Ripple's Dubai License & XRP's Technical Breakout: Updated Price Prediction

Table of Contents

The cryptocurrency market is buzzing with excitement following Ripple's acquisition of a major regulatory license in Dubai. This landmark achievement has ignited a surge in XRP's price, prompting many to reassess their XRP price prediction. This article delves into the implications of Ripple's Dubai license, analyzes XRP's technical breakout, and offers an updated price prediction, considering both the bullish potential and inherent risks.

Ripple Secures a Major Regulatory Win in Dubai

The Significance of the Dubai Virtual Asset Regulatory Authority (VARA) License

The Dubai Virtual Asset Regulatory Authority (VARA) license is a game-changer for Ripple. It represents a significant validation of Ripple's technology and business model within a progressively regulated environment. This is far more than just another license; it signifies:

- Increased trust among investors: The license instills greater confidence in Ripple and XRP, attracting a new wave of investors seeking regulated exposure to the crypto market. This increased trust is vital for attracting institutional investors who often prioritize regulatory compliance.

- Access to a burgeoning Middle Eastern market: Dubai, a global financial hub, provides Ripple with a strategically important gateway to the Middle East and North Africa (MENA) region, a rapidly growing market for fintech and blockchain solutions.

- Potential for partnerships with Dubai-based firms: The license opens doors for collaborations with established financial institutions and technology companies based in Dubai, accelerating XRP's integration into existing payment systems and expanding its utility.

- Positive impact on XRP's regulatory landscape globally: This success in Dubai could pave the way for smoother regulatory approvals in other jurisdictions, reducing the uncertainties that have previously plagued the cryptocurrency sector.

Implications for XRP Adoption and Liquidity

The VARA license is expected to significantly boost XRP's adoption and liquidity. The ripple effect will be felt across several aspects of XRP's ecosystem:

- Increased transaction volume: As more businesses and individuals in the MENA region adopt XRP as a payment solution, transaction volume is poised to increase substantially, driving demand and potentially influencing its price.

- Potential for integration with existing payment systems: Ripple's technology can now be more easily integrated into existing payment rails within Dubai, potentially facilitating faster, cheaper, and more efficient cross-border payments. This integration could significantly enhance the speed and scalability of financial transactions.

- Enhanced liquidity in the XRP market: Increased adoption and transaction volume translate directly into greater liquidity in the XRP market, reducing price volatility and making it a more attractive asset for investors.

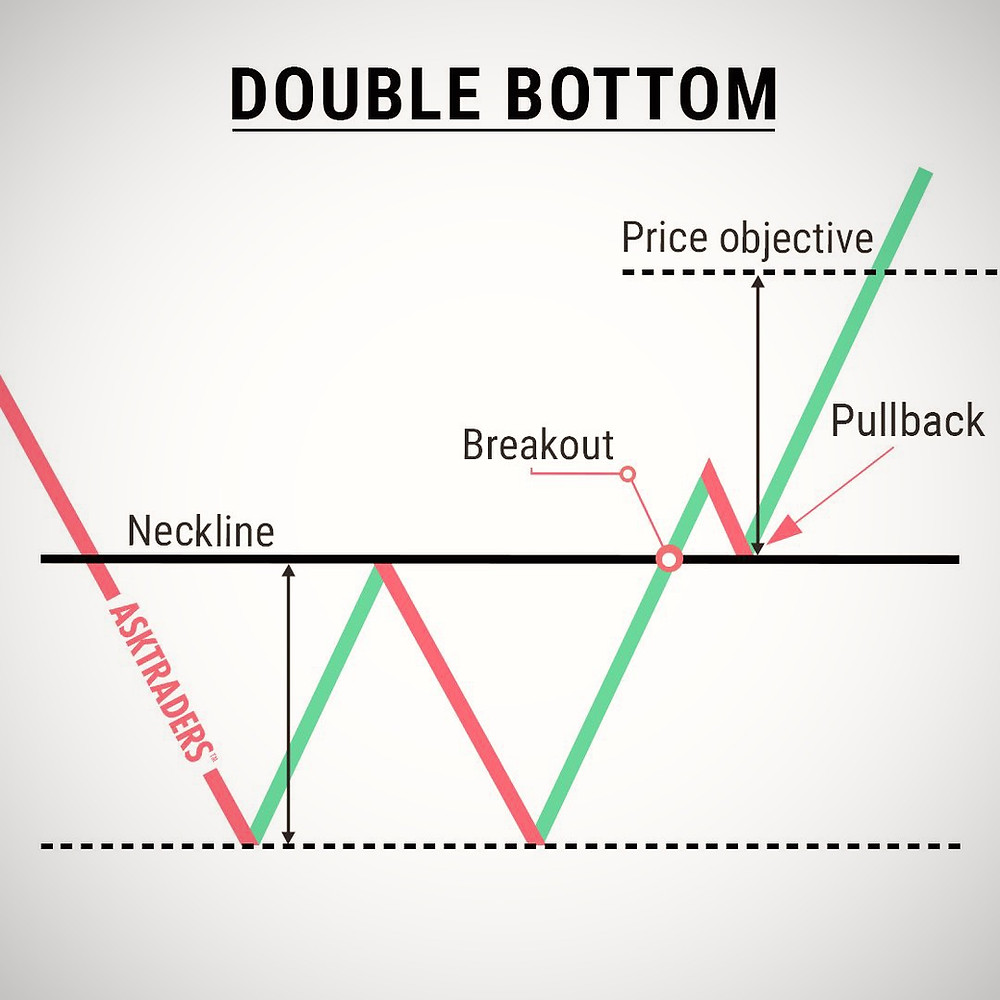

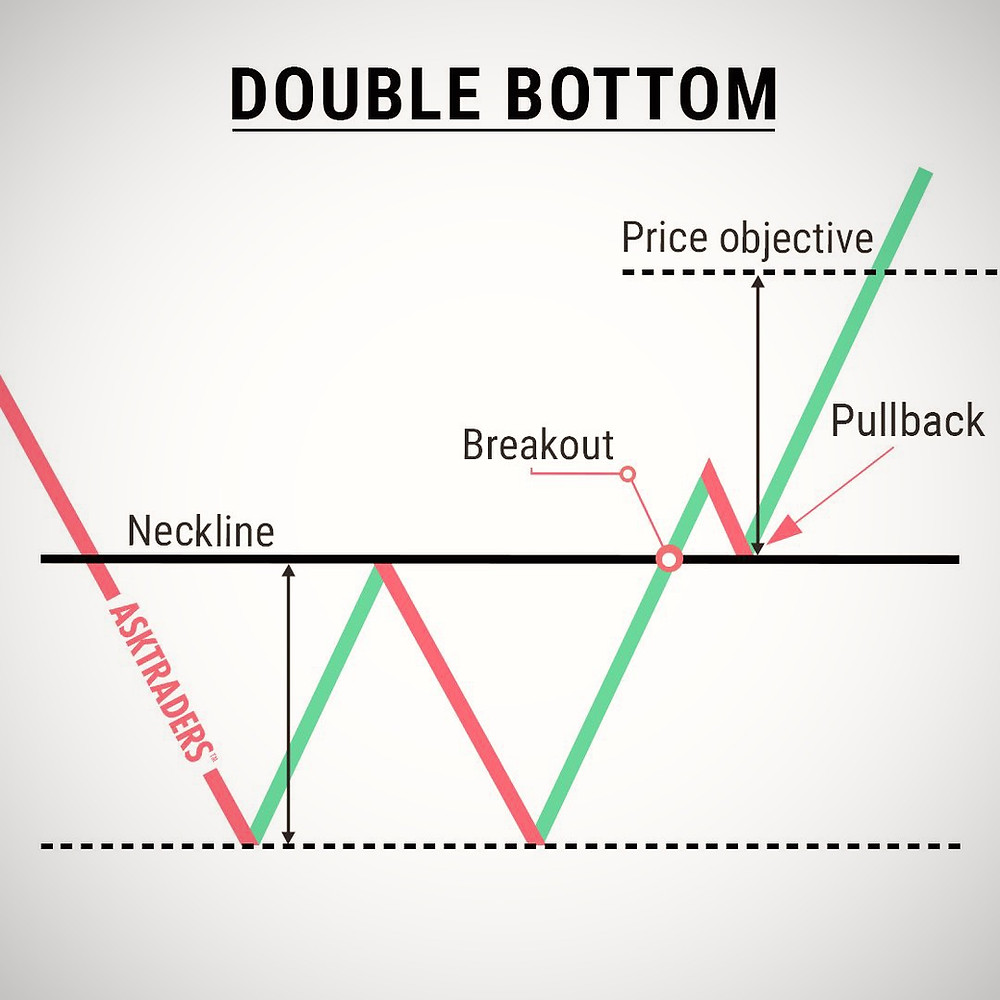

XRP's Technical Breakout: Chart Analysis and Indicators

Identifying Key Technical Indicators

XRP's price chart currently shows signs of a significant technical breakout. Key indicators support this assessment:

- RSI (Relative Strength Index): The RSI has moved above the overbought level, suggesting strong buying pressure and momentum. (Illustrative chart would be inserted here)

- MACD (Moving Average Convergence Divergence): A bullish crossover of the MACD lines indicates a potential upward price trend. (Illustrative chart would be inserted here)

- Trading Volume: A notable surge in trading volume accompanies the price increase, confirming the strength of the upward movement. (Illustrative chart would be inserted here)

Support and Resistance Levels

Based on the current chart patterns, key support levels are identified at [Price Level 1] and [Price Level 2]. Resistance levels are anticipated at [Price Level 3] and [Price Level 4]. A break above [Price Level 4] could signal a strong bullish trend.

- Bullish Scenario: Sustained buying pressure above [Price Level 4] could propel XRP towards [Price Target 1] and potentially [Price Target 2] in the short term.

- Bearish Scenario: Failure to break above [Price Level 4] and a decline below [Price Level 2] could signal a temporary correction or a more prolonged bearish period.

Updated XRP Price Prediction

Short-Term Price Prediction (Next 3 Months)

Considering the positive impact of the Dubai license and the technical indicators mentioned above, a short-term price range of $[Price Range Low] to $[Price Range High] for XRP is predicted within the next three months. This prediction is based on the assumption of continued positive market sentiment and a sustained flow of positive news surrounding Ripple's developments.

Long-Term Price Prediction (Next 12 Months)

Predicting long-term prices is inherently more speculative. However, considering widespread adoption, further regulatory approvals, and technological advancements, a potential price range of $[Price Range Low] to $[Price Range High] within the next 12 months is plausible. This prediction is highly dependent on several external factors and should be considered with caution. Market volatility and regulatory uncertainties can significantly impact this projection.

Risks and Considerations

Regulatory Uncertainty in Other Jurisdictions

While the Dubai license is a significant victory, regulatory hurdles remain in other jurisdictions.

- The ongoing SEC lawsuit in the US continues to pose uncertainty.

- Regulatory clarity in other key markets is crucial for widespread XRP adoption.

Market Volatility

The cryptocurrency market is inherently volatile. Several factors can impact XRP's price:

- Broader market trends in the cryptocurrency sector.

- Global economic conditions and investor sentiment.

- Unexpected news events or regulatory changes.

Conclusion:

Ripple's Dubai license is a game-changer for XRP, enhancing its credibility and potential for growth. Technical analysis suggests a bullish outlook, with a potential price breakout. However, it's crucial to acknowledge the inherent risks associated with the cryptocurrency market, including regulatory uncertainty and price volatility. Our updated XRP price prediction considers these factors, offering both short-term and long-term price ranges. Remember to conduct thorough research and understand the risks before making any investment decisions related to XRP or any other cryptocurrency. Learn more about Ripple and XRP by visiting [link to Ripple's website].

Featured Posts

-

Will France Reign Supreme In The Six Nations 2025

May 01, 2025

Will France Reign Supreme In The Six Nations 2025

May 01, 2025 -

Tbs Safety And Nebofleet Automating Workboat Operations

May 01, 2025

Tbs Safety And Nebofleet Automating Workboat Operations

May 01, 2025 -

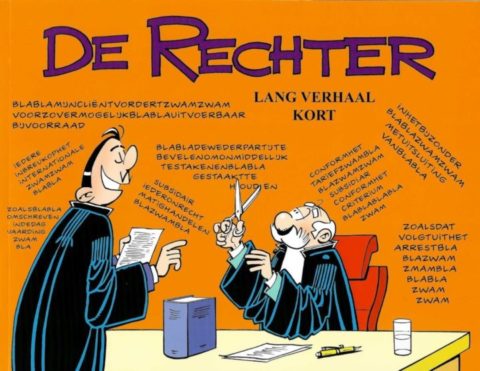

Kampen Neemt Enexis Voor De Rechter Stroomnet Aansluiting In Kort Geding

May 01, 2025

Kampen Neemt Enexis Voor De Rechter Stroomnet Aansluiting In Kort Geding

May 01, 2025 -

Arc Raider Tech Test 2 Console Players Invited Registration Now Open

May 01, 2025

Arc Raider Tech Test 2 Console Players Invited Registration Now Open

May 01, 2025 -

Xrp Price Surge After Ripple Sec Settlement Market Reaction And Future Outlook

May 01, 2025

Xrp Price Surge After Ripple Sec Settlement Market Reaction And Future Outlook

May 01, 2025

Latest Posts

-

Dallas Star Passes Away At 100

May 01, 2025

Dallas Star Passes Away At 100

May 01, 2025 -

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025 -

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025 -

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025 -

Death Of Priscilla Pointer Actress And Mother Of Amy Irving Aged 100

May 01, 2025

Death Of Priscilla Pointer Actress And Mother Of Amy Irving Aged 100

May 01, 2025