaches similar cases in the future.

-

Overall effect on investor confidence in the crypto market: The prolonged uncertainty and the relatively vague nature of the settlement may affect broader investor confidence in the cryptocurrency market, particularly for projects facing regulatory ambiguity.

H3: The Future of XRP and Regulatory Uncertainty

Despite the settlement, significant uncertainty surrounds XRP's regulatory status. The question of whether XRP is a security or a commodity remains open to interpretation.

-

Ongoing debates on XRP's classification as a security or a commodity: The debate about XRP's classification continues, with varied opinions from legal experts and within the crypto community.

-

Potential for further legal challenges: The possibility of future legal challenges, perhaps in different jurisdictions, remains a real possibility.

-

Impact of different jurisdictions' regulatory approaches to XRP: The regulatory landscape for cryptocurrencies varies internationally. How different jurisdictions classify and regulate XRP will significantly impact its future.

3. Conclusion:

The Ripple vs. SEC settlement, while concluding the lawsuit, leaves a lasting impact on XRP and the crypto market. The reduced $50 million penalty represents a complex outcome, neither a decisive victory nor a complete defeat for either party. The lack of a clear regulatory definition for XRP highlights the ongoing challenges in navigating the evolving regulatory landscape for cryptocurrencies. To understand the long-term implications, stay updated on the Ripple vs. SEC saga, monitor the impact of this settlement on XRP, and follow the evolving regulatory landscape for cryptocurrencies.

Featured Posts

-

Riot Platforms Inc Press Release Details On Early Warning Report And Proxy Waiver

May 02, 2025

Riot Platforms Inc Press Release Details On Early Warning Report And Proxy Waiver

May 02, 2025 -

Comparativo Melhores Mini Cameras Chaveiro Do Mercado

May 02, 2025

Comparativo Melhores Mini Cameras Chaveiro Do Mercado

May 02, 2025 -

Ananya Panday Celebrates Riots First Birthday With A Bone Shaped Cake

May 02, 2025

Ananya Panday Celebrates Riots First Birthday With A Bone Shaped Cake

May 02, 2025 -

Why Arent Nick Robinson And Emma Barnett Hosting Together On Radio 4

May 02, 2025

Why Arent Nick Robinson And Emma Barnett Hosting Together On Radio 4

May 02, 2025 -

Hollywood Stars Generous Donation Following Tata Steel Job Cuts

May 02, 2025

Hollywood Stars Generous Donation Following Tata Steel Job Cuts

May 02, 2025

Latest Posts

-

Farmings Future Can Reform Uk Be Trusted To Deliver

May 03, 2025

Farmings Future Can Reform Uk Be Trusted To Deliver

May 03, 2025 -

Is Reform Uk The Right Choice For Farmers Promises Vs Reality

May 03, 2025

Is Reform Uk The Right Choice For Farmers Promises Vs Reality

May 03, 2025 -

Can Reform Uk Deliver For Farming A Critical Analysis

May 03, 2025

Can Reform Uk Deliver For Farming A Critical Analysis

May 03, 2025 -

Reactions Des Partis Algeriens Pt Ffs Rcd Jil Jadid A La Reforme De La Loi

May 03, 2025

Reactions Des Partis Algeriens Pt Ffs Rcd Jil Jadid A La Reforme De La Loi

May 03, 2025 -

Farage Denies Far Right Claims Amidst Union Confrontation

May 03, 2025

Farage Denies Far Right Claims Amidst Union Confrontation

May 03, 2025