Rising Fuel Costs: Navigating The Impact On The Airline Industry

Table of Contents

The Direct Impact of Rising Fuel Costs on Airline Profitability

Rising fuel costs directly translate to higher operational expenses and significantly impact airline profitability. This impact is felt across the board, affecting both large and small carriers, but particularly impacting those with less efficient fleets.

Increased Operational Expenses

Fuel represents a substantial portion of an airline's operating costs, typically ranging from 20% to 30%, but often exceeding this in periods of high fuel prices. This makes aviation fuel price volatility a key factor determining an airline's financial health.

- Increased Fuel Costs, Increased Fares: The simple reality is that increased fuel costs necessitate higher fares or reduced services to maintain profitability. Airlines are forced to make difficult choices to offset the increased expense.

- Inefficient Aircraft, Higher Impact: Airlines operating less fuel-efficient aircraft are disproportionately affected by rising fuel costs, facing steeper increases in operational expenditure compared to their more modern counterparts.

- Reduced Frequency on Certain Routes: In some cases, airlines might even reduce the frequency of flights on less profitable routes to manage fuel expenses.

Reduced Profit Margins and Potential Losses

The constant pressure of rising fuel costs squeezes profit margins, leading to reduced profitability and, in some cases, potential losses for airlines. This is particularly true for smaller carriers with limited financial reserves.

- Financial Reports Reflecting Losses: Recent financial reports from numerous airlines clearly demonstrate decreased profitability, with many reporting significantly reduced net income due to increased fuel costs.

- Cost-Cutting Measures and Route Reductions: Many airlines have publicly announced cost-cutting measures and route reductions in direct response to the escalating fuel prices. This impacts both employment and passenger options.

- Investor Confidence Eroded: The impact on investor confidence is substantial. Reduced profitability and uncertainty around future fuel prices lead to decreased investment in the sector.

Strategies for Mitigating the Impact of Rising Fuel Costs

Airlines are actively implementing various strategies to lessen the blow of rising fuel costs. These range from financial hedging to operational improvements and exploring alternative, more sustainable fuels.

Fuel Hedging Strategies

Fuel hedging involves using financial instruments to lock in future fuel prices, thereby mitigating the risk associated with price volatility.

- Futures Contracts and Options: Common hedging instruments include futures contracts, which obligate the purchase of fuel at a predetermined price, and options contracts, which provide the right, but not the obligation, to buy fuel at a specific price.

- Advantages and Disadvantages: While hedging can protect against price spikes, it also limits potential gains if fuel prices fall. Effective hedging requires sophisticated forecasting and risk management.

- Successful and Unsuccessful Examples: The success of hedging strategies depends on market predictions. Some airlines have successfully mitigated losses through hedging, while others have incurred losses due to inaccurate forecasts.

Operational Efficiency Improvements

Improving operational efficiency is crucial in reducing fuel consumption and, consequently, costs. Airlines are constantly seeking innovative ways to optimize their operations.

- Fuel-Efficient Flight Routes and Techniques: Optimizing flight routes and employing techniques like continuous descent approaches can significantly reduce fuel burn.

- Investing in Fuel-Efficient Aircraft: Airlines are investing in newer, more fuel-efficient aircraft models to reduce their overall fuel consumption. This is a long-term strategy requiring significant capital investment.

- Aircraft Weight Optimization and Maintenance: Optimizing aircraft weight through careful cargo loading and proactive maintenance to ensure optimal engine performance are also key strategies.

Exploring Alternative Fuels

The transition to sustainable aviation fuel (SAF) is vital for long-term sustainability and cost management. However, widespread adoption faces challenges.

- Benefits and Challenges of SAF: SAF offers environmental benefits and potentially reduces reliance on traditional fossil fuels, but its current high production cost and limited availability are significant hurdles.

- Government Incentives and Policies: Government incentives and policies play a crucial role in promoting SAF development and adoption. Tax breaks and subsidies can make SAF more economically viable.

- Airlines Investing in SAF: Many major airlines are investing heavily in SAF research, production, and usage, demonstrating commitment to reducing their carbon footprint and dependence on volatile fossil fuel prices.

The Ripple Effect: Impact on Consumers and the Broader Economy

The impact of rising fuel costs extends far beyond the airline industry, affecting consumers and the broader economy.

Increased Airfare Prices

Rising fuel costs are inevitably passed on to consumers through higher airfares.

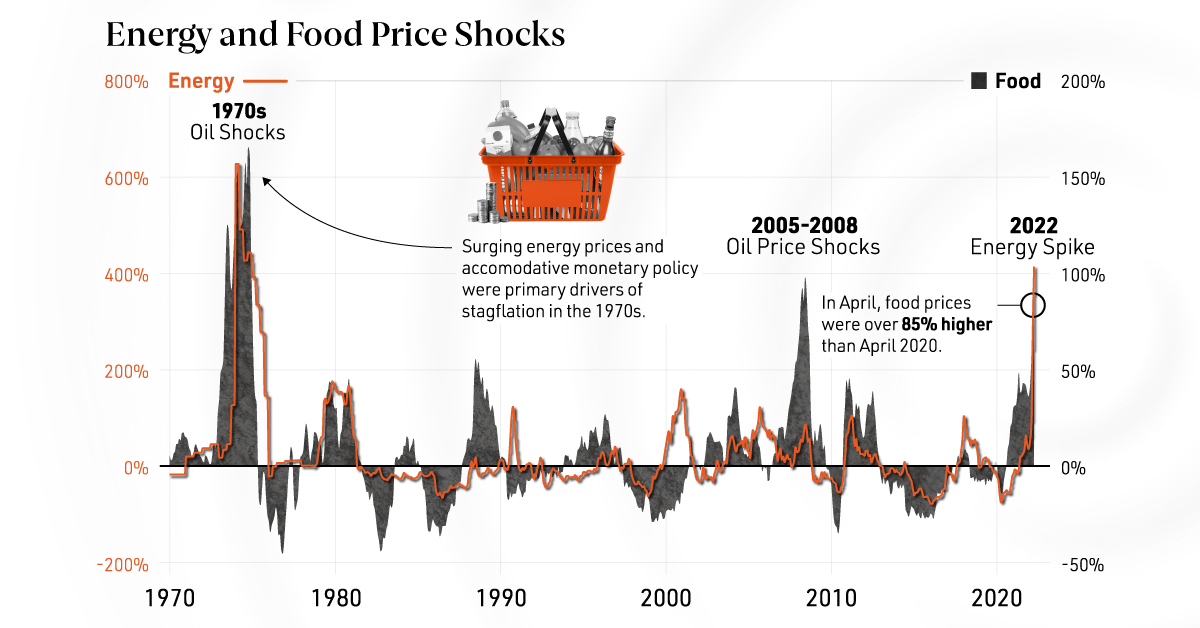

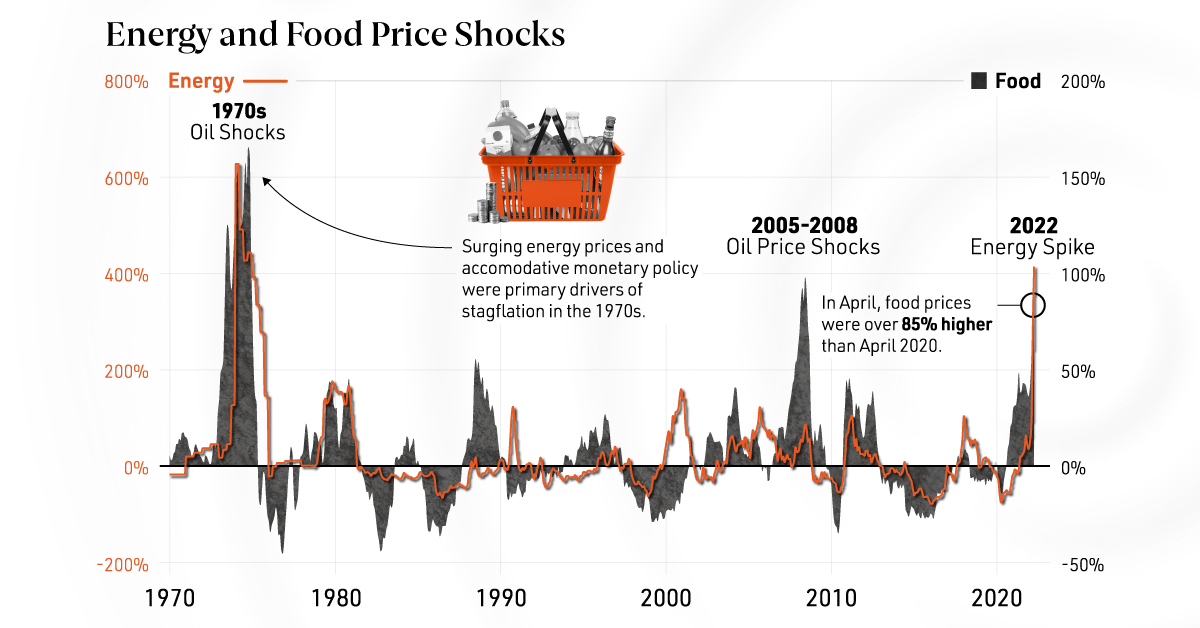

- Airfare Price Trends: Analysis of recent trends shows a clear correlation between fuel price increases and higher airfares.

- Impact on Air Travel Demand: Higher airfares can decrease demand, particularly for leisure travel, potentially affecting the tourism sector.

- Affordability Concerns: Increased airfares raise concerns about the affordability of air travel for different income groups, potentially widening the gap in accessibility.

Economic Implications

Increased airfares have knock-on effects on the broader economy, influencing several key sectors.

- Tourism Industry Impact: The tourism industry, heavily reliant on air travel, is significantly affected by higher airfares, potentially leading to reduced tourist numbers.

- Business Travel and International Trade: Increased costs associated with business travel can impact international trade and economic collaborations.

- Potential for Job Losses: Reduced air travel demand may lead to job losses within the airline industry and related sectors.

Conclusion

Rising fuel costs represent a significant and persistent challenge for the airline industry. Airlines are actively implementing diverse strategies – fuel hedging, operational efficiency improvements, and the exploration of sustainable aviation fuel (SAF) – to mitigate these impacts. However, the consequences ripple throughout the economy, affecting consumers and related industries. Understanding the complexities of rising fuel costs and the industry's response is crucial. Staying informed about the latest developments in fuel prices and SAF is key to understanding the future of air travel and its economic implications. Continue to follow news and analysis on rising fuel costs and their impact on the airline industry to stay ahead of the curve.

Featured Posts

-

Avrupa Is Birligi Kazan Kazan Ortaklik Modeli

May 03, 2025

Avrupa Is Birligi Kazan Kazan Ortaklik Modeli

May 03, 2025 -

Directorial Change In Harry Potter Exploring The Absence Of Chris Columbus

May 03, 2025

Directorial Change In Harry Potter Exploring The Absence Of Chris Columbus

May 03, 2025 -

Wizarding World Holiday Marathon On Syfy Everything You Need To Know

May 03, 2025

Wizarding World Holiday Marathon On Syfy Everything You Need To Know

May 03, 2025 -

Declaration De Macron Sur La Militarisation Potentielle De L Aide A Gaza

May 03, 2025

Declaration De Macron Sur La Militarisation Potentielle De L Aide A Gaza

May 03, 2025 -

Keller Williams Announces New Affiliate Partnership In Arkansas

May 03, 2025

Keller Williams Announces New Affiliate Partnership In Arkansas

May 03, 2025

Latest Posts

-

Channel Selena Gomez The Perfect High Waisted Suit For A Modern Office Look

May 03, 2025

Channel Selena Gomez The Perfect High Waisted Suit For A Modern Office Look

May 03, 2025 -

Selena Gomezs High Waisted Power Suit 80s Style Inspiration

May 03, 2025

Selena Gomezs High Waisted Power Suit 80s Style Inspiration

May 03, 2025 -

Selena Gomezs Sophisticated High Waisted Suit An 80s Office Dream

May 03, 2025

Selena Gomezs Sophisticated High Waisted Suit An 80s Office Dream

May 03, 2025 -

Cotswolds Mansion Paint Job Lands Daisy May Cooper In Legal Trouble

May 03, 2025

Cotswolds Mansion Paint Job Lands Daisy May Cooper In Legal Trouble

May 03, 2025 -

Daisy May Cooper Faces Legal Action Over House Paint Colour

May 03, 2025

Daisy May Cooper Faces Legal Action Over House Paint Colour

May 03, 2025