Ripple Vs SEC: XRP Price Action And The Future Of US Crypto ETFs

Table of Contents

Analyzing XRP Price Action During the Lawsuit

Pre-Lawsuit XRP Price and Market Sentiment

Before the SEC filed its lawsuit in December 2020, XRP was trading at a relatively stable price, hovering around $0.20-$0.30. Market sentiment towards XRP was generally positive, fueled by its adoption within Ripple's payment solutions and its position as a significant player in the cross-border payments market. Technical indicators, such as moving averages and relative strength index (RSI), showed a relatively stable trend, although volatility was still inherent to the cryptocurrency market.

- Price Range: $0.20 - $0.30 (approximate)

- Market Sentiment: Generally positive, driven by Ripple's adoption and cross-border payment solutions.

- Technical Indicators: Relatively stable, although volatility remained a characteristic of the crypto market.

Impact of the Lawsuit Filing on XRP Price

The SEC's lawsuit announcement immediately sent XRP's price plummeting. The uncertainty surrounding the legal battle and the potential classification of XRP as a security created significant volatility. Investor confidence was shaken, leading to widespread selling pressure. The price drop was substantial, highlighting the sensitivity of XRP's value to regulatory developments.

- Immediate Impact: Significant price drop upon lawsuit announcement.

- Volatility: Increased price fluctuations reflecting uncertainty and market speculation.

- Investor Confidence: A decline in confidence contributed to selling pressure and price drops.

XRP Price Fluctuations During Key Legal Developments

Throughout the lawsuit's progression, significant legal events have directly correlated with XRP's price movements. Positive developments, such as favorable court rulings or expert testimonies supporting Ripple's arguments, tended to boost the price. Conversely, negative developments, like unfavorable rulings or SEC counter-arguments, often led to price declines. Analyzing these price fluctuations alongside the unfolding legal battle provides valuable insights into market sentiment and the influence of regulatory uncertainty.

- Correlation: Strong correlation observed between legal developments and XRP's price.

- Visual Representation: Charts and graphs illustrating price reactions to key legal events are crucial for understanding market response.

- Key Events: Tracking specific filings, hearings, and expert testimony is essential for understanding price fluctuations.

Current XRP Price and Future Predictions

As of [insert current date], XRP's price is [insert current price]. Its position relative to other cryptocurrencies varies depending on market conditions. Predicting XRP's future price is inherently speculative, but several factors could influence its trajectory. The outcome of the Ripple vs SEC lawsuit is paramount, with a favorable ruling potentially leading to significant price appreciation. Broader market trends, such as overall cryptocurrency adoption and regulatory clarity, will also play a crucial role.

- Current Price: [Insert current XRP price and source].

- Factors influencing future price: Lawsuit outcome, broader market trends, and regulatory clarity are key factors.

- Expert Opinions: Consider different predictions from analysts and experts, acknowledging inherent uncertainty.

The Ripple vs SEC Case and its Influence on US Crypto ETF Approval

Regulatory Uncertainty and its Impact

The Ripple vs SEC lawsuit significantly exacerbates regulatory uncertainty in the US cryptocurrency market. This uncertainty makes it challenging for the SEC to approve crypto ETFs, as regulators are hesitant to approve products based on assets with unclear regulatory status. The lack of clear guidelines regarding the classification of crypto assets as securities or commodities creates a significant hurdle for ETF applications.

- Uncertainty: The lawsuit fuels a lack of clear regulatory guidelines for cryptocurrencies.

- ETF Approval: Regulatory uncertainty creates significant obstacles to crypto ETF approval.

- Classification: The SEC's difficulty in classifying crypto assets hinders the ETF approval process.

The SEC's Stance on Crypto Assets and ETFs

The SEC has historically shown reluctance to approve crypto ETFs, citing concerns about market manipulation, investor protection, and the lack of regulatory frameworks for underlying crypto assets. The SEC has rejected numerous crypto ETF applications, often emphasizing these concerns in their decisions. These rejections underscore the significant challenges facing the approval of crypto ETFs in the US.

- SEC Concerns: Market manipulation, investor protection, and lack of regulatory frameworks are key concerns.

- Previous Rejections: Analyze past SEC rejections of crypto ETF applications and their reasoning.

- Factors Considered: Examine the criteria used by the SEC when reviewing ETF applications.

Potential Outcomes of the Ripple Case and their Implications for ETFs

The Ripple vs SEC case could have several outcomes: Ripple could win, the SEC could win, or a settlement could be reached. Each outcome carries different implications for the likelihood of future crypto ETF approvals. A Ripple victory could potentially pave the way for greater regulatory clarity and increase the chances of ETF approvals. Conversely, an SEC victory might solidify the regulatory uncertainty and hinder ETF approvals. A settlement could offer a mixed result, depending on its terms.

- Potential Outcomes: Ripple victory, SEC victory, or settlement.

- Implications for ETFs: Analyze how each outcome could impact the approval process for crypto ETFs.

- Regulatory Landscape: The case's outcome will significantly influence the overall regulatory landscape for digital assets.

Investing in XRP and Crypto ETFs: Risks and Opportunities

Risk Assessment for XRP Investment

Investing in XRP carries significant risks, especially given the ongoing legal uncertainty surrounding the Ripple vs SEC lawsuit. The cryptocurrency market is inherently volatile, and XRP's price can fluctuate dramatically based on legal developments and market sentiment. Thorough research and due diligence are crucial before investing in XRP or any other cryptocurrency.

- High Volatility: XRP's price is highly sensitive to legal developments and market sentiment.

- Regulatory Uncertainty: The lawsuit adds another layer of risk to XRP investments.

- Due Diligence: Thorough research is essential before investing in any cryptocurrency.

Potential Benefits of XRP Investment

Despite the risks, XRP investment offers potential benefits. Its utility within the Ripple ecosystem for cross-border payments could drive future growth. The potential for high returns, although accompanied by high risk, attracts investors. Its role in facilitating international transactions provides a potential long-term growth driver.

- Utility and Adoption: XRP's use in Ripple's payment network offers a potential growth driver.

- Potential Returns: The potential for high returns exists, but high risk must be considered.

- Long-Term Growth: Consider the long-term potential of XRP within the broader cryptocurrency ecosystem.

Investing in Crypto ETFs vs. Direct XRP Investment

Investing in crypto ETFs offers diversification compared to direct XRP investment. ETFs spread risk across various cryptocurrencies, reducing the impact of any single asset's price fluctuations. However, ETFs also come with management fees. Direct XRP investment offers potentially higher returns but carries higher risk. The choice depends on individual risk tolerance and investment goals.

- Diversification: ETFs offer diversification, mitigating the risk associated with individual cryptocurrencies.

- Risk Tolerance: Direct investment offers higher risk and potential returns.

- Management Fees: ETFs incur management fees, impacting overall returns.

Conclusion: The Ripple vs SEC Case: Shaping the Future of XRP and US Crypto ETFs

The Ripple vs SEC lawsuit has profoundly impacted XRP's price action and significantly influences the future of US crypto ETFs. The outcome of this case will have far-reaching consequences for the cryptocurrency market's regulatory landscape. Staying informed about legal developments and their implications is critical for investors. Conduct thorough research, understand the risks involved, and make informed investment decisions based on your own risk tolerance and research. Continue following the "Ripple vs SEC" case for updates that will shape the future of XRP and the potential for US crypto ETF approval.

Featured Posts

-

Frances Six Nations Dominance Ireland Next In Line

May 01, 2025

Frances Six Nations Dominance Ireland Next In Line

May 01, 2025 -

Kort Geding Gemeente Kampen Eist Stroomnetaansluiting Van Enexis

May 01, 2025

Kort Geding Gemeente Kampen Eist Stroomnetaansluiting Van Enexis

May 01, 2025 -

Nikki Burdines Departure From Nashvilles News 2 Morning Show Confirmed

May 01, 2025

Nikki Burdines Departure From Nashvilles News 2 Morning Show Confirmed

May 01, 2025 -

Windstar Cruises A Foodies Voyage

May 01, 2025

Windstar Cruises A Foodies Voyage

May 01, 2025 -

Xrp Price Prediction Will Xrp Hit 10 Ripples Dubai License And Resistance Breakout

May 01, 2025

Xrp Price Prediction Will Xrp Hit 10 Ripples Dubai License And Resistance Breakout

May 01, 2025

Latest Posts

-

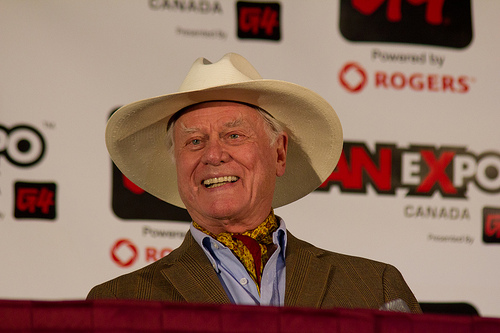

100 Year Old Dallas Star Passes Away

May 01, 2025

100 Year Old Dallas Star Passes Away

May 01, 2025 -

80s Tv Icon And Dallas Star Dies A Tribute

May 01, 2025

80s Tv Icon And Dallas Star Dies A Tribute

May 01, 2025 -

Remembering A Dallas Legend Passing At 100

May 01, 2025

Remembering A Dallas Legend Passing At 100

May 01, 2025 -

Dallas Tv Show The Passing Of Another 80s Icon

May 01, 2025

Dallas Tv Show The Passing Of Another 80s Icon

May 01, 2025 -

Longtime Dallas Star Dies At 100

May 01, 2025

Longtime Dallas Star Dies At 100

May 01, 2025