Ripple Wins Partial Victory: Analyzing The $50M SEC Settlement And XRP's Future

Table of Contents

The SEC vs. Ripple Settlement: A Detailed Breakdown

The SEC's lawsuit against Ripple, filed in December 2020, alleged that Ripple's sale of XRP constituted an unregistered securities offering, violating federal securities laws. The core allegation centered on whether XRP should be classified as a security under the Howey Test, a legal framework used to determine whether an investment contract exists. The lengthy legal battle involved extensive discovery and expert witness testimony, examining Ripple's various XRP sales, including programmatic sales and institutional sales.

The settlement itself saw Ripple pay $50 million to the SEC without admitting guilt. This is a crucial distinction: while the SEC didn't secure a full-blown admission of wrongdoing, the settlement does offer a degree of closure, allowing Ripple to move forward with its operations.

Key aspects of the settlement:

- $50 Million Payment: This represents a significant financial penalty, but far less than the potential damages Ripple could have faced if found guilty.

- No Admission of Guilt: This is a critical point for Ripple, as it avoids a damaging precedent that could have negatively impacted its future prospects. This lack of admission also allows for continued arguments that XRP is not a security.

- Impact on Ripple's Operations: While the settlement imposes financial penalties, it allows Ripple to continue its operations without the crippling uncertainty of an ongoing legal battle.

- Programmatic vs. Institutional Sales: The settlement appears to differentiate between Ripple's programmatic sales of XRP (deemed problematic by the SEC) and institutional sales, which were largely spared from the same level of scrutiny. This could have implications for how other crypto companies structure their token sales.

The Ripple settlement sets a precedent, though not necessarily a clear one, for other crypto companies currently facing similar SEC scrutiny. It highlights the importance of navigating the complex legal waters surrounding the classification of crypto assets as securities.

XRP Price Reaction and Market Sentiment

The immediate market reaction to the settlement was mixed. While the price of XRP initially surged, this was followed by a period of consolidation. (Insert chart/graph showing XRP price movement around the settlement date). The initial price increase reflected a degree of relief amongst investors, who had been anticipating a potentially much worse outcome.

Key market observations:

- Short-term Price Volatility: The XRP price experienced significant short-term volatility in the days following the settlement, reflecting the uncertainty surrounding the longer-term implications.

- Long-term Price Predictions: Analyst viewpoints are divided. Some predict continued growth based on increased adoption, while others remain cautious, citing ongoing regulatory uncertainty.

- Trading Volume Changes: Trading volume spiked immediately following the announcement, indicating heightened investor interest and activity.

- Impact on XRP Adoption and Usage: The long-term impact on XRP adoption remains uncertain. While the settlement removes a significant legal hurdle, the uncertainty surrounding its regulatory status persists.

Investor sentiment shifted from cautious pessimism to a guarded optimism after the settlement. The absence of a full-blown defeat for Ripple boosted confidence, yet the lingering questions regarding XRP's security classification keep investor sentiment from reaching euphoric levels.

Legal Implications and Future Regulatory Uncertainty

The Ripple settlement raises significant legal questions, particularly concerning the application of the Howey Test to cryptocurrencies. While the settlement doesn't explicitly define a new legal framework, it does provide some insights into the SEC's current approach. However, the lack of a definitive ruling leaves considerable uncertainty.

Legal uncertainties:

- Clarity on the Howey Test Application: The settlement offers limited clarity on how the Howey Test will be applied to other cryptocurrencies. Each case will likely be evaluated on its own merits.

- Future of SEC Enforcement Actions: Other crypto projects face an uncertain future regarding potential SEC enforcement actions. The Ripple case sets a precedent, but the implications are far from clear.

- Potential for Further Legal Challenges: The possibility of further legal challenges remains. The settlement may be viewed as an incomplete resolution by some parties, prompting further legal action.

- Ripple's Future Legal Strategies: Ripple may choose to pursue further legal challenges to definitively clarify XRP's regulatory status. They could also focus on lobbying efforts to create a more favorable regulatory environment.

The settlement has broader implications for the global cryptocurrency regulatory landscape. Other jurisdictions are watching the outcome closely, as they grapple with similar regulatory challenges.

The Future of XRP: Potential Scenarios

Several scenarios are possible for XRP's future, all depending on a variety of factors:

Potential scenarios:

- Increased Mainstream Adoption: If regulatory clarity emerges, and XRP's utility continues to increase, mainstream adoption could significantly boost its price and market capitalization.

- Continued Institutional Interest: Institutional investors may increase their involvement in XRP if regulatory uncertainty is reduced, potentially driving up demand.

- Integration into DeFi Applications: Integration into decentralized finance (DeFi) platforms could enhance XRP's utility and increase its adoption.

- Declining Relevance: If regulatory hurdles remain significant, and adoption rates fail to increase, XRP could see its relevance decline over time.

The ultimate trajectory of XRP depends on regulatory developments, adoption rates, technological advancements, and overall market sentiment.

Ripple's Partial Victory and the Path Forward for XRP

The $50 million settlement represents a partial victory for Ripple, allowing it to avoid a potentially catastrophic defeat. However, significant uncertainties remain about XRP's regulatory status and its long-term prospects. The settlement provides some clarity but leaves many questions unanswered, impacting not only Ripple, but also the wider cryptocurrency landscape and the companies navigating similar regulatory challenges. The future of XRP, and indeed much of the cryptocurrency market, hinges on future regulatory decisions and market adoption.

Call to action: Stay informed about the evolving regulatory landscape and its impact on Ripple and XRP. Continue to research and follow developments related to Ripple's legal battles and the future of XRP, keeping abreast of updates concerning cryptocurrency regulation and its impact on digital assets.

Featured Posts

-

What Is Xrp And How Does It Differ From Bitcoin

May 02, 2025

What Is Xrp And How Does It Differ From Bitcoin

May 02, 2025 -

The Importance Of Mental Health Literacy Education In Schools And Communities

May 02, 2025

The Importance Of Mental Health Literacy Education In Schools And Communities

May 02, 2025 -

Neispricana Prica Zdravkove Prve Ljubavi I Njena Udaja

May 02, 2025

Neispricana Prica Zdravkove Prve Ljubavi I Njena Udaja

May 02, 2025 -

Thlyl Shaml Mstqbl Aleab Alfydyw Me Blay Styshn 6

May 02, 2025

Thlyl Shaml Mstqbl Aleab Alfydyw Me Blay Styshn 6

May 02, 2025 -

Frances Dominant Six Nations Victory A Warning To Ireland

May 02, 2025

Frances Dominant Six Nations Victory A Warning To Ireland

May 02, 2025

Latest Posts

-

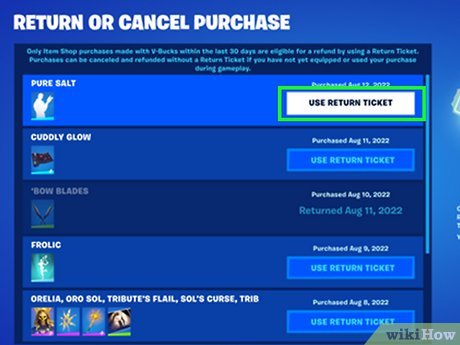

Fortnites Refund Policy Shift What It Means For Cosmetics

May 02, 2025

Fortnites Refund Policy Shift What It Means For Cosmetics

May 02, 2025 -

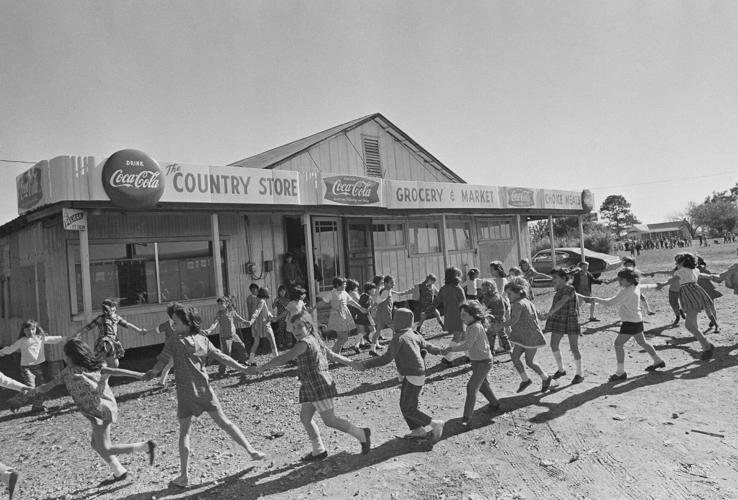

Louisiana School System Freed From Federal Desegregation Order

May 02, 2025

Louisiana School System Freed From Federal Desegregation Order

May 02, 2025 -

Fortnite Refund Hints At Cosmetic Policy Changes

May 02, 2025

Fortnite Refund Hints At Cosmetic Policy Changes

May 02, 2025 -

End Of An Era Justice Departments Decision On Louisiana School Desegregation

May 02, 2025

End Of An Era Justice Departments Decision On Louisiana School Desegregation

May 02, 2025 -

Justice Department Concludes Louisiana School Desegregation Case

May 02, 2025

Justice Department Concludes Louisiana School Desegregation Case

May 02, 2025